econ macro test

1/70

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

71 Terms

macro objectives

1) low unemployment

2) low & stable rate of inflation

3) Economic growth

4) Equity in distribution of income

self correcting gap

inflationary:

Wages rise

Price levels rise

Sras decreases

deflationary:

Wages lower

Price levels lower

Sras increase

cyclical unemployment

Job losses that occur when an economic downturn reduces demand, leading to a decrease in labor demand and, consequently, layoff

cyclical unemployment solutions

demand management policies (monetary / fiscal)

fiscal: better

Increase Government Spending: Invest in infrastructure = create jobs and stimulate economic activity.

Lowering taxes = increases income & investment = boosts spending & demand

Monetary: not ideal

Lowering interest rates = increase borrowing and spending

Effectiveness is limited when interest rates are already low or in a liquidity trap

Structural unemployment

permanent fall in demand for a particular skill and therefore a mismatch between supply and demand for a certain type of labor skills

structural unemployment solutions

Market-based / interventionist

interventionist: education & training programs, subsidies to individuals (reallocation / firms (training)

market-based: move to different areas, personal skill development

Frictional unemployment

temporary and voluntary unemployment that occurs when individuals are between jobs or entering the workforce for the first time, taking time to find a position that matches their skills and preferences

frictional unemployment solutions

Market-based / interventionist

interventionist: job training programs, unemployment benefits

market based: improve flow of information, career counseling

Seasonal unemployment

When people working certain jobs are only needed during certain times of the year

seasonal unemployment solutions

Market-based / interventionist

Interventionist: subsidies for off-season industries, training program

Market based: encourage seasonal contracts, improve flow of information

inflation

persistent increase in APL of the economy

effect of inflation

Reduced Purchasing Power

Increased Cost of Living

Increased Costs

Price Adjustments

Reduced Economic Growth

higher interest rates

inflation solutions

best: contractionary monetary policy (but any other policy will work)

—> central bank raise interest rates = borrowing more expensive = decrease AD component

worst: supply side (because inflation is a short run problem)

deflation

persistent fall in the APL in economy

demand pull inflation

Happens due to an increase in component of AD

cost push inflation

Increased costs of production

Decrease in SRAS

fiscal policy

set of government policies relating to expenditure & taxation that influences aggregate demand in an economy

fiscal policy advantages / disadvantages

advantages

long-term economic growth (when investing in infrastructure)

Ability to target sectors of the economy (because gov can control what to tax)

income redistribution

Dealing with rapid and escalating inflation (because gov hold power to directly influence)

disadvantages

Time Lags (takes time to get used to)

Political Pressure (electoral cycles, ideological differences)

Sustainable debt (when govs run budget deficits to fund expansionary fiscal policy it can become national debt)

for expansionary fiscal only:

Crowding-out Effect (increase gov spending = increase AD = higher prices = fall in investment) —> contractionary side effects

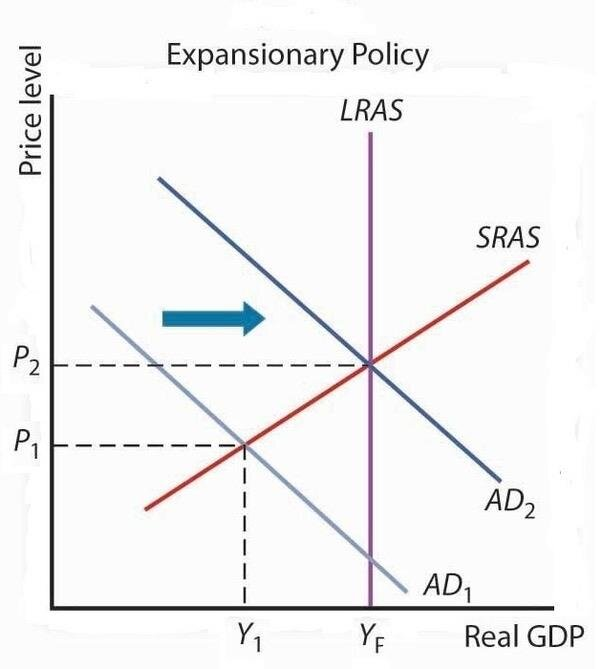

monetary policy

the use of interest rates and the money supply to influence the level of aggregate demand and economic activity in a country

how monetary policy works

expansionary:

lowering interest rates = reduce cost of borrowing money = increase in consumer spending & investment

Increasing money supply = lower interest rates

monetary policy advantages / disadvantages

advantages:

fast to implement

No political intervention

No “crowding out”

Reversibility

disadvantages:

Time lags (takes time to have effect)

Ineffectiveness when interest rates are low

Low consumer and business confidence = wont effect consumer spending and investment

market based supply side policies

policies that aim to increase LRAS with minimal gov intervention to foster economic efficiency

DEREGULATION: reducing regulations on operations which may increase their costs of production

PRIVATIZATION: sale of government-owned firms to the private sector (privatized firms operate more efficiently)

POLICIES THAT INCREASE COMPETITION: Policies to increase competition (competition encourages greater efficiency (such as enforcing strict anti-monopoly laws)

TRADE LIBERALIZATION: increase competition to encourage more free trade and lead firms to be more efficient

supply side policies

policies that are designed to increase the LRAS in the economy by increasing the quantity / quality of FOP

market based supply side policy advantages / disadvantages

advantages:

Reduces government burden

Improved efficiency & productivity (encouraged by increase competition)

Promotes individual and business incentives

disadvantages

Reduction of income taxes may have opposite effects = not incentivize more work

reduce income tax = more income = people choose to work less

Reduction in taxes = increase income inequality

Income tax: benefits higher wage earners more

Corporate tax: benefit wealthy shareholders

Deregulation may negatively affect the environment, worker safety, health, and working conditions

Privatization may not have the desired effects (firms dont succeed)

Time lags

interventionist supply side policies

policies that aim to increase LRAS with active gov intervention to foster economic growth

Investment in human capital: government provided training programs

Research and development: offering tax incentives and guaranteeing intellectual property rights, such as patents and copyrights

Provision and maintenance of infrastructure

Direct support for businesses/industrial policies

interventionist supply side policy advantages / disadvantages

advantages:

Target specific areas

Positive externalities

improve standard of living

disadvantages

gov / national debt

Time lags

Policies depend on ideology of gov

Controversies from funding specific programs

progressive tax

income increases, increasing tax rate

regressive tax

income increases, decreasing tax rate

proportional tax

income increases, constant tax rate

Direct taxes

taxes paid directly to the government

Indirect taxes

taxes on spending on goods and services

policies to reduce inequality

progressive tax

interventionist: Investing in human capital, increase min wage, targeted gov spending

progressive taxation for reducing inequality advantages / disadvantages

advantages:

More equitable (fair) for lower income individuals to pay a lower tax rate

(since they need the money more than higher income individuals)

Provides the government with funds to finance its expenditures

improves inequality directly by closing the gap

reduced burden on low income

Disadvantages:

less incentive to work harder (because higher income = more taxes)

discourage businesses from operating in a specific place and cause them to move to a place with lower tax rates

less incentive to invest = decrease ecnomic growth

gdp

the total value of all final goods and services produced within a country over a year, regardless of who owns the factors of production

gni (gross national income)

total income received by the nationals of a country, equal to the value of all final goods and services produced by the country’s nationals regardless where they’re located.

purchasing power parity

method of currency conversion that accounts for differences in price levels between countries

unemployment

People of working age who are without work, available for work, and actively seeking employment

AD

total demand for all final g&s within an economy over a period of time at different APL

AS

total output of g&s produced in an economy over a period of time at different APL

sras

total output of g&s produced in an economy at different APL in the short run, when resource prices are fixed.

lras

total output of g&s produced n an economy at different APL when all resource prices, are flexible, and the economy is producing at full employment of resources.

labor force

People who are eligible to work and actively looking for work

inflationary / deflationary gap

inflationary: Equilibrium is at a level of output greater than the full employment level of output due to excess AD

deflationary: Equilibrium is at a level of output lower than the full employment level of output due to shortage of AD

stagflation

period of falling output and rising prices

hidden unemployment

People who are not considered unemployed but are not fully employed

disinflation

decreasing rate of inflation

cpi

a measure that examines the weighted average of prices of a basket of consumer goods and services

economic growth

increase in real GDP over time

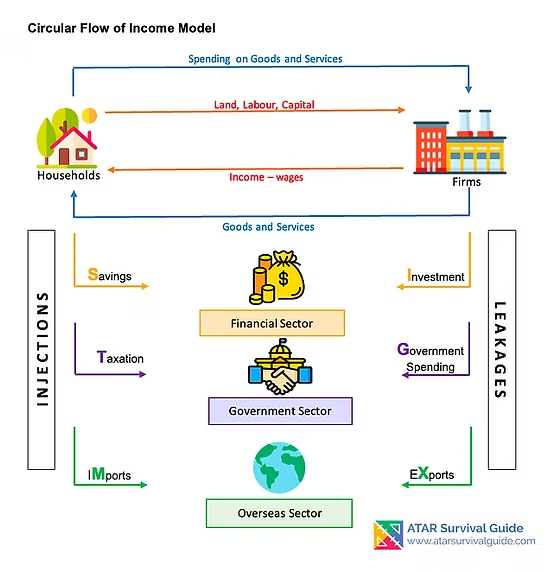

demand management policies

policies used by governments and central banks to influence the level of AD in an economy to achieve macroeconomic objectives

interest rate

price of borrowing money

base rate

interest rate set by the central bank

equity

fairness

equality

same amount of something

income

money received by owners of FOP

wealth

money, assets, or things of value that people own

types of inequalities

ECONOMIC INEQUALITY: Degree people differ in their ability to satisfy their economic needs

INCOME INEQUALITY: differences in how income is distributed in a population

WEALTH INEQUALITY: differences in the amount of wealth people own

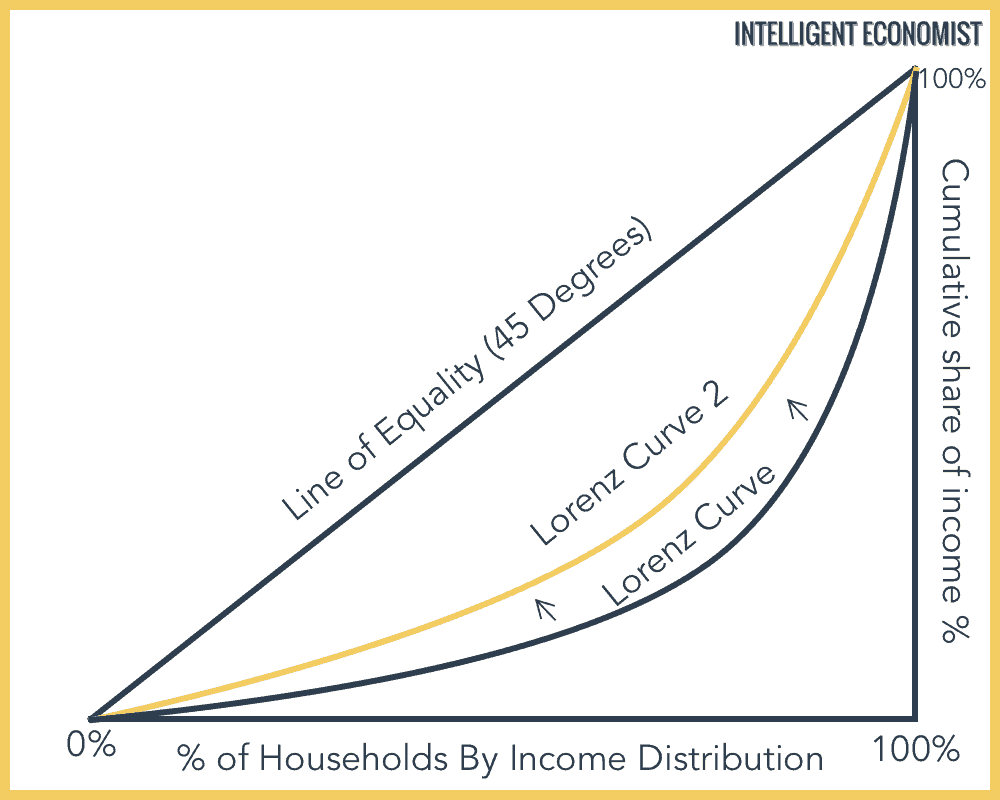

gini coefficient

numerical measure of income / wealth inequality within a population

poverty

inability to satisfy minimum consumption needs

absolute poverty

when a person/household does not have enough income to meet basic human needs

relative poverty

an individual or household's income is lower than the median income of their population

Multidimensional poverty index (MPI)

Measures poverty in three dimensions: (Health, Education, Living standards)

Values are from 0 to 1

Countries are poor = people are deprived in at least ⅓ of the indicators

see what areas contribute to poverty

transfer payments

payment made by gov to individuals that redistribute income away from certain groups & towards other groups

keynesian diagram

Active gov intervention is necessary to stimulate AD and correct economic downturns

new classical diagram

Limited gov intervention needed because markets self-correct

business cycle

circular flow of income model

labor market

used to describe unemployment content

sticky wages

when nominal wages are slow to adjust in response to changes in economic conditions

sras diagram

lras diagram

can be new classical or keynesian

lorenz curve