Ch 9: Long-Lived Tangible and Intangible Assets

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

Long-lived assets

for use over one/more years, not intended for resale

Tangible assets

Assets subject to depreciation, called “fixed assets” bc they are fixed in place. Ex: Land, building, equipment, furniture, fixtures

Acquisition cost of tangible assets

Purchase price AND all necessary expenditures to acquire the asset and prepare it for use

Basket purchase

Land & Buildings purchased at the same time.

Total cost is allocated in proportion to relative market values

Component allocation

cost of an individual asset’s components are allocated to each component which depreciates separately over their useful life

Ordinary repairs & maintenance

Expense/ Revenue Expenditure

small recurring expenditures

doesn’t increase productivity

doesn’t extend life beyond original

Extraordinary repairs, replacements, and additions

Capitalize

large, infrequent expenditure

may extend useful life

may increase productivity or efficiency

Cost allocation (depreciation)

costs of operational assets matched to periods of use

Depreciation values are based on? (3)

Asset cost

Useful life

Residual value

Asset cost

Purchase & all capitalized costs

Useful life

estimate of asset’s useful economic life

Residual value

estimate of amnt company could receive if they dispose of the asset

What are the 3 depreciation methods?

Straight line

Units of Production

Declining balance

Straight Line Method

Used when an asset will be used in equal amounts each period

The depreciation expense is the same each year

s

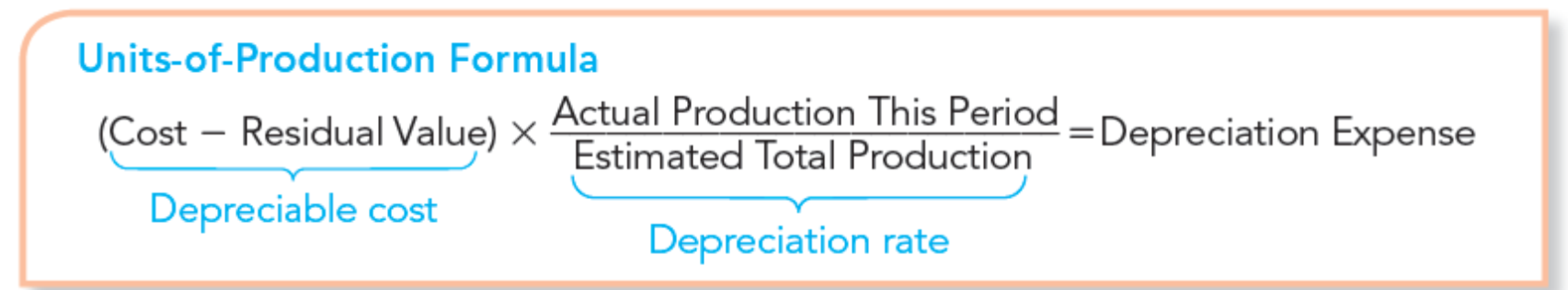

Units of production method

If the amount of asset production varies significantly from period to period

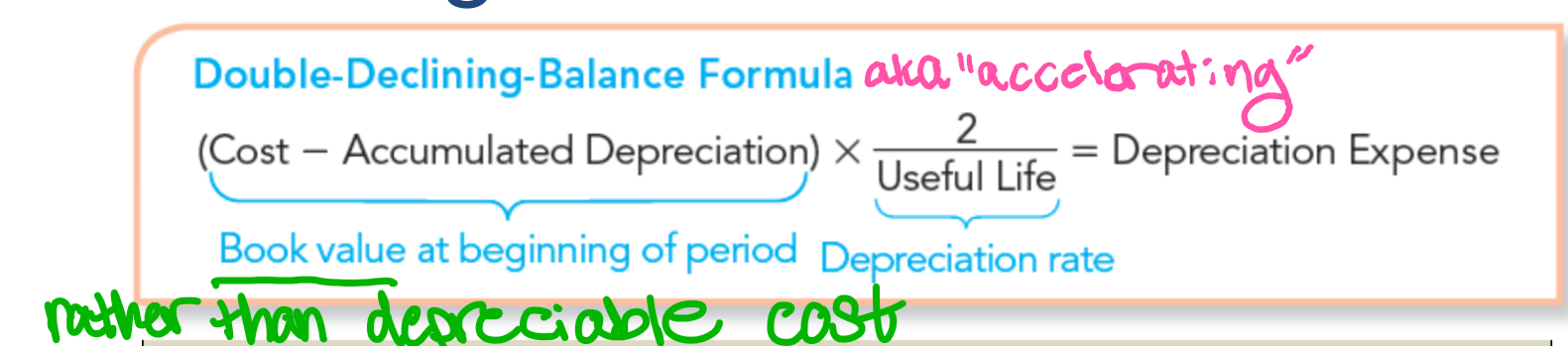

Declining-Balance Method

When an asset loses its usefulness over time

Use to report more depreciation expense in early years when the asset is more efficient

looks better for investors, used as a tax loophole

Partial year depreciation

when in asset is acquired during the year, depreciation is calculated for the fraction of the year the asset is owned

Deferred income tax

tax payment is temporarily put off as a result of large tax deductions for depreciation

Asset impairment losses

sudden drop in value due to impairment

Accounted for by:

Eliminate the asset’s accumulated depreciation against the asset account

Write down the asset to its fair value

Disposal of tangible assets

sell, trade, retire

Update depreciation to date of disposal

record the disposal

Gain if cash is greater than asset’s book value, loss if less than book value

Recording disposal of tangible assets

Book value - Value received on disposal = Loss/gain

Intangible Assets

No physical substance, exclusive rights privileges, copyrights, useful life is difficult to determine since they are usually long lived

Acquisition of intangible assets

Cash cost + legal fees + set up fees + any other costs

Amortizing intangible assets

Use straight-line method to spread out the cost of a patent over the years you will use it

Trademarks & copyrights

a symbol, design, or logo associated with a business

lasts forever

amortize cost over the period benefited

Patents & Licensing rights

last 20 yrs, after 20 yrs, becomes public knowledge

Amortize costs during the 20 yrs

Technology assets & franchises

software & web development, usually a short time (3-7 yrs)

Goodwill

Value not on the balance sheet (reputation, brand, fan base, location)

Only purchased goodwill is an intangible asset

Recognized when one company buys another company

Not amortized bc we cannot predict how long smth will be popular

What happens if you sell a patent?

It is still only private for 20 yrs, and becomes public afterwards

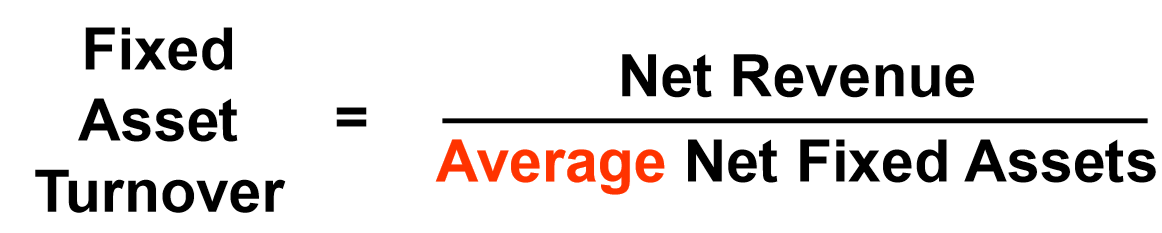

Fixed Asset Turnover

measures sales dollars generated by each dollar invested in fixed assets

Impact of depreciation differences

Selling an asset w/ a low book value (accelerated depreciation) may result in a gain

Selling the same asset w/ a higher book value (straight-line deprec) might result in a loss

EBITDA

Earnings Before Interest Taxes Depreciation & Amortization

Depletion

the process of allocating a natural resources over the period of its extraction

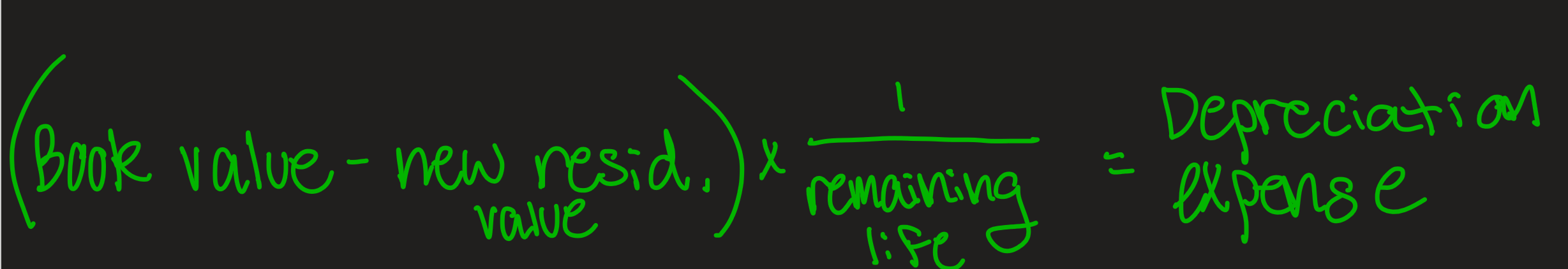

Changes in depreciation estimates

when estimate of remaining life changes