Measuring economic activity

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

23 Terms

national income

measures economic activity within country

main method of determining economic activity = measuring rate of change of output

nominal GDP

GDP = total value of final goods produced within a country over a time period, regardless of who owns the FOP

nominal GNI

GNI = total income received by residents of a country, regardless of where they live

more relevant metric

basically nominal GDP + net income earned abroad

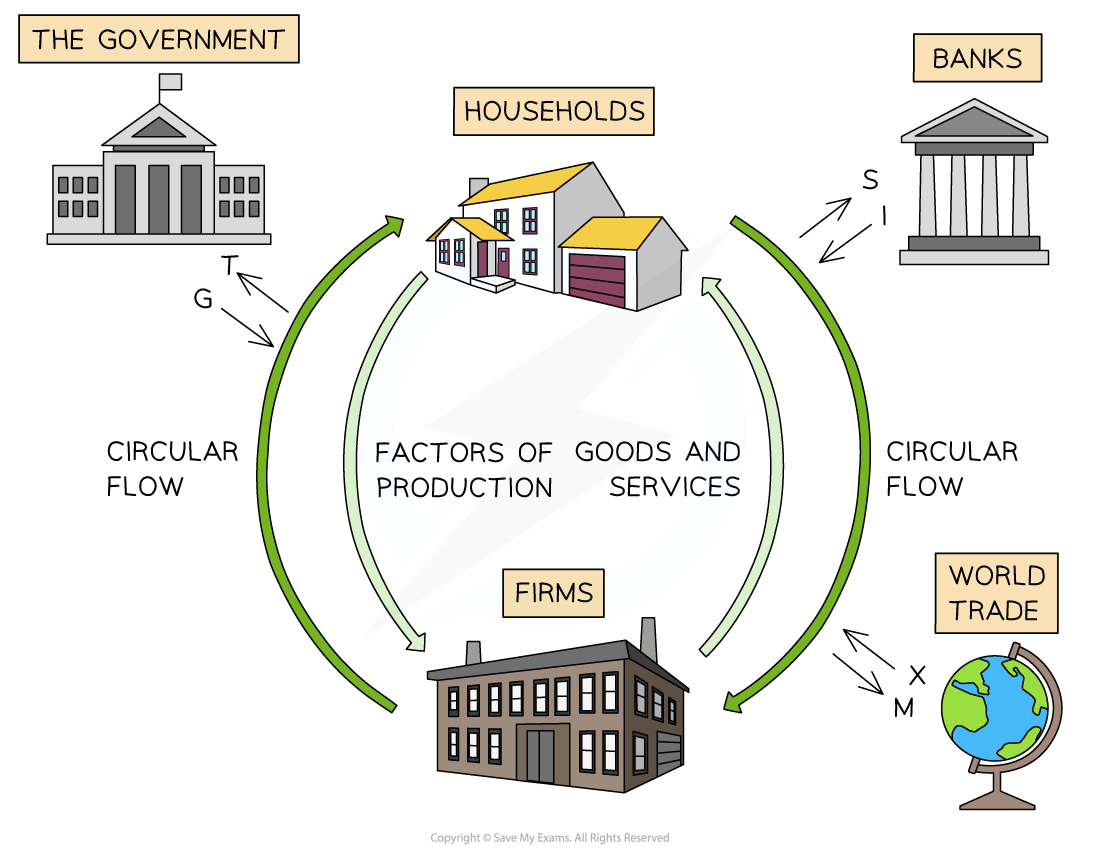

circular flow of income

injections add money to circular flow and increase its size

increased gov spending (G)

increased investment (I)

increased exports (X)

leakages remove money and reduce its size

increased savings by households (S)

increased taxation by government (T)

increased import purchases (M)

high levels of interdependence between all these components

how the flow of income is equal to the expenditure flow & value of output flow

income flow from firms to houses = expenditure flow from houses to firm

household incomes from selling FOP = expenditures by households on goods and services

these 2 flows are also equal to the value of the goods/servies or the value of the total output produced by firms

size of changes affecting size of economy

injections > withdrawals = economic growth

withdrawals > injections = economic decline

changes to any factors that influence gov spending, investment, exports, etc will increase/decrease size of circular flow of income

calculating national income

all 3 approaches should provide the same figure

value of finished goods is equal to expenditure paid to acquire them

value of GDP = monetary worth

volume of GDP = physical number

expenditure approach in calculating national income

adds up value of all expenditures in the economy in a year

consumption (C), gov spending (G) , investment (I) exports (X), imports (M) and net exports (X-M)

nominal GDP = C + I + G + (X-M)

components of expenditure approach

consumption: total spending on goods by consumers in an economy

investment: total spending on capital goods by firms

gov spending: total spending by gov in economy

doesn’t include transfer payments

net exports: difference between revenue gained from selling goods abroad and expenditure on goods from abroad

income approach in calculating national income

adds up payments for the FOP in a year

includes wages (W), rent (R), interest from capital (I) and profit (P) from entrepreneurship

national income = W + R + I + P

output approach in calculating national income

adds up value of all finished goods produced within the economy each year

real GDP and GNI

nominal means the metric hasn’t been adjusted for inflation, so it’s the actual value of all goods produced in an economy in a 1-year period

real GDP & GNI is adjusted for inflation

they’re calculated using a price deflator, GDP deflator, used to convert GDP/GNI from current prices to constant prices

Real GDP = Nominal GDP / GDP deflator x 100

real GDP/capita & GNI/capita

real GDP or GNI/capita = Real GDP or GNI/ the population

shows mean wealth of each citizen in country

provides insight on standard of living as it shows how much of the total output in an economy corresponds to each person on avg

PPP (purchasing power parity)

PPP is a conversion factor, calculates relative purchasing power of different currencies

shows number of units of a country’s currency that are required to buy a product in the local economy, as 1$ would buy that product in the US

helps make a more accurate standard of living comparison between countries

national income statistics to measure well-being

national income statistics are useful for comparing countries

allow judgments to be made about relative wealth and standard of living within each country

allow comparisons to be made over same or different time periods

real GDP is a better comparison than nominal GDP

one country may have higher rate of economic growth but much higher rate of inflation

real GDP/capita is better than real GDP because takes into account population differences

real GNI/capita is more realistic for analysing income available per person than GDP/capita

limitations of using GDP Data to compare living standards between countries over time

lack of information on inequality

distribution of income in an economy is an average (GDP/capita)

differences in SOL within same country can be significant

quality of goods

GDP provides no information on fluctuations of quality of goods

if quality worsens but prices are lower, SOL is judged to have increase, while poor quality may have actually decreased it

doesn’t include unpaid work

if unpaid work was included GDP/capita would be higher

differences in hours worked

GDP data doesn’t capture amount of time taken to produce the GDP/Capita

in 1 country where it takes less time to generate income than in a similar country, SOL should be higher

environmental factors

doesn’t capture environmental and health impacts of generating income within a country

if there are fewer externalities in generating income in 1 country, SOL should be higher

the business cycle

changes to real GDP that occur in the economy over time

it’s the actual growth

real GDP fluctuates above and below the long-term trend rate of growth

points in the cycle: peak, expansion, contraction, trough

peak: maximum real GDP

expansion: positive growth in real GDP, unemployment falling, general price level rising

contraction: negative growth in real GDP, growing unemployment of resources, falling price levels

trough: minimum real GDP

flow of real GDP can be moderated by gov intervention

characteristics of a recession (contraction lasting for more than 6 months)

occurs when there are 2 or more consecutive quarters of negative economic growth

increased unemployment

increasing negative output gap and spare production capacity

low confidence for firms/households

low inflation

increase in gov expenditure leading to a budget deficit

characteristics of a boom

increasing rates of economic growth

decreased unemployment

reduction of negative output gap or creation of positive gap, spare capacity reduced

high confidence, more risky decisions

increasing inflation

improvement in government budget as tax revenue rises and expenditure falls

alternative measures of well-being

OECD Better life index

Happiness index

Happy Planet index

GDP focuses on production, happiness includes health, relationships, environment, education etc

national income statistics present more positive data while national happiness surveys present more normative data

Easterlin Paradox: happiness and increases in income have a direct relationship up to a point, beyond that point relationship is less evident

OECD better life index

has 11 variables which it considers essential to well-being

housing: living conditions and proportion of household expenditure spent on housing

income: net income and net wealth

jobs: job security, average earnings and unemployment rate

community: social support networks

education: quality of education

environment: environmental health, pollution

civic engagement: voter turnout and community involvement in legislation

health: quality of healthy, life expectancy

life satisfaction: overall satisfaction of life

safety: how safe people feel walking alone at night

work-life balance: percentage of employees working long hours, amount of time for leisure

happy planet index HPI

measures sustainable wellbeing, how efficiently countries deliver long happy lives using the earths resources sustainably

measures country’s progress using: Wellbeing, life expectancy, ecological footprint

HPI score = wellbeing x life expectancy / ecological footprint

happiness index

survey that measures happiness in 10 different areas of a persons life:

psychological well being

health

time balance

community

social support

education, art, culture

environment

governance

financial security

work