IFM - chapter 5 - How do risk and term structure affect interest rates?

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

What is default risk?

Default risk occurs when a bond issuer is unable or unwilling to:

make interest payments as promised, or

pay off the face value at maturity.

What are default-free bonds?

Bonds (e.g., U.S. Treasury bonds) considered free of default risk because the government can raise taxes or print money to meet obligations.

Are all government bonds default-free?

No. While generally low-risk, government bonds are not entirely free from default. Risk depends on creditworthiness, economic stability, and politics.

Which bonds have low default risk?

U.S. Treasury Bonds: seen as “risk-free” due to strong credit and printing power.

Highly Rated Countries: e.g., Germany, UK, Japan – low-risk but not completely default-free.

Which bonds have high default risk?

Emerging Markets: e.g., Argentina, Venezuela

Recent Defaulters: e.g., Greece during Eurozone crisis

→ Due to economic instability and weaker credit ratings.

What is the credit spread?

The difference in interest rates between bonds with default risk and default-free bonds.

→ Reflects the risk premium investors require. (How much extra return investors demand to compensate for credit risk)

A credit spread is the difference between the yield of a risky bond and a risk-free bond of the same maturity.

How does credit spread relate to default risk?

Bonds with default risk always have a positive risk premium.

If default risk ↑ → risk premium ↑

Why do investors care about default probability?

It influences the size of the risk premium and helps assess risk. Investors use credit-rating agencies (e.g., Moody’s, S&P, Fitch) for estimates.

What are bond ratings and what do they mean?

Ratings like AAA (Moody’s, S&P, Fitch) indicate lowest risk. Ratings go down to C, indicating high or certain risk of default.

What are corporate bonds and their risk?

Issued by corporations

Subject to credit/default risk

→ Their cash flows are not certain.

How do corporate bond yields relate to credit risk?

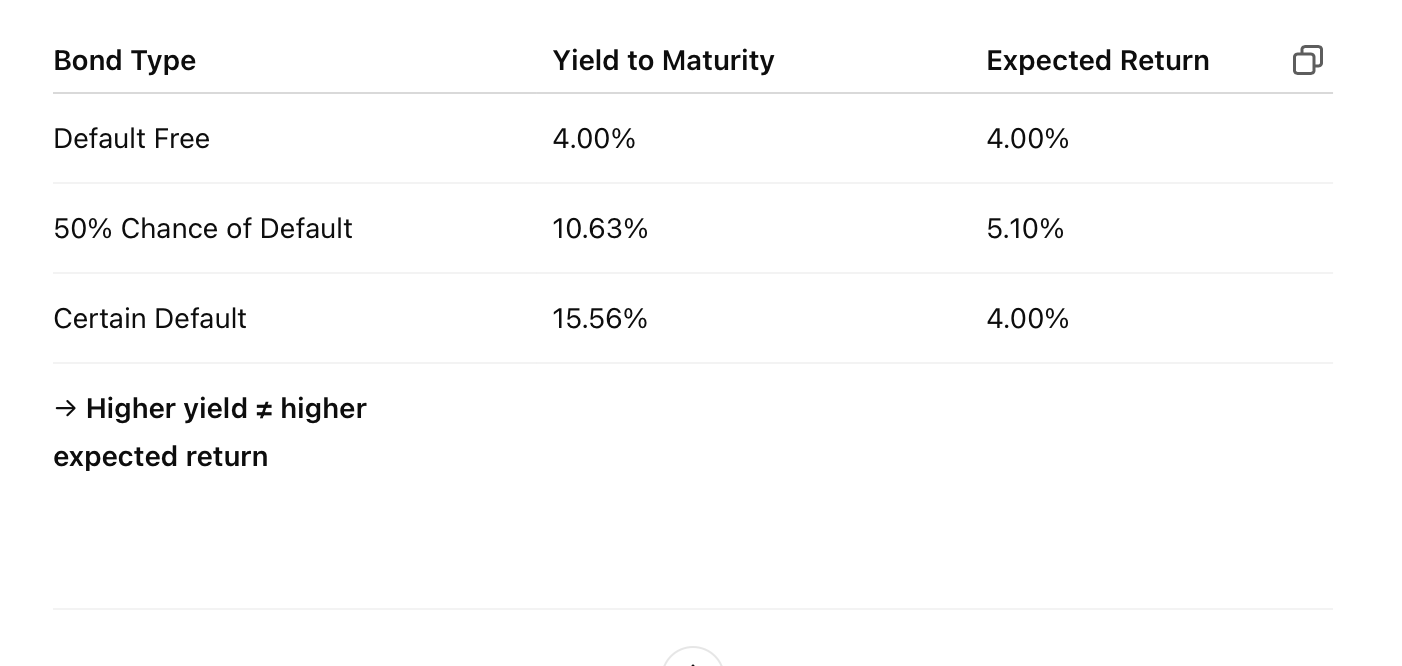

Investors pay less for bonds with credit risk ⇒ Yield is higher than that of identical default-free bonds.

A corporate bond’s yield (the return investors demand) reflects how risky the bond is.

Why is the yield to maturity of a bond with certain default misleading?

Because it overstates the actual return; expected return is lower due to the certainty of not receiving full payments.

What does a higher yield to maturity imply if there is default risk?

It does not guarantee a higher expected return. A bond’s expected return is less than its yield if default is possible.

In the Avant Bond example, how do yield and return compare across different default risks?

What is a liquid asset?

An asset that can be quickly and cheaply converted to cash. More liquid = more desirable.

What is the risk premium in bond pricing?

The difference between corporate and Treasury bond interest rates:

Reflects default risk and liquidity

More accurately: risk and liquidity premium

👉 Bonds with higher risk (corporate bonds, junk bonds, emerging market bonds...) must offer investors a higher yieldthan a risk-free bond (like a government bond) to attract buyers.

👉 This extra yield = risk premium.

Why do US municipal bonds have lower rates than Treasuries despite higher risk?

Because US municipal bonds are exempt from federal income tax, while:

Treasury bonds are exempt from state & local income tax

Corporate bonds are fully taxable

But municipal bonds are NOT default-free and NOT as liquid as Treasuries.

How does maturity affect interest rates?

Bonds with different maturities have different required interest rates — longer maturities typically demand higher yields, all else equal

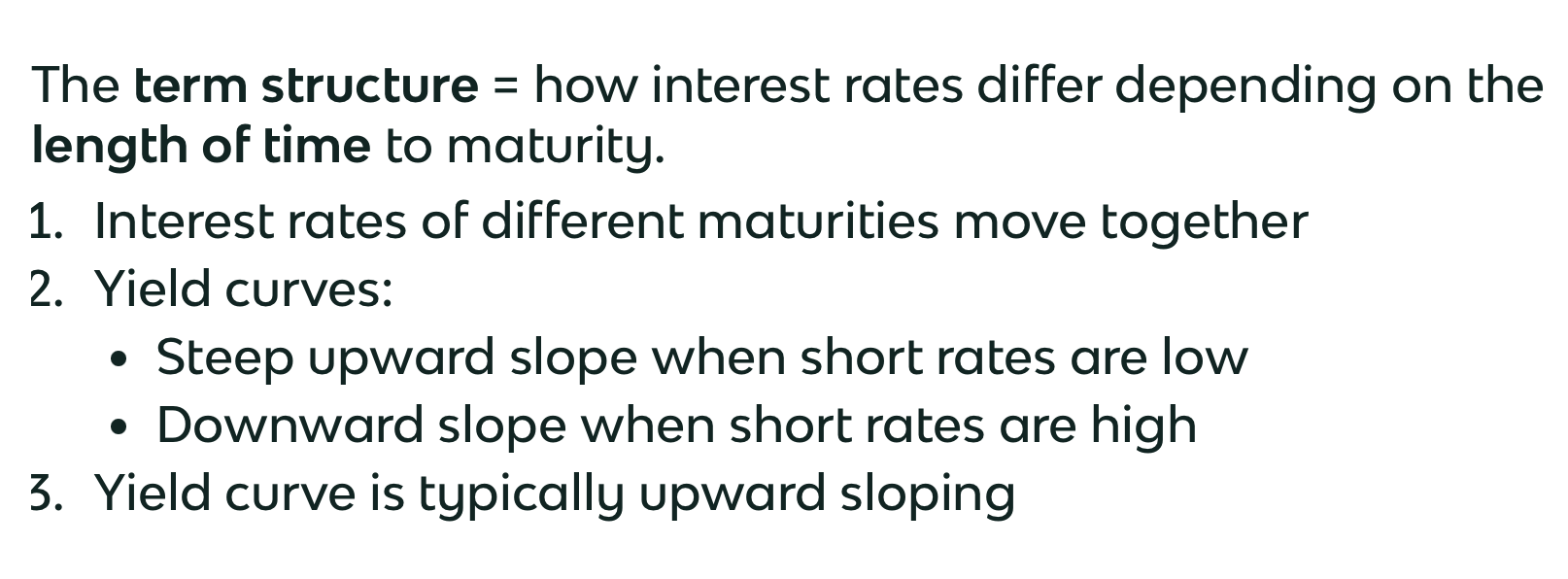

what three facts must a good theory of the term structure of interest rates explain?

The term structure = how interest rates differ depending on the length of time to maturity.

Interest rates of different maturities move together

Yield curves:

Steep upward slope when short rates are low

Downward slope when short rates are high

Yield curve is typically upward sloping

short rate: The interest rate on a short-term loan or a short-term bond.

What are the three theories of term structure and what do they each explain?

Expectations Theory: explains (1) and (2)

Market Segmentation Theory: explains (3)

Liquidity Premium Theory: explains all three by combining the above two

What is the key assumption and implication of the Expectations Theory?

Assumption: Bonds of different maturities are perfect substitutes

Implication: Expected returns on all maturities are equal

What does the Expectations Theory say about investment strategies over 2 years?

Strategy 1: Buy 1-year bond twice

Strategy 2: Buy 2-year bond once

→ If the theory is correct, both yield the same expected wealth

(But actual wealth may differ if rates change)

How does the Expectations Theory explain different yield curve shapes?

Short rates ↑ in future → upward slope

Short rates stay the same → flat curve

Short rates ↓ in future → downward slope

How does Expectations Theory explain that short and long rates move together?

If short rate ↑ today, expected future short rates ↑ too

→ Average of future rates ↑ → long-term interest rates ↑

Why do yield curves steepen when short rates are low?

If short rates are low, they’re expected to rise

→ Future rates > current → steep upward-sloping curve

The yield curve steepens when short rates are low because markets expect them to rise in the future, and investors demand extra compensation for holding long-term bonds.

Why doesn’t Expectations Theory explain why yield curves are usually upward sloping?

Because short rates are equally likely to rise or fall

→ Future average rates won’t consistently be higher

→ So theory can’t explain the usual upward slope

What is the key assumption and implication of Market Segmentation Theory?

Assumption: Bonds of different maturities are not substitutes at all

Implication:

Markets are completely segmented

Interest rates at each maturity are determined independently

SUPPLY AND DEMAND

What does Market Segmentation Theory explain about the yield curve?

✔ Explains Fact 3: yield curve is usually upward sloping

People prefer short holding periods → higher demand for short-term bonds

Short-term bonds: higher price, lower interest rates

✘ Does not explain Facts 1 and 2 (rates determined independently)

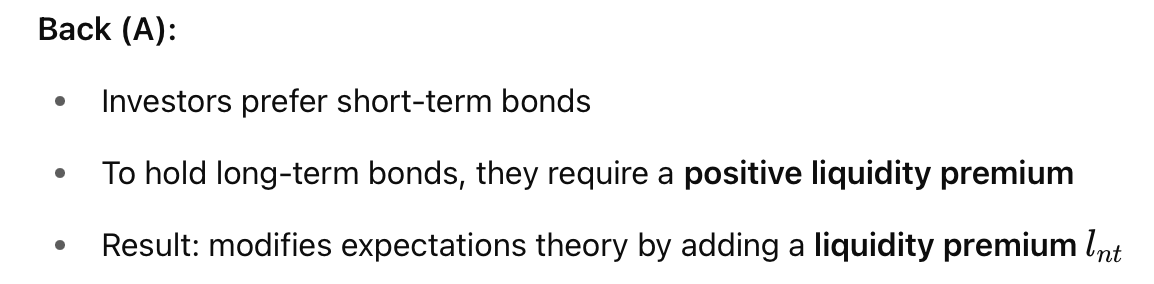

What is the key assumption and implication of Liquidity Premium Theory?

Assumption: Bonds of different maturities are substitutes, but not perfect substitutes

Implication: Combines expectations theory with market segmentation theory → explains all 3 facts

Why do investors require a liquidity premium for long-term bonds?

Why does the Liquidity Premium Theory explain all three facts of the term structure?

Explains Fact 3: yield curve is usually upward sloped because of the liquidity premium for long-term bonds

Explains Fact 1 & 2: like the expectations theory, it uses the average of future short rates to determine long-term rates

How is the term structure of interest rates useful as a forecasting tool?

The yield curve provides information about future interest rates

It helps forecast inflation and real output

Rising rates → economic booms

Falling rates → recessions

Rates include both real and expected inflation components

Why are interest-rate forecasts important for financial institutions?

Future changes in interest rates affect profitability

Managers must set loan interest rates in advance for future periods

→ Accurate forecasts are crucial for planning and pricing

What does the slope of the yield curve tell us about future interest rates?

A steeply upward-sloping yield curve → future rates expected to rise

A downward-sloping yield curve → future rates expected to fall

→ Reflects the market's prediction of interest rate direction

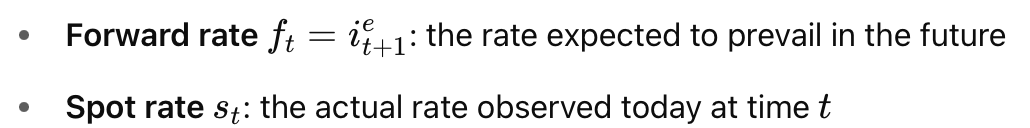

What is the difference between forward and spot rates?

What is a forward interest rate, and how is it used?

A forward rate is the interest rate agreed today for a loan or investment that will happen in the future.

A forward rate is guaranteed today for a future loan or investment

Example: Forward rate for year 5 is the rate for a 1-year investment starting 4 years from now