Chapter 6: Deductions and Losses: In General

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

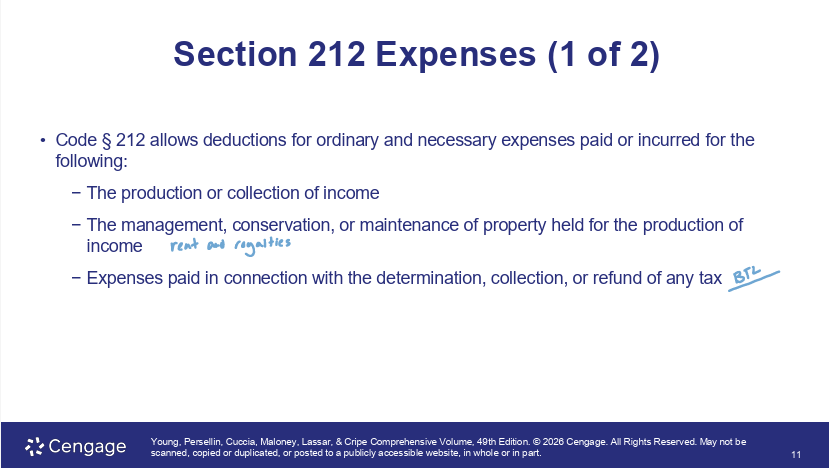

most common deductions for AGI

expenses for production of rent and royalties

expenses for a trade or business

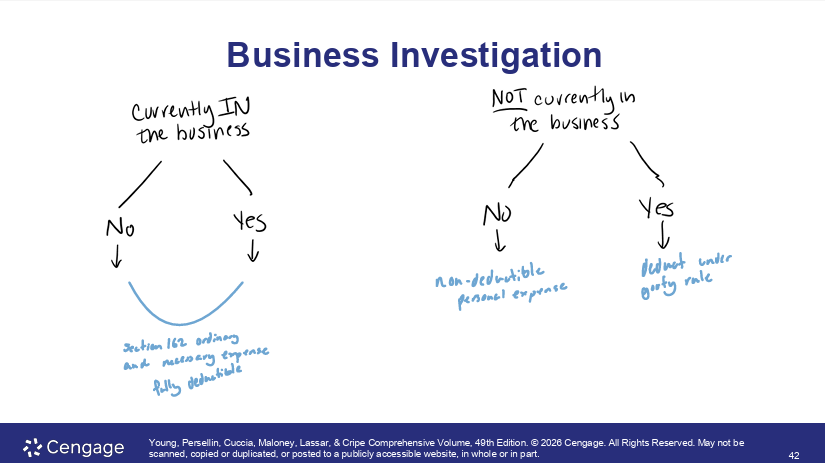

what does code 162 allow

deduction for all ordinary and necessary expeneses for trade/business

code 162 excludes what from trade/business expense

charitable contributions

illegal bribes

fines

for code 162 and 212 deductions need to be what (3)

ordinary

necessary

reasonable

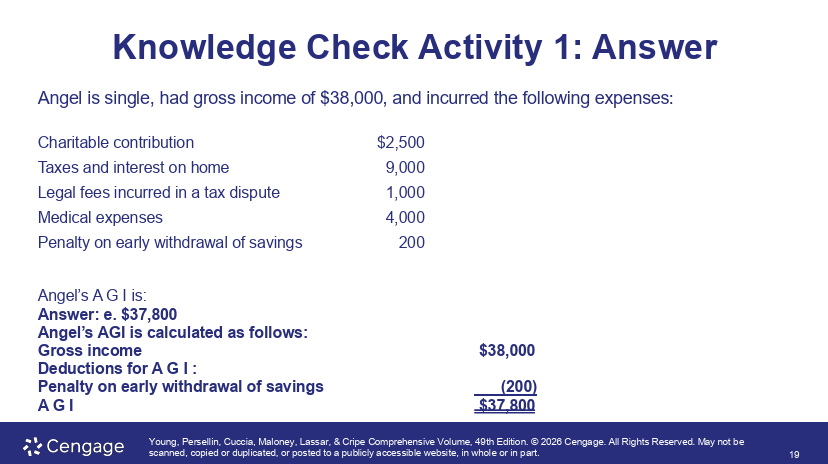

Angel is single, had gross income of $38,000, and incurred the following expenses:

Charitable contribution $2,500

Taxes and interest on home 9,000

Legal fees incurred in a tax dispute 1,000

Medical expenses 4,000

Penalty on early withdrawal of savings 200

Angel’s A G I is:

a. $21,300.

b. $28,800.

c. $32,800.

d. $35,500.

e. $37,800.

does inventory use accural or cash method

always accural

in what situation can corporation use cash method

if average gross recepits over the last 3 yeras are 30 million or under

what is the all events test

deductions to be claimed only when all of the events have occurred and the amount of liability is determined with reasonable accuracy

to deduct legal expenses ,it must be related to what (2)

a trade or business

income producing activity

are personal legal expenses deductible

no

are illegal business expenses deductible

yes

according to section 162 what illegal activies can’t be deducted

fines

bribes

illegal kickback

what is the only thing drug dealers allowed to deduct

cost of goods sold

can businesses deduct for political donations

NO

are lobbying cost deductible

No

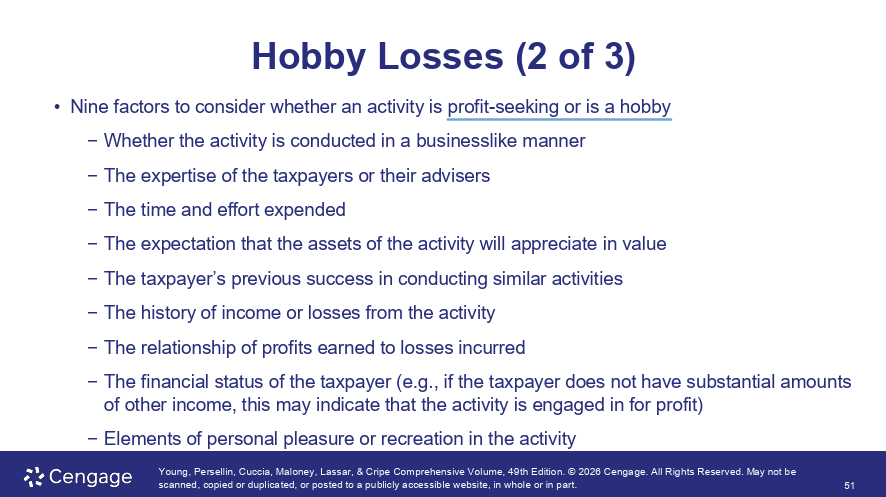

how much of hobby expense can be deducted

extend of hobby income

if a activity made a profit in ______ it’s a trade or business

3 out of 5 years

delete

delete