ACYMANS6: Segment Reporting & Decentralization; Transfer Pricing

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Goal congruence exists when

a. The goals of the company harmonize with each other

b. The company's managers are pursuing their own goals effectively

c. The company's managers are pursuing the goals of the company

d. All of the above are true

c. The company's managers are pursuing the goals of the company

The sequence that reflects increasing breadth of responsibility is

a. Cost center, investment center, profit center

b. Cost center, profit center, investment center

c. Profit center, cost center, investment center

d. Investment center, cost center, profit center

b. Cost center, profit center, investment center

A maintenance manager is most likely responsible for a(n)

a. Revenue center

b. Investment center

c. Cost center

d. Profit center

c. Cost center

A manager of a profit center is responsible for all of the following, except

a. Sales revenue

b. The cost of merchandise purchased for resale

c. Expanding into new geographic areas

d. Selling and marketing costs

c. Expanding into new geographic areas

→ investment center

In a responsibility accounting, a center’s performance is measured by controllable costs. Controllable costs are best described as including

a. Differential costs

b. Only those costs that the manager can influence in the current time period

c. Incremental and fixed costs

d. Only discretionary cost

b. Only those costs that the manager can influence in the current time period

Controllability may be difficult to pinpoint because of all the following, except

a. Some costs depend on market conditions

b. Current managers may have inherited inefficiencies of a previous manager

c. The current use of stretch or challenge targets

d. Few costs are under the sole influence of one manager

c. The current use of stretch or challenge targets

A major problem in comparing profitability measures among companies is the

a. Lack of general agreement over which profitability

b. Differences in the size of the companies

c. Differences in the accounting methods used by the companies

d. Differences in the dividend policies of the companies

c. Differences in the accounting methods used by the companies

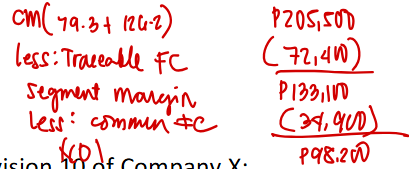

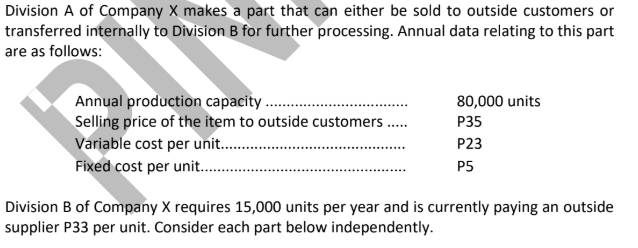

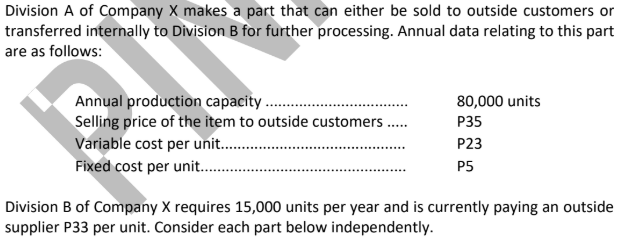

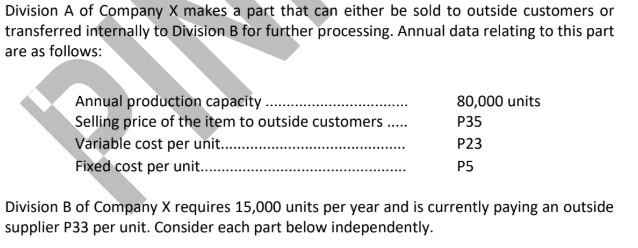

Company X has two divisions. Division A has a contribution margin of P79,300 and Division B has a contribution margin of P126,200. If total traceable fixed costs are P72,400 and total common fixed costs are P34,900, what is the company’s net operating income?

a. P168,000

b. P170,600

c. P133,100

d. P98,200

d. P98,200

The divisional return on investment is

a. 15 percent

b. 13 percent

c. 25 percent

d. 20 percent

c. 25 percent

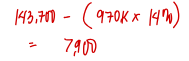

Company X uses residual income to evaluate the performance of its divisions. The company's minimum required rate of return is 14%. In January, Division 12 had average operating assets of P970,000 and net operating income of P143,700. What was Division 12’s residual income in January?

a. P7,900

b. (P20,118)

c. P20,118

d. (P7,900)

a. P7,900

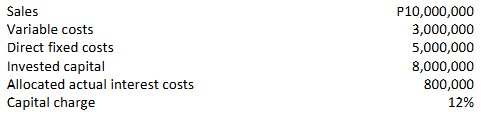

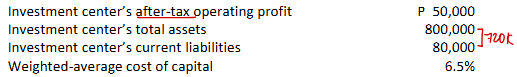

Consider the following:

What is the economic value added (EVA)?

a. P60,000

b. P 6,000

c. P 3,200

d. P50,000

c. P 3,200

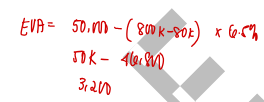

Segment A generated sales revenues of P400,000 and variable operating expenses of P180,000. Its controllable fixed expenses were P40,000. It was assigned 20% of P200,000 of fixed costs which is considered controllable. The common fixed costs were P25,000. What was Segment A's controllable segment profit margin?

a. P220,000

b. P140,000

c. P180,000

d. P160,000

c. P180,000

A transfer price is

a. An accounting device to turn profit centers into investment centers

b. The price charged by one segment of the company for goods or services provided to another segment

c. Only useful in a segment that deals with outsiders as well as with other segments of the same company

d. The amount charged by a cost center for a service performed for a profit center

b. The price charged byone segment of the company for goods or services provided to another segment

The criteria used for evaluating performance

a. Should be designed to help achieve goal congruence

b. Can be used only with profit centers and investment centers

c. Should be used to compare past performance with current performance

d. Motivate people to work in the company's best interests

a. Should be designed to help achieve goal congruence

With two autonomous division managers, the price of goods transferred between thedivisions needs to be approved by

a. Corporate management

b. Both divisional managers

c. Both divisional managers and corporate management

d. Corporate management and the manager of the buying division

b. Both divisional managers

The minimum transfer price is determined by

a. Incremental costs in the selling division

b. The lowest outside price for the good

c. The extent of idle capacity in the buying division

d. Negotiations between the buying and selling division

a. Incremental costs in the selling division

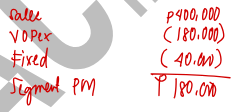

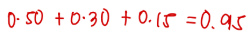

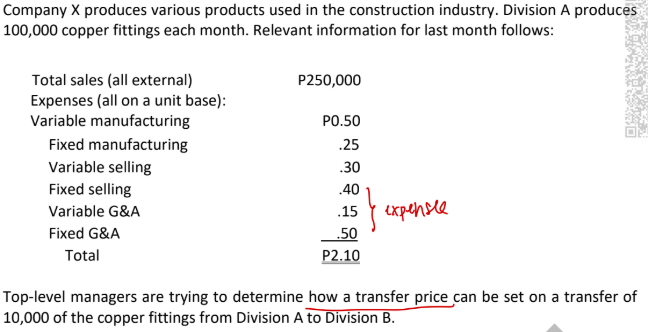

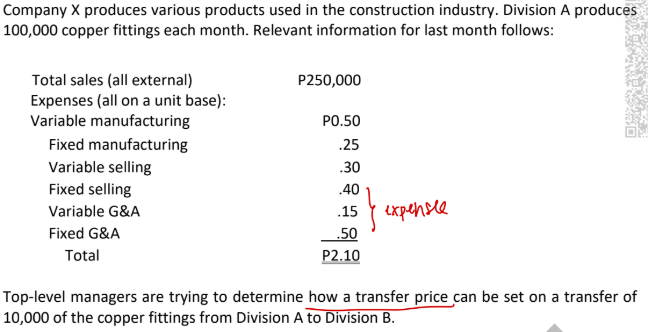

A transfer price based on variable cost will be set at ___ per unit.

a. P0.50

b. P0.95

c. P0.80

d. P0.75

b. P0.95

A transfer price based on full production cost will be set at ___ per unit.

a. P0.75

b. P1.45

c. P2.10

d. P1.60

a. P0.75

If Division A sells 100,000 fittings per month to outside customers, the per-unit transfer price is not likely to be below

a. P0.75

b. P2.10

c. P1.60

d. P2.50

d. P2.50

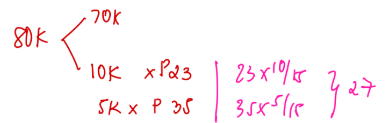

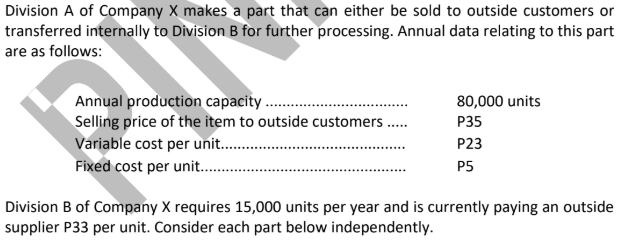

If outside customers demand only 50,000 units per year, what is the lowest acceptable transfer price from the viewpoint of the selling division? w/ excess

a. P35

b. P33

c. P28

d. P23

d. P23

If outside customers demand 80,000 units, what is the lowest acceptable transfer price from the viewpoint of the selling division? w/o excess

a. P35

b. P33

c. P28

d. P23

a. P35

If outside customers demand 80,000 units and if, by selling to Division B, Division A could avoid P4 per unit in variable selling expense, what is the lowest acceptable transfer price from the viewpoint of the selling division?

a. P35

b. P21

c. P31

d. P33

c. P31

If outside customers demand 70,000 units, what is the lowest acceptable transfer price from the viewpoint of the selling division for each of the 15,000 units needed by B?

a. P33

b. P27

c. P28

d. P29

b. P27