Commercial Banks - Financial Statement Analysis

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

58 Terms

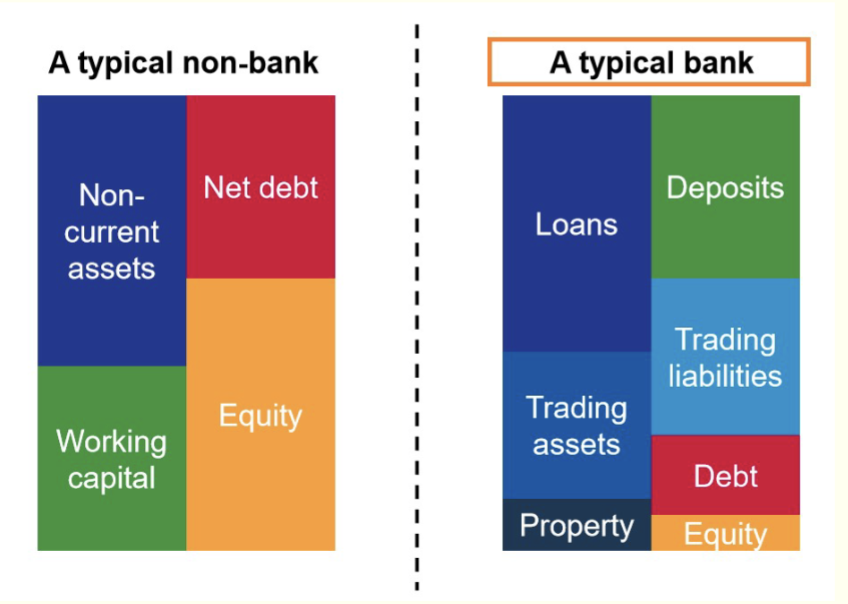

Non Bank vs. Bank Balance sheet

Federal financial institutions examination council (FFIEC)

Federal Financial Institutions Examination Council (FFIEC) in the

US prescribes uniform principles, standards, and report forms for

depository institutions.

Who do Central Banks submit financial statements to?

Financial statements of CB’s must be submitted to regulators and

stockholders at the end of each calendar quarter.

Call Report

Financial information on CB’s is reported in two basic documents, called Call Report

Report of condition (or balance sheet) presents financial information on a bank’s

assets, liabilities, and equity capital.

Report of income (or income statement) presents major categories of revenues and

expenses and the net profit (or loss) for a bank over a period of time.

All FI’s, and particularly commercial banks, are engaging an an increased level of off-balance-sheet (OBS) activities.

Assets: Cash and due from depository institutions

Consists of vault cash, deposits at the Federal Reserve, deposits at

other financial institutions, and cash items in the process of

collection.

None of these generates much income for the bank.

Assets: Investment securities

Consists of federal funds sold, repurchase agreements (RP’s or

repos), U.S. Treasury and agency securities, securities issued by

states and political subdivisions (municipals), mortgage-backed

securities, and other debt and equity securities.

Highly liquid, low default risk, and can usually be traded in

secondary markets.

Generate some income for the bank but predominantly used for

liquidity risk management purposes.

Assets: Loans and leases.

Categorized as commercial and industrial (C&I) loans, loans secured by

real estate, individual or consumer loans, and other loans.

Major asset items on the bank’s balance sheet and generate the largest

flow of revenue income.

Least liquid asset items and a major source of credit and liquidity risk for

most banks.

Assets: Other Assets

Consists of items such as trading assets, premises and fixed assets, other

real estate owned, intangible assets, and other.

Generally a small part of the bank’s overall assets

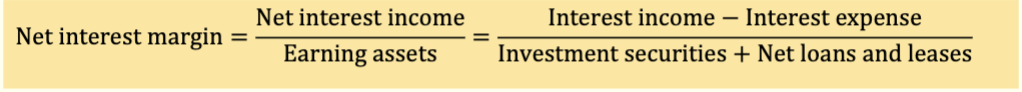

Assets: Earning assets

Investment securities plus net loans and leases.

Liabilities

Liabilities consist of various types of deposit accounts and

other borrowings used to fund the investments and loans

on the asset side of the balance sheet.

Liabilities: Deposits

Demand deposits are transaction accounts that generally pay no

explicit interest.

Negotiable order of withdrawal (NOW) accounts pay interest

when a minimum balance is maintained.

Money market deposit accounts (MMDA’s) have retail savings

accounts and some limited checking account features.

Other savings deposits include all savings accounts other than

MMDA’s.

Deposits in foreign offices

Deposits in foreign offices are generally large and held by

corporations with a high level of international transactions and

activities.

Retail certificates of deposits

Retail certificates of deposits (CD’s) are time deposits with a face value below $100,000.

Wholesale certificates of deposits (CD’s)

Wholesale certificates of deposits (CD’s) are time deposits with a face value of $100,000 or more.

Negotiable instrumenets

Negotiable instruments, meaning they can be resold by title assignment in a secondary market to other investors.

Brokered deposits

If wholesale CD’s are obtained through a brokerage or investment house rather than directly from a customer, they are referred to as brokered deposits.

Liabilities: Borrowed Funds

• Federal funds.

• Repurchase agreements (R P’s or repos).

• Other borrowing: Banker’s acceptances (BA’s), commercial paper, medium-

term notes, and discount window loans.

Liabilities: Core deposits

Core deposits: sum of demand deposits, NOW accounts, MMDAs,

other savings accounts, and retail CDs.

Liabilities: Purchased funds

Sum of brokered deposits, wholesale CDs,

deposits at foreign offices, fed funds purchased, repos, and

subordinated notes and debentures.

Purchased funds can be more expensive and more volatile sources of

funds than core deposits

Core deposits

Core deposits are the cheapest, and most stable, funds and are deposits that are at

the bank for reasons other than earning interest. Earning interest may still be

important but convenience, a relationship with the bank, customer satisfaction, etc.

keep the customer at the bank even if the bank does not pay the highest rate of

interest available on similar accounts at other banks.

Liabilities: Other liabilities

• Do not require interest to be paid.

• Accrued interest, deferred taxes, dividends payable, minority

interests in consolidates subsidies, and other miscellaneous claims.

Liabilities: Equity Capital

• Preferred and common stock (at par value).

• Surplus and additional paid-in capital (capital raised by selling shares

above the par value).

• Retained earnings

Loan Commitments

• are contractual commitments to loan to a firm a certain

maximum amount at given interest rate terms.

• Bank may charge up-front fee and/or commitment fee.

• Only when the borrower draws on the commitment do the

loans made under the commitment appear on the balance

sheet.

• A commitment fee is the fee charged on the unused

component of a loan commitment.

• By providing liquidity to depositors and credit-lines to borrowers,

banks can be exposed to double-runs on assets and liabilities.

Off balance sheet items

Off-balance-sheet items are contingent assets and liabilities

that may affect future status of a FI’s balance sheet.

Letters of Credit: Commercial LC’s

Commercial L C’s are contingent guarantees sold by an F I to underwrite the trade

or commercial performance of the buyers of the guarantees.

• A commitment by a bank to pay the seller of goods if the buyer of the goods

cannot pay.

• The creditworthiness of the bank is substituted for the creditworthiness of the

buyer.

• They are frequently used in international trade where sellers would find credit

investigation of buyers to be costly.

Letters of credit: Standby LC’s

Standby L C’s cover contingencies that are potentially more severe than

contingencies covered under trade/commercial L C’s.

• Cover less predictable risks, and are usually for higher amounts than

commercial letters of credit.

• Examples: a bank’s promise to pay if a commercial paper borrower fails to

repay, or if a municipal borrower cannot make scheduled payments, or if a

construction project is not completed on time.

• Financial letters are often used by commercial paper issuers to obtain higher

credit ratings on the paper.

Both commercial and standby letters are forms of insurance.

Both commercial and standby letters are forms of insurance.

OBS Items: Loans sold

Loans sold are loans originated by the bank and then sold to

other investors that can be returned (sold with recourse) to the

originating institution.

• Recourse is the ability to put an asset or loan back to the seller should the

credit quality of that asset deteriorate.

OBS Items: Derivative securities

Derivative securities include futures, forward, swap, and option

positions taken by the FI for hedging or other purposes.

• Banks can be either users or dealers of derivatives.

• Counterparty, or contingent credit, risk is likely to be present when

banks expand their positions in futures, forward, swap, and option

contracts.

• These risks are less important for exchange-traded derivatives

compared to over-the-counter instruments.

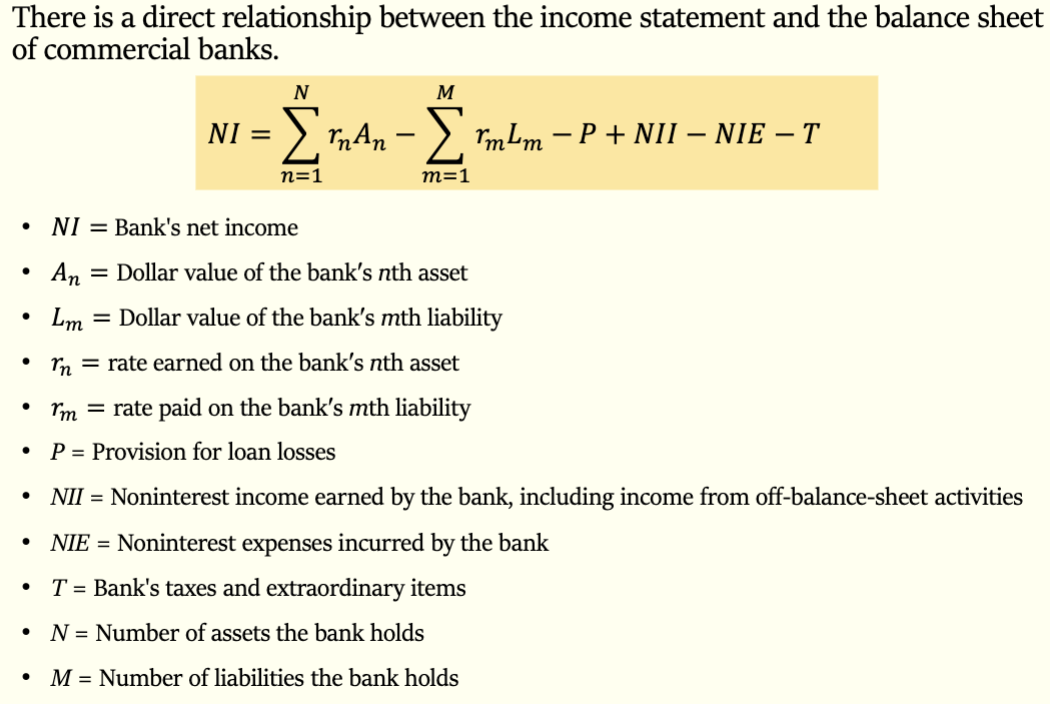

Income statement

Income statement identifies interest income and expenses, net interest

income, provision for loan losses, noninterest income and expenses, income

before taxes and extraordinary items, and net income from on- and off-

balance sheet activities.

Interest income

Interest income is taxable, except for that on municipal securities and tax-

exempt income from direct lease financing.

• Interest and fee income on loans and leases is the largest interest income-

producing category.

Interest expense

Interest expense is the second major category on a bank’s income

statement, and items listed here come directly from the liability section of

the balance sheet.

Net interest income formula

Net interest income = interest income − interest expense.

Provision for loan losses

Provision for loan losses is a noncash, tax-deductible expense, and it is the

current period’s allocation to the allowance for loan losses listed on the

balance sheet.

Noninterest income

Noninterest income include all other income received by the bank as a

result of its on- and off-balance sheet activities.

Total operating income

Total operating income = interest income + noninterest income.

Noninterest expense

Noninterest expense items consist mainly of personnel expenses and are

generally large relative to noninterest income.

• Items in this category include salaries and employee benefits, expenses of

premises and fixed assets, and other operating expenses.

• For almost all banks, noninterest expense is greater than noninterest

income

Income before taxes and extraordinary items

Income before taxes and extraordinary items (that is, operating profit) is

calculated as net interest income minus provisions for loan losses plus

noninterest income minus noninterest expense.

income taxes

Income taxes include federal, state, local, and foreign income taxes due

from the bank.

Extraordinary Items

Extraordinary items and other adjustments are events or transactions that

are both unusual and infrequent.

• For example, changes in accounting rules, corrections of accounting

errors made in previous years, and equity capital adjustments.

Net income

Net income is calculated as income before taxes and extraordinary items

minus income taxes plus (or minus) extraordinary items.

• Bottom line on the income statement.

18

Relationship between income statement and balance sheet

Ratio analysis

Ratio analysis allows a bank manager to evaluate the

bank’s:

• Current performance;

• The change in its performance over time (time series

analysis of ratios over a period of time); and,

• Its performance relative to that of competitor banks (cross-

sectional analysis of ratios across a group of firms).

The UBPR

The Uniform Bank Performance Report (UBPR), a tool

available to assist in cross-sectional analysis, summarizes

the performance of banks for various peer groups, for

various size groups, and by state.

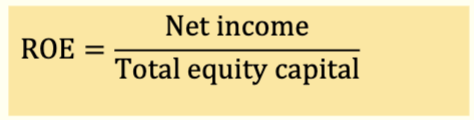

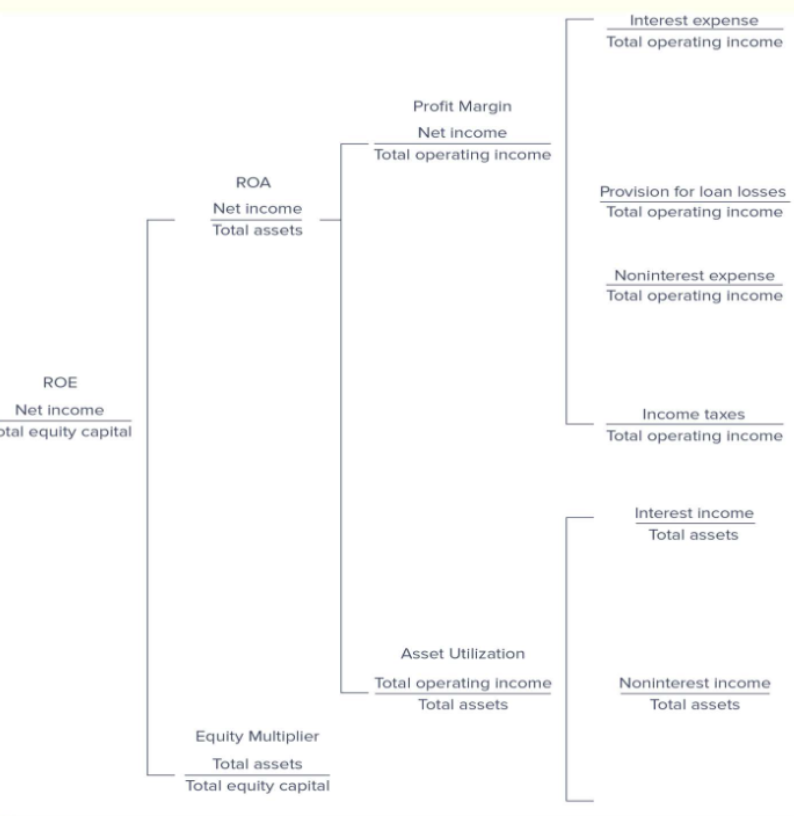

Return on equity framework

Return on equity (ROE) framework starts with ROE, and then breaks

it down to identify strengths and weaknesses in a bank’s performance.

• ROE measures the amount of net income after taxes earned for each

dollar of equity capital contributed by the bank’s stockholders

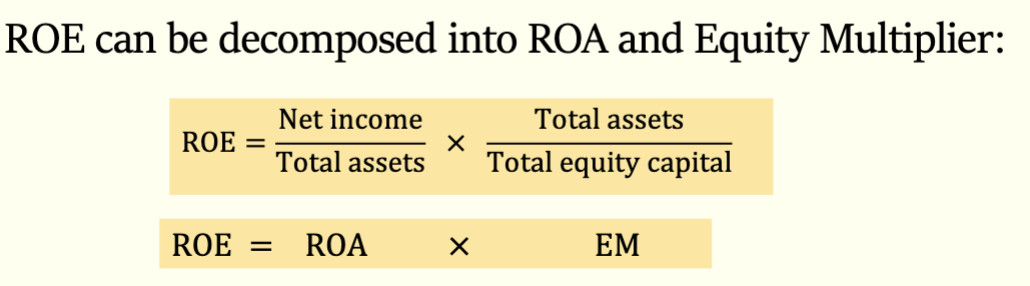

ROE to ROA and Equity

ROA

Return on assets (ROA) determines the net income produced per dollar of assets

Equity Multiplier

measures the dollar value of assets

funded with each dollar of equity capital.

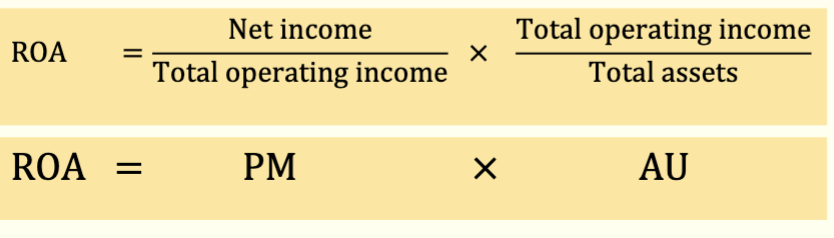

ROA broken down into 2 components

Profit Margin

Profit margin (PM) measures a bank’s ability to control

expenses and thus its ability to produce net income from its

operating income (or revenue).

Main expense items

Main expense items measured as a ratio of total operating

income:

• Interest expense ratio.

• Provision for loan loss ratio.

• Noninterest expense ratio.

• Tax ratio.

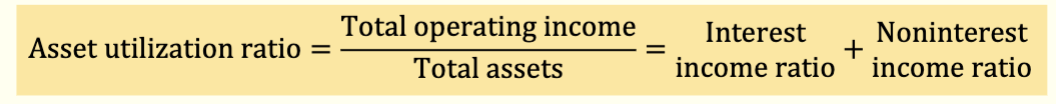

Asset Utilization

Asset utilization (AU) measures the extent to which the bank’s

assets generate revenue.

Asset utilization ratio

ROE framework

Net interest Margin (NIM)

Net interest margin (NIM) measures the net return on a bank’s earning assets.

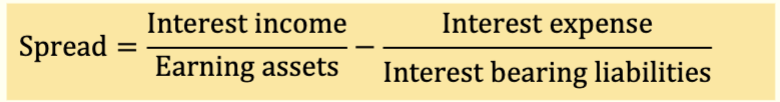

Spread

Spread measures the difference between the average yield on earning assets and average cost of interest bearing abilities

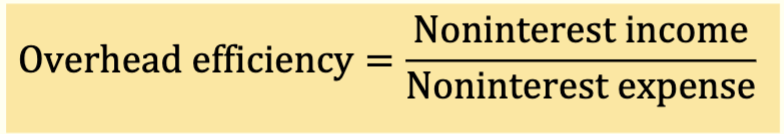

Overhead efficiency

Overhead efficiency measures the bank’s ability to generate

noninterest income to cover noninterest expenses.

Because of high levels of noninterest expenses (salaries,

back-office technology and systems, etc.) relative to

noninterest income, this ratio is barely larger than one.

The impact of market niche and bank size on financial statement analysis

• Retail, wholesale, and community banks operate in different market

niches that should be noted when performing financial statement

analysis.

• Large banks have greater access to purchased funds and capital

markets compared to small banks.

• Large banks generally operating with lower amounts of equity

capital than small banks.

• Large banks generally use more purchased funds and fewer core

deposits than do small banks.

• Large banks tend to put more into salaries, premises, and other

expenses than do small banks.

• Large banks tend to diversity their operations and services more

than small banks, and they also generate more noninterest income.