Free trade and Protectionism

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Free trade

Absence of goverment intervetion of any kind in international trade, so that trade takes palce without restrictions between individuals, firms or goverments of different countries.

Free Trade Agreement (FTA)

Trade agreement to expand the market for goods and services among the participant countries.

Advantages of free trade

Greater efficency in production and productivity

Lower price for consumers

Greater choice for consumers

Increased competition

Acces to larger markets

More efficient resource allocation

Protectionism

Economic policy that seeks to protect a country's production and jobs by imposing restrictions, limitations or tariffs on goods or services from abroad (imports), making them more expensive to make them less competitive with domestic products.

Advantages of Protectionism

Protection of new infant industries

Protecting domestic employment

National security and strategic reasons

Avoid over-specialization

Prevent dumping

Health and environmental standards

Protect industries from cheap labor

Raise goverment revenue

Correct balance of payments

Disadvantages of Protectionism

Missalocation of resources

Higher cost of production

Reduced efficency

Higher consumer prices

Less choice

Reduced export competitivines

Retaliation, potentialy leading to trade war

Types of protectionism

Tarifs

Quotas

Subsidies

Administrative barriers

Nationalist campaigns

Tariffs

Import tax that increases the price of imported products

Most common form of protectionism.

Purpose:

Protection of domestic firms

Increase goverment revenue

Winners:

Domestic producers

Domestic employment

Goverment (tariff revenue)

Losers:

Domestic consumers

Foreign producers

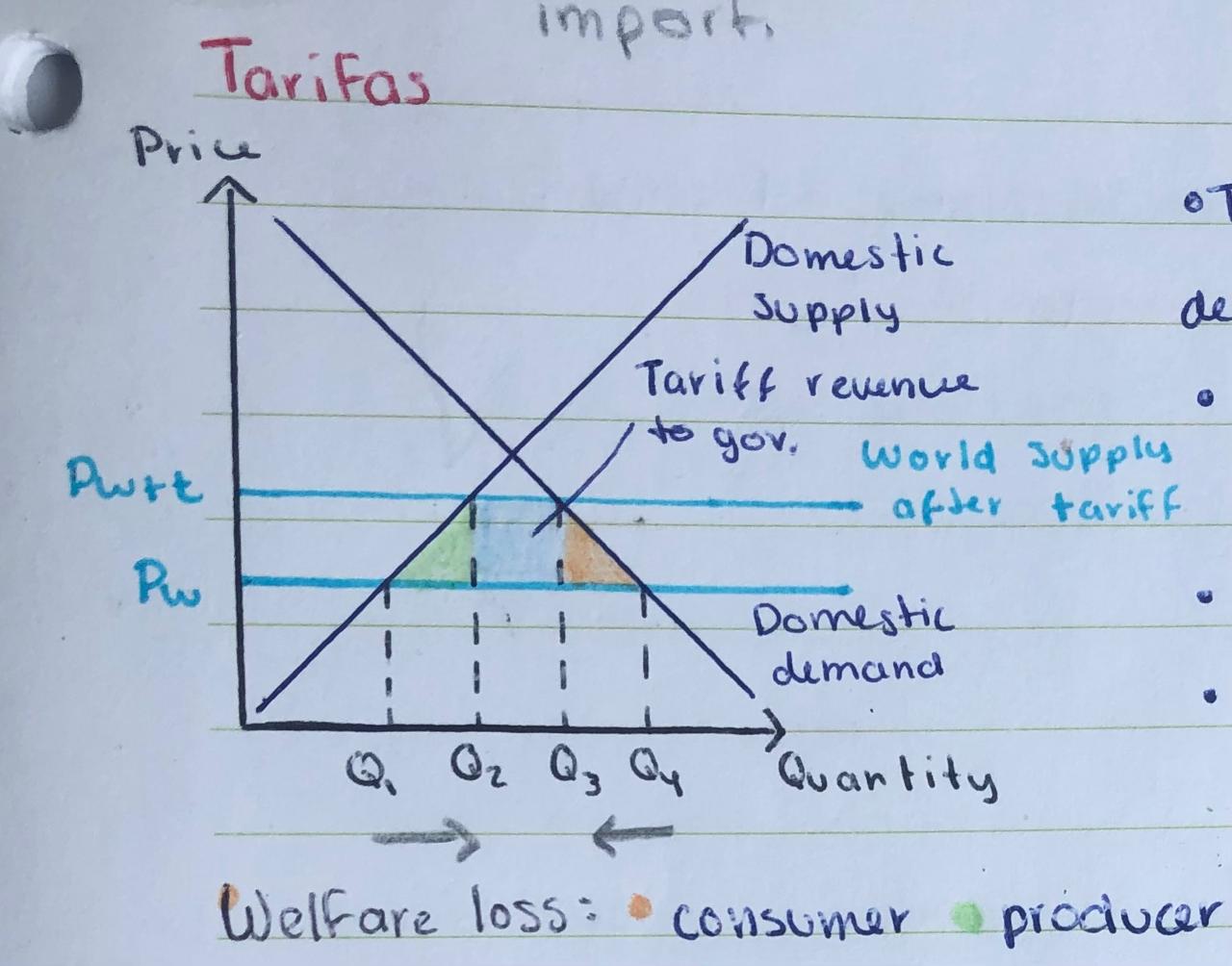

Tariffs diagram

Price of the products increases from Pw → Pwt

Quantity of imported products demanded reduced: Q4 → Q3

Quantity of national market products increases: Q1 → Q2

Actual import sales: Q2 - Q3

Subsidies

Aid from the government to stimulate a good. It is used to protect domestic production from imports.

Subsidy allows producers to increase their production since its cost of production are low.

Winners:

Local producers

This gain does not affect the consumers.

Affected:

Foreign producers

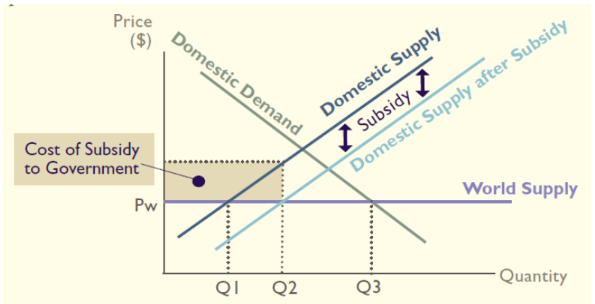

Subsidies diagram

With world price at Pw, producer can sell more from Q1 → Q2

Q2 - Q3 is fullfilled by imports

Quotas

Non-tariff barrier.

Quantitative restriction to trade through which a limit is set on the total amount of imports of a good allowed into the country for a given period of time.

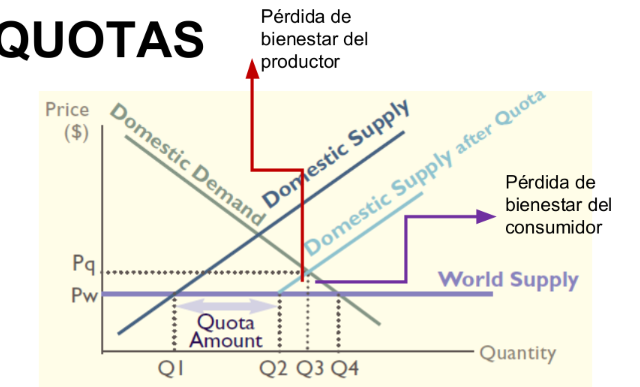

Quotas diagram

The consumers will only be able to buy imported products from Q1 - Q2

In Q2 the national supply has a shift to the right → national prices increase

Q3: National consumers can sell their products at Pq (consumers lose)

Product supply decreases from Q4 → Q3. Foreign producers can charge up to Pq to compensate the loss.

Non-tariff barriers

Mechanism that allows the application

of restrictions to international trade.

Main Non-tariff barriers

Licenses

Sanctions

Embargos

Licenses

This mechanism allows only certain companies to import certain commercial goods. The rest of the goods destined for trade are restricted in the rest of the country.

Sanctions

Increase bureaucracy to make international trade more difficult.

Impose new administrative measures.

Minimum price of import.

Standardization of products.

Sanitary and safety rules.

Embargos

Actions taken by any country to prohibit another country from trading with any type of service or good determined.