Management Science (Decision Analysis)

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

What are the six steps in decision making? PAID MA

Clearly define the problem at hand.

List the possible alternatives.

Identify the possible outcomes or states of nature.

List the payoff (typically profit) of each combination of alternatives and outcomes.

Select one of the mathematical decision theory models.

Apply the model and make your decision

The types of decisions people make depend on how much knowledge or information they have about the situation. There are three decision-making environments:

Decision making under certainty

Decision making under uncertainty

Decision making under risk

Decision making under certainty

People choose the alternative that will maximize their well-being or will result in the best outcome

Decision making under certainty

Decision makers know with certainty the consequences of every alternative or decision choice

Decision making under uncertainty

There are several possible outcomes for each alternative, the decision maker does not know the probabilities of the various outcomes.

Decision making under risk

There are several possible outcomes for each alternative, the decision maker knows the probability of occurrence of each outcome.

Decision making under risk

The decision maker usually attempts to maximize his or her expected well being.

Decision theory models in a risk environment typically employs two equivalent criteria;

maximization of expected monetary value

minimization of expected opportunity loss

What is the goal in decision theory models in a risky environment?

maximize profit

minimize opportunity loss

To determine the unknown probabilities of various outcomes in decision making under certainty the several criteria is followed: OPERM

Optimistic

Pessimistic

Criterion of realism

Equally likely

Minimax regret

The optimistic criteria is also known as

maximax

The pessimistic criteria is also known as

maximin

The criterion of realism criteria is also known as

Hurwicz

The equally likely criteria is also known as

Laplace

What criteria can be computed directly from the decision (payoff) table?

Optimistic

Pessimistic

Criterion of Realism

Equally likely

What does the minimax regret criterion require?

The use of the opportunity loss table

Optimistic

the best (maximum) payoff for each alternative is considered and the alternative with the best (maximum) of these is selected.

Pessimistic

The worst (minimum) payoff for each alternative is considered and the alternative with the best (maximum) of these is selected.

Criterion of realism is also often called…

The weighted average

Criterion of realism

the criterion of realism (the Hurwicz criterion) is a compromise between an optimistic and a pessimistic decision. To begin with, a coefficient of realism, , is selected;

When a coefficient of realism is selected, what does it measure?

this measures the degree of optimism of the decision maker.

The coefficient of realism is between…

0 and 1

When the coefficient is 1, that means…

The decision maker is 100% optimistic about the future

When the coefficient is 0, that means…

The decision maker is 100% pessimistic about the future.

What is the advantage of weighted average approach (criterion of realism)

it allows the decision maker to build in personal feelings about relative optimism and pessimism.

The weighted average is computed as follows:

Equally likely

Uses all the payoffs for each alternative is the equally likely. The equally likely approach assumes that all probabilities of occurrence for the states of nature are equal, and thus each state of nature is equally likely.

The computation of equally likely involves…

This involves finding the average payoff for each alternative, and selecting the alternative with the best or highest average.

Minimax regret

Based on opportunity loss or regret.

Opportunity loss

the difference between the optimal profit or payoff for a given state of nature and the actual payoff received for a particular decision.

Opportunity loss is also defined as…

the amount lost by not picking the best alternative in a given state of nature.

How is opportunity loss computed?

calculated by subtracting each payoff in the column from the best payoff in the same column.

Decision making under risk

The alternative with the maximum EMV is chosen.

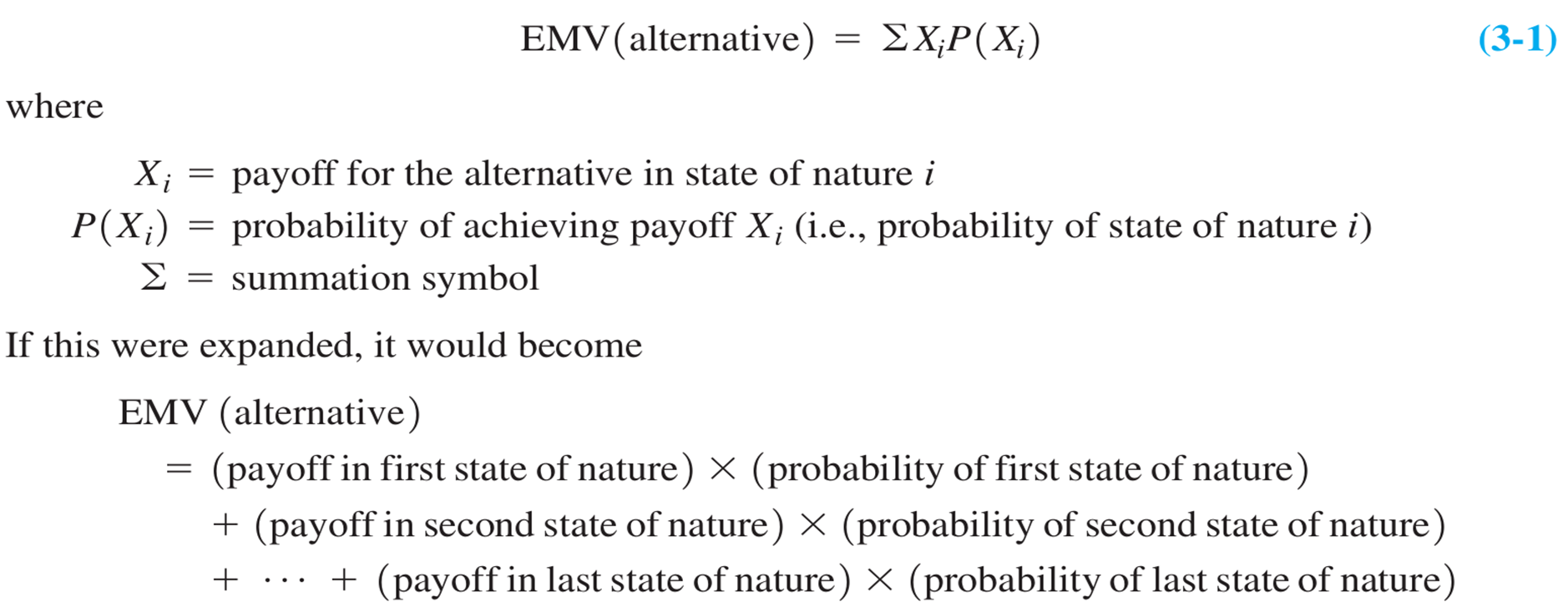

What does EMV means?

Expected Monetary Value (EMV) is the weighted sum of possible payoffs for each alternative. Also, the long-run average value of that decision.

EMV is computed as…

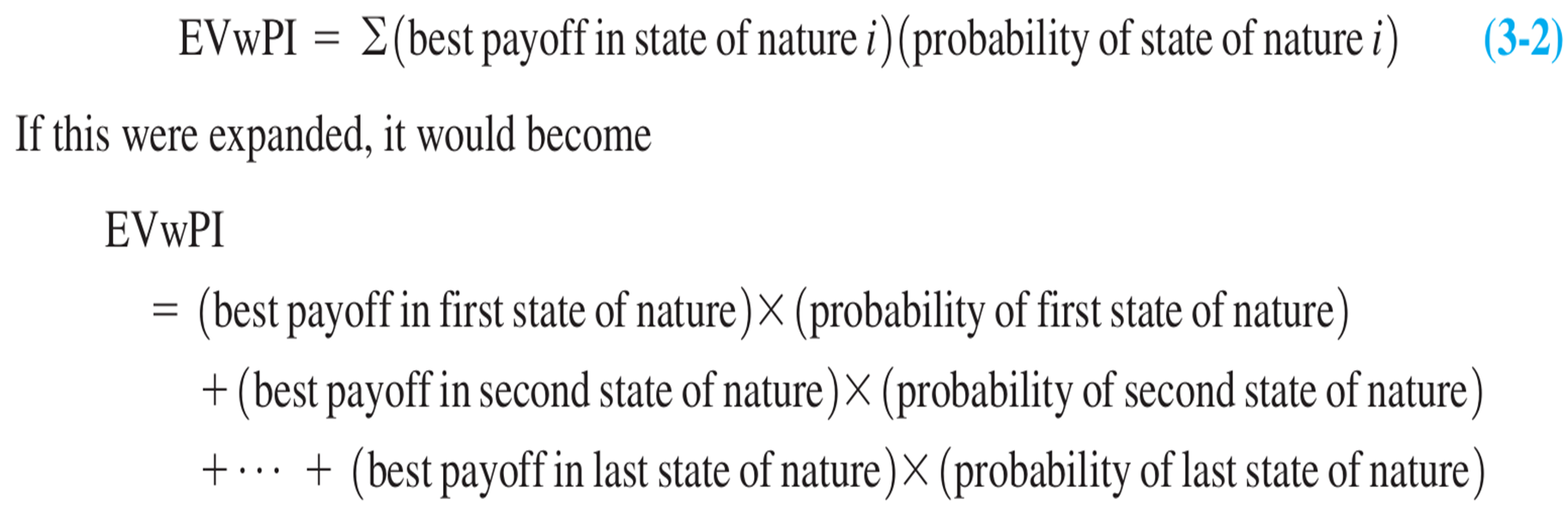

In expected value of perfect information, will result to the following computations:

The expected value of perfect information (EVPI)

the expected value with perfect information (EVwPI)

EVPI…

Places an upper bound on what to pay for information

The expected value with perfect information less the maximum EMV

EVwPI is computed as…

EVPI is computed as…

What is only considered by both the maximax and maximin criteria?

They only consider one extreme payoff for each alternative, while all other payoffs are ignored.

EOL means

Expected Opportunity Loss (EOL) is the cost of not picking the best solution.

EOL will always…

EOL will always result in the same decision as the maximum EMV.

EOL = max EMV

Sentivity Analysis

Investigates how our decision might change with different input data.

Cost of survey needs to be…

The cost of the survey had to be subtracted from the original payoffs.

EVSI is…

Expected Value of Sample Information (EVSI) is the increase in expected value resulting from the sample information. It also measures the value of sample information

Efficiency of sample information is…

EVSI/EVPI * 100%

Utility

The overall value of the result of a decision.