Test 4/ Final Exam Practice

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

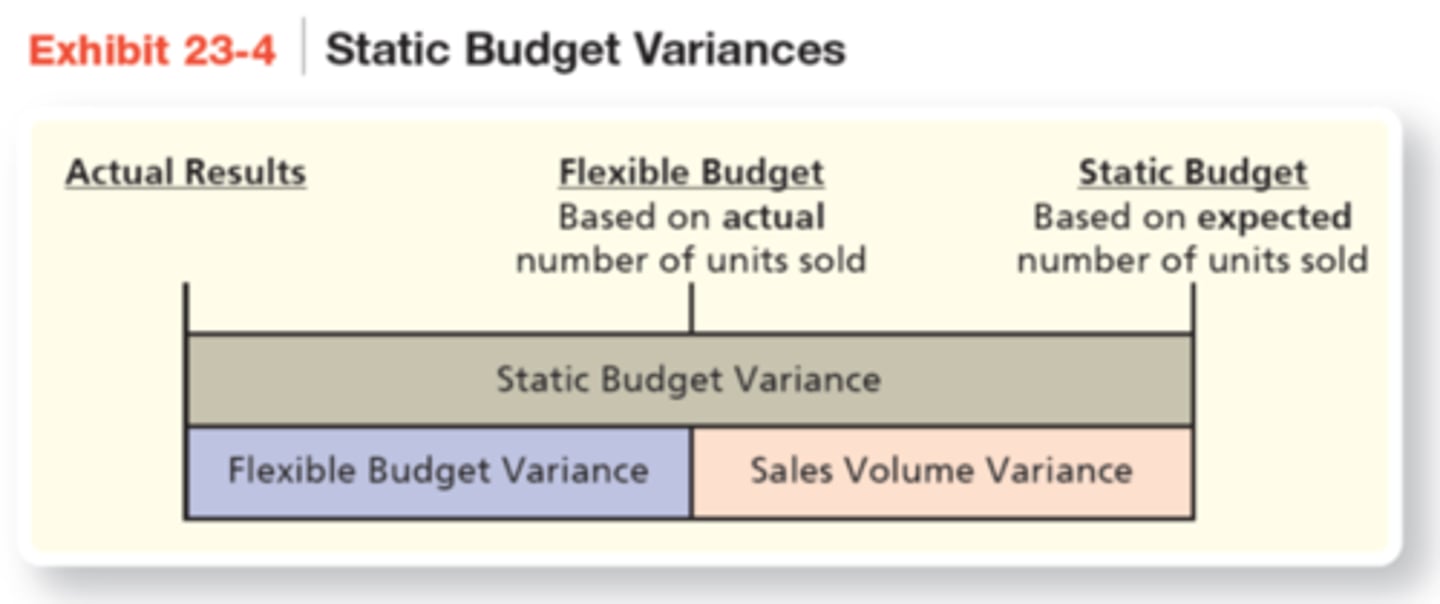

Static Budget

Your best guess/ expected amounts for the upcoming year, based on an expected number of units to be sold

Note that number units for _____ and ______ are the same

actual, flexible

Flexible budget variance is:

Comparing actual amounts and flexible budget amounts

The master budget focuses on:

the planning step

The difference between the actual results and the expected results in the static budget is what type of variance?

Static Budget Variance

Which of the following amounts of a flexible budget remains constant as sales volume changes?

a. total variable cost

b. total sales revenue

c. total fixed cost

d. all of the above

*exam

c. total fixed cost

Which of the below is true of the sales volume variance?

a. it is the difference between actual results and expected results?

b. it is the difference between expected results in the flexible budget and static budget at for actual units sold

c. it is the difference between static budget and actual results

d. it is the difference between fixed cost at flexible budget and Static budget

b. it is the difference between expected results in the flexible budget and static budget at for actual units sold

On Jan 1: Estimated we would use 100 lbs of steel during year Estimated we would pay $2 per lb for the steel

By Dec 31: We actually used 90 lbs and actually paid $3 per pound for the steel

Q1: What is the expected cost of steel for the year?

Q2: What is the actual cost of steel during the year?

Q3: Based on above, what is my total flexible budget variance for direct material cost, or what is actual cost - budgeted cost?

Q4:How much of the flexible budget variance had to do with cost variance based on price we paid?

Q5: How much of the flexible budget variance had to do with quantity we used, orour efficiency variance?

1. $200 (2 x100)

2. $270 (3 x 90)

3. $70 Unfavorable

(270 - 200)

4. $90 Unfavorable

(90 x $1)

5. $20 Favorable

(2$ x 10)

A cost variance measures:

how well the business keeps unit costs of material and labor inputs within estimates

An efficiency variance measures:

how well the business uses its materials or human resources, or keeps quantities (with in the estimates)

(T/F)

Cost variance measures how well the business keeps UNIT COSTS of materials and labor inputs within standards?

True

(T/F)

Efficiency variance measures how well the business USES its materials and human resources, or quantities?

True

URCo has the following data:Direct materials:

2 lbs per unit; $10 per lb (standard DM cost per unit)

Direct labor: 2 hours per unit; $19 per hour

Units produced during qtr: 3,000

Actual material used: 6,500 lbs

Actual total material cost: $70,000

Calculate the direct materials cost variance.

Actual total material cost - actual material used cost

70,000 - 65,000 = 5000 unfavorable

URCo has the following data:

Direct materials: 2 lbs per unit; $10 per lb (Standard DM cost per unit)

Direct labor: 2 hours per unit; $19 per hour

Actual material used: 6,500 lbs

Standard material used: 6,000 Lbs

Calculate the direct materials efficiency variance.

(10 x 6,500) - (10 x 6,000)

65,000 - 60,000 = $5000 Unfavorable

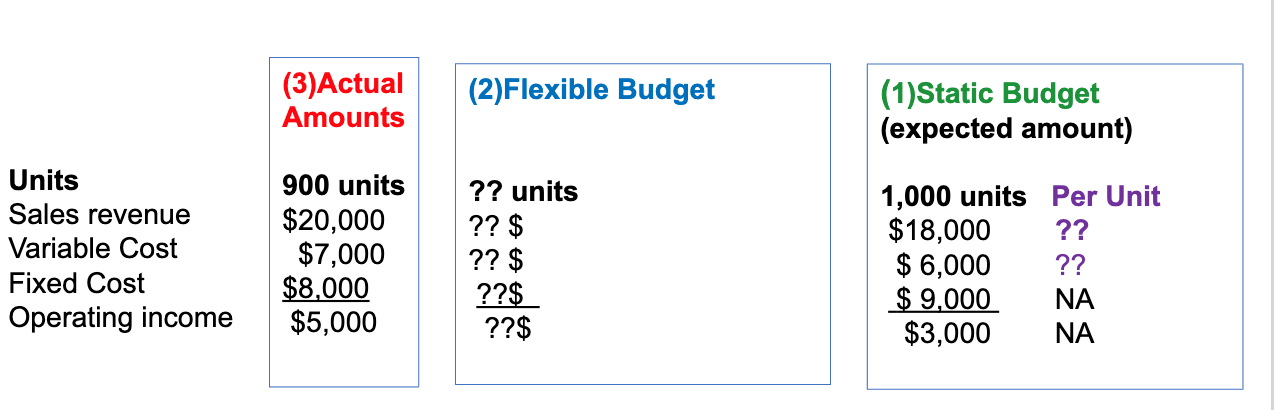

Calculate all amounts for flexible budget

Units: 900

Sales rev: 900 x $18 = 16,200

Fixed Cost: 900 × 6 = 5,400

Fixed Cost: 9,000

Operating Income: $1,800

Items:

Profitability of company

Profitability of hat department

Sales rev of hat department

production costs of hat department

Quality of hats based on survey

Who is responsible for these items?

CEO of company

Dep. Manager of hat dept

sales manager of hat dept

production managet hat dept

assembly line employee in hat dept

Small companies are most often considered to be ______ companies = all important decisions are made by one person / unit

centralized

_______ companies split their operations into different segments, such as department s and devisions

decentralized

Advantages of decentralization:

Frees top management time

Supports use of expert knowledge

improves customer relations

Provides training

Improves manager motivation and retention

Empowering them with decision making

URCo is a company which owners or top executives make all

decisions around planning, controlling and directing the company.

This is what type of company?

a. decentralized

b. compartmentalized

c. centralized

d. both a and b

c. centralized

URCo is a company which segment managers make all

decision around planning, controlling and directing the company.

This is what type of company?

a. decentralized

b. compartmentalized

c. centralized

d. both a and b

a. decentralized

Which of the below is an advantage of decentralized companies?

a. some costs may be duplicated

b. motivation and retention of managers can be increased

by empowering segment managers to make decisions

c. customers satisfaction is decreased

d. all of the above

b. motivation and retention of managers can be increased by empowering segment managers to make decisions

URCO has determined to hold a unit accountable for both revenue

and expenses. What type of responsibility center is this?

a. profit center

b. cost center

c. revenue center

d. Investment center

c. profit center

URCO is defining manager responsibility. Which of the below

would have the most diverse responsibility?

a. production manager

b. sales manager

c. investment center manager

d. profit center manager

e. cost center manager

c. investment center manager

The primary goals of a performance evaluation system are:

Promoting goal congruence and coordination (align goals)

Communicating expectations

Motivating segment managers

Providing feedback

Benchmarking

Financial performance measures are ______ indicators. Which reveal past performance

Lag

Responsibility reports are ________ that capture the financial performance of __________ which a focus on responsibility and control

performance reports, cost, revenue, and profit centers

A controllable cost:

A cost that a manager has the power to influence by his or her decisions

Upper-level mgmt has control over more costs can lower lvl

Lower lvl have responsibility for a limited number of costs

Responsibility reports are completed for the ____ of each business segment

manager

Responsibility accounting attempts to associate _____ with the manager who has ______ over each costs

costs, control

Responsibility reports are used to evaluate the ______ of a manager. Only _____ _____ by the manager are included

performance, costs controllable

Cost center responsibility focus on the ______ budget variance for each costs.

flexible

URCO: Customer Service Department Performance report contains:

Salaries

Supplies Used

Depreciation on phone system

What will be included on the customer service department responsibility report?

Salaries

Supplies used

Note: this report only includes “controllable costs”

Revenue centers focus on _______ budget variance and _____ volume variance for revenue

Flexible, sales

URCO is designing a responsibility report for its Hat Department

Revenue Center. Which items will this report compare?

a. actual profit to budgeted profit

b. actual costs to budgeted cost

c. actual revenue to budgeted revenue

d. number of sales staff to production staff

e. actual revenues and actual costs to budgeted revenues and costs

c. actual revenue to budgeted revenue

URCO is designing a responsibility reports for its Hat Department.

What is the most important factor to consider when designing

responsibility reports?

a. costs

b. revenue

c. profits

d. stock price

e. controllability

e. controllability

URCO is designing a responsibility report for its Hat Dept. Production

Supervisor. Which of below is most relevant?

a. Hat factory rent

b. Hat factory direct labor costs

c. Advertising for company

d. Hat factory depreciation

e. Hat factory sales tax

b. Hat factory direct labor costs

URCO is designing a responsibility report for its Hat Dept. and

wants a report that will cover the authority to open and close

new hat stores. Which report is most appropriate?

a. profit center

b. revenue center

c. cost center

d. both b and c

e. investment center

e. investment center

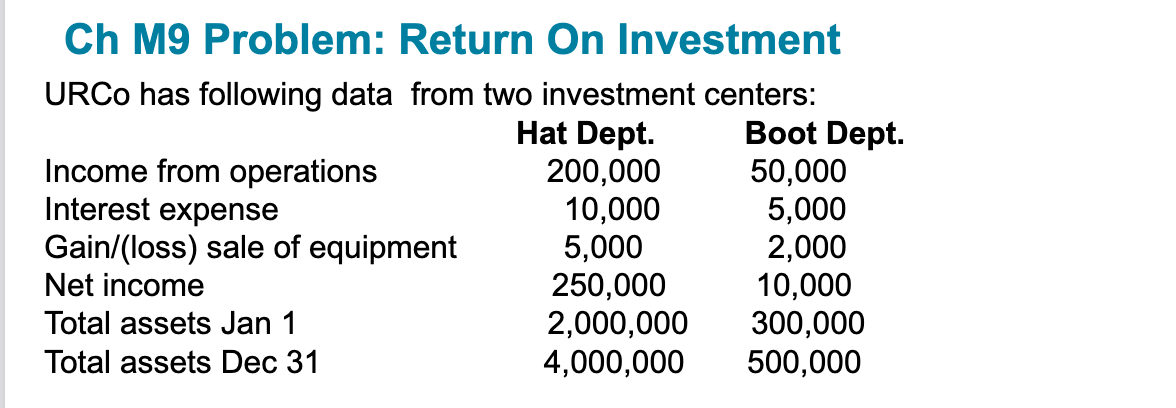

Q1: Calculate return on investments to 2 decimal places for both

departments. Q2: which department uses its assets more efficiently?

ROI = Income from Operating / Avg. Total Assets

Hat Dept: 200,000/ 3,000,000 .066 6.67%

Boot dept: 50,000 / 400,000 = .125 12.5%

Boot department more efficient since higher ROI

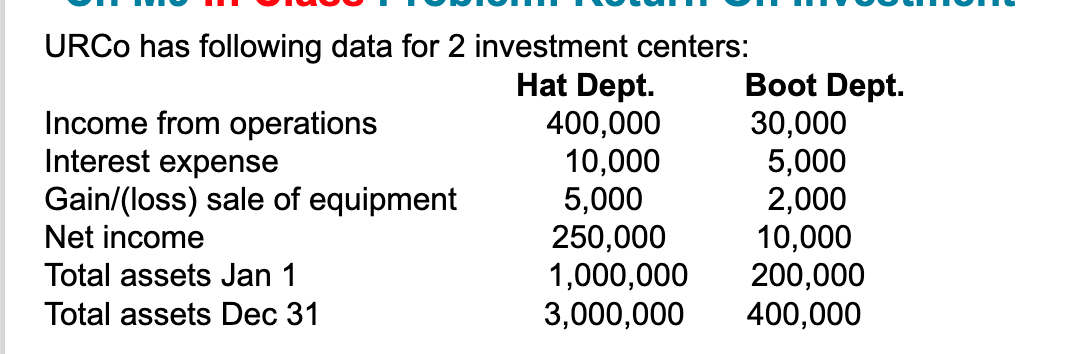

Q1: Calculate return on investments to 2 decimal places for both

departments. Q2: which department uses its assets more efficiently

ROI Hat Dept: 400,000 / 2,000,000= .2 20%

ROI Boot Dept: 30,000 / 300,000 .1 10%

Hat dept uses assets more efficiently since higher ROI

Relevant information is:

expected future data that differs among alternatives.

Future data that differs among alternatives is best

described as?

a. Irrelevant costs

b. Sunk costs

c. Fixed Costs

d. Relevant information

d. Relevant information

Which best describes differential analysis?

a. evaluates relevant and irrelevant data

b. looks at sunk costs

c. considers all areas of traditional income statement information

d. looks at how operating income would differ under each

decision alternative

e. all of the above

d. looks at how operating income would differ under each decision alternative

Desired Profit =

Return on Investment x ROI

If return on investment goal is 10% and assets are $500,000, what is

desired profit?

Desired profit = ROI x Total assets

= .10 × 500,000 = 50,000

URCO sells 1,000 microwaves per year at a price of $200 per unit in

a highly competitive environment and uses target pricing. URCO

has $1,000,000 in assets and its shareholders wish to make a

profit of 5% on assets (ROI). Assume all hats made are sold.

What is the target full product cost per unit needed to hit the target profit?

Step 1: .05 x $1,000,000 = 50,000

Step 2: 1,000 units x $200 spu = 200,000

Step 3: Calc. target full product cost per unit (200,000 - 50,000) /1000 units = $150 per unit

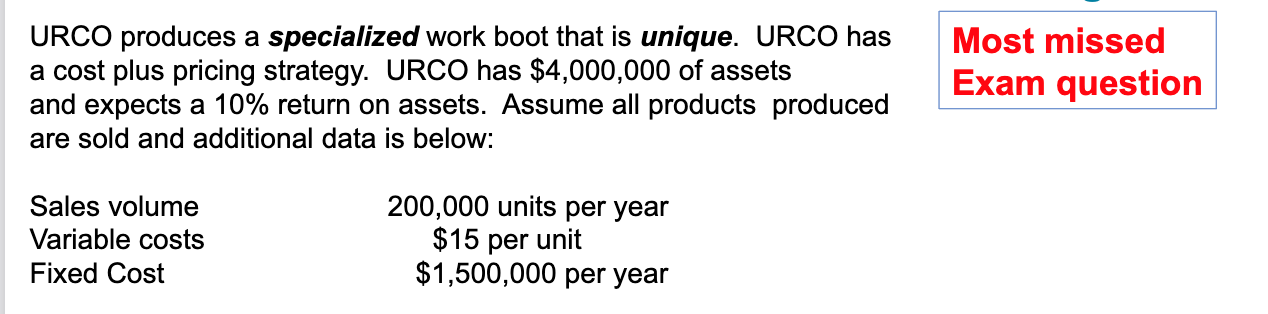

Using cost-plus pricing, what should be sales price per unit?

1, Calculate Desired Profit: