Inequality and poverty

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

equity

a condition in which people receive from a relationship in proportion to what they give to it

efficiency

using resources in such a way as to maximise the production of goods and services

equity vs equality

giving everyone what they need to be successful vs treating everyone the same

income inequality vs. wealth inequality

income: unequal distribution of flow of income to households (rent, wages, profit, interest)

wealth: differences in amount of assets households own

absolute poverty

situation where individuals cannot afford to acquire the basic necessities for a healthy and safe existence

relative poverty

situation where household income is a certain percentage less than the median household income in the economy

households living with <50% of median household income considered to be in relative poverty

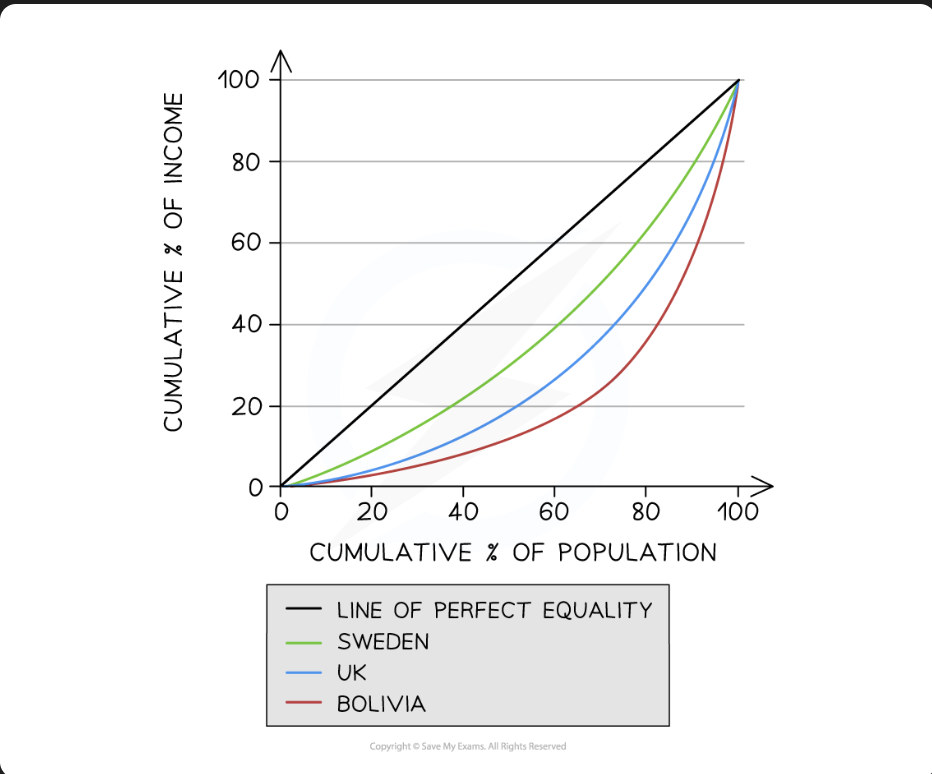

lorenz curve

visual representation of the income inequality existing between households in an economy

data presented in quintiles (population divided by 20%)

line of equality represents perfect income distribution (not desirable)

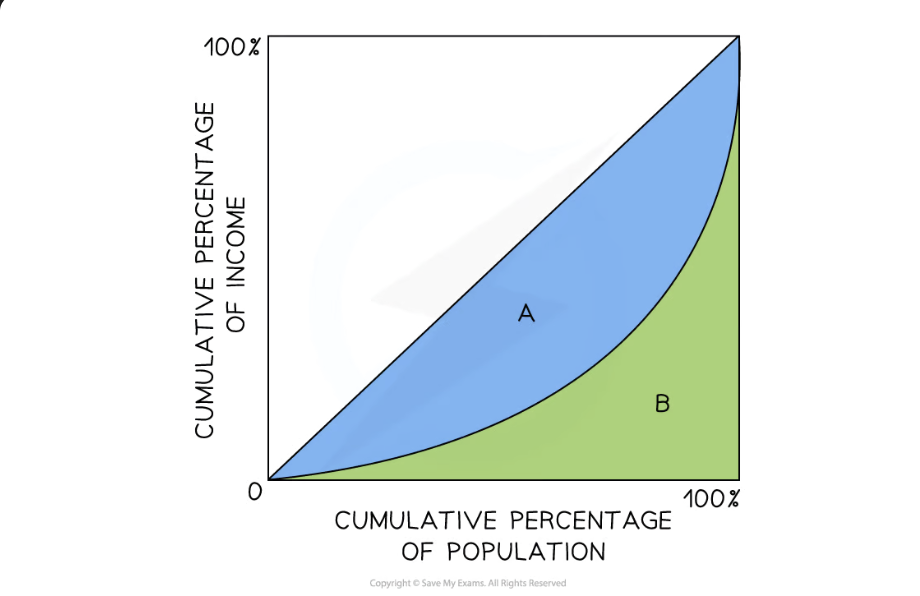

gini coefficient

gini coefficient = A / (A+B)

0 = absolute equality, 1 = perfect inequality

governments use progressive taxation and transfer payments to shift gini coeff. closer to 0

single indicators of poverty

international poverty line (IPL)

absolute minimum level of income a person must receive in order to meet basic needs required for human survival - 1.90$ a day

minimum income standard (MIS)

lowest amount of income needed for what society views as an acceptable SOL in the country

value differs from region to region

composite indicators of poverty

Multi dimensional poverty index (MPI)

survey to measure complexities of poor people’s lives each year

tracks deprivation across 3 dimensions and 10 indicators (health, education, living standards)

survey identifies which 10 deprivations each household experiences

household classed as poor if they suffer deprivations across 1/3 or more indicators

difficulties in measuring poverty

multi dimensional concept, difficult to quantify

measured through self reported surveys giving rise to multiple discrepancies

households identifying as poor may exhibit very diff characteristics from eachother

urban vs. rural poverty is very different

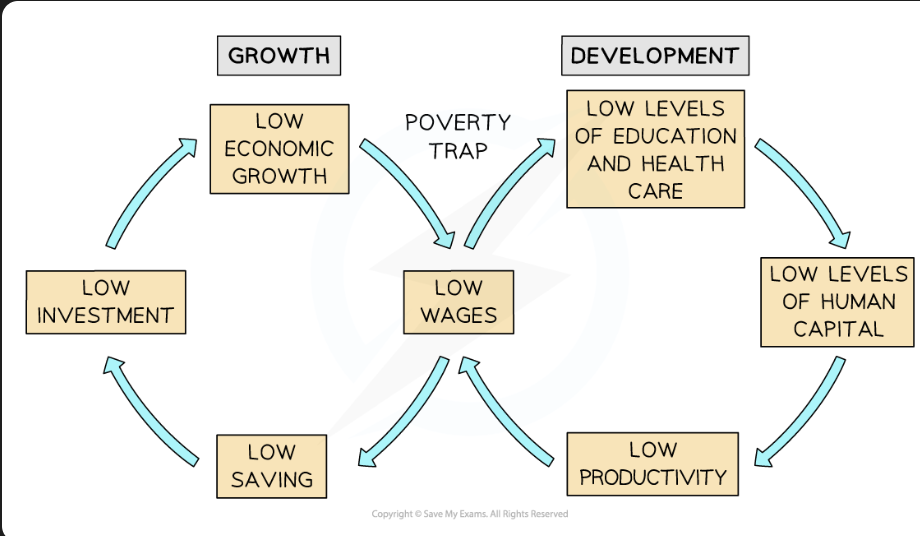

causes of poverty / poverty cycle

causes of inequality

differences in human capital

higher skill level, higher level of income

inequality of opportunity

unequal access to education and health = inequality of opportunity in job market

different levels of resource ownership

assets generate income

discrimination

gender, race, etc.

unequal status and power

economies w/ strong trade union membership provide workers w/ more power and higher levels of income and equality

gov taxes and benefits policies

countries providing range of benefits (unemployment, pension) raise income of lowest 20%, more equal distribution

progressive tax systems allow income earners to contribute according to their ability, more equal distribution

globalisation and technological change

integration of diff countries through increasing freedoms in cross border movement of people, goods, tech

globalisation speeds up industrialisation developing nations

more isolated countries experience higher levels of inequality

market based supply side policies

supply side policies provide great opportunities but also increase inequality

costs of inequality

impact on economic growth

increasing inequality becomes disincentive for workers to work and be productive

resources aren’t being used efficiently, national output falls, growth slows

gov unemployment payments and welfare benefits may increase

gov tax revenues decrease

impact on SOL

as inequality gap grows, rich get richer poor get poorer

wealthier people access the better education and healthcare, even less opportunity for poorer households in future

impact on social stability

more equal societies are more stable, with lower levels of crime

less equal societies suffer from political instability, social unrest and strife

role of taxation

used to redistribute income as to reduce income inequality

types of taxes:

direct: imposed on income and profits

paid directly to gov by individual or firm

indirect: imposed on spending

the less a consumer spends, the less indirect tax paid

types of tax systems

progressive:

as income rises, a larger percentage of income is paid as tax

regressive:

as income rises, smaller percentage of income is paid as tax

all indirect taxes are regressive

proportional:

as income rises, same percentage of income is paid in tax

indirect taxation and reduction of income inequality

selective use of indirect taxes can be used to improve income inequality

higher tax on luxury goods, goods with a PED>1,

no taxes on essential/necessity goods,

progressive taxation and reduction of income inequality

pros :

reduces disposable income for high income earners, redistributing income from those with higher to those with lower, reducing income inequality

redistribution often starts with provision of free education and healthcare

many govs use tax revenues to provide financial support to poorer households e.g disability payments, heating subsidies

cons:

discourages rich people from working as hard as large proportion of their income goes towards taxes, reducing overall productivity and growth

higher income individuals may participate in tax evasion affecting overall revenue generated

other policies that help break poverty cycle

investing in human capital

more generous transfer payments

establishment/increase of national minimum wage

establishing universal basic income

targeted gov spending on goods

policies to reduce discrimination

investing in human capital

investing in this supply side policy increases potential output of country (shifts PPC outwards)

higher education = higher skills = higher human capital = increased productivity = higher output = higher income

more generous transfer payments

transfer payments: payments made by gov where no goods/services are exchanged

usually given to poorest households, include unemployment, disability, pension payments

more benefits = higher wages = better healthcare/education = better human capital = better productivity = higher wages

cons: disincentives for unemployed people and poor people to accept work that would shorten their period of unemployment, higher burden on gov aswell as high unemployment rates

establishment/increase of national minimum wage

minimum wage set above free market rate

higher wages = better education/healthcare = better human capital = better productivity = higher wages

cons: allocative inefficiency

establishing universal basic incoem

UBI = guaranteed minimum income level, when necessary paid by gov to each individual

minimum income for all = better better education/healthcare = better human capital = better labour offer = decreased unemployment

targeted gov spending on goods/services

spending can be aimed at greatest needs in society

better education = higher human capital = increases productivity = higher output = higher wages

cons: opportunity cost of gov spending

policies to reduce discrimination

less discrimination leads to less social exclusion, leading to decrease in inequalities of opportunity and income

less discrimination = better productivity = higher wages

RWE: transfer payments

in 2003 Brazil enacted a scheme providing cash transfers of 35$ per month to families living below poverty line, aimed to reduce poverty, inequality, break poverty cycle

roughly 11% of population lived below poverty line then

gini coeff fell to 0.489 from 0.595, scheme reached over 46 million people

RWE: progressive taxation

Denmark has one of most progressive tax systems in the world with highest bracket paying up to 55% of income

Denmarks gini coeff fell from 0.282 to 0.277

tax revenue is readily reinvested into provision of free education, healthcare, and very generous paternity leave