7 - Accounting Information Systems #1

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

What do accounting information systems (AIS) do?

a. Collect and process data from transactions and events, organize them in reports, and communicate results to decision makers

b. Help users make more informed decisions and better understand the risks and returns of different strategies

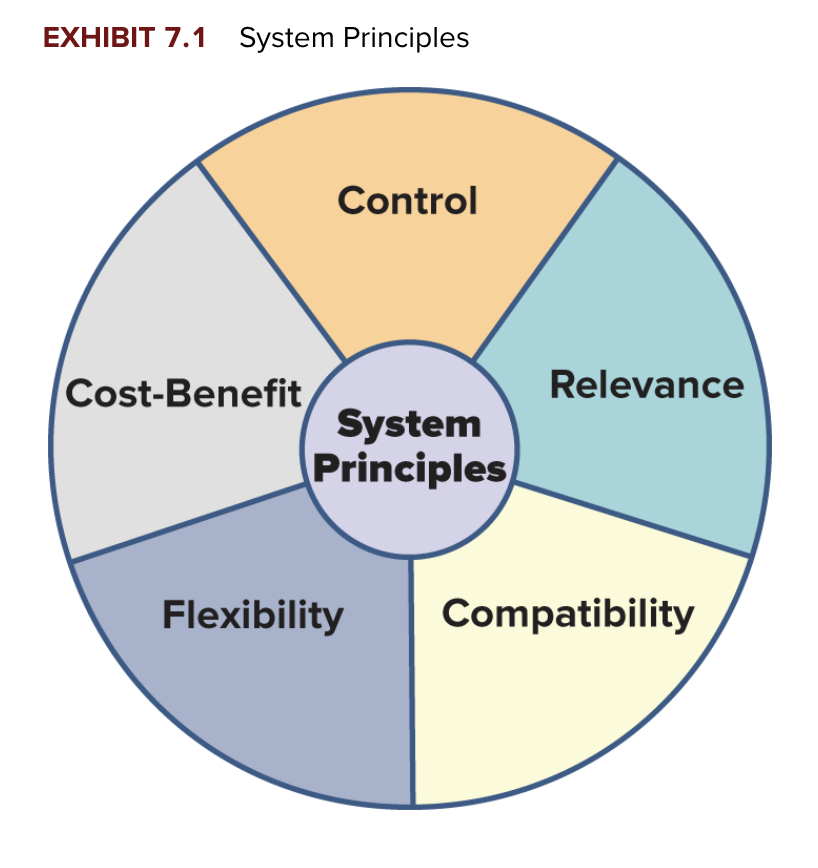

What are the five main principles in accounting information systems?

Control

Relevance

Compatibility

Flexibility

Cost-Benefit

What are internal controls?

procedures that help managers control and monitor business activities. Includes policies to protect company assets and ensure compliance with laws/regulations

Describe the Control Principle

prescribes that an accounting information system has internal controls

Describe the Relevance Principle

prescribes that an accounting information system reports useful, understandable, and timely information for decision making

Describe the Compatibility Principle

prescribes that an accounting information system conforms with a company's activities, personnel, and structure

Eg. Amazon requires a huger, automated system; a small retail shop only needs a simple system

Describe the Flexibility Principle

prescribes that an accounting information system be able to adapt to changes in the company, business environment, and the needs of decision makers

Technological advances, competitive pressures, consumer tastes, regulations, and company activities constantly evolve

A system must be designed to adapt to these changes

Eg. Tech: AI, cloud systems, new software

Eg. Customer preference for online shopping → AIS must track online sales

Describe the Cost-Benefit Principle

prescribes that the benefits from an activity in an accounting information system outweigh the costs of that activity

Decisions about other system principles (control, relevance, compatibility, and flexibility) are also affected by the cost-benefit principle

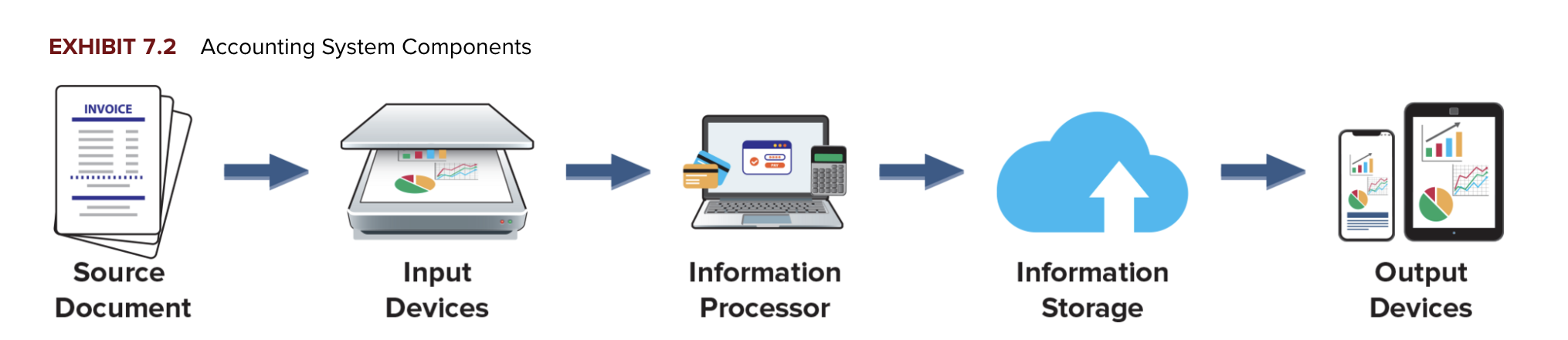

What are the five components of an accounting system?

Source documents

Input devices

Information processors

Information storage

Output devices

Do the give components of an accounting system only apply if a system is computerized?

No, they apply whether a system is computerized or manual

Describe SOURCE DOCUMENTS

Provide the information processed by an accounting system

Eg. Bank statements and checks, invoices from suppliers, customer bills, sales receipts, employee earning records

Why is it crucial to have accurate source documents?

the input of wrong information damages the reliability of the accounting information system

Describe INPUT DEVICES

take information from source documents and transfer it to information processing (eg. keyboards and scanners)

Journal entries are a type of input device

Describe INFORMATION PROCESSORS

summarize information for use in analysis and reporting

Includes journals, ledgers, working papers, and posting procedures

Helps transform raw data into useful info

Describe INFORMATION STORAGE

keeps data accessible to information processors

Auditors pull from a database when auditing financial statements and company controls

Also used for future analyses and reports

CLOUD STORAGE!!

Describe OUTPUT DEVICES

make accounting information available to users

Includes printers, monitors, smartphones, etc

Output devices provide users with a variety of items, including customer bills, financial statements, and internal reports

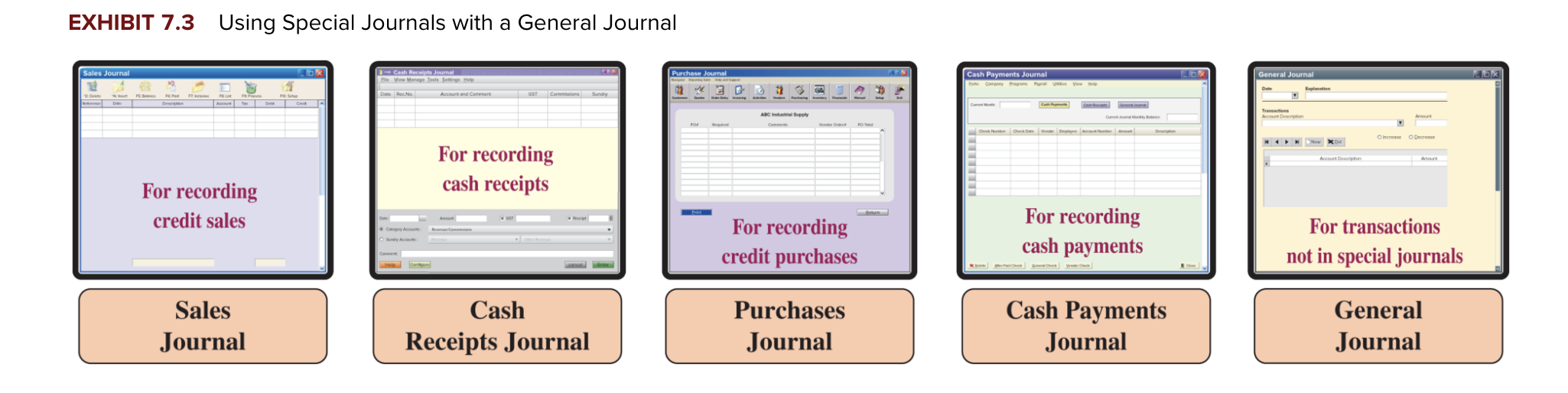

What is a general journal?

An all-purpose journal in which we can record ANY transaction

Used for transactions not covered by special journals, as well as adjusting, closing, and correcting entries

What is important about a special journal?

Groups transaction of a similar type; helps to enhance internal control and reduce costs

Accumulate debits and credits of similar transactions and post column totals rather than individual amounts

Allows for efficient division of labor and serves as an effective control procedure

Special journals are different for various types of businesses and are created for the most common transactions

What are very common transactions?

Sales, cash receipts, purchases, and cash payments (disbursements)

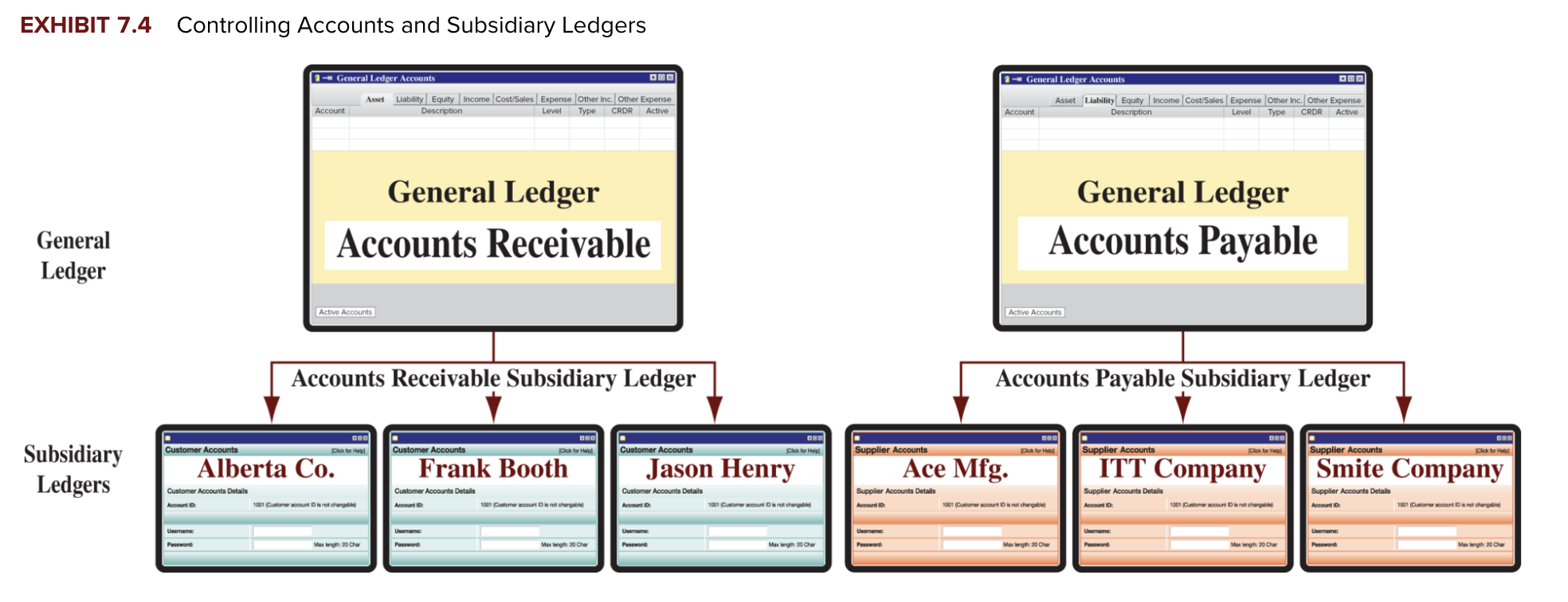

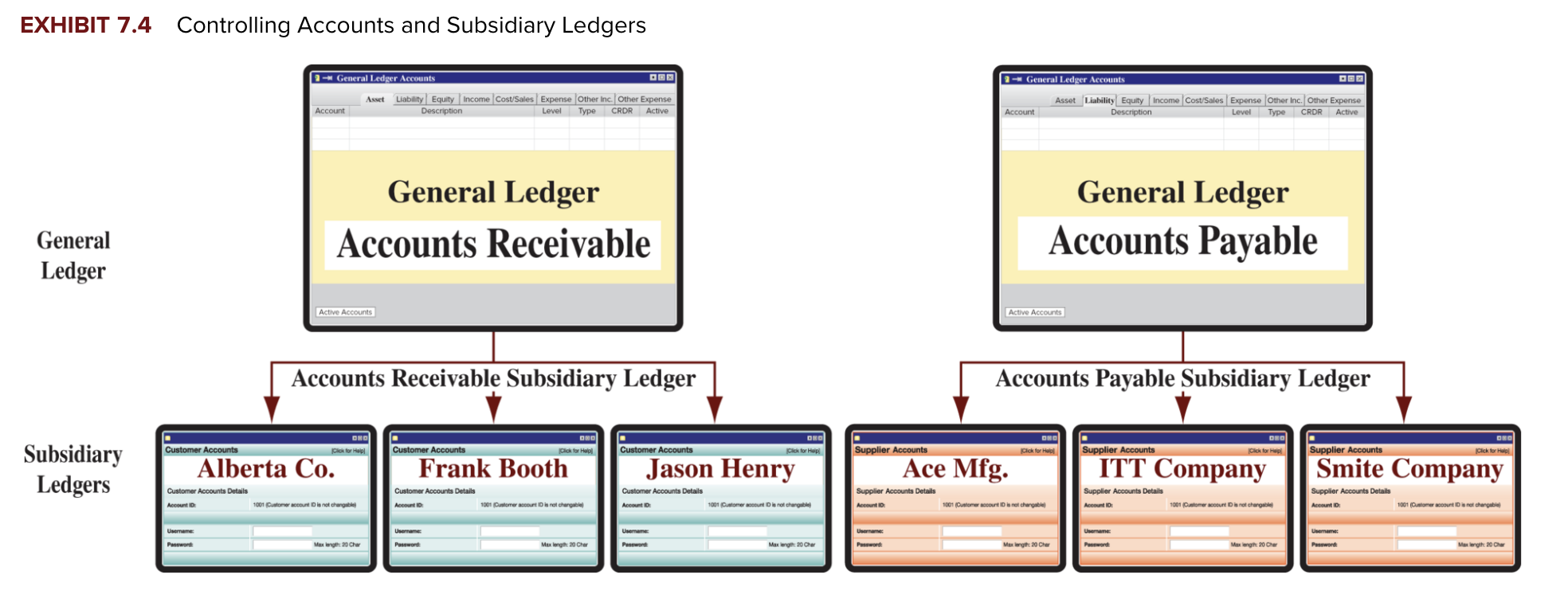

What is a subsidiary ledger?

A list of individual accounts with a common characteristic that provides detailed information supporting a general ledger account

Think of it as a detailed breakdown of certain accounts in the general ledger, organized by a common characteristic (eg. customers or suppliers)

The subsidiary ledger shows who owes what or who you owe what

What does a subsidiary ledger do?

It contains detailed information on specific accounts in the general ledger (supporting the control account)

What is the Accounts Receivable Subsidiary Ledger?

A ledger that stores transaction data and balances for individual customers

What is the Accounts Payable Subsidiary Ledger?

A ledger that stores transaction data and balances for individual suppliers

Why do companies use an Accounts Payable control account?

To track the total amount owed to all suppliers, while the subsidiary ledger tracks individual supplier balances

T/F: The Accounts Receivable account is said to control the accounts receivable (subsidiary) ledger and is called a controlling account

True, the A/R account is the GL is called a controlling account since:

Its balance must EQUAL the SUM of all individual customer balances in the subsidiary ledger

It “controls” or summarizes the detailed info kept in the subsidiary ledger

What is a control account?

any general ledger account that summarizes subsidiary ledger data or details. It is an account that “controls” a specific subsidiary ledger

eg. “We owe $45,000 in TOTAL”

Eg. The A/P subsidiary ledger would detail that Supplier A owes $10,000, Supplier B owes $20,000, and Supplier C owes $15,000.

Are subsidiary accounts only used to A/R and A/P?

No, they are used for several other accounts

A company may have one Equipment account in the GL, but its equipment subsidiary ledger could record each type of equipment in a separate account

What are the benefits of subsidiary ledgers?

Remove clutter from the general ledger (keep it simple)

Provide up-to-date, detailed information on specific customers, suppliers, equipment, etc.

What is the relationship between a control account and its subsidiary ledger?

The total of all subsidiary ledger accounts must equal the balance in the control (account)

Why might a company use an equipment subsidiary ledger?

To track individual pieces or types of equipment, even though the general ledger has only one Equipment account