Market failure and socially undesirable outcomes 3 : Market power (HL only)

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

revenues definition

payments that firms receive when they sell the goods and services that they produce.

total revenue vs average revenue

total revenue = PxQ → amount of money a firm gets when they sell a g/s

average revenue = TR/Q = P → revenue per unit output sold

marginal revenue

formula = change in TR/ change in quantity

additional revenue from producing one more unit of output

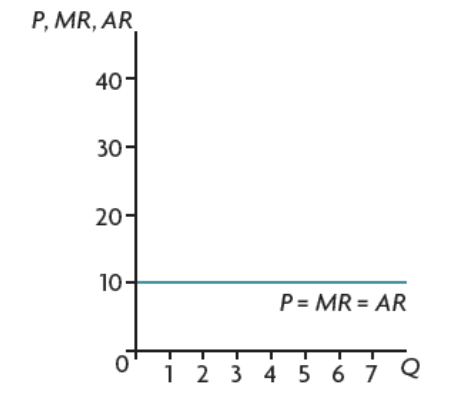

average + marginal revenue for price taker firms

AR=MR=P

straight horizontal line → price is constant

price taker vs price maker

price taker → cannot control the price → exists with perfect competition (price does not change with output)

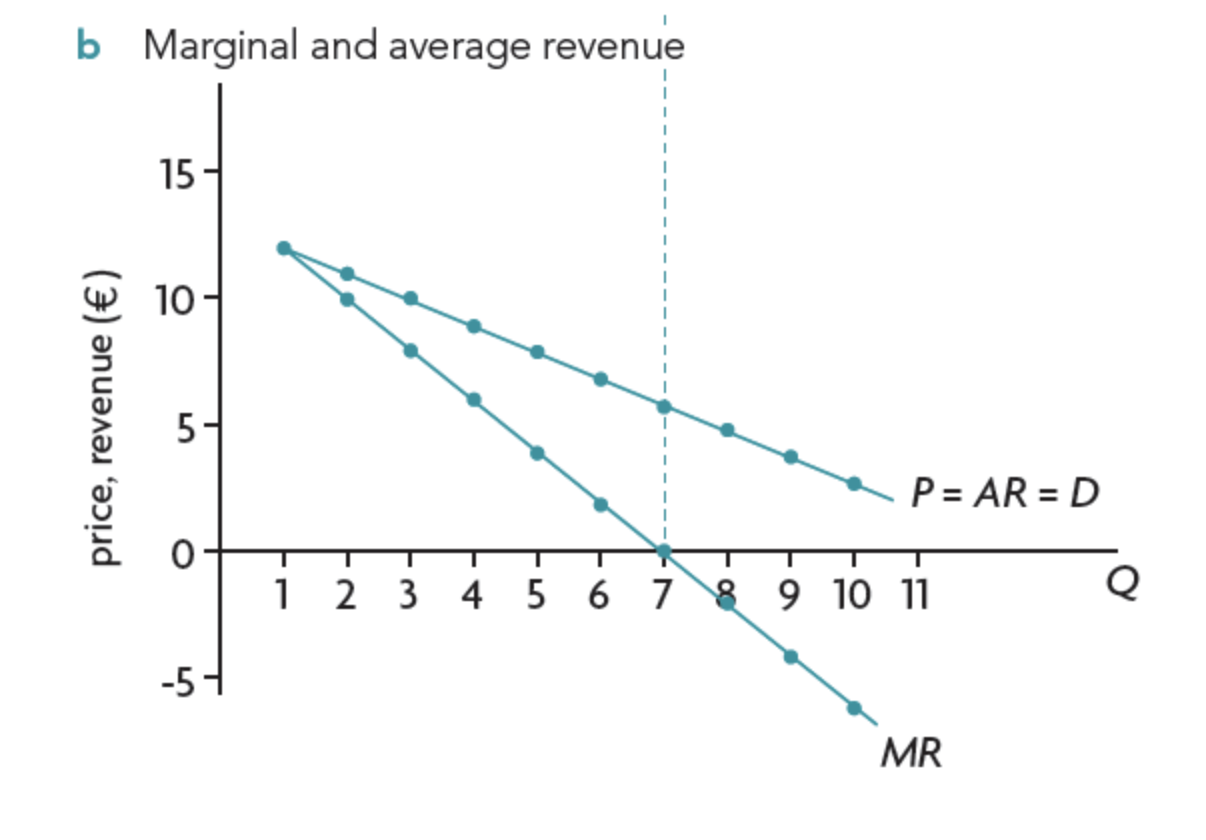

price maker → can set their own price → monopoly, oligopoly, monopolistic competition (price changes with output)

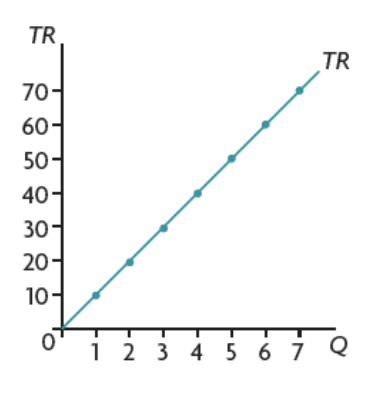

total revenue for price taker firms

increases by the same amount

examples of firms that are price takers

agricultural farmers

commodity producers

individual stock investors

Average revenue + marginal revenue for price taker firms

MR is twice as steep as AR

MR is negative → firm is loosing revenue with each extra unit of output

when MR = 0 TR is at maximum

Total revenue for price taker firms

revenue is maximized at the local maximum (where MR=0)

PED and TR

PED is rel. elastic → price increases → TR increases

PED is rel. inelastic → price increases → TR decreases

costs of production definition

payments by firms to obtain and use factors of production in their production process

fixed vs variable costs definition

fixed - costs that don’t change with output (short run)

variable - costs that change with output

Total costs

total amount of money spent on producing a certain quantity

= fixed + variable costs

Average costs

costs per unit output produced

average fixed costs + average variable costs

Marginal cost

additional costs to produce an extra unit of output

= change in total costs / change in quantity

the relationship between average costs + marginal costs in the short run

MC<AC → average cost is falling

MC>AC → average cost is rising

MC intersect AC at AC’s minimum

what is meant by short run vs long run

short run - at least one factor of production is fixed

long run - all factors of production are variable

total product vs marginal product

total - the total quantity of output produced by a firm

marginal - the additional output that results from one additional variable input

relationship between marginal and total product

when MP=0, TP is maximized

when MP is rising TP rises faster

when MP is falling TP falls slower

relationship between marginal and average product

MP>AP → AP increases

MP<AP → AP decrease

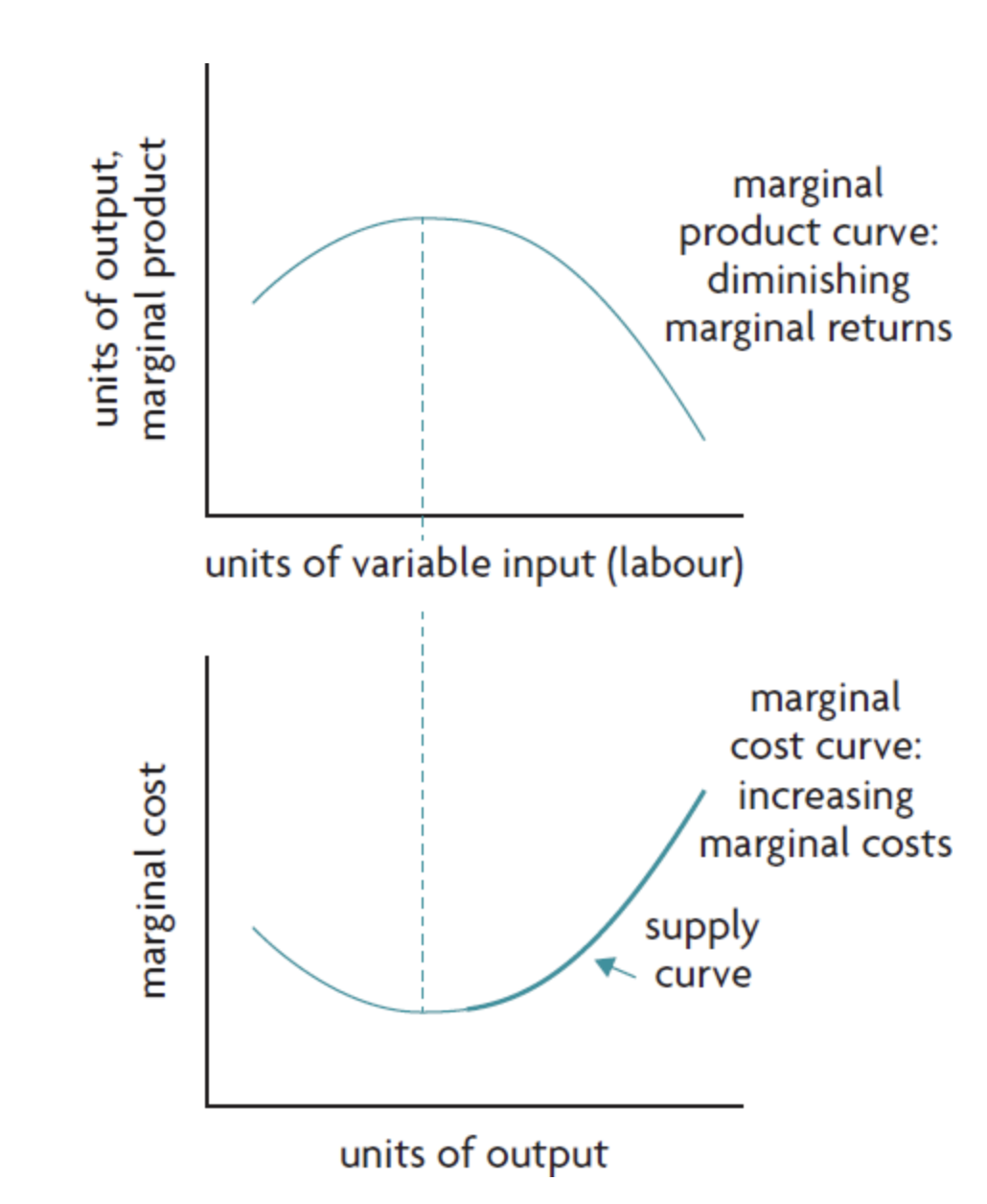

law of diminishing marginal returns

states that as more and more units of a variable input are added to one or more fixed inputs the marginal product of the variable input at first increases, but then it reaches a point after which the marginal product of the variable input starts to decrease

relation of marginal costs to diminishing marginal returns

marginal product increases → marginal cost decreases

when marginal product is at maximum → marginal costs is at minimum

when marginal product falls → marginal costs increase

marginal costs and the firms supply curve

upward sloping part of MC curve = supply curve

the firm can only produce more output if the price of the good increases to cover the extra cost of each extra unit produced

explicit vs implicit costs

explicit - direct, out-of-pocket payments that businesses actually make, e.g wages, rent, materials, and utility bills.

implicit - opportunity costs - value of resources the firm already owns but could have used elsewhere (not used when calculating accounting profit)

profit formulas

revenue - costs of production

economic profit = total revenues - economic costs

total revenue - sum of explicit costs - implicit costs

(economic costs = implicit + explicit costs)

profit maximization

producing a level of output where the difference between total revenue and total costs is the largest

largest amount of profit

rewards for f.o.p

land - rent

labour - wages

capital - interest

enterprise - profit

→ the costs of a business

normal profit

the minimum amount of revenue that the firm must receive in order to keep the business running

TR=TC

normal profit also = the opportunity cost of running the business instead of doing something else.

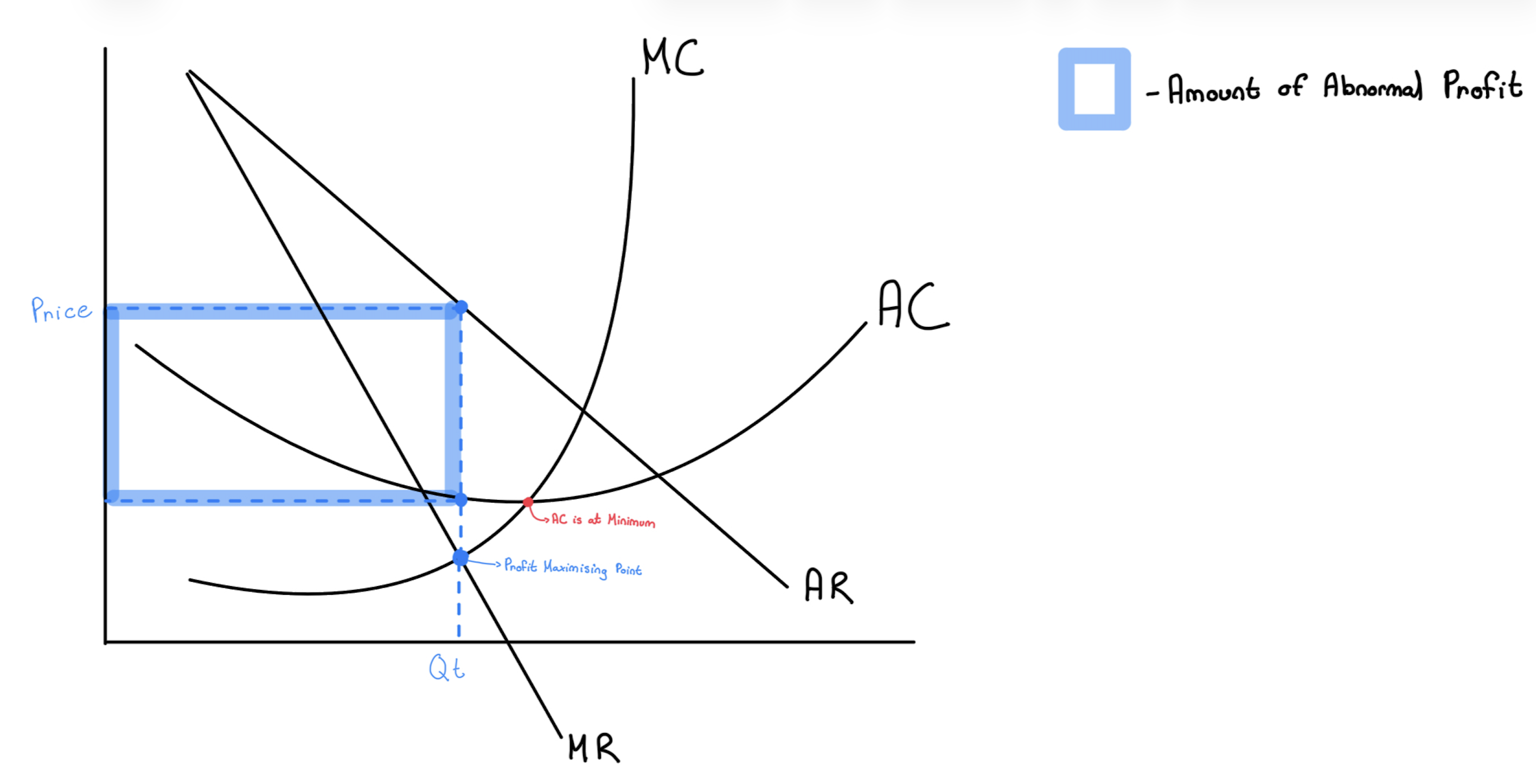

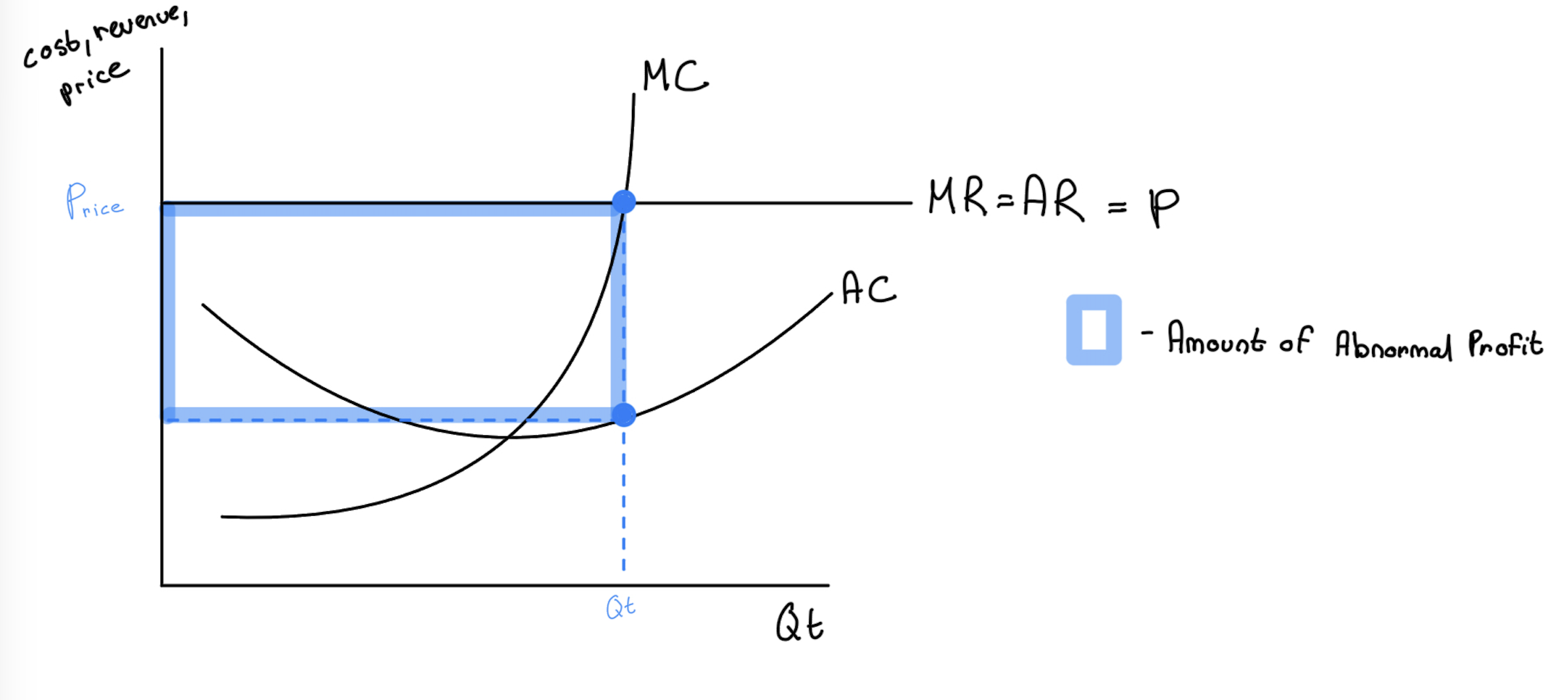

abnormal/supernormal profit

TR>TC

more than normal profit is made

losses

TR<TC

less than normal profit is made

profit maximization - price takers

AR>AC → abnormal profit

AR=AC → normal profit

MC=MR → profit maximization

minimizing loss - price takers

when AR<AC

MC=MR → minimize loss

profit maximization - price makers

MR=MC

as long as MR>MC the profit can be increased by producing more units until the last unit of output brings not more profit (MC=MR)