Finance Management

0.0(0)

0.0(0)

Card Sorting

1/216

There's no tags or description

Looks like no tags are added yet.

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

217 Terms

1

New cards

When is it comes to things that makes a business successful, what is the most important factor?

Customer satisfaction

2

New cards

Which part of the Value Creation Process does the financial person focus on?

Investment Decisions

3

New cards

Aside from investments, what other decisions does a financial manager make for a corporation?

Accessing financial capital in terms of debt and equity

4

New cards

What is a debt holder?

Someone who invested in the company and still needs to be paid the principle and interest by the company

5

New cards

What are the owners of the corporation?

The focus of the financial manager. These are the people who are the equity owners once the debt holders have been accounted for

6

New cards

Describe the flow in the Value Creation Process that involves financing decisions

Financial Markets (Stockholders and Bondholders) → Corporation

7

New cards

Describe the flow in the Value Creation Process that involves investment decisions

Corporation → Factor Market (Land, Labor, and Physical Capital)

8

New cards

Describe the flow in the Value Creation Process that involves dividends and interest

Corporation → Financial Markets (Stockholders and Bondholders)

9

New cards

Describe the flow in the Value Creation Process that involves profits

Product Market (Customers)

10

New cards

Describe the flow in the Value Creation Process that involves products or services

Factor Market (Land, Labor, and Physical Capital) → Product Market (Customers)

11

New cards

Investment decisions are also sometimes called ______

Operating decisions

12

New cards

What is supposed to be the outcome of making operating decisions?

To increase internal capital (resource allocation), also by acquisitions and divestitures. This in turn should also increase expected cash flows.

13

New cards

What happens alongside the operating decisions?

The financing decisions

14

New cards

What is the outcome of financing decisions?

Focusing on improving capital structure (debt and equity), as well as managing risk and the payout policies. Results in decrease cost of capital.

15

New cards

Which branch in the role of finance involves valuation and monitoring?

Operating decisions and performance evaluation

16

New cards

Which branch in the role of finance involves strategy formulation and implementation?

Financing decisions

17

New cards

What is the number one goal of financial management?

Maximizing shareholder wealth

18

New cards

What are some special qualities about shareholders?

They are residual claimants and the owners of a corporation

19

New cards

What payments need to happen prior to the shareholder receiving money?

* Supplier paid

* Wages to workers paid

* Interest to bondholders paid

* Taxes paid

* Wages to workers paid

* Interest to bondholders paid

* Taxes paid

20

New cards

What are firms constantly interacting with?

Financial Markets

21

New cards

What does IPO stand for?

Initial Public Offering

22

New cards

What is IPO?

It’s when investors in the market give money to the firm, then the firm gives securities to the investors.

23

New cards

If a company is successful, what two things can it generate profits and cashflows through?

Debt and Equity

24

New cards

Cashflows are returned to ____ and debt repayments to ____

Equity holders and debt holders

25

New cards

Aside from paying equity and debts, what third payment happens between firms and financial markets?

Tax payments to the government

26

New cards

Cash flows from the firm must _____ the cash flows from the financial markets

Exceed

27

New cards

What is capital budgeting?

The process of determining exactly which assets to invest in and how much to invest

28

New cards

What are the four steps, in order, of the decision making process for investments?

1. Identification

2. Evaluation

3. Selection

4. Implementation

\

29

New cards

Describe the Identification step in Investment Projects

Finding out opportunities and generating investment proposals

30

New cards

What type of investments fall under the identification step?

* Required

* Replacement

* Expansion

* Diversification

* Replacement

* Expansion

* Diversification

31

New cards

Describe the evaluation step in Investment Projects

Estimating the project’s relevant cash flows and appropriate discount rate

32

New cards

What type of investments fall under the evaluation step?

* Expected cash-flow stream

* Discount rate

* Discount rate

33

New cards

Discount rate is also sometimes known as ____

Cost of capital

34

New cards

Describe the selection step in investment projects

Choosing a decision making rule (accept / reject criteria)

35

New cards

List the types of investments that fall under the selection step

* Net present value

* Profitability index

* Internal rate of return

* Payback period

* Profitability index

* Internal rate of return

* Payback period

36

New cards

Describe the implementation step in investment projects

Establishing an audit and a follow-up procedure

37

New cards

List the types of investments that fall under the implementation step

* Monitor the magnitude and timing of cash flows

* Check if the project still meets the selection criterion

* Decide on a continuation or abandonment

* Review previous steps if failure rate is high

* Check if the project still meets the selection criterion

* Decide on a continuation or abandonment

* Review previous steps if failure rate is high

38

New cards

Money received in the future is _____ than money received today

less

39

New cards

Define opportunity cost

Rate of return sacrificed on the next best alternative

40

New cards

What is the formula for finding the future value FV of an investment of PV dollars today

FV = PV\*(1+r)^t

41

New cards

What is the present value

The amount of money you would need to invest today in order to duplicate some future dollar amount

42

New cards

What excel formula allows you to calculate the number of periods it will take for a future value to be achieved?

NPER

43

New cards

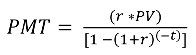

What is the formula for calculating payments of an amount with an interest rate?

PMT

44

New cards

What rule is usually used for forecasting the benefits and costs of an investment project?

Net Present Value (NPV)

45

New cards

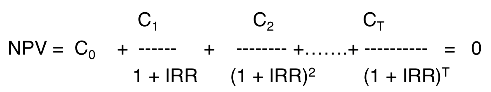

What is the formula for Net Present Value (NPV)?

NPV= C0 + C1/(1+r) +…+ Ct/(1+r)^t

46

New cards

What condition needs qualifies a project to be accepted when using NPV?

If NPV > 0, the the project will increase shareholder value and should be accepted

47

New cards

What is an independent project?

Acceptance or rejection is independent of the acceptance or rejection of other projects

48

New cards

What is a mutually exclusive project?

Can accept “A” or you can accept “B” or you can reject both -- you cannot accept both

49

New cards

What is the payback period?

The number of periods required for the sum of the project’s expected cash flows to equal its initial cash outlay

50

New cards

What are some of the consequences of the payback period?

* Penalizes long-term projects

* Difficult to know who decides the period

* Ignores cashflows after the period

* Difficult to know who decides the period

* Ignores cashflows after the period

51

New cards

What is the internal rate of return?

It is the discount rate that makes the net present value of the project equal zero

52

New cards

What is the criteria for an acceptable project using the internal rate of return?

The IRR needs to be greater than the cost of capital

53

New cards

What is the profitability index?

It is the present value of an investment’s future cash flows divided by its initial cost

54

New cards

What is another name for the profitability index?

Benefit / cost ratio

55

New cards

How do you calculate the profitability index?

(CF + NPV) / CF

56

New cards

What is the criteria for accepting the profitability index?

PI > 0 means you accept the project

57

New cards

What are some of the issues with IRR?

* Multiple IRRs can exist

* Scale issue

* Timing issue

* Scale issue

* Timing issue

58

New cards

What happens to cause multiple IRRs?

There is more than one change of sign of the cashflows (positive to negative and negative to positive)

59

New cards

What is the crossover rate?

NPVa = NPVb

60

New cards

What two evaluation methods will generally give the same decision?

NPV and IRR

61

New cards

Why would NPV and IRR not produce the same outcomes?

1. Non-conventional cashflows (flow signs change more than once)

2. Mutually exclusive projects

1. Initial investments are substantially different

2. Timing of cash flows is substantially different

62

New cards

What is the most popular capital budgeting method?

IRR and NPV

63

New cards

What is the difference between discounted and undiscounted payback periods?

Undiscounted means that the payments shown already are adjusted to incorporate the time value of money, whereas discounted means you need to make that adjustment

64

New cards

If you want to determine the amount of capital expenditures a company made during the previous year, you should find the company’s most current ____ and look under the caption ________

cash flow statement; cash flow investments

65

New cards

When combining investment IRR, the combined IRR will be _____ the two individual IRRs

between

66

New cards

Conventional cash flows must be ______ for the NPV and IRR methods to be consistent in accept / reject decisions

independent

67

New cards

What are the two principle for recording relevant cash flows:?

1. Record cash flows when the money actually moves

2. Cash flows that are different in both scenarios (accepting or rejecting an investment) are relevant to the decision, and those that are the same are irrelevant

\

68

New cards

Define Sunk Costs

Something you’ve already spent -- not relevant for decision making

69

New cards

Define test marketing costs

These are the marketing research expenses expended

70

New cards

Define erosion costs

Taking away costs from an existing location -- Cash flow transferred to a new project from sales and customer of other products of the firm

71

New cards

Define Opportunity Costs

Lost revenues from alternative uses of the asset

72

New cards

What kind of an expense is depreciation?

Non-cash

73

New cards

How do you calculate the after-tax cash flow (ATCF)?

ATCF = (revenue - costs - depreciation)(1- tax) + depreciation

74

New cards

What is working capital?

Changes in the current assets that are the result of the investment decision -- this is relevant to the decisions

75

New cards

What is working capital considered (directionally) at the start and end of a project?

Start: cash outflows

End: cash inflows

End: cash inflows

76

New cards

What are the three groups to consider when making cash flow estimates?

* Price, volume

* Variable costs

* Fixed costs

* Capital expenditure

* Working capital

* Variable costs

* Fixed costs

* Capital expenditure

* Working capital

77

New cards

What are the factors to consider with Price, Volume?

* Competition from existing products

* Competition from technological advances

* Values to customer

* Competition from technological advances

* Values to customer

78

New cards

What are the factors to consider with variable costs?

Labor, material, energy

79

New cards

What are the factors to consider with fixed costs?

Marketing (sales, advertising), information technology, accounting management

80

New cards

What are the factors to consider with capital expenditure?

Property, plant and equipment

81

New cards

What are the factors to consider with working capital?

Inventory, accounts payable, accounts receivable

82

New cards

What does the operating margin consist of?

Revenues (price, volume) and costs (variable and fixed)

83

New cards

What does the operating cash flow consist of?

The operating margin and taxes

84

New cards

What does the capital requirement consist of?

Capital expenditure, working capital (accounts receivable/payable, inventory)

85

New cards

What does the free cash flow consist of?

Operating cash flow and capital requirement

86

New cards

What does the cost of capital consist of?

Cost of debt and cost of equity

87

New cards

What does the net present value (NPV) consist of?

Free cash flow and cost of capital

88

New cards

The goal of the company is to ______ free cash flow and _______ cost of capital

maximize; minimize

89

New cards

What is a nominal return?

The percentage change in the amount of money you have

90

New cards

What is the real return?

The percentage change in the amount of stuff you actually buy

91

New cards

What is the Fisher Effect?

1 + Nominal = (1+Real) \* (1+Inflation)

92

New cards

Describe the two methods you can use to account inflation and estimation of cashflows

1. Express cash flows in real terms and discount them at the real interest rate

2. Convert real cash flows to nominal cash flows by allowing them to grow at rate of inflation and discount them at the nominal rate

\

93

New cards

Cost of capital is expressed in ______ terms

Nominal

94

New cards

Depreciation is expressed in ______ terms

Nominal

95

New cards

When is it important to account for inflation/

When dealing with long horizons and high inflationary times

96

New cards

How can you do sensitivity analysis?

Ask what if questions:

* Target Market Share

* Cost overrun

* Inflation

* Competition

* Discount rate

* Valuable options

\

\

* Target Market Share

* Cost overrun

* Inflation

* Competition

* Discount rate

* Valuable options

\

\

97

New cards

What are the steps?

1. Identify each key variable and the probability distribution associated with it

1. Base case

2. Revenues

3. Growth

4. Operating Margin

5. Working Capital

2. Draw one outcome for each variable

3. Estimate PV and IRR

4. Repeat steps 2 and 3 many times (\~5000)

5. Use the distribution of NPV to answer the following questions:

1. What is the likelihood that this will be a bad project?

2. What is the worst case and best case scenarios?

3. Can you try to build linkages in the simulations?

98

New cards

What is the most preferred technique for capital investment analysis?

Net Present Value (NPV)

99

New cards

Capital budgeting must be done on an _____ basis

Incremental

100

New cards

In regards to capital budgeting, what costs are ignored and what costs are considered?

Sunk costs are ignored; opportunity costs and side effects are considered