EV and Accounting

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

62 Terms

Why do we add cash to equity value?

It’s bc shareholders own residual claim on business. The cash pile is still theirs once debt is settled

EV vs Equity Valud

EV (Market cap + stuff - cash) | Equity Value (market cap or EV - stuff + cash)

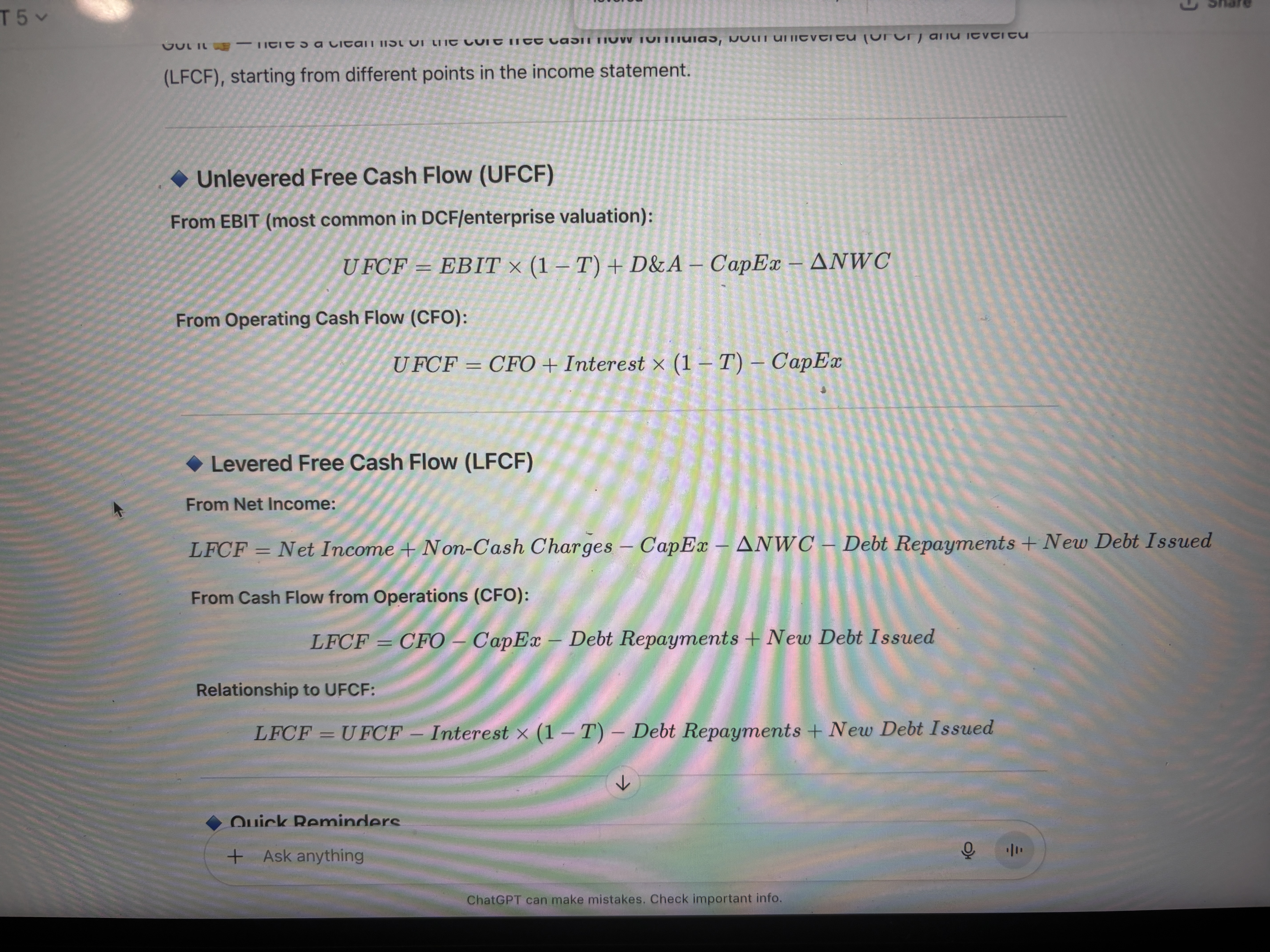

LFCF vs UFCF

Net income minuses interest hence why we add it back with the tax rate. So LFCF from UFCF we add subtract interest minus debt + new debt

Enterprise Value why we use it?

We use it bc it includes debt and equity. It represents the theoretical COST TO ACQUIRE a company and can therefore be used to compare. Rly good for M&A

PE ratios explain it

How much investors are willing to pay for $1 of a company. Low means market thinks growth slowed, risk high, or stock undervalued. High PE means higher future growth expected. Good for companies with consistent earnings!

Price-to-Sales

Price*#of sales( or js market cap)/ revenue

Good for unprofitable growth companies. Higher PS shows that market is paying more for each dollar of company’s revenue. Good for when company has negative earnings

Price to book

Current price/ book value per share

Book value = total assets - total liabilities.

Low PB means undervaluation, distress, or outdated assets. PB = 1 means market values close to book value. And PB >1 means market expects company to generate above book value

We use EV/EBIDTA

Because it is good for comparing companies with high Capital like telecom or utilities who might have different depreciation schedules. It is good cus it cuts out Capex

It is often said that the true value of something is only what people will pay for it, and EV/EBITDA, without the market distortions of the stock price and unavoidable non-cash expenses that are outside a company’s control, gives a better sense of that. EBIDTA is the company’s profitability minus some other factors.

The noise:

Interest expenses from financing decisions.

Taxes, which vary by jurisdiction.

Depreciation and amortization (D&A), which are non-cash expenses that can be highly variable, especially in capital-intensive industries.

Why EV/ebit

Good for comparing similar asset intensity. Good for when depreciation actually matters like airlines or manufacturing

EV/Rev

Good for early stage companies where profits don’t mean much. It is capital neutral while p/s only looks at equity. If leverage is diff b/n peers it can be misleading.

We use EV/Rev

Because so many companies don’t have profit

Why do we want capital neutral companies

Bc if two perform the same js one is more leveraged the interest payment may heavily distort net income. Removing debt values the whole business. Apples to apples

Net income, Ebitda, or ebit/rev

Js shows if it is profitable. Bottom-line profitability, cash operating profitability, operating margin profitability

How do u do a comp transaction

Find multiples with comps. Multiply to company. Take EV subtract debt add cash to get EqV. Pay a premium

Pros for Comp Transaction

Pros:

• Easy to perform analysis

• Information is easy to find

• Applicable to all companies

Cons for Public Comparable Analysis

Cons:

• Assuming markets are efficient (sometimes mispricing)

• Multiples don’t tell full story

• Hard to find for niche markets

PROS Precedent TRANSACTION Analysis

Pros:

• Easy to perform analysis

• Information is publicly available

• Most accurate method for M&A

Cons for Precedent Transactions

Cons:

• Deals become outdated quickly

• Deal details are hard to find

• There are rarely “perfect” fits (Market was different at the time)

How to project Capex and D&A and NWC

as %s of revenue. Equity research reports and consensus analysis or historical data can get you the rest.

Enterpise Value is capital neutral because…

it is the underlying asset value that both debt and equity shareholders own. Equity Value decreases with more debt, therefore it is capital inclusive. UFCF, EBIT, EBIDTA are all prefinancing metrics, and they are therefore used with EV.

How to calculate cost of debt

YTM of debt or bonds of a company that is publicly traded (weighted avg of market rate of return for debt holders).

Total Interest Expense/Total Debt

Avg interest rate of existing debt

Risk free rate + credit spread

Which of the four valuation methods return the highest estimates

Typically you cannot tell. If you need an answer:

Precedent transactions because you pay a multiple

DCF but can vary due to assumptions you make

Comparable Company Analysis: As-is and is more conservative than precedent transactions

LBO: Lowest bc its PE firms want to pay the smallest amount possible to reach their IRR of like 20-25%. No premium as well.

So whats so good about PE ratio anyway?

PE ratio is good when you are looking at things from the perspective of a shareholder, and when capital structure is very similar therefore you don’t need to root it out (minimal distortions, especially with taxes and debt). If interest is integral to operations like banks then you should really use PE.

Does EV or Equity value have interest included?

EV does not, hence EBIT while Equity Value does because it compares full. capital strucutre and you are adding back debt adn stuff.

What’s so good about EV/EBIDTA anyway

Capital neutral and interest excluding. We look to acqiure everything of a business not just the equity value we acquire debt. Good for when leverage can vary heavily. Ebidta does not include capex tho.

Why are taxes subtracted when finding FCF

Because taxes are a real cash outflow, reducing what is available to both Equity and Debt holders. We do not incorporate interest because it must be capital-structure neutral.

Levered FCF (interest)?

interest included in the form of net income:

LFCF=Net Income+NonCash Charges−ΔWorking Capital−CapEx−Mandatory Debt Repayments

what the fuck is accrued expenses

When we receive a service but have not yet paid like salaries that get paid next month., It is a liability. Does not affect CFS and is an expennse on income statement

On the IS like wages or interest.

Since you received a service, it is on IS

3 statements link tgt

Changes in (CFS) Operating assets from balance sheet like PPE and Inventory. Changes in CFS financing and investing come from debt, shareholder’s equity, etc. on Balance Sheet. Cash and Shareholder’s equity are plugs. Cash from CFS and SE from Net Income

Why Depreciation Affects cash balance?

Depreciation is non-cash but it is tax-deductible and paying taxes is a cash outflow.

Accrued Compensation is Accrued Expense

From Y1 > Y2, what happens when 100$ of inventory is used (paid w/debt)

incorporate interest payment and depreciation cost.

If debt is high-yield…

We DO NOT pay back principal, and we assume that Liabilities in balance sheet does not change.

When inventory is used up… to make a good for example… what happens to cash

cash goes up as money tied up to it is used up.

Retained earnings is NOT net income… then what is it?

Retained Earnings incorporates money paid out for dividends. Net income is a part of retained earnings, and retained earnings funnels into shareholder’s equity.

Shareholder’s equity, can it be negative?

Yes, if in an LBO with dividend recapitalization, the owner can take out a large portion of equity, sending it negative at times.

Yes, when a company has consistently been losing money in retained earnings goes down and it becomes negative.

Working Capital? How about Operating Working Capital?

Current assets - current liabilities: Shows if a company can pay off its short-term debts

Operating Working Capital: ( Current assets - cash ) - Current liabilities - Debt

OWC Excludes financing activities

Negative Working Capital?

Not a bad thing always, such as when a company

1) Has high deferred revenue like subscriptions.

2) When considering operating working capital, companies that do retail like Walmart where consumers pay up front, they collect the cash, but they have high AP from suppliers, so their liabilities look higher. This can make it look negative, but then you are just using credit and converting inventroy to cash very quickly - efficiency

3) Financial trouble

Bailout? What is it and 3 statements

Bailout - Government puts like an equity investment or sometimes debt

No IS changes → CFS Cash up by 100 bc gov invests in company → BS Cash up by 100 and SE up by 100

How does a debt write-down affect the income statement?

IS increases

But then because the reduction on debt is a non-cash increase, you have to subtract it. CFS from operations would be zero.

Deferred Revenue

an advance payment a company receives for products or services it hasn't delivered or performed yet; it's recorded as a liability on the balance sheet because the company has an obligation to provide something to the customer in the future.

not on income statement

E.x. Subscriptions, event tickets

Deferred Revenue vs Accounts Receivable vs Accrued Revenue

DR: Liability → income a company has received payment for but NOT YET DELIVERED

Accounts Receivable: Asset → Money a company is owed, but it has ALREADY DELIVERED SERVICE (30-60 days takes to collect bread differs for transaction value companies)

Accrued Revenue: Asset → Money a company is owed but not yet received payment for. Service DELIVERED

(The ARs differ as Accounts Receivable has billed the ppl alr while Accrued Revenue has not)

Why do companies use Accrual rather than Cash based Accounting

Accrual recognizes revenue when it is reasonably certain it will get paid, and it recognizes expenses when they are paid not when they are received.

Since so many people use credit cards, accrual accounting recognizes that money.

Accrued Expenses vs Accounts Payable

No invoice = AE, Invoice = AP

Both are services a company has received, but they have not paid for (liabilities)

Capitalization versus Expensing a purchase

If it is useful for more than a year, then it is capitalized and D&A over certain years. This goes into the B/S.

If it is less, like salary or manufacturing costs, then it is put in COGS and in the I/S.

GAAP vs NonGAAP

Companies report non-GAAP to strip out accounting artifacts—like amortization of acquired intangibles, SBC, and acquisition adjustments—to highlight core, recurring performance. SHOWS RECURRING, not one-time earnings power. for M&a it can include synergies and stuff.

It’s useful for comparability, but I always start from GAAP, reconcile the adjustments, and treat recurring ‘one-time’ items and SBC as real economic costs. Companies can report recurring costs as one time costs.

Why does Goodwill get written down?

Post-acquisition, the amount of overpay a company did for things like brand, IP, and customers is too much. Typically when companies overpay. Or when companies discontinue part of operations and must IMPAIR goodwill. Goodwill is a plug in acquisitions.

EQV = public sees and money available to shareholders. EV is real value

Why do we add Non-controlling interest to EV

B/c we need to consider that when we compare to other companies, we need to assume we are buying the full 100%. We are required to report 100% of the companies performance, even when we don’t own it.

We add it because we need to consider all stakeholders and value of all assets to ALL CAPITAL PROVIDERS

Subtracting Cash is not always accurate b/c…

You should be accounting for the minimum cash balance a company must have on hand.

You should be only subtracting excess cash.

EV can be negative

Obv if cash is too high or really low market cap.

Preferred Stock is added to Enterprise Value why?

It is because PS pays out a fixed dividend and have a higher claim to a company’s assets than equity investors (so not in the same realm as Eqv). Seen as more similar to debt.

Bonds and if they are convertible

Bonds are like loans from investors to the company, hence why treated like debt

In-the-money (share price > CP) → treat as equity

Assume they convert.

Add shares to the diluted share count (Equity Value ↑).

Do NOT count the convert as debt in Net Debt (because upon conversion the liability disappears).

Out-of-the-money (share price ≤ CP) → treat as debt

Assume they won’t convert.

No extra shares.

Include the face value of the converts in Debt (Net Debt ↑).

Case A: In-the-money → equityIf-converted shares added = 500 / 40 = 12.5

Diluted shares = 100 + 12.5 = 112.5

Equity Value = 112.5 × 50 = $5,625

Net Debt = (Other debt $80) − Cash $20 = $60 (convert excluded)

EV = 5,625 + 60 = $5,685

Case B: Out-of-the-money → debt (say CP = $70)

No dilution (0 extra shares) → Equity Value = 100 × 50 = $5,000

Net Debt = (Other debt 80 + convert 500) − 20 = $560

EV = 5,000 + 560 = $5,560

How do we calculate the total number of stocks in each bond and total amount of convertible bonds?

We take divide the convertible bonds by the par value. To see how many BONDS we have.

Then we divide how many BONDS we have to the conversion price to see how many shares we have then we can add it to total share amount.

EQV vs Shareholder’s Equity

Different b/c EQV is the market value and SE is the book value. EQV always exceeds SE and SE can be negative. EQV is what market think shareholder ownerhsip is worh

Shareholder Equity Equation

Total assets - total liabilities

What are the components of Shareholder’s Equity

Shareholders’ Equity=Common Shares+Preferred Shares+Paid-In Capital+Retained Earnings

Operating Vs Financing Leases in IFRA 16/ US GAAP

🟩 General Overview

Both Operating and Finance leases now appear on the Balance Sheet.

Each creates:

a Right-of-Use (ROU) Asset → your right to use the leased asset, and

a Lease Liability → your obligation to make future payments.

The difference is how expenses are recognized on the Income Statement and Cash Flow Statement.

🟦 Finance (Capital) Lease

Treated like buying the asset with debt.

You assume most risks and rewards of ownership.

Examples: equipment, airplanes, or data centers with purchase/transfer options.

Accounting treatment

Balance Sheet:

Record ROU Asset + Lease Liability (both equal at start).

Liability decreases as payments are made (principal).

Asset depreciates over the lease term.

Income Statement:

Two expenses each period:

Depreciation on the ROU Asset.

Interest on the Lease Liability.

Total expense is front-loaded (higher early, lower later).

Cash Flow Statement:

Interest → Operating Cash Flow.

Principal → Financing Cash Flow.

Depreciation → non-cash add-back in OCF.

Impact: increases EBITDA (no rent expense).

🟨 Operating Lease

Treated like renting the asset — ownership stays with the lessor.

Used for offices, retail space, vehicles, etc.

Accounting treatment (ASC 842 – U.S. GAAP):

Balance Sheet:

Still records an ROU Asset and Lease Liability.

Both decline gradually over the lease term.

Income Statement:

Single Lease (Rent) Expense reported straight-line each year.

No separate depreciation or interest lines shown.

Cash Flow Statement:

Entire lease payment shown in Operating Cash Flow.

Impact: lower EBITDA (rent reduces operating profit).

When are Deferred Tax Liabilities Created?

DTLs often arise because of different Depreciation methods, such as when companies

accelerate Depreciation for tax purposes, reducing their tax burden in the near term but

increasing it in the future. They may also be created in acquisitions.

OWC

🟩 Operating Working Capital (OWC) Overview

Definition: Operating Current Assets − Operating Current Liabilities

Measures: How much cash is tied up in daily operations.

🟦 High OWC

Means cash is stuck in receivables or inventory.

Reduces liquidity and free cash flow.

Often seen in manufacturing or retail firms.

✅ Acceptable if tied to growth, 🚫 bad if due to inefficiency.

🟨 Low / Negative OWC

Means the company collects cash fast and/or pays suppliers slowly.

Frees up cash → stronger free cash flow.

Common in software, subscription, or service businesses.

🚫 Too low can cause supply or operations issues.

🟩 Ideal Situation

Efficient balance: enough working capital to run smoothly, but not excess cash trapped in operations.

Goal: Keep OWC low or decreasing relative to revenue over time.