EC330 AT W7: Second Best Environmental Policy

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

What is the theory of the second best?

When there are market distortions, output and prices will not be at their efficient level even when Pigouvian tax is implemented.

Pigouvian optimal policy prescription is a tax equal to marginal social damages at the optimal pollution level

Also considered constraints to achieving this: information requirements, uncertainty, political economy, equity concerns

Types of market distortion

Market power

Interactions with the fiscal system

Other unpriced externalities

Difficulties of a uniform tax addressing a heterogeneous externality

Market power definition

the ability of a firm to maintain a price above the level that would prevail in a competitive market

First Welfare Theorem is violated as it is not Pareto Efficient when producer’s MC < consumer’s MB

What is the Buchanan critique (1969) of Pigouvian taxation with market power?

Monopolists already restrict output.

Emissions tax reduces externalities and further cuts production.

Tax based only on marginal external damages ignores the social cost of more output contraction.

A Pigouvian tax could lower welfare instead of improving it.

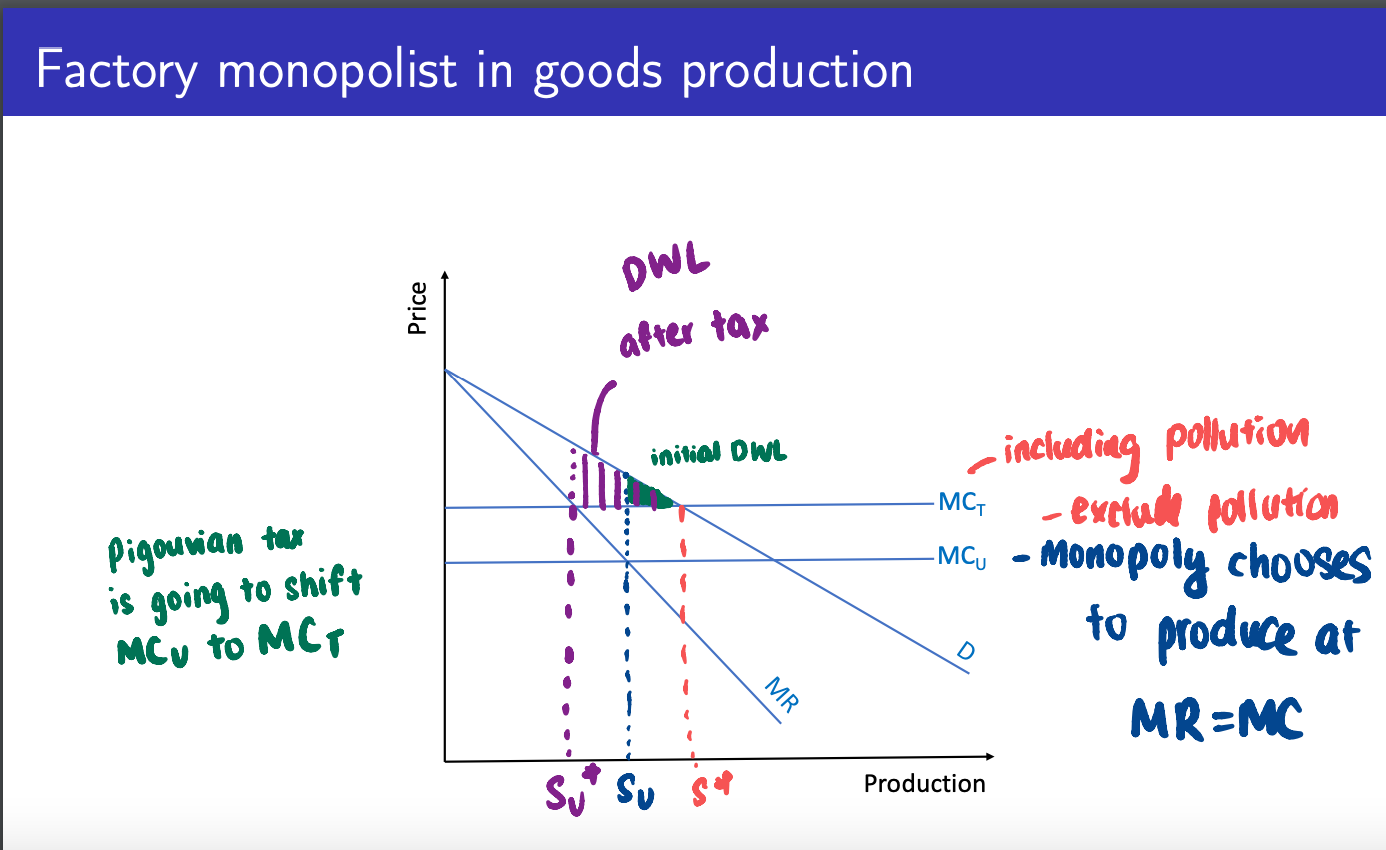

Explain the graph of the factory monopolist in goods production

MC_u = Marginal Cost excluding pollution (initial cost curve).

MC_t = Marginal Cost including pollution (after tax).

A Pigouvian tax shifts the marginal cost curve upwards from MC_u to MCₜ.

Monopolists set output where MR = MC.

Initially, without tax, monopolist produces at quantity Sᵤ.

After tax, production falls further to Sᵤᵗ.

Result:

Externality (pollution) is reduced (good).

But production contracts even more than efficient level S (socially optimal output)*. (P=MC)

Creates higher deadweight loss (DWL) after tax compared to initial DWL.

Key insight: Pigouvian tax intended to correct externality can lower welfare if monopolist already under-produces.

What would the second best optimal tax rate be?

Second best optimal tax rate < Pigouvian tax

aka lower than marginal social damages

this is because taxing at marginal social damages can overshoot such that the outcome is worse than not imposing an emissions tax at all

What is marginal cost pricing?

Setting the price of a good equal to the marginal cost of production.

How do 2-part tariffs relate to marginal cost pricing?

2 part tariff comprises a fixed fee + marginal charge per unit of consumption

fixed fee covers fixed cost

marginal charge covers marginal cost

Under marginal cost pricing, net revenue should be independent of consumption.

the company charges only the true cost of providing the gas.

So, when you use more gas, they get more money, but they also spend more money to supply it — it cancels out.

No matter if you use a little or a lot, their leftover money (net revenue) doesn’t change based on your gas usage.

Net Revenue (NRₜ) equation:

NRt=α0+α1qt+εtNR_t

If pricing = marginal cost (MC) of natural gas (no markup), α₁ should be 0.

Why would nonmarginal cost pricing occur for US oil market?

LDC Profit Maximization:

Firms want to maximize allowed rates of return (often above market rate).

Capital depends more on number of customers, not their consumption.

Firms lobby for low fixed fees to attract more small customers.

Distributional Concerns:

If fixed fees are low, people who use a lot of gas end up paying more overall — that's fair if richer families use more gas (this is called progressive pricing)

Political resistance to raising fixed fees (would burden lower-income households).

Environmental Externalities:

prices are set higher on purpose to discourage gas use and protect the environment (like reducing pollution).

effectively internalise the external environmental damages from natural gas consumption

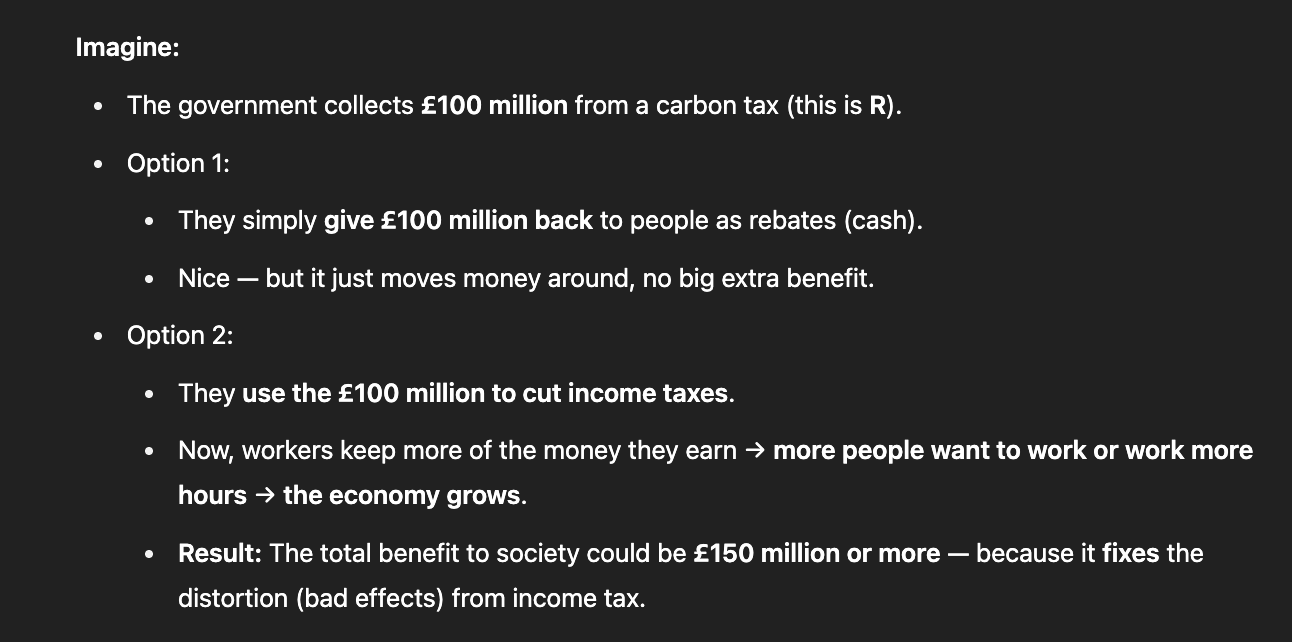

What are the types of fiscal interaction?

Revenue recycling effect

Tax interaction effect

What is a revenue recycling effect?

The efficiency improvements from using revenues generated by environmental policies to cut existing distortionary taxes

Result:

Reduces deadweight loss from those taxes.

Pollution tax boosts welfare through both Pigouvian effect (fix pollution) and revenue recycling effect (fix tax inefficienies)

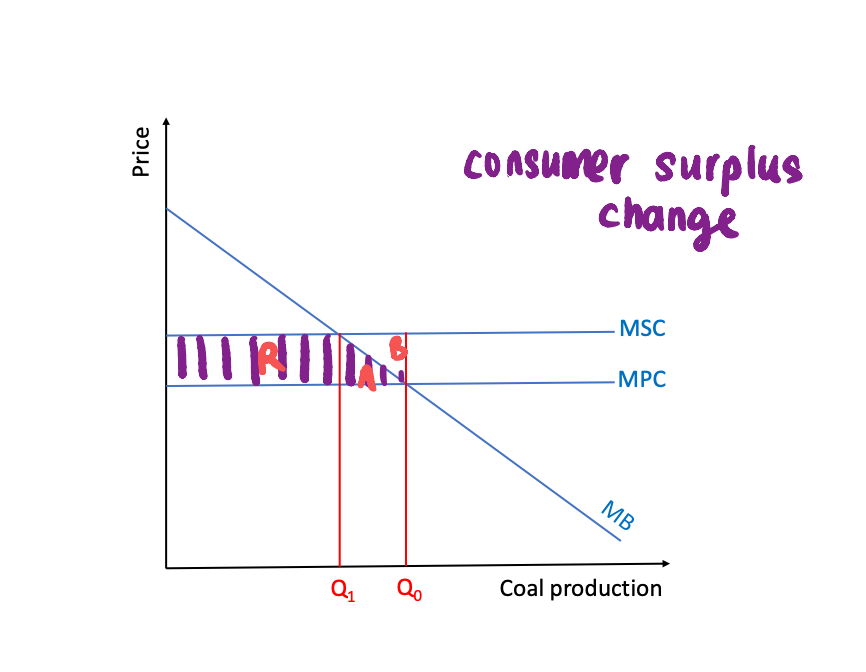

Revenue recycling effect graph

Tax revenue (R) can either:

Be given back to the private sector (simple rebate, small benefit).

overall cost to economy is A

policy offers net social benefits of B

Or be used to cut distortionary taxes (like income or sales tax) — bigger benefit!

If used to cut taxes, social value of R can be greater than R.

Result:

Pollution tax boosts welfare through both Pigouvian effect and RR effect.

Environmental improvement could even feel like a "free lunch"!

What is the tax interaction effect?

Occurs when the environmental policy affects the returns to factors of production (wage, returns on investment)

A coal tax makes goods and services more expensive.

real wages (what you can actually buy with your income) fall.

Profits from investments (returns to capital) also fall.

This effect is like an extra hidden (implicit) tax on workers and businesses.

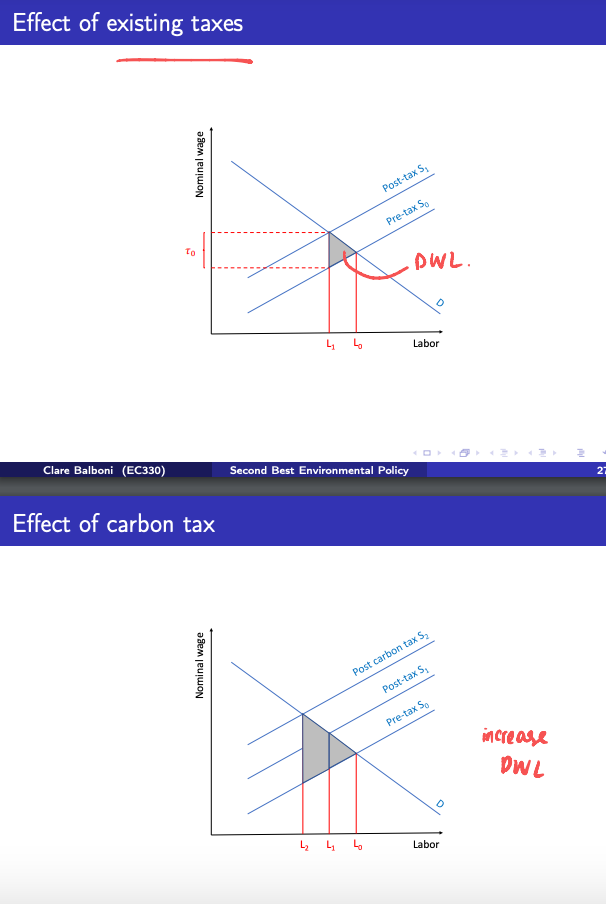

Tax interaction effect graph

How do existing taxes and a carbon tax affect labor markets and deadweight loss (DWL)?

Existing taxes (like income taxes) shift the labor supply curve from Pre-Tax S₀ to Post-Tax S₁, causing:

Higher wages needed to get workers.

Lower employment (from L₀ to L₁).

Deadweight loss (DWL) — lost economic value (grey triangle).

Carbon tax adds another distortion:

Shifts labor supply curve again to Post-Carbon Tax S₂.

Employment falls further (from L₁ to L₂).

DWL increases even more (larger grey area).

Why is there a larger DWL from tax interaction effect?

An efficiency cost arises from the fact the carbon tax functions as an implicit tax on labor

Generates loss via indirect effect on pre-existing distortionary taxes

When does double dividend occur?

Revenue recycling effect > tax interaction effect

→ overall policy cost < primary cost of policy

What is a strong double dividend

The revenue recycling effect is large enough to offset the primary cost and the tax interaction effect

→ overall cost of policy is negative

What is a weak double dividend?

The revenue recycling effect is greater than the tax interaction effect, but not enough to offset the primary cost, resulting in an overall cost that is positive but reduced.

via the cuts in pre-existing distortionary taxes vs in a lump sum fashion

What are unpriced externalities?

harms (or benefits) caused by an activity that aren't reflected in the market price.

ie:

congestion

accidents

noise pollution

Do different externalities need different, specific taxes to correct them?

Yes in terms of automobile use context

Congestion happens per mile driven

→ Best to tax each mile you drive.

Global warming comes from fuel burned

→ Best to tax per gallon of fuel you buy.

Why is a gas tax (gallon) poor in controlling the congestion externality?

A gasoline tax makes fuel more expensive, but it mainly encourages people to buy more fuel-efficient cars, not to drive less.

Congestion happens because too many people drive at the same time and place (e.g., rush hour), not because cars are fuel-inefficient.

So even with a high gasoline tax, people might still drive the same amount, just with more efficient cars → congestion remains!

Tax on miles travelled may have higher gains than optimal gas tax