20 - Low and Stable Inflation

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

What is inflation?

Defined as a persistent increase in APL in the economy usually measured through calculation of a consumer price index

Costs of high inflation (7)

loss of purchasing power

If price of good increase, but income doesn’t change or not enough, can no longer buy as much

effect on saving

effect on economic growth

if people want to save - may choose to buy fixed assets

fewer savings in economy for investment

effect on interest rates

commercial banks make money by changing interest

if inflation rate increases, banks increase nominal IR

effect on international competitiveness

if country has higher rate of inflation than of trading partners - exports less competitive, imports more attractive

lower export revenue and higher import expenditure, worsen trade balance

Uncertainty

firms discouraged from investing - uncertainty of inflation

labour unrest

workers feel wages are not keeping up with inflation

disputes between unions and management

Winners of inflation

people with index-linked income

people with high wage bargaining power

borrowers - real interest rate lowered by inflation - amount paid back now worth less

people who are “asset rich“

buy assets as opposed to spending

increase p of assets

importers - price of domestic increases, import demand increases

Losers of inflation

Fixed income/wages

low wage bargaining power

savers/lenders - real IR lowered by inflation, amount received worth less

people who are cash rich

value of cash decreases over time

exporters - less attractive abroad as higher P make them compare less favourably with foreign

How is inflation measured?

Consumer price index

Basket of good - when p of basket increases, APL has risen

different categories, different weights

Issues in measuring CPI

CPI - typical consumption of a household, doesn’t apply to all

variations in regional rates - national figures typically used

doesnt reflect accuracy of groups

Errors in data collection

larger the sample, more accurate, costs money and time

Due to consumption habits - items removed/added over time

if items are changed, hard to make comparisons

Further complicated by change in quality.

Countries measure differently - hard to make international comparison

Prices change for variety of reasons that are not sustained

e.g seasonal food prices

CPI measures change in consumer prices, indicates common economy health

other prices change essential for doing this

economists measure change in FOP’s

Commodity prices - change

Upward movements in price - signal of cost push pressures and may be leading indicators of inflation

Producer Price index

tracks price of goods as leave the factories before distributors, wholesalers or retailers and their profit margin

Causes of inflation - two types

demand pull and cost push

How does D inflation work - brief

Increase demand in the industry

prices up from APL1 to APL2

Change in AD can be sue to changes in the components

How does cost push inflation work - brief

increase in COP

increase in costs fall in sras

Wage -push inflation, increase in APL due to increase in labour costs

Fall in countries currency - import-push inflation

lower exchange rate makes imports more expensive, increases cost of imported FOP’s to countrys firm

Inflationary spiral

Ad keeps going up due to increased wealth, If Ad increases, demand-pull, workers demand higher wage as APL increased. Shift in SRAS due to cost push.

Inflation is a short run problem - supply side policy

supply-side policies not suitable

successful policies reduce APL over time, but time lag too great

Gov intervention for demand-pull

GOV and CB should use contractionary monetary and fiscal policy to reduce AD

Why is cost-push hard to intervene with

Caused by rising COP’s, policy makers have no control over

demand side policies needed to fight inflation

Problems with contractionary policies

Highly unpopular from a political standpoint

Fiscal

voting population not happy to accept higher taxes as it reduce disposable income

reduction in gov spending - impacts groups of people

takes time - time lag too long

Monetary

higher IR harm people in economy, especially with loan or mortgage

less borrowing, less investment, harm economy

Which policy is considered most effective

Monetary, IR considered best weapon

What is deflation

Persistent fall in average price level

“Good“ deflation - how does it work

improved in supply side of the economy, and/or increased productivity

Increase in LRAS - increase in real output, fall in price level

Bad deflation - how does it work

demand side of economy

fall in AD, decrease in APL, decrease in real output, increase unemployment

Disinflation

falling rate of inflation

prices rise, but inflation can reduce

Costs of “bad“ deflation

Unemployment

AD decreases, lay off workers, AD decreases more

deflationary spiral

Deferred consumption

put off purchase of durable goods, wait for p to drop more

fall in AD, deflationary spiral

falling consumer confidence

households become pessimistic about economic future, consumer confidence lowers

deflationary spiral

effect on investment

Business make less profit, lay off workers. Business confidence low, likely to reduce investment

costs to debtors

Anyone who has taken a loan suffers, value of their debt rises. If profits low, difficult to pay loans - bankruptcies, further lower confidence

policy ineffectiveness

Deflation make monetray ineffective. very low/negative interest rates with deflation make expansionary monetary ineffective, not possible to reduce IR to increase AD

What does the weighted price index do

Take a basket of products, which are given a different weight, based upon relatives amount people spend

Inflation rate calculation - basket

(Index for (X+1) - Index for X) / Index for X x 100

Og philips curve

inverse relationship between rate of change of money wages (wages not adjusted for inflation) in economy and unemployment

Philips curve - low unemployment

If low unemployment, firms pay higher wages to attract labour

Philips curve - high unemployment

If high unemployment, workers compete, wages could be low

Philips curve

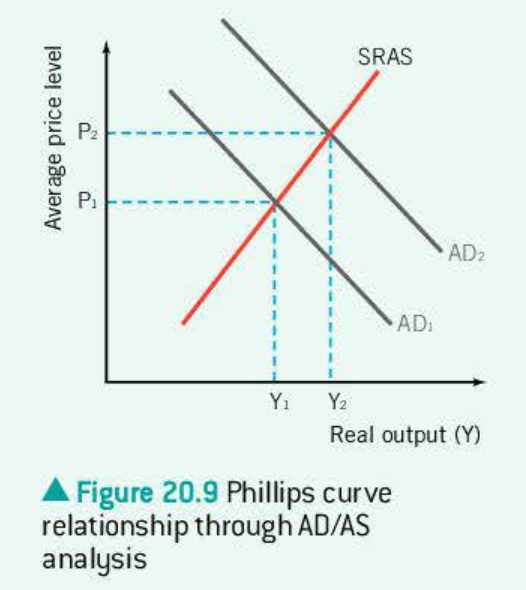

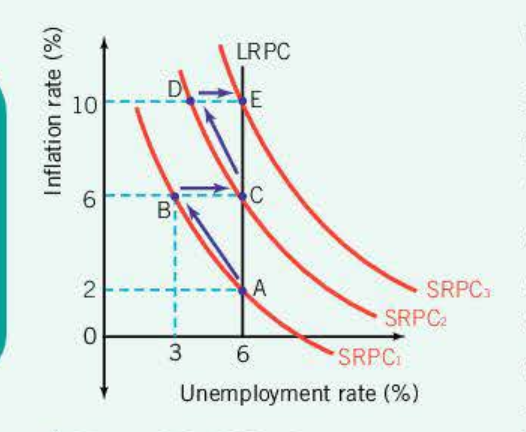

philips curve AD/AS

People expect inflation to be 2%, hence want higher wages

unemployment drops, people interested in higher wages

workers suffered from money illusion

workers realise wages havent risen, leave jobs, unemployment

back to natural rate, but now at a higher inflation

This is an on going cycle, resulting in higher inflation

Natural rate of unemployment

Rate that is consistent with stable rate of inflation. Economy is at full employment, labour market at eq.

if gov doesnt use expansionary policies, inflation will not accelerate at natural rate of unemployment

Difference in unemployment between countries due to dif, factors

availability of unemployment benefits

trade union power

extent of labour market regulations

wage-setting practice

Countries with more benefits and regulations of markets tend to have…

higher rate of natural unemployment