Chapter 5 - IAS 38 Intangible Assets

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

Intangible Asset

an identifiable non-monetary asset without physical substance. It is a resource that is controlled by the entity as a result of past events and from which future economic benefits are expected

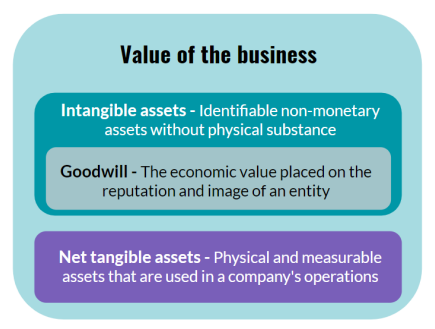

Value of Intangibles

Often the provide market advantage.

More to do with increasing the company’s future worth.

Can easily be destroyed by excessive carelessness and a bad reputation.

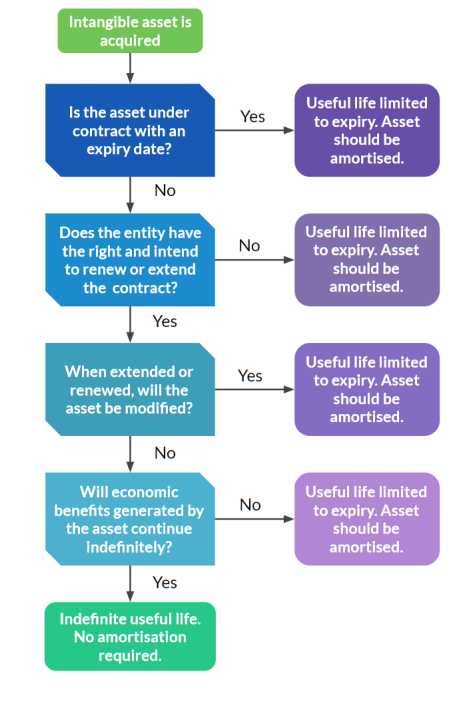

Definite intangibles

Contact based with an agreed upon expiration date - limited lifespan

Indefinite intangibles

Do not have a limiting factors to their useful life. these assets are not amortised as there is no foreseeable limit to the benefit, or cash flow generated from them.

Recognition criteria

Probable that any future economic benefit associated with the asset will flow to, or from the entity

Cost, or value that can be measured reliably

Economic benefit

Probability of future economic benefits from intangible assets may be based in reasonable and supportable assumptions. there is an exceptionally high likelihood of gaining benefit from the asset.

Cost

Main criterion for recognition is that we should be able to reliably measure the cost of the asset. in the same way as we would measure a tangible asset.

Includes the price a company pays plus any amounts incurred to get the asset into working order.

Goodwill

Purchased Goodwill

is Measured at the consideration paid at acquisition, less the fair value of the net assets of the acquired entity

Internally generated goodwill

Incurs expenses, increasing the possibility of the future economic benefit. Is never considered as an intangible asset. Any expenditure incurred is directly expensed

Research and development

It is important that research are identified separately from development as they are recorded differently.

Research phase

Are expensed when incurred , the likelihood of future benefit is uncertain - if research and development cannot be properly differentiated, whole amount must then be expensed.

Development phase

IAS 38 - an intangible asset should be recognised if an entity demonstrates all of the following:

technical Feasibility of completing the intangible asset

Intention to complete the asset

Ability to use or sell

Probable that the asset will generate future economic benefit

technical, financial and other resources to complete the project

Measure the development cost

In-process research and development

a Project acquired during a merger or acquisition is recognised as an asset at cost. additions to the project will be subject to the main recognition criteria.

Measurement of intangible assets

The Cost model.

The revaluation model.

Cost Model

Carried at cost less accumulated amortisation and impairment losses - valued at historical cost.

Revaluation model

Intangible assets being carried at re-valued amounts less any subsequent amortisation and impairment losses.

Based on fair market value and must be determined by an active market.

If no active market can be found - only then the cost model can be used.

If an active market can found - Same logic as the rules for revaluing property, plant and equipment are followed.

If the re-valued amount is higher than the original cost, then the added amount is recognised in other comprehensive income as ‘revaluation surplus’

Useful life

Definite intangible assets amortise over its life

Indefinite intangible assets with infinite nature, should not be amortised at all.

Accounting for amortisation

Amortisation

Is the systematic reduction of the value of an intangible asset over its useful life.

Straight-line amortisation method should be chosen when consumption pattern cannot be determined.

Impairment IAS 36

What was previously a valuable intangible asset no longer has as much value. this process of reduction in value of an asset is known as impairment.

Requires an entity to regularly check for impairment of its intangible assets.

Carrying amount

Is important that this is not overstated or inflated.

Once it exceeds its fair market value or recoverable amount, that intangible asset is deemed to be impaired.

Impairment losses are recognised as an expense

De-recognition

No longer any future economic benefits to be expected it needs to be written off.

Any gains or losses arising from the disposal recorded as income or expenses.

Asset held for sale and discontinued operations

Re-classified as an asset held for sale and discontinued operations. amortisation of the asset stops immediately at this point.

Acquisition deal transactions

consideration paid at acquisition less fair value of the net assets of the acquired entity.