G202 Exam 2 Case Material

1/94

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

95 Terms

What is special about Unilever’s Logo

represents Unilever’s values

List some of Unilever’s values

Reduce greenhouse gases

Pollution free

better tomorrow

nature and environment

sustainability

positive transformation

science and research

recycling

transparent communication

towards betterment

_____ of Unilever’s values are sustainability focused

Over half

What is the Stakeholder Hierarchy of Unilever

Consumers-Society-Employees-Shareholders

How did the USLP hierarchy hope to improve business performance

Signaled to key stakeholders that societal issues are integrated in Unilever’s core business strategy

Describe the consumer trend toward health and protected environment

Growing trend to improve health and protected environment

What does employee motivation and empowerment around solving society’s biggest challenges lead to

innovation

Government regulations and NGO activist campaigns are focusing more on what

mitigating global social threats

Who is Trust and Transparency important for

socially responsible investoers (SRIs) that are growing in importance in capital allocations

The Sustainable Living Plan (USLP

Allows Unilever to differentiate its products in markets that are usually seen as more homogeneous

What is the result of the differentiation in the USLP

creates loyal customers from those that value sustainability

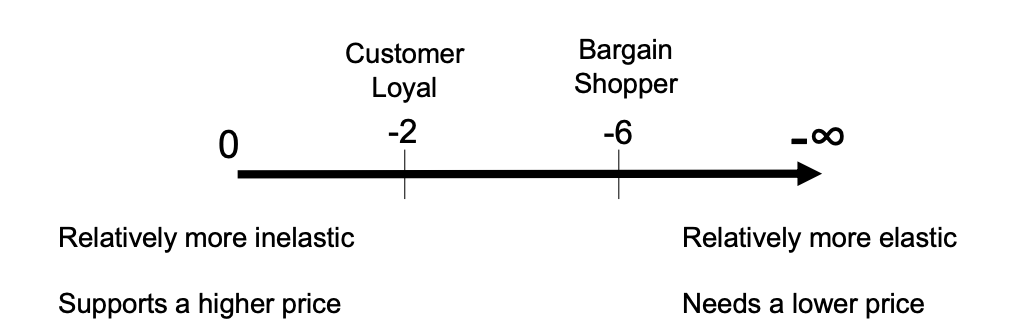

Loyal customers have more ______ demand, giving Unilever market power in pricing

inelastic

Understand this

Consumer Loyalty: _____ Prices and _______Sales

Higher; more

Market shares have outpaced market growth

What improves with Employee Loyalty

Recruiting, Retention, Productivity

What increases with Investor Loyalty

Resources for R&D and Expansion

Listen on the Dow Jones Sustainability Index and GlobeScan Sustainable Leaders

Profit Maximization

Differentiation and Customer Loyalty

Pf and Qf

Found where MR=MC

Social Efficiency

Competition and Homogenous Goods

Pe and Qe

Found where D=MC

Inefficiency in the Market

When firms with market power under produce relative to the socially efficient output (Qf<Qe)

Firms will not go to Qe as units are not profitable past Qf

Social Impact Results

Sustainability Target

Improved Internal Resource Efficiency

USLP Problem Curbing External GHG and Water

Unilever’s Options on moving forward

Double down on USLP

Hunker Down on Profits

Pivot to Partners

Pros of Unilever Doubling Down on USLP

Early profit increase

Employees motivated and driver of innovation

Culture and brand loyalty to social accountability

Cons of Unilever Doubling Down on USLP

Not in control of GHGs and water within value chain

Diminishing returns and rising costs

What to to with brands (AXE) that don’t fit USLP

Pros of Hunkering Down on Profits

Picked all low-hanging fruit

Slow growth, rising costs

Focus on the 11 sustainable brands that are in Unilever’s top 30

Cons of Unilever Hunkering Down on Profits

Reputational loss if Unilever publicly gives up

May reduce employee morale and productivity

Miss on stakeholder trend towards sustainability

Pros of Unilever Pivot to Partners

Can’t meet all USLP goals without help

Partners can cut costs and offer expertise

Partners expand reach

Cons of Unilever Pivot to Partners

Lose control of agenda

Employee objectives may become unclear

Having others do your work may signal lack of commitment

What did Unilever do from 2010-2020

Hybrid approach. Unilver doubled down with the help of more partnerships

Recount some Unilever achievements

Reached 1.3 billion people through health and hygiene programs

Reducing the total waste footprint per consumer by 32% and achieving 0 waste to landfill across all our factories

Reducing GHG by 65%

100% renewable grid electricity

Reduce sugar across sweet tea and foods portfolio

Enabling 2.34 million women to access initiatives

51% of management is women

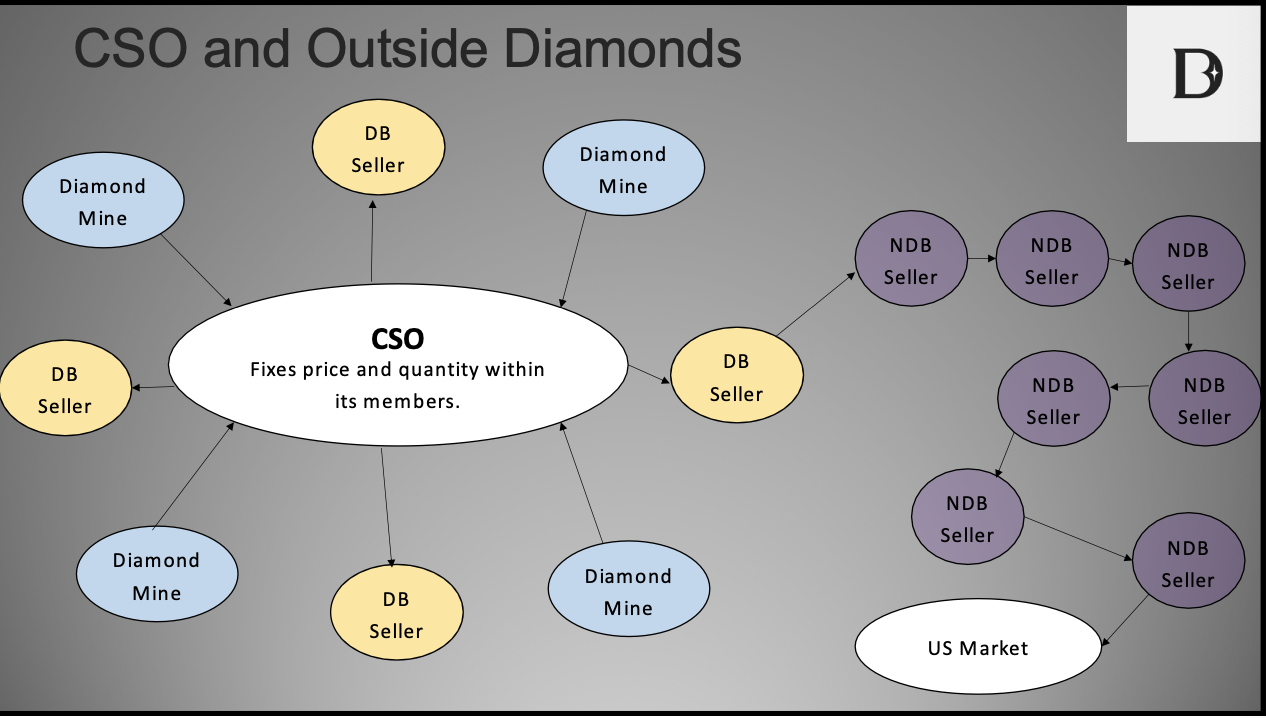

What is DeBeers?

A cartel - collection of diamond mines and diamond sellers

Collusive Game (Debeers)

The members of debeers collectively agree to restrict the number of diamonds released to the world market to raise the value of their diamond assets

collusion risk (debeers)

The cartel is not always stable as there can be a strong incentive for a member to cheat for a one-shot gain

Which countries deviated from the agreed upon quotas and try to take advantage of the short-term revenues

Russia, Zaire, and Israel

Which countries completely defected from the cartel

Russia and Angola

What is the role of the Central Selling Organization (CSO)

punish cheating - glue that holds the cartel together - enforces the collusive agreement

CSO makes a _______ offer where the price and quantity offered to each DeBeers Seller is ____

“take-it, or leave--it”; fixed

Stockpiling

Debeers takes diamonds out of the market, locks them in a vault and pretends like they’re not there

What market forces can DeBeers control with stockpiling

supply (stockpiles its own diamonds coming from its own mines)

demand (DeBeers acts as a “Buyer of Last Resort,” buys outside diamonds adn then stockpiles those

Anitrust laws

make monopolizing a market, cartels, excessive market power, and other collusive arrangements illegal

Why can’t antitrust laws reach DeBeers

DoJ can’t prove that DeBeers does sufficient business with US interests

What does the US Diamond market look like?

Stockpiling Bursting

Ever-growing stockpile → Bain Consulting to help

Bain recommendation:

change advertising to focus on DeBeers brand, instead of just diamonds

DeBeers’ diamonds expected to fetch 15% higher prices than rivals

However, targeted advertisements, with the DeBeers logo, could bring about more antitrust liabilities

Who and what was addressed in the DeBeers speech to the Harvard Business School

Nicky Oppenheimer addressed the antitrust policy

What did Nicky Oppenheimer state in his speech to Harvard

DeBeers should be an exception to the rule because of the economic good that they do on the African Continent

Ex: Botswana’s infrastructure investment put forth by DeBeers can be traced to double digit growth in the country’s GDP for two decades

What did DeBeers have to do based on the recommendation from Bain

Find a way to enter the US market directly to leverage its 15% premium with customers

Was Nicky Oppenheimer’s Speech compelling?

Yes. African Growth and Opportunity Act signed by the US result

African Growth and Opportunity Act

DeBeers agreed in principal to a class action antitrust lawsuit in the US (2005)

Courts approved settlements as fair (2008)

Settlement was appealed(2010) but then the supreme court upheld the settlement (2012)

Since 2008 settlement - what has DeBeers gained?

the right to open stores in the US, cutting out a lot of the intricate trades that happened outside of the US

(Houston, Naples, NY)

What was DeBeer’s brand strategy to fight competition

The brand allowed DeBeers to strategically sell off its stockpile by taking sales away from its competitors without flooding the market with diamonds

DeBeers focused on grabbing more market share within existing sales, so that it would not devalue the diamond market with excessive supply

What does the textile industry do to minimize compliance costs

locates production facilities in areas that have low regulations against toxins

what are the effects of textile producers locating themselves in areas with low regulations?

not held accountable for full costs of their production

by leaving out the full costs of their chemical hazards, the polluting industry is over-producing → net cost on society

Western governments are threatening _______ against heavy polluters

more stringent regulations

Greenpeace Detox

social activists are starting to pressure leading brands to adopt higher environmental standards

Lev'i’s Culture

Sustainability is sewn into the fabric of everything we do

How has Levi’s demonstrated their mission of “Profits through Principles”?

1950s: integrated factories in the south well before Civil Rights movement

1980s one of 1st companies to recognize HIV/AIDS and support educational efforts

1990s: one of the first companies to adopt a comprehensive code of conduct and social responsibility standards in its out-sourced factories

What does Greenpeace expect from Levi’s

Levi’s to back up its reputation for social impact

Social risk of activist campaigns (Levi’s)

directly from activist campaigns like DeTox

political risk of activist campaigns (Levi’s)

government regulatory threat for improved worker and consumer safety

consumer risk of activist campaigns (Levi’s)

organic food, chemical free health and beauty products/cleaning supplies → consumer trend of being more conscious of what goes in and on our bodies

What could be an effective strategy to mitigate the common risk of the textile industry

chemical management

Hazard Based approach (proactive product development)

Screened Chemistry: keep prohibited chemicals out of original product designs so that other risk management is unneeded

Supply chain risk based approach (reactive factory level)

Manufacturing Restricted

Substance List (MRSL): certain chemicals restricted in manufacturing process

Pollution risk based approach (reactive product level)

Restricted substance list (RSL): certain chemicals below threshold in jeans

Global effluent requirements (GER): certain chemicals below threshold in wastewater

What does the success of Screen Chemistry depend on

industry-wide adoption

what are the proft drivers of widespread adoption of screened chemistry

growing activist pressure to increase corporate accountability

governments more concerned with regulations

consumers are trending away from chemicals

Effect on chemical companies when creating a new chemical

High R&D costs

High new chemical screening costs

Spread minor processing fees over high volume of chemical sales → second mover pays significantly less than the first mover (free-loader, so industry doesnt innovate fast enough to mitigate the industy’s risks )

How is levi’s trying to avoid the free-rider problem

convince everyone to invest together

Under cooperative advantage, everyone will pay more than free-riding (individual costs are greater than a processing fee)

no one would have to incur the high r&d costs from first-mover disadvantage

Barriers to widespread adoption of screened chemistry

Resource/time commitement to follow new standard

program relies on proprietary info (rivals hesitant to share)

program competes with other existing ceritifcation programs (bluesign and greenscreen)

shortage and bottleneck of screening services (ToxServices)

Payoff from Free-riding

free-ride on positive industry reputation and enjoy lower marginal production cost

payoff from cooperation

shield industry from activist groups

joint lobbying against govt regulation

accelerate development of more sustainable clothing preferred by consumers

the ZDHC could be the coordination mechanism that lowers the cost of cooperation

ZDHC

Zero Discharge of Hazardous Chemicals - collection of multinational brands that are voluntarily committed to removing chemicals

economices of scale in innovation share best practices, improve and facilitate coordination and lower costs

what is needed from ZDHC

voluntary agreement from consensus of members, Levi’s pitches as ZDHC program, not Levi’s branded program

Is cooperative advantage illegal?

no - industry colluding on reducing a societal bad, and govts support efforts that lower the cost of improving social welfare

Levi’s Update

Levi’s, nike, h&m and c&a adopted a single standard for chemical management closely resembling the screened chemistry program

Gap put forth a similar screened chemistry program

ZDHC announced that they would take over the future development of screened chemistry

What is CC&S

the process of capturing, securing, and storing carbon dioxide

What is the goal of CC&S

Carbon Captreduce the amount of carbon that reaches our atmosphere, in order to reduce climate warming

What are the three types of CC&S

Biological- soils and trees act as natural carbon sinks

Geological- old mines and wells can store carbon (enhanced oil recovery [EOR] occurs from re-pressurizing a mature oil well with carbon dioxide injections in order to recover more oil)

Technological- synthetic carbon sinks can be engineered

Exxon released these nationally televised CC&S commercials

Carbon Capture Technology

Carbon Capture Plants

Who were the intended audiences of the CC&S commercials?

Employees, Socially responsible investors, and policy makers looking to pass green policies

What can companies that invest in CC&S apply for?

Apply to gain carbon credits

Explain carbon credits and VERs

Carbon credits usually come in the form of voluntary emission reductions (VERs)

VERs involve reducing, avoiding, destroying, or sequestering the equivalent of a ton of greenhouse gas (GHG) in one place to “offset” an emission taking place somewhere else

In addition to offset markets, the ICO2N members would benefit from what

If a robust international carbon trading market were to develop because the network’s CC&S emission reductions would have increased value

Indirect Social Risk of the energy market without ICO2N

Activists are targeting banks to cut off tar sands funding (ex: Please help us Mrs. Nixon, Mr. Nixon, drink a glass of water)

Politcal Risk of the energy market without ICO2N

EU, US and some Asian governments are threatening to pass policies that raise the costs of dirty energy sources

Economic Risk of the energy market without ICO2N

Renewable energy technology is maturing faster than CC&S technology and gaining cost parity with fossil fuel energy

How does Suncor and other ICO2N members mitigate their risks

Suncor enjoys reputational leadership as a founding member

Social risk: one united network that better shields each member from NGO threats (hard to cut off financing to the whole industry)

Political risk: one lobbying voice to slow down regulation on dirty energy and lobby for increased government funding in CC&S

Economic Risk: Technology must be shared within the network members

CC&S Investment Decision

$25 million is around .3% of the total $7.5 billion cost and less than 2.5% of Suncor’s annual profit

If govt covers $3.75 billion - leaves $3.75 billion for the ICO2N members to cover

1/12 of that would be $312.5 million - should Suncor invest $312.5 million before the others?

What are the opportunity costs of investing in CC&S

Oil and Gas Exploration: core competency and Alberta oilsands are rapidly being developed

Renewable Energy Technology: Wind and solar are seen as key inputs in a sustainable energy basket and are rapidly maturing

Cheaper Carbon Credits: Biological carbon sinks are a cheaper investment for reputational gains

Suncor Invests First Risks

ICO2N already mitigated social, political, and economic risks and enhanced founding member reputations

High opportunity costs as other investments are given up

First-mover disadvantage from the high learning curve costs and network free-rider (technology shared in network)

As renewable energy technologies mature…

there will be more pressure to clean up the world’s dirtiest energy supply - CC&S can help with this

Activists and voters demand more renewable energy,

governments will consider constraining dirty energy sources

2012-2016 the US (Obama and California) and the EU began to debate legislations against dirty energy

CC&S technology can help preempt or shape government regulation

Who has first mover disadvantage in the Suncor Case Update?

CC&S technology has a first-mover disadvantage

Did the ICO2N invest heavily in CC&S technology

No…

It was unreasonable for the industry to cover teh $7.5 billion and are lobbying the Canadian government to invest first

Successfully lobbied against US/EU green energy policy

Is sheltered from direct NGO activist leverage as it is hard to boycott against the energy network - Notice that energy producers are better insulated from social risk and enjoy more political influence than clothing brands, and thus were able to take less actions than the ZDHC members did

Without major investments in CC&S technology and lobbying against green legislation, the ICO2N network lost some reputation

Suncor and others formed a new energy network: Canada’s Oil Sands Innovation Alliance (COSIA)

COSIA has continued to shelter the industry from social activist threats while pressuring governments to invest in CC&S technology

If the EU’s carbon trading system continues to influence other countries to develop similar systems…

the business case for capturing carbon would improve and more aggressive investments in CC&S technology may follow