Practice Questions for Final for new material

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

___________are funds that the bank keeps on hand that are not loaned out or invested in bonds.

Reserves

__________________ pool the deposits of many investors together and invest them in a safe way like short-term government bonds.

Money market funds

All the inhabitants in an economy have $10 million in money. There is only one bank that all the people deposit their money in and it holds 5% of the deposits as reserves. What is the money multiplier in this economy?

20

What do stock markets do (PlayPosit video)?

spread risk, channel savings from savers to investors

Which of the following assets is MOST liquid?

funds in your checking account

If the central bank decreases the amount of reserves banks are required to hold to 5%, then:

both the money multiplier and the supply of money in the economy will increase.

What term is used to describe the interest rate charged by the central bank when it makes loans to commercial banks?

discount rate

Which of the following terms is used to describe the proportion of deposits that banks are legally required to deposit with the central bank?

reserve requirements

Which of the following is a traditional tool used by the Fed during recessions?

open market operations

The ___________________ is the institution designed to control the quantity of money in the economy and also to oversee the:

Central Bank; safety and stability of the banking system.

The economy is in a recession and the government wants to increase output. If the multiplier equals 3 and the government increases spending by 250, how much will output increase by?

750

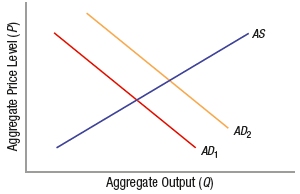

(Figure: Predicting Aggregate Demand Shifts) Which of these would shift the aggregate demand curve from AD1 to AD2?

a decrease in interest rates

A shift of the aggregate _____ curve to the _____ would cause inflation to rise and employment to increase.

demand; right

(Inside Job) What is a credit default swap?

an insurance contract in which the buyer pays the seller to protect her against losses

(Inside Job) What is a credit ratings agency?

a company which assigns credit ratings (risk assessment) for firms, and were often paid by those firms

What is a subprime loan?

a high-risk and high-interest rate loan

If people stopped using banks and instead used saddlebags to hold all of their money, what would happen to the (actual, not potential) money multiplier?

it would shrink

An expansionary fiscal policy either _____ government spending or _____ taxes.

increases; decreases

A law requiring the federal budget to be balanced each year would likely:

make business cycles more severe.

If the U.S. passed a law that require the federal government to run a balanced budget. If there were a recession, the government would want to implement _____________________, but may be unable to do so because such a policy would ____________________________.

expansionary fiscal policy; lead to a budget deficit

When the government passes a new law that explicitly changes overall tax or spending levels, it is enacting:

discretionary fiscal policy.

When inflation begins to climb to unacceptable levels in the economy, the government should:

use contractionary fiscal policy to shift aggregate demand to the left.

If a country’s GDP increases, but its debt also increases during that year, then the country’s debt to GDP ratio for the year will _______________ in proportion to the magnitude of the changes.

increase or decrease

A ______________________ is created each time the federal government spends more than it collects in taxes in a given year.

budget deficit

Javonte paid $475,000 for his house in 2013 and sold it for $625,000 in 2019. What function did the house serve during the time he owned it?

store of value

True or false The "Zero Lower Bound" problem exists for Fiscal (but not Monetary) policy.

False

When did the U.S. Financial Crisis happen that was the subject of The Inside Job?

2008

True or false: Monetary and Fiscal policy primarily work by affecting the AD and AE curves (not the SRAS or LRAS) curves.

true

In class we viewed historical data about deficits. We found that, starting in the 1980's deficits really started to rise, even in non-recession years.

true

When did Keynes think governments should run deficits to stimulate the economy?

Only during recession