ACCOUNTING :)

5.0(2)

Card Sorting

1/102

Earn XP

Description and Tags

Accounting terms

Last updated 7:41 AM on 9/7/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

103 Terms

1

New cards

**Assets**

A present economic resource controlled by the entity (as a result of past events) that has the potential to produce future economic benefits.

^^Eg : Spare parts, Cash, Equipment, Accounts Receivable^^

^^Eg : Spare parts, Cash, Equipment, Accounts Receivable^^

2

New cards

**Liability**

A present obligation of the entity (as a result of past events) to transfer an economic resource.

%%Eg : Bank overdraft, Loans, Mortgage, Accounts Payable%%

%%Eg : Bank overdraft, Loans, Mortgage, Accounts Payable%%

3

New cards

**Current VS Non-Current Asset**

Current - to be converted to cash, sold or cosumed within 12 months. ^^Eg : GST Receivable, Supplies^^

Non-Current - not held for resale and expected to be used for more than 12 months. ^^Eg : Vehicles, Tools^^

Non-Current - not held for resale and expected to be used for more than 12 months. ^^Eg : Vehicles, Tools^^

4

New cards

**Current VS Non-Current Liability**

Current - transfer will occur within 12 months. %%Eg : Loan, GST Payable%%

Non-Current - transfer will occur after 12 months. %%Eg : Mortgage,Loans%%

Non-Current - transfer will occur after 12 months. %%Eg : Mortgage,Loans%%

5

New cards

**Owner’s Equity**

The residual interest in the assets of the entity after the liabilities are deducted. (informal - what the business owes the owner).

6

New cards

**The Accoutinting Equation**

Assets = Liabilities + Owner’s Equity

7

New cards

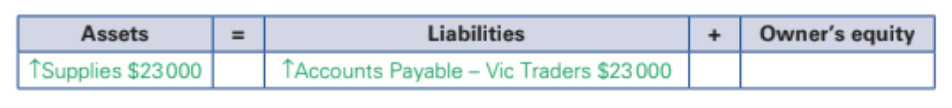

**Transactions and the Accounting equation**

1. Every transaction will afect ==at least 2 items== in the accounting equation.

2. After the changes, the accounting equation must still balance.

8

New cards

**Accounting Assumptions**

Assumptions which govern the way Accounting information is recorded.

==P== : Period assumption

==A== : Accrual basis

==G== : Going concern

==E== : acounting Entity

==P== : Period assumption

==A== : Accrual basis

==G== : Going concern

==E== : acounting Entity

9

New cards

**Accounting Entity**

The records of the assets, liabilities and business activities of the entity are kept completely seperate from those of the owner of the entity as well as from those of other entities.

10

New cards

**Going Concern**

The business wil continue to operate in the future, and its records will be kept on this basis.

11

New cards

**Period**

Reports are prepared for a particular period of time, such as a month or year, in order to obtain comparability of results.

12

New cards

**Accrual Basis**

Revenues are recognised when earned and expenses when incurred. Profit is calculated as revenue earned in a particular period less expenses incurred in that period.

13

New cards

**Qualitative Characteristics**

Are the ‘generally accepted rules’ that govern the way Accounting information is recorded.

==T== : Timeliness

==U== : Understandability

==R== : Relevance

==F== : Faithful representation

==C== : Comparability

==V== : Verifiability

==T== : Timeliness

==U== : Understandability

==R== : Relevance

==F== : Faithful representation

==C== : Comparability

==V== : Verifiability

14

New cards

**Relevance**

Financial information must be capable of making a difference to the decisions made by users of the report.

15

New cards

**Faithful representation**

Financial information should be a faithful representation of the real-world economic event it claims to represent : complete, free from material error and neutral (without bias).

16

New cards

**Verifiability**

Financial information should allow different knowledgable and independent observers to reach a consensus that an event is faithfully represented.

17

New cards

**Comparability**

Financial information should be able to be compared with similar information about other entities and with similar information about the same entity for another period or another date.

18

New cards

**Timeliness**

Financial information should be available to decision makers in time to be capable of influencing their decisions.

19

New cards

**Understandability**

FInancial information should be understandable or comprehensible to knowledgable users and presented clearly and concisely.

20

New cards

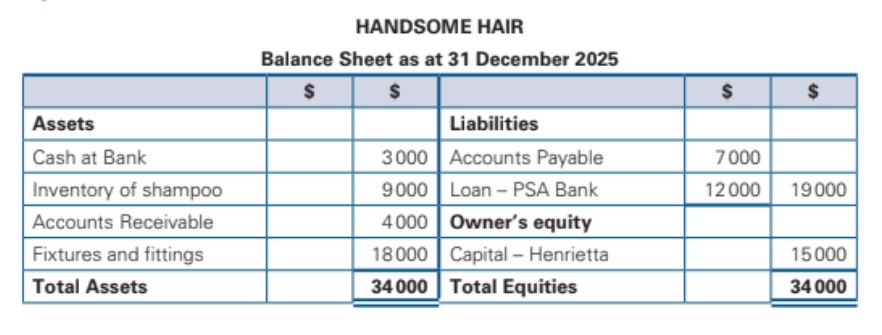

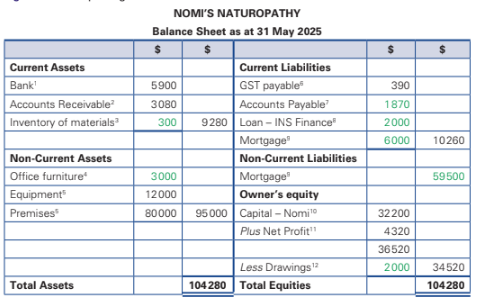

**The Balance Sheet**

An accounting report that details a firm’s financial positions at a particular point in time by reporting assets, liabilities and owner’s equity.

21

New cards

**Debt Ratio**

Measures the proportion of the firm’s assets that are funded by external sources.

Dangers - High Debt Ratio indicates a high reliance on liabilities, and consequently a high risk of financial collapse. Furthermore, a high Debt Ratio may actually prevent a business from being able to access more borrowed funds.

Benefits - Borrowing does give the business access to funds to purchase assets that it may not have been able to afford by only trying to raise funds internally. Furthermore a high Debt Ratio means a higher return for the owner, as he or she has less capital invested, but still earns all the profits.

Dangers - High Debt Ratio indicates a high reliance on liabilities, and consequently a high risk of financial collapse. Furthermore, a high Debt Ratio may actually prevent a business from being able to access more borrowed funds.

Benefits - Borrowing does give the business access to funds to purchase assets that it may not have been able to afford by only trying to raise funds internally. Furthermore a high Debt Ratio means a higher return for the owner, as he or she has less capital invested, but still earns all the profits.

22

New cards

**Small Business**

A business in which the owner and manager is the same person and which employs fewer than 20 people.

23

New cards

**Reasons for becoming an Owner**

* Profit Motive

* Desire for freedom/independence

* Identifiying a market opportunity

* Unemployment

* Desire for freedom/independence

* Identifiying a market opportunity

* Unemployment

24

New cards

**External Support Resources**

* Accountant - are experts in providing advice and direction on ownership structures, pricing policies, tax minimisation, superannuation obligations, tax obligations regarding pay-as-you-go tax and GST and strategies for improving business performance.

* Lawyers - to assist them in any form of legal matter in ownership structure such as a partnership or proprietary company, representation in civil cases, registering for necessary licenses or assistance with the lodging of a registered trademark.

* Bank Managers - can provide specific advice regarding business finance and suggest alternatives in terms of financing options.

* Lawyers - to assist them in any form of legal matter in ownership structure such as a partnership or proprietary company, representation in civil cases, registering for necessary licenses or assistance with the lodging of a registered trademark.

* Bank Managers - can provide specific advice regarding business finance and suggest alternatives in terms of financing options.

25

New cards

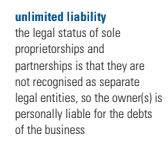

**Sole Proprietorship**

A business owned by a single individual, operating their business in their own right under their own name or a registered business name.

%%Advantages%% : Easy and cheap to set up, owner has full control over decision making, owner receives all profit and has full access to capital, simple to sell or wind up.

==Disadvantages== : Owner has __unlimited liability__ and is thus responsible for debts and liabilities incurred, business has limited life if the owner dies the business is in danger, limited access to captial, skills may be limited, may have to endure long hours and stress.

%%Advantages%% : Easy and cheap to set up, owner has full control over decision making, owner receives all profit and has full access to capital, simple to sell or wind up.

==Disadvantages== : Owner has __unlimited liability__ and is thus responsible for debts and liabilities incurred, business has limited life if the owner dies the business is in danger, limited access to captial, skills may be limited, may have to endure long hours and stress.

26

New cards

**Partnership**

A business owned by two or more persons in business together with a view to making a profit.

%%Advantages%% : Relatively cheap to set up, relatively simple to wind up and reclaim individual investment in the business, greater access to capital and skills, tax advantages when partners are married.

==Disadvantages== : Control over decision is shared among partners, owners have unlimited liability and are thus personally responsible for debts and liabilities incurred by the business, the partnership has a limited life – if one of the partners die or be declared insane the partnership is dissolved, profit are shared among partners.

%%Advantages%% : Relatively cheap to set up, relatively simple to wind up and reclaim individual investment in the business, greater access to capital and skills, tax advantages when partners are married.

==Disadvantages== : Control over decision is shared among partners, owners have unlimited liability and are thus personally responsible for debts and liabilities incurred by the business, the partnership has a limited life – if one of the partners die or be declared insane the partnership is dissolved, profit are shared among partners.

27

New cards

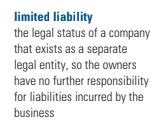

**Proprietary Company (Ptd Ltd) / Private Company**

A business that exists as a separate legal entity that is entitled to do business in its own right.

%%Advantages%% : __Limited liabilities__, greater ability to attract capital to the business as there is limited liabilities, life of the business is ongoing due to it being owned by a seperate legal entity.

==Disadvantages== : Establishment cost are high, there may be difficulty attracting additonal capital because a proprietary company cannot publicly advertise for funds, higher compliance costs, degree of regulation is much higher than that imposed on sole proprietorships or partnerships.

%%Advantages%% : __Limited liabilities__, greater ability to attract capital to the business as there is limited liabilities, life of the business is ongoing due to it being owned by a seperate legal entity.

==Disadvantages== : Establishment cost are high, there may be difficulty attracting additonal capital because a proprietary company cannot publicly advertise for funds, higher compliance costs, degree of regulation is much higher than that imposed on sole proprietorships or partnerships.

28

New cards

**Public Company (Ltd)**

A large business structure that is also incorporated, so it also has its own legal existence but derives the ‘Public’ name because it can publicly raise funds by advertising and selling shares through the Australian Securities Exchange (ASX).

%%Advantages%% : Limited liabilities, greater ability to attract capital as they can publicly advertise, greater transferability of ownership (selling of shares), life of business is ongoing due to being a seperate legal entity.

==Disadvantages== : Establishment costs, ongoing administration and compliance costs are high, much more scrutiny, greater seperation between ownership and control, greater statutory obligations with the possibility of fines and penalties if not met, greater disclosure requirements.

%%Advantages%% : Limited liabilities, greater ability to attract capital as they can publicly advertise, greater transferability of ownership (selling of shares), life of business is ongoing due to being a seperate legal entity.

==Disadvantages== : Establishment costs, ongoing administration and compliance costs are high, much more scrutiny, greater seperation between ownership and control, greater statutory obligations with the possibility of fines and penalties if not met, greater disclosure requirements.

29

New cards

**Reasons for success and failure**

Success - High demand for product or service, ;ocation that is visible and easily accessible for customers, thorough business plan, sufficient starting capital, ppropriate personal qualities.

Failure- Competition for other small or large businesses, poor location, insufficient start-up capital, poor marketing, poor management skills, poor customer relations .

Failure- Competition for other small or large businesses, poor location, insufficient start-up capital, poor marketing, poor management skills, poor customer relations .

30

New cards

**Ethical Considerations**

There is a close relationship between the ethical performance of a business and whether or not it is meeting its legal requirements. Ethical considerations go beyond following legal requirements and reducing legal risk, as a firm with sound ethical practices will build strong goodwill for their business in the form of a strong customer base, loyalty and growing profits.

31

New cards

**Treatment of employees**

The business should ensure employees have safe working conditions and are paid correctly. Poor treament can lead to the business becoming hated by the public and employees working less efficient,

32

New cards

**Products Sold**

The business should ensure that:

– products are sourced from suppliers that provide safe working conditions and fair wages.

– products meet minimum required safety standards. There are mandatory standards that exist to ensure information and safety features exist for consumers. If a business deals with foods or perishable items, proper food handling and storage needs to take place.

– products are of a particular quality and do what has been advertised.

– products are purchased from local suppliers and the suppliers support the local community or economy.

– products are sourced from suppliers that provide safe working conditions and fair wages.

– products meet minimum required safety standards. There are mandatory standards that exist to ensure information and safety features exist for consumers. If a business deals with foods or perishable items, proper food handling and storage needs to take place.

– products are of a particular quality and do what has been advertised.

– products are purchased from local suppliers and the suppliers support the local community or economy.

33

New cards

**Type of service**

Ensure that customers are sold only what they require and not forced or charged for purchasing unwanted extras.

34

New cards

**Impact on society environment**

Privacy considerations/packaging considerations/disposal of waste/products which have a positive social impact.

35

New cards

**Methods of Accounting and financial reporting**

If a business chose not to follow these and other ethical considerations but instead chose to try to cut costs or profiteer, and was subsequently caught out, then the impact would be:

1\. damage to the business’s reputation leading to a decline in sales, profits and market share

2\. large costs in the forms of fines and other penalties for breaches of the law.

1\. damage to the business’s reputation leading to a decline in sales, profits and market share

2\. large costs in the forms of fines and other penalties for breaches of the law.

36

New cards

**Internal sources of finances**

Funds generated by and within the firm.

37

New cards

**Capital Contribution**

Internal source of finance consisting of cash (or other assets) contributed to the business from the personal assets of the owner.

Advantage - no set repayment date, no interest charge.

Disadvantage - limited to resources of owner.

Advantage - no set repayment date, no interest charge.

Disadvantage - limited to resources of owner.

38

New cards

**Retained earnings**

Internal source of finance consisting of funds generated from business profits that are not taken as drawings by the owner.

Advantage - no set repayment date, no interest charge.

Disadvantage - limited to previous profits (may be none).

Advantage - no set repayment date, no interest charge.

Disadvantage - limited to previous profits (may be none).

39

New cards

**External sources of finances**

Funds generated from sources outside of the business.

40

New cards

**Trade Credit**

An internal source of finance offered by suppliers that allows its customers to purchase goods or services immediately and then pay at a later date.

Advantage - allows immediate access to goods/services, allows businesses to generate sales before payment is required, no interest charge if credit terms are met, discounts are available from some suppliers for early payment.

Disadvantage - trade credit can only be used with purchases with that supplier.

Advantage - allows immediate access to goods/services, allows businesses to generate sales before payment is required, no interest charge if credit terms are met, discounts are available from some suppliers for early payment.

Disadvantage - trade credit can only be used with purchases with that supplier.

41

New cards

**Bank overdraft**

An external source of finance provided by a bank that allows the account holder to withdraw more than their current.

Advantage - readily accesible, flexible - can be used for a variety of purposes.

Disadvantage - high interest charge, can be recalled on short notice.

Advantage - readily accesible, flexible - can be used for a variety of purposes.

Disadvantage - high interest charge, can be recalled on short notice.

42

New cards

**Term Loan**

External finance provided by banks and other lenders for a specific purpose and repaid over time.

Advantage - makes possible the purchase of expensive assets, flexible, secured loans attract a lower interest rate.

Disdvantage - interest charge, requires commitment by business to make repayment for term of the loan, principal and interest repayments can put pressure on cash flows.

Advantage - makes possible the purchase of expensive assets, flexible, secured loans attract a lower interest rate.

Disdvantage - interest charge, requires commitment by business to make repayment for term of the loan, principal and interest repayments can put pressure on cash flows.

43

New cards

**Mortgage**

A specific type of term loan that is secured against property.

44

New cards

**Lease**

A written agreement that grants to the lessee the right to use a particular asset for a specified period of time in return for periodic payments to the lessor.

Advantage - reduces intial outlay to acquire assets, allows assets to be up to date, reduces maintenance and repair costs.

Disadvantage - no ownership of asset, requires commitment for the term of the lease.

Advantage - reduces intial outlay to acquire assets, allows assets to be up to date, reduces maintenance and repair costs.

Disadvantage - no ownership of asset, requires commitment for the term of the lease.

45

New cards

**Interest-only loan**

Loan that requires the borrower to make regular interest payments before repaying the entire principal in one lump sum on the last day of the loan period.

46

New cards

**Principle and Interest Loan**

Loan that requires the borrower to make regular repayments of both the principal and interest over the life of the loan.

47

New cards

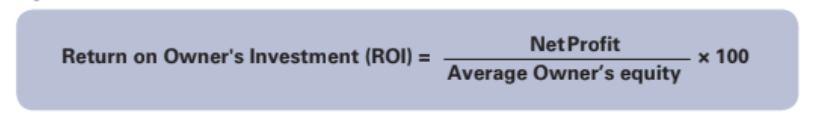

**Return on Owner’s Investment (ROI)**

A profitability indicator that measures how effectively a business has used the owner’s capital to earn profit.

48

New cards

**Guidelines for seeking external finance**

1. The term of the finance should match the life of the asset. Short-term assets should be purchased using short-term finance, and long- term assets should be purchased using long-term finance.

2. The cost of interest must be considered. The interest rate is equivalent to the cost of using borrowed funds, and the borrower must be able to repay both the principal (the amount borrowed) and the interest charges.

3. The conditions of the loan should be tailored to suit the borrower. The longer the term, the lower the instalments but the higher the total interest charges.

4. Consider the impact on the Debt Ratio and the firm’s ability to borrow further.

49

New cards

**Accounting process**

1. Source Documents

2. Records

3. Reports

4. Advice

50

New cards

Source documents

Source documents have two separate yet related functions:

They provide the verifiable evidence of the details of a transaction, thus ensuring that the information in the Accounting reports provides a Faithful representation and the Verifability of Accounting reports by authenticating each transaction.

They provide the evidence that is required by the Australian Tax Office relating to the firm’s income tax and Goods and Services Tax obligations.

They provide the verifiable evidence of the details of a transaction, thus ensuring that the information in the Accounting reports provides a Faithful representation and the Verifability of Accounting reports by authenticating each transaction.

They provide the evidence that is required by the Australian Tax Office relating to the firm’s income tax and Goods and Services Tax obligations.

51

New cards

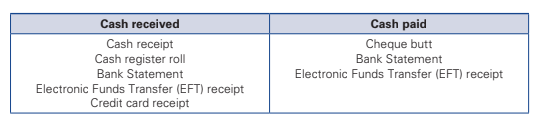

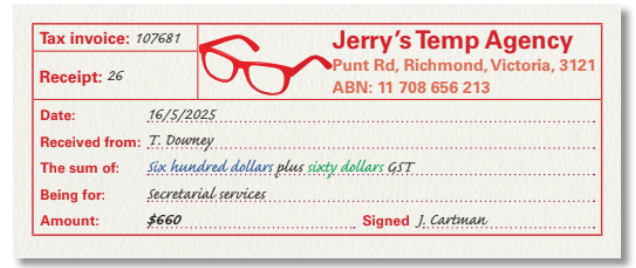

**Cash Receipts**

Can refer to both the transaction that occurs when cash is received from another entity, as well as the source document that verifies that transaction.

52

New cards

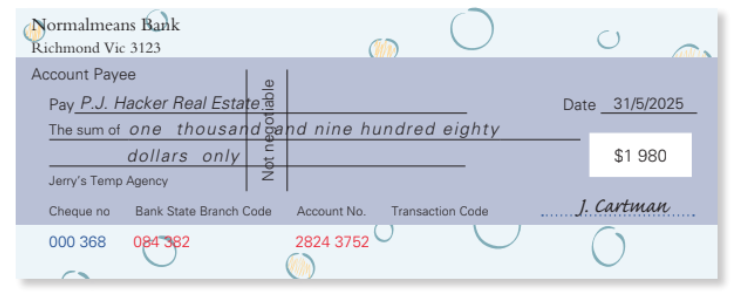

**Cheques**

A document informing the bank, the drawee, to transfer funds from the account of the drawer to the bank and account of the payee. The drawer actually hands the cheque to the payee, who then presents it at their own bank. It is a sensible business practice to nominate the payee and cross it not negotiable. A cheque that is marked ‘Not negotiable’ can only be deposited into the account of the nominated payee.

53

New cards

**Bank Statements**

Statements provided by a business’s bank that shows all cash transactions in and out of a particular bank account for a specified period. They provide two useful functions:

Provide a list of all transactions that can be used as a point of comparison to ensure all transactions are legitimate and to provide a balance of the account at the end of a specified period.

Identify transactions that you may have been unaware of such as direct debits, direct credits or direct deposits from other entities.

Provide a list of all transactions that can be used as a point of comparison to ensure all transactions are legitimate and to provide a balance of the account at the end of a specified period.

Identify transactions that you may have been unaware of such as direct debits, direct credits or direct deposits from other entities.

54

New cards

**Credit Transactions**

When goods or services are sold or purchased on credit, the source document will be an invoice. Because GST is recognised and reported at the time of purchase or sale, the invoice must also show all the information necessary for it to be classified as a tax invoice.

55

New cards

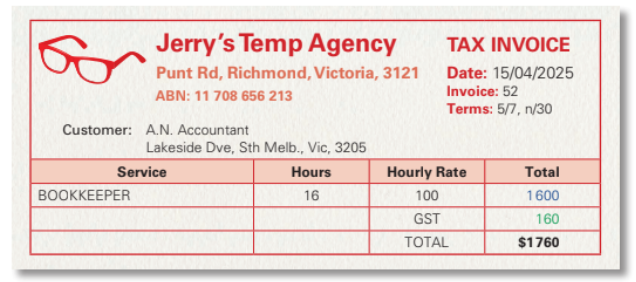

**Sales Invoice**

A source document that verifies a credit sale of inventory

The seller or supplier is also the business that issues the invoice and so will have its name at the top of the invoice. Conversely, the purchaser or customer is named in the middle of the invoice. The original is sent to the customer with the copy being retained by the seller for its recording purposes.

The seller or supplier is also the business that issues the invoice and so will have its name at the top of the invoice. Conversely, the purchaser or customer is named in the middle of the invoice. The original is sent to the customer with the copy being retained by the seller for its recording purposes.

56

New cards

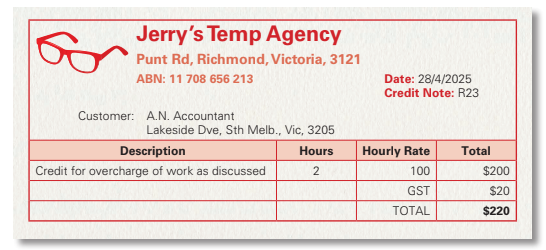

**Credit Note**

A document that evidences that there is a reduction in the amount owed by a customer

57

New cards

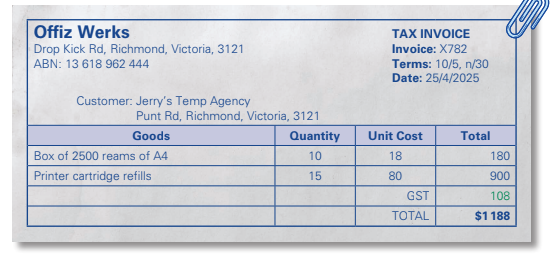

**Purchase Invoice**

a source document that verifies a credit purchase (usually of inventory).

The seller or supplier is the business that issues the invoice, so will have its name at the top of the invoice. Tthe customer has its named in the middle of the invoice. The original is sent to the customer, the copy is retained by the seller for its recording purposes.

The seller or supplier is the business that issues the invoice, so will have its name at the top of the invoice. Tthe customer has its named in the middle of the invoice. The original is sent to the customer, the copy is retained by the seller for its recording purposes.

58

New cards

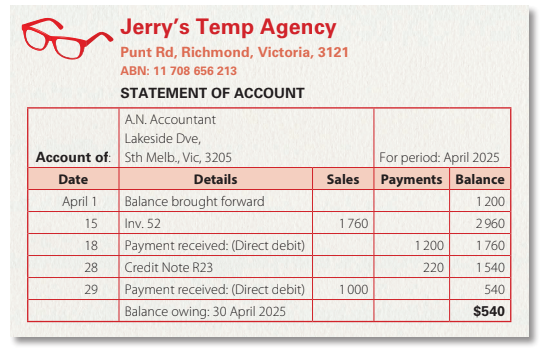

**Statement of Account**

A statement provided to credit customers to give details of transactions that have occurred over a specific period of time and the resulting balance owing at the end of that period.

59

New cards

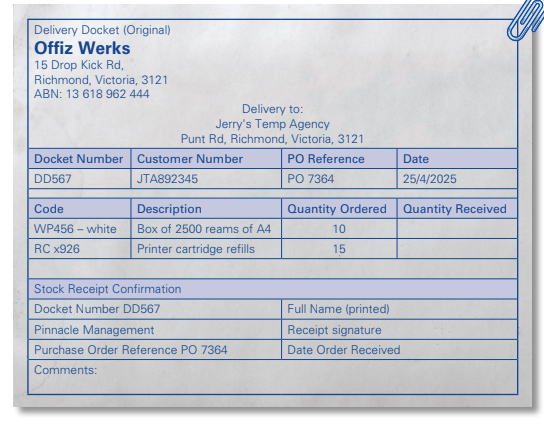

**Delivery Docket**

a document used to verify that the goods received are the goods ordered.

60

New cards

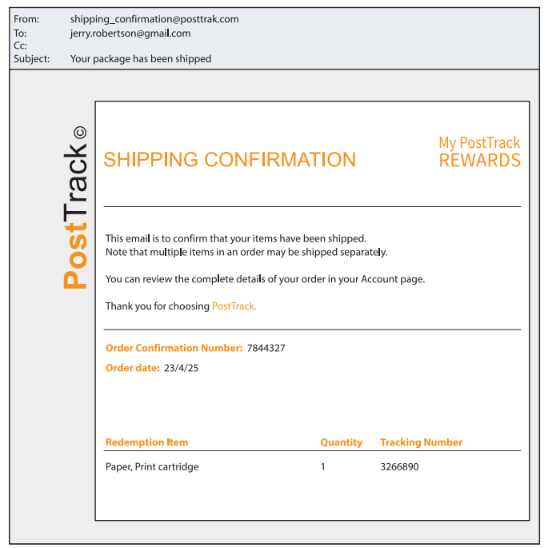

**Shipping and order confirmation**

a document that indicates that an order has been dispatched (sent) and can be expected at some point.

61

New cards

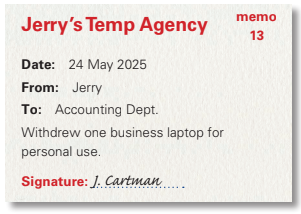

**Memo**

a source document used to verify internal transactions.

62

New cards

**Journals**

an Accounting record that classifies and summarises transactions during a particular reporting period.

63

New cards

**Cash Journals**

Cash transactions are recorded in one of two journals:

* Cash Receipts Journal, which summarises all cash received by the business (from other entities) during a particular reporting period

* a Cash Payments Journal, which summarises all cash paid by the business (to other entities) during a particular reporting period.

* Cash Receipts Journal, which summarises all cash received by the business (from other entities) during a particular reporting period

* a Cash Payments Journal, which summarises all cash paid by the business (to other entities) during a particular reporting period.

64

New cards

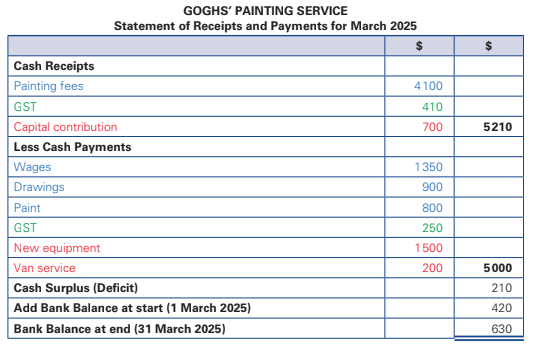

**Statement of Receipts and Payments**

an Accounting report that lists cash receipts and payments during a reporting period, the change in the bank balance, and the opening and closing bank balance.

65

New cards

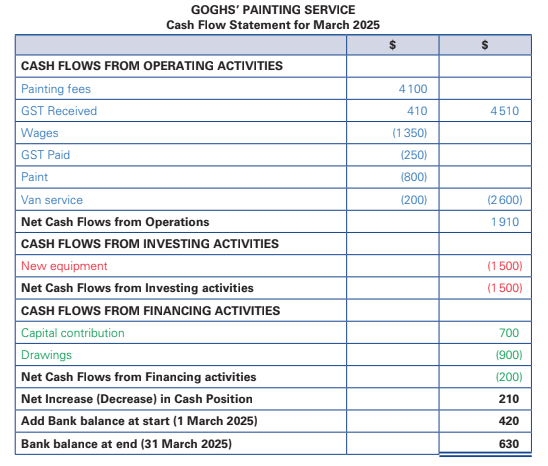

**Cash Flow Statement**

an Accounting report that reports all cash flows during a reporting period, classified as Operating, Investing and Financing activities.

Operating activities - cash flows related to day-to- day trading activities

Investing activities - cash flows related to the purchase and sale of non- current assets

Financing activities - cash flows related to changes in the financial structure of the firm

Operating activities - cash flows related to day-to- day trading activities

Investing activities - cash flows related to the purchase and sale of non- current assets

Financing activities - cash flows related to changes in the financial structure of the firm

66

New cards

**Uses of Cash Flow Statement**

The specific benefits of preparing a Cash Flow Statement are:

* to aid decision-making about the firm’s cash activities by detailing the sources and uses of cash in a particular period

* to assess whether or not the business is meeting its cash targets by comparing the Cash Flow Statement against budgeted (or expected) cash flows, which will highlight problems and allow for corrective action to be taken

* to assist in planning for future cash activities by providing a basis for the next budgeted Cash Flow Statement, which will set targets for the future

* to identify whether or not the business is generating enough cash from its Operating activities to fund its Investing and Financing activities.

* to aid decision-making about the firm’s cash activities by detailing the sources and uses of cash in a particular period

* to assess whether or not the business is meeting its cash targets by comparing the Cash Flow Statement against budgeted (or expected) cash flows, which will highlight problems and allow for corrective action to be taken

* to assist in planning for future cash activities by providing a basis for the next budgeted Cash Flow Statement, which will set targets for the future

* to identify whether or not the business is generating enough cash from its Operating activities to fund its Investing and Financing activities.

67

New cards

**GST Payable**

GST owed by the business to the ATO when the amount of GST the business has received on its fees is greater than the GST it has paid to its suppliers.

68

New cards

**GST Settlement**

a payment made to the ATO by a small business to settle GST payable (operating outflow).

69

New cards

**GST Receivable**

GST owed to the business by the ATO when the amount of GST the business has paid to its suppliers is greater than the GST it has received on its fees.

70

New cards

**GST Refund**

a cash receipt from the ATO to clear GST receivable (operating inflow).

71

New cards

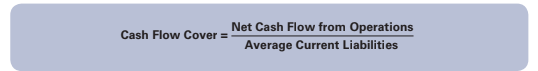

**Cash Flow Cover**

a liquidity indicator that assesses the firm’s ability of the business’s Operating Cash Flow to meet its short-term debts as they fall due.

72

New cards

**Internal control mechanisms**

the procedures and strategies used to protect the firm’s assets from theft, damage and misuse.

73

New cards

**Physical Safeguards**

These prevent unauthorised people from accessing a particular asset through barriers such as fences, padlocks or locked storerooms, and for cash, in particular, through the use of safes, lock-boxes and lockable cash drawers. If people cannot touch the asset, they have less chance of misusing or misappropriating it.

74

New cards

**Preventive safeguards**

These involve dissuading misuse or theft of assets through the threat of apprehension. Systems such as alarms and security cameras (open, hidden and even dummy) work on the premise that people are less likely to attempt theft if they are concerned they will be caught.

75

New cards

**Separation of duties**

This involves ensuring that no one employee (except the owner) has complete control over a particular type of asset, so their actions are open to scrutiny by another employee. The more people involved in the process, the less chance there is of collusion occurring.

76

New cards

**Rotation of duties**

This involves ensuring that tasks are not always performed by the same employee, so that their actions are open to scrutiny by the next employee who performs that task. (This has the added benefit of multi-skilling employees, who can then perform a number of tasks.)

77

New cards

**Careful hiring practices**

These involve effective screening and assessment of potential employees to ensure that only the most trustworthy and responsible candidates are employed. This should reduce the need to rely on other internal control mechanisms.

78

New cards

**Effective employee training**

This involves ensuring that staff are skilled in the use and management of the assets they are required to use or supervise, reducing the likelihood that assets are damaged through misuse. This is particularly the case for equipment, but also protects another of the firm’s assets its staff.

79

New cards

**Cash Control**

the procedures and strategies used to protect the firm’s cash.

80

New cards

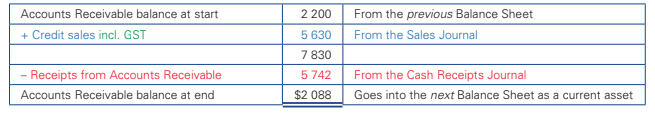

**Accounts Receivable**

a customer who owes a debt to the business for goods or services sold to them on credit.

81

New cards

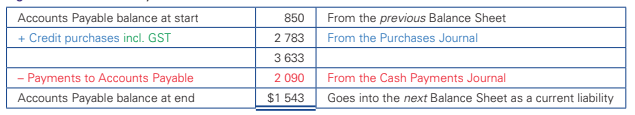

**Accounts Payable**

the business owes a debt to the suppliers for goods or services sold to them on credit.

82

New cards

**Credit Purchases**

a transaction that involves the acquisition of materials or supplies (or other goods) from a supplier who does not require payment until a later date.

Inventory of materials is valued at the supplier’s price, and the GST on credit purchases reduces the GST payable.

Inventory of materials is valued at the supplier’s price, and the GST on credit purchases reduces the GST payable.

83

New cards

**Purchases Journal**

an Accounting record that summarises all transactions involving the purchase of materials or supplies on credit.

84

New cards

**Accounts Payable formula**

With total credit purchases recorded in the Purchases Journal, and total payments to Accounts Payable recorded in the Cash Payments Journal, we can calculate the total balance owed to Accounts Payable at the end of the reporting period.

85

New cards

**Sales Journal**

an Accounting record that summarises all transactions involving the sale/performing of services on credit during a reporting period.

86

New cards

**Credit Fees**

a transaction that involves the provision of a service to a customer who is not required to pay until a later date.

As a result, any GST charged on credit fees is therefore owed back to the ATO, increasing the GST payable.

As a result, any GST charged on credit fees is therefore owed back to the ATO, increasing the GST payable.

87

New cards

**Accounts Receivable Formula**

Using the summaries from the Sales Journal and Cash Receipts Journal, we can calculate the total balance owed by Accounts Receivable at the end of the reporting period.

88

New cards

**Profit**

Profit = Revenue - Expenses

89

New cards

**Revenue**

an increase in assets or reduction in liabilities that leads to an increase in owner’s equity (except for a Capital contribution).

90

New cards

**Expenses**

a decrease in assets (or increase in liabilities) that reduces owner’s equity (except for Drawings).

91

New cards

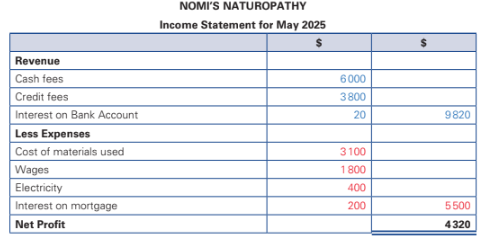

**Income Statement**

an Accounting report that details the revenue earned and expenses incurred during the reporting period.

92

New cards

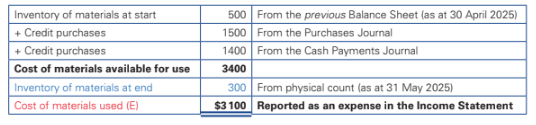

**Cost of materials used**

the business needs to calculate how much of its materials were actually consumed or ‘used up’ within the Period. Under the Accrual basis assumption, this amount incurred will be reported as an expense.

93

New cards

**Cash vs Profit**

A net increase in cash position (net decrease) measures the difference between cash inflows and cash outflows.

A Net Profit (or Loss) measures the difference between revenue and expenses.

A Net Profit (or Loss) measures the difference between revenue and expenses.

94

New cards

**Reporting a Net Profit or Loss in the Balance Sheet**

A Net Profit represents a net increase in owner’s equity, whereas a Net Loss represents a net decrease in owner’s equity, both as a result of business operations. This must then be reported in the owner’s equity section of the Balance Sheet. Must show the initial Capital balance, as well as any Capital contribution, Net Profit or Loss, and Drawings to show how the capital at end was determined.

95

New cards

**Uses of Income Statement**

1. Aid decision-making about the firm’s operations by measuring the firm’s performance. Detailing revenue and expenses (and ultimately profit) allows the owner to identify where changes may be necessary.

2. Assess whether the business is meeting its revenue and expense targets by comparing the Income Statement against budgeted (or expected) performance

3. Assist in planning for future service activities by providing a basis for the next budgeted Income Statement, which will set targets for the future. This may include setting targets to achieve a certain level of fees, staffing requirements or advertising expenditure.

4. Assess the performance of management in operating the business, primarily relating to generating sales and controlling expenses.

96

New cards

**Strategies to increase revenue**

1. Decrease prices - Decreasing prices can make the business’s service appear more competitive leading to a higher volume of sales.

2. Employ effective marketing - Advertising could be engaged more effectively by ensuring it targets the prospective customer base specifically desired. The best method of conveying a business’s service needs to be determined; for example, print, radio, internet or a mix that will provide the most reach. Marketing material must accurately represent the qualities of the service offered to maintain a business’s ethics and reputation.

3. Improve their service - Improving the service already offered with additional services as part of the standard package and being more customer-friendly can improve customer satisfaction and word of mouth.

97

New cards

**Strategies to decrease expenses**

1. Change supplier - Finding an alternative supplier who can provide cheaper materials could result in a reduction in Cost of materials used. Also looking at different providers of electricity, mobile and internet services can expose cost savings via different plans.

2. Buy in bulk - Purchasing in large quantities can allow a business to achieve a reduced cost price per unit of materials thus decreasing cost of materials used. Also, it could potentially cut delivery costs if a business reduced the number of purchases and deliveries per month by making one large purchase rather than many small ones.

98

New cards

**Liquidity**

the ability of the business to meet its short-term debts as they fall due.

99

New cards

**Stability**

the ability of the business to meet its debts and continue its operations in the long term.

100

New cards

**Price Setting Strategies**

• recommended retail price - a selling price that is recommended by the manufacturer or wholesaler

• competitors’ prices - prices charged by businesses competing in the same market

• market reaction - the response of customers in a particular marketplace to price levels for a particular good or service

• quotes - a method of determining a selling price by estimating the costs involved with a particular job, and then adding on a certain amount to provide for profit

• percentage mark-up

• cost-volume-profit analysis.

• competitors’ prices - prices charged by businesses competing in the same market

• market reaction - the response of customers in a particular marketplace to price levels for a particular good or service

• quotes - a method of determining a selling price by estimating the costs involved with a particular job, and then adding on a certain amount to provide for profit

• percentage mark-up

• cost-volume-profit analysis.