BFC2140

1/105

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

106 Terms

What is valuation principle?

The benefits and cost of a decision should be evaluated

the decision will increase market value when benefits exceeds costs

What is Franking credit?

The credit used by individual shareholder to reduce his/her own taxation liability

Define Agency problem

When managers, despite being hired as the agents of shareholders, put their own self-interest ahead.

What is limited partners?

Have limited liability

no management authority and cannot legally be involved in the management of the business

Define imputation system

Overcome the double taxation of corporate profits

allowing company to transfer a tax credit to the shareholder for the amount of the tax the company has paid

What is Arbitrage?

The practice of buying and selling equivalent goods in different markets to take advantage of a price difference

Law of one price

Market tries to push towards equilibrium where cashflow must have the same price.

Define Perpetuity

A stream of equal cash flows that occur at regular interval that lasts forever

Arrives at the end of the first period (payment in arrears)

Define Annuity and the type of annuity

A stream of equal cash flows that ends after some fixed number of payments.

Ordinary Annuity:

Pays at the end of the period

Annuity due:

Pay at the start of the period

What is a bond?

A tradeable debt security, usually issued by a government or semi government body to raise money

Received a fixed rate over a period of time

Repaid with interest on predetermined maturity date

What is a share trading when Coupon rate = discount rate?

the bond trade at par

What is a share trading when Coupon rate < discount rate? How does this affect the price and value?

price < par value the bond trade at discount

price is less than par value

which is not valuable to investors

What is a share trading when Coupon rate > discount rate? How does this affect the price and value?

par value The bond trade at a premium

Price is more than par value

What are the factors that would impact the bond price?

1. Interest rate changes

Market interest rate increase =the YTM also increases

Higher YTM = investors demand for a higher return for the bond

Leads to higher discount rate =reducing present value and the bond's price

Time affect

Zigzag pattern

Price slowly rising as coupon payment nears

Drop after payment has been made

Interest rate risk

Unexpected changes in interest rate --> risk that arises for bond owners

Greater time to maturity = greater interest rate risk

Lower coupon rate = greater interest rate risk

What is share equity?

Corporate create and issue shares to raise equity capital, and incur a cost of equity

More difficult to value due to uncertainty of promised cash flow and have no maturity

Part ownership in a company

What are the types of shares?

ordinary shares

preference shares

partly paid shares

Define ordinary shares

Carry no special or preferred rights

The right to vote and participate in any dividends or an distribution of assets

Define preference shares

Priority or preference over ordinary shareholders to payments of dividends

Voting rights are restricted

Many different types of preference shares

Define partly paid shares

Issued without the company requiring payment of the full issue price

The company is entitled to call for all or part of the outstanding issue price

Shareholder is legally obliged to pay for the call

Similar rights as ordinary shareholder

What is the difference between a public and private corporation?

Public corporation is listed on the ASX and their shares are traded on an exchange, while shares of private corporation are not traded on a public exchange.

What is the difference between primary and secondary market?

A primary market is where the company sells shares of itself to investors. The secondary market is where investors can buy and/or sell the company's shares with other investors.

What is a corporation’s key objective?

The corporation key objective is to generate a profit and maximise the wealth of its shareholders, as well as generating a long term value.

What are the key tasks a corporation financial manager should undertake?

Investment decision-Includes weighing the benefits and cost of a potential investment to be qualified as good use of money

Financing decisions-Whether to raise more capital or obtain a bond during difficult financial situation

Management of cash flow from operating activities-ensure the business has enough cash on hand to meet day-to-day activities

What is a bond issuer?

View the bond as a liability

Received the money from the bond

Obligated to pay the periodic interest payments

Obligated to pay the principal amount and the final coupon payment

What is a bond holder?

a lender (investor) --> seek a steady stream of income

View the bond as an asset

Highlight the difference between yield and coupon rate.

Coupon rate is the interest rate on the bond issued by the issuer, and is determined by the issuer

Yield rate is the required rate of return demanded by the bond investor, and is determined by the investors

Define NPV

The difference between the net present value of the benefit and net present value of cost

A range of discount rate

How to evaluate projects with different lives?

Using Matching cycle or replacement chain approach or EAA

What are the advantage and disadvantage of NPV?

Advantage:

Uses cash flows

Discount cash flow properly

consider the time value

Direct application of value principle

Disadvantage:

Relies on accurate estimate of discount rate

can be time consuming to compute

Define IRR

Sets NPV of cash flows equal to zero = average return of investment

Summarises the merit of a project

The higher the IRR = the better it is

When IRR<k = generates insufficient return

IRR > k = project's rate of return is greater than cost

The required rate of return is the minimum return that a project must earn in order to be acceptable

Define EAA

Intention of comparing projects with different lives

Takes NPVs and spread across the lives

Computing the annuity = PMT

Define conventional CF projects

A negative cash flow is followed by a series of positive cash flows

Define non-conventional CF projects

Two or more changes of signs - different cash flows

What is payback period?

Number of years required to cover a project's cost

Only accept if the payback period is within the specified want

What are the pitfalls of IRR?

Mutually exclusive projects = where k<crossover rate creates a conflict between IRR and NPV, but k>crossover rate there is no conflict

IRR is not feasible

Multiple rates of returns, such as non-conventional cfs

Lending project and borrowing project can have the same IRR

Define profitability index

For project ranking and capital restrictions

When have capital rationing issue

Investment return measurement

Finds the ratio

Higher PI = better

What to leave out in an incremental cash flow?

sunk cost

research cost

accounting income

allocated overhead

financing cost

What is a free cash flow?

the left over cash after counted for investments in working capital and long term assets

amount that is generated for a project

What is NWC?

Short term in nature

To be settled in cash within a year

Managing working capital is critical to a firm because the working capital usually ties up funds that could be deployed elsewhere in the firm to earn returns or distribute to shareholders

Minimising NWC to maximise FCF/ the firm value

If depreciation expense is not a cash flow, why do we have to subtract it and add it back? Why not just ignore it?

It is important to include depreciation because it provides a tax saving or tax shield, where it affects the cash flow positively by reducing the taxable income.

Define break even analysis

A financial tool used to determine the point at which a business or project generates enough revenue to cover its total costs

The minimum level of sales or output to break even

The level of a parameter = NPV is zero

Define sensitivity analysis

A capital budgeting tool that determines how the NPV varies as a single underlying assumption is changed

How responsive is the output to changes in variables

Assessing the sensitivity of NPV calculation to the uncertainty about the cost of capital used as the discount rate

Define scenario analysis

Determines how the NPV varies as the number of the underlying assumptions are changed simultaneously

Analysis situations involving major economic shocks

Define Decision tree analysis

Evaluate risky investments that involve sequential decisions

Enable decision maker to study the various decision points in relation to subsequent chance, events and choose from alternatives

Shows magnitude, profitability and inter-relationship of all possible outcomes

Relationship between present decision and future events

Taking account of the probability of various events occurring and the effect of those decisions on the NPV of the project

How do you calculate average daily COGS or sales?

COGS/365 or sales/365

What does negative cash conversion mean?

The firm generally receives cash before it pays its supplier.

What is a trade credit?

An agreement between customer and supplier

Customer can purchase goods without paying cash upfront but at later scheduled date

The difference between receivables and payables that is the net amount of a firm's capital consumed as a result of those credit transactions

For buyer can calculate the cost of giving up the discount of EAR = (1+r)^n-1, where n is 365/days (full term days- days pay before discount) and r is dollar of discount/amount left to paid

Trade credit : Pros and Cons for buyers

Pros for buyers:

Improve cash flow because payment is not due till later

Simple and easy access to financing at no extra cost

Improves the customer's business profile as well as the relationship with the suppliers

Cons for buyers:

High cost if payment are not made on time due to penalty charges or negative impact on the business profile

Trade credit : Pros and Cons for sellers

Pros for sellers:

Strong relationship with its clients and encourage customer loyalty

Higher sales volumes as buyers are more likely to purchase more when there are no additional cost

Cons for sellers:

Delayed revenue = may impact operating cost

Risk of buyers not paying

What should the firm do when the effective annual cost of buyer is more than interest rate?

A high EAR is the cost the buyer will bare if they choose not to take the discount

If bank charge less interest compared to the EAR then the buyer should take the discount because when they borrow money the cost is less than not choosing to take the discount and they can use the money to pay for the supply to get that benefit.

What are the type of accounts receivable managements

Accounts receivable days:

The average number of days that it takes a firm to collect on its sales

Aging schedule:

Categorises accounts by number of days they have been on the firm's books

Can be prepared using either the number of accounts or the dollar amount of the accounts outstanding

Payment patterns:

Provide information on the percentage of monthly sales that the firm collects in each month after the sales

Explain what is stretching payable account and the consequences.

When a firm pays its account payable after the term days.

Cheaper cost of borrowing

However, could impose cash on delivery or discontinue any business with the firm altogether.

Inventory management

Holding appropriate level to help prevent stock outs

Holding too much inventory can be costly = acquisition cost +carrying cost

Just in time (JIT) inventory management = when a firm acquires inventory precisely when needed so that inventory balance is always zero or very close to it

What is the importance of cash management?

Cash earns zero to no interest

The cash can be used for day to day operation needs, precautionary balance (unexpected losses) and compensating balance (bank requirements)

Cash can also be used for alternative investments, such as short term investments that can be turned into cash easily

Define measuring return

Measure of profit on an investment

Can be measured over any interval of time

Higher risk requires higher return = expected return

Risk is uncertainty associated with future possible outcome

doesn’t provide good indication even with decade long of historical data = share are volatile

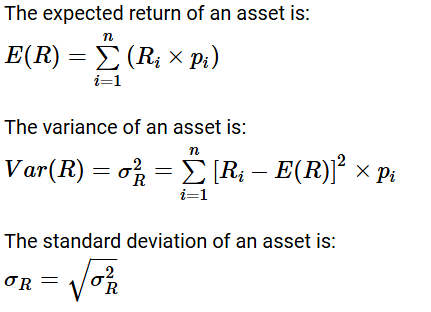

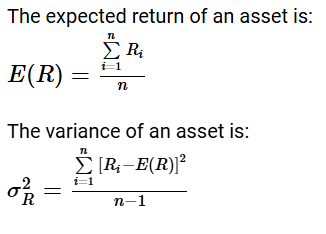

Define variance

average value of squared deviations from mean. A measure of volatility

Define standard deviation

square root of variance and a common proxy for risk

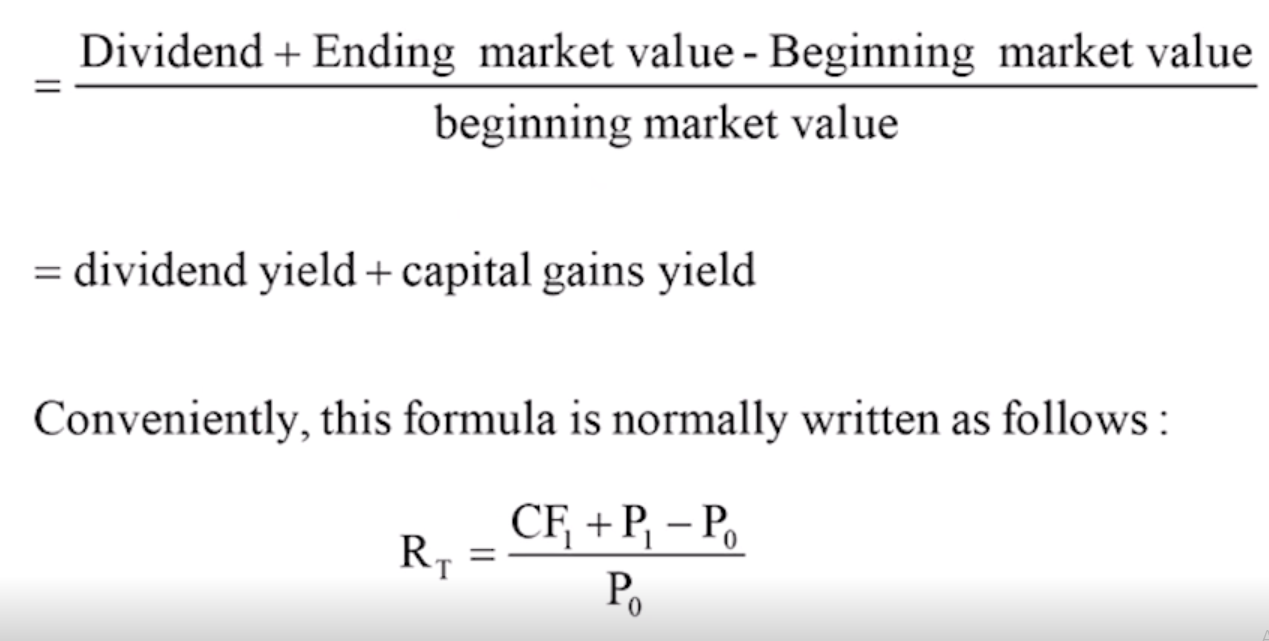

Holding period return (HPR)

Total return received by an investor from holding an asset or a portfolio of asset over a period of time

Useful to compare returns on investment purchased at different periods of time

Considers not only the appreciation of the asset but also the income payments

What are the methods to calculate expected return?

Using a probability distribution (Individual security)

Using a time series approach

probability distribution (Individual security) method

There is uncertainty associated with returns from shares

Assuming that we can assign probabilities to the returns expected

The sum of return of the product of return* probability

Risk is measured in terms of how much a particular return deviates from an expected return

Time series method

Use historical stock market data

Assume that the distribution of the past returns can be useful in some way to estimate the possible future returns for the investors

N is minus 1 because it is a sample historical data

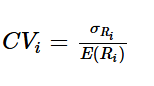

Define coefficient of variation

Statistical measure that compares the risk-to-return relationship among different assets/securities

How much risk faced by an investor on a security per unit of return

The lower the cv the better

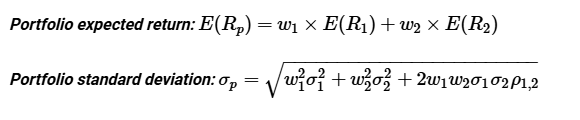

Define a portfolio

A collection or combination of many assets that are of different asset classes such as stocks, bonds, cash, real estate and more

To balance risk and return based on the investor's risk tolerance, time horizon and investment goals = diversification = risk minimization

Weighted average of the return of all the assets in a portfolio

Portfolio risk is not a weighted average

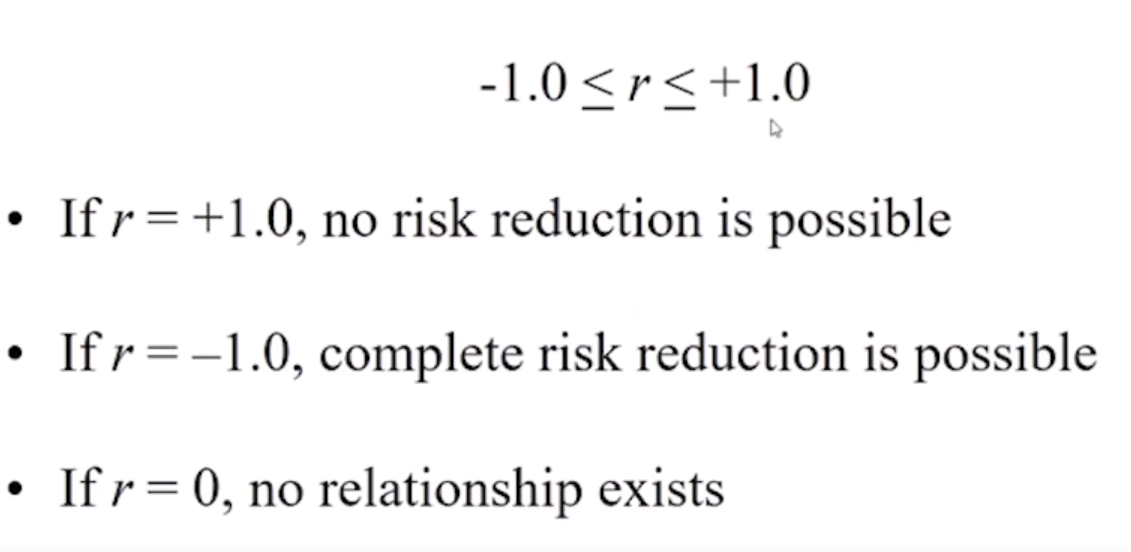

Define correlation

Combining the two assets in the same portfolio may reduce the portfolio risk = if they are not perfectly or positively correlated with another asset

Measure of the extent to which two securities' returns tend to move together

Closer to 1 = the assets are highly correlated so when one asset decrease the other also decreases

Closer to -1 = the assets are less correlated so when one asset decrease the other may increase

Range from -1 to +1

Degree of co-movement

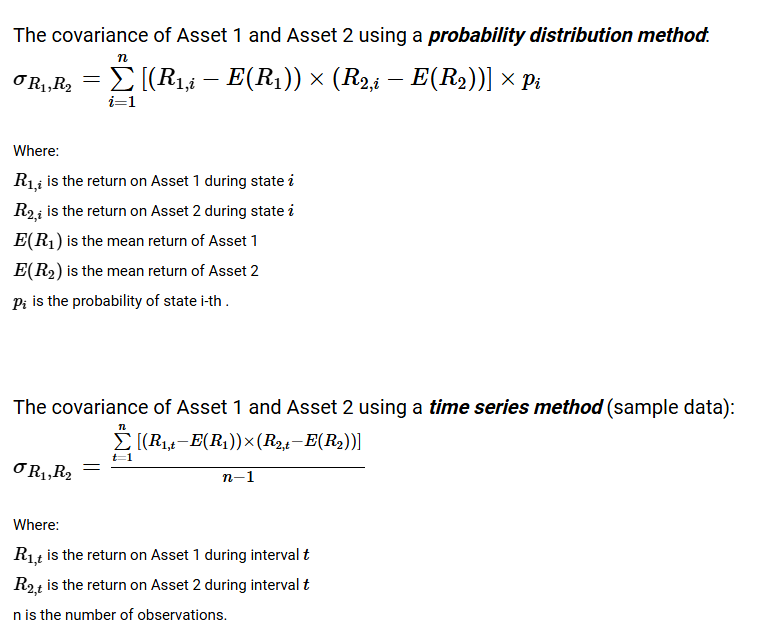

Define Covariance

Covariance = a measure of correlation = (-infinity, infinity)

Unsystematic risk

Risk factors affecting only that firm

Also called diversifiable risk

Can be removed by holding a well diversified portfolio

systematic risk

Economy-wide sources of risk that affect the overall stock market

Depend on its sensitivity to the effects of these market-wide factor

Risk premium of a security is determined by its systematic risk and does not depend on its diversifiable risk

No relationship between volatility and average returns for individual securities

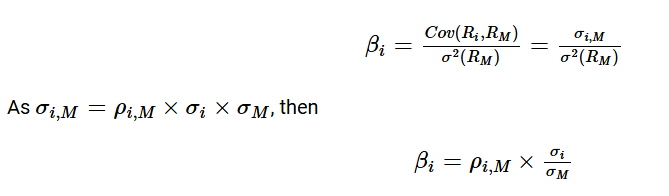

Define beta

Best measure of the risk of a security in a large portfolio

Measure the responsiveness of a security to movements in the market portfolio

If:

Beta =1, stock is as risky as the market

Beta >1, stock is riskier than the market

Beta <1 stock is less risky than the market

Beta = 0, the security has no relationship with the market

Define CAPM

Expected return= risk-free rate +risk premium for systematic risk

Expected return = risk-free rate + (beta*market risk premium)

Only high systematic risk will result in higher expected return

Used to determine the expected return on investment based on its systematic risk

Calculate required rate of return considering risk-free rate of return, expect market return and the systematic risk of that investment

allows to infer beta based on historical data = more accurate estimates of returns for shares than historical average return

Security market line

The linear relationship between expected returns for individual securities and systematic risk, measured by beta

The line can move because of inflation = expecting a higher compensation

Above the SML = underpriced because it is generating a higher expected return than the systematic risk provided

Below the SML = overpriced because it is generating a lower expected return than the systematic risk provided

Define cost of capital

The rate of return the firm must earn to maintain its market value and attract investors

Project > COC = profitable and adds to the firm's value

Project < COC = will harm the firm's value

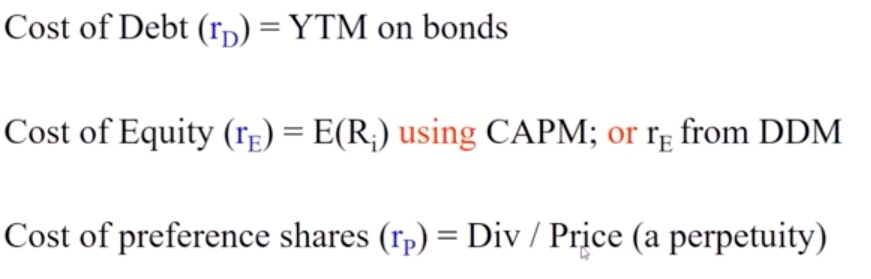

Types of cost of capital

Also known as WACC

Combination of cost of debt and cost of equity

Cost of debt

The required rate of return on the company’s debt

It is the YTM to an existing debt and not the coupon rate

Interest paid on debt is tax deductible

Kd*(1-T) = because interest expense reduces tax liability

Cost of preference share

Pay a constant dividend every period = perpetuity

R= d/p

Cost of equity

Return required by investors given the risk of the cash flow from the firm

dividends are not tax deductible so there is no impact on the cost of equity

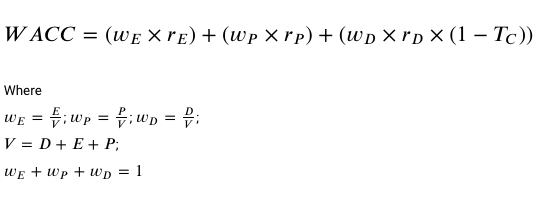

WACC

it is the average required return on the asset based on market’s perception of those risk

WACC with preference shares

Why is cost of capital important?

Provides an indication of how the market views the risk of the companies assets

Can help determine the required return for capital budgeting

What are the assumptions to value a project using WACC?

Average risk:

assume that the market risk of a project is equal to the average market risk of the firm’s investment

Constant debt-equity ratio:

assume that the firm adjusts its leverage continuously to maintain a constant ratio of the market value of debt to the market value of equity

Limited leverage effects:

assume that the main effect of valuation follows from interest tax deduction

What are the limitation of WACC?

WACC is only appropriate to evaluate projects with systematic risks that are exactly the same as those for the company as a whole

only used to evaluate projects varying levels of risk = discount rate may be too low or too high in some cases

When should WACC be used to evaluate individual security?

the level of systematic risk for that project is the same as the overall portfolio of projects that currently comprised in the company

the project uses the same financing mixed

What is a perfect capital markets?

Securities are fairly priced. = same set of securities are traded at competitive market prices equal to the present value of their future cash flows

No tax consequences or transactions costs or other cost associating with financing decisions or security trading

Investment cash flows are independent of financing choices. = are not based on financing decisions but by return on investment

Define leverage

Levered equity is where the firm has outstanding debt

leverage will increase the risk of the firm’s equity and raise its equity cost of capital

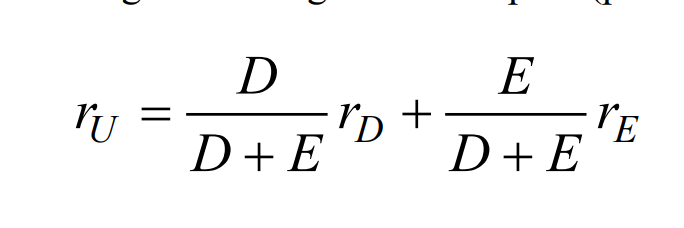

What is Modigliani and Miller theory in a perfect market?

in an unlevered firm, cash flows to equity equal the free cash flows from the firm’s asset

in a levered firm, the cash flows are divided between debt and equity holders

The total to all investors equals the free cash flows generated by the firm’s asset

What is MM proposition 1 ?

In a perfect capital market, the total value of a firm is equal to the market value of the free cash flows generated by its assets and not affected by its choice of capital structure

VL= E+D = Vu

What is home made leverage?

investors use leverage in their own portfolios to adjust firm’s leverage

it is a perfect substitute for firm leverage in perfect capital markets

What is MM proposition 2 ?

The cost of equity increases in a manner to offset exactly the use of cheaper debt funds, to compensate the associated risk

the cost of levered equity equals to the cost of unlevered equity, plus a premium proportional to the debt-equity ratio

the more debt used, the more return equity investors are expected to compensate for the increased risk

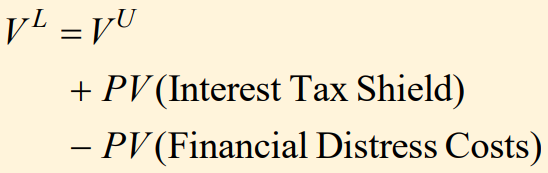

What is interest tax shield?

When a firm uses debt = provides a corporate tax benefit each year

The value of the tax saved due to deductibility of interest expense

Increases amount paid to investors

Interest tax shield = corporate tax rate * Interest payments

If increasing debt also increases the firm value, why not shift to 100% debt?

With more debt, there is greater chance that the firm will default on its debt obligations

a firm that has trouble meeting its debt obligation is in financial distress

What is trade off theory?

the total value of a levered firm is equal to the value of the firm without leverage plus the present value of the tax savings from debt, less the present value of financing distress cost

suggests that an optimal level of debt exists = when marginal cost and benefits are equaled = levered firm is maximised

cost of financial distress decreases the value of the firm = increases with probability of default = increase level of debt

Agency costs can reduce the firm’s value = if there is excessive risk taking or under investment problem

What are the qualitative factors used to determine the pv of financial distress cost?

the probability of financial distress

the magnitude of the direct and indirect costs related to financial distress that the firm will incur

What does trade off theory resolve about leverage?

the presence of financial distress cost can explain why firms choose debt levels that are too low to fully exploit the interest tax shield

Differences in magnitude of financial distress costs and the volatility of cash flows can explain the differences in the use of leverage across industries

What is asymmetric information?

When managers’ information about the firm and its future cash flows is likely to be superior to that of outside investors

managers use leverage to convince investors that the firm will grow

What is market timing?

Market timing is an asymmetric information

the proposition that managers sell new shares when they believe the share is overvalued, and rely on debt

retained earnings if they believe the share is undervalued

What is Pecking order Hypothesis?

managers have a preference to fund investment using retained earnings, followed by debt, and will only choose to issue equity as last resort

different from trade off theory

does not suggest an optimal capital structure, but rather addresses the impact of information asymmetries between company managers and outsiders

How should a financial manager determine the right capital structure for the firm?

The firm should increase its leverage to a point at which the tax savings resulted from increasing leverage are just offset by the increased probability of incurring the costs of financial distress.

What is Efficient Market Hypothesis? (EMH)

The price of the security accurately reflect the information available

If the market processes new information efficiently, the reaction of the market prices to new information will be instantaneous and unbiased

Investors cannot earn abnormal returns by using information that is already available

Define Overreaction

Initial price movement can be expected to be reversed

Define Underreaction

Initial price movement can be expected to continue

Define weak form efficiency

the information contained in the past sequence of prices of a security is fully reflected in the current market price of that security