MGMT 200 Quest 1 Review

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

45 Terms

What are the two functions of financial accounting?

Measure businesses activities of a company

Communicate those measurements to external parties for decision-making process

Investors

buy ownership in the company and have the right to share in the company’s profits

Creditors

lend money to a company, expecting to be paid back the loan amount plus interest

What are the types of business activites?

Financing: transactions the company has with investors and creditors

Investing: transactions involving the purchase and sale of resources that are expected to benefit the company for several years

Operating: transactions that relate to the primary operations of the company

Business Structures

Corporation: a company that is legally separate from its owners

Sole Proprietorship: a business owned by one person

Partnership: a business owned by two or more persons

Accounting Equation

Assets = Liabilities + Stockholders’ equity

Assets

total resources of the company

Example: cash, equipment, land, supplies, accounts receivable, buildings, inventory, investments

Liabilities

amounts owed to creditors

Example: accounts payable, salaries payable, deferred revenue, rent expense, advertising expense

Stockholders’ Equity

owners’ claims to resources

Example: common stock, retained earnings, dividends, service revenue, salaries expense

Revenue

the amounts recognized when the company sells products or provides services to customers

Expenses

the cost of providing products and services and other business activities during the current period

Net Income

the difference between revenues and expenses

Dividends

cash payments to stockholders (not expenses)

Financial Statements

periodic reports published by the company for the purpose of providing info to external users

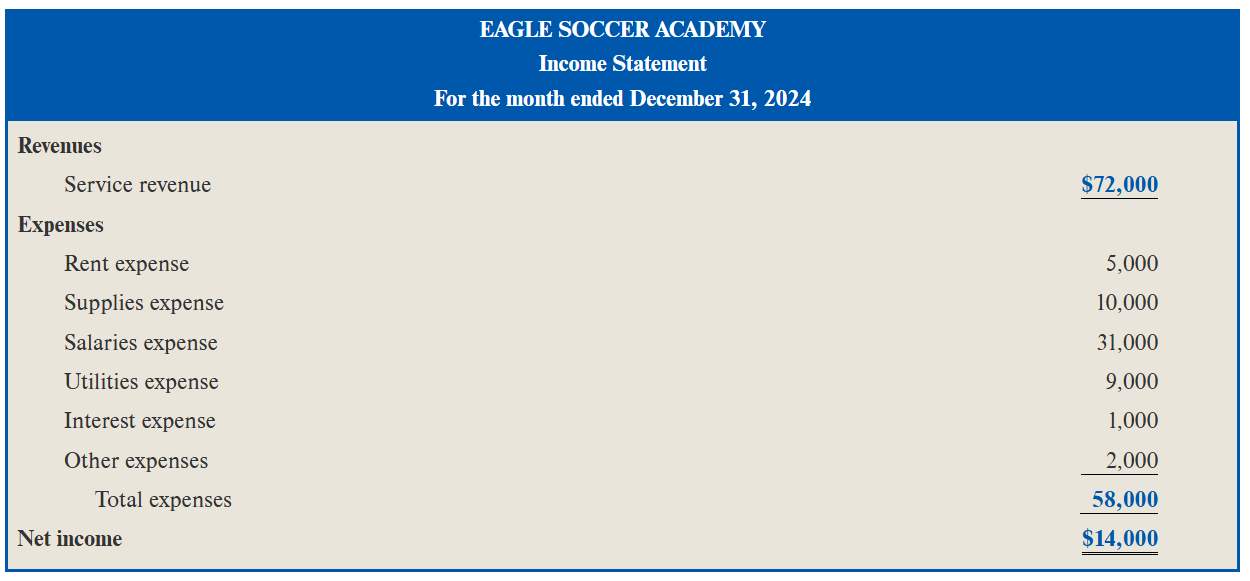

Income Statement

reports the company’s revenues and expenses over an interval of time

If revenues > expenses; net income

If revenues < expenses; net loss

Compares revenues and expenses for the current period to assess the company’s ability to earn a profit from running its operations

Heading: At the top of the statement including company’s name, title of financial statement, and the time period covered

Revenues: Total revenues

Expenses: Typical costs such as rent, supplies, salaries, etc.

Net Income/Loss: Final total

Underlines: single underline represents subtotal, double underline represents final total

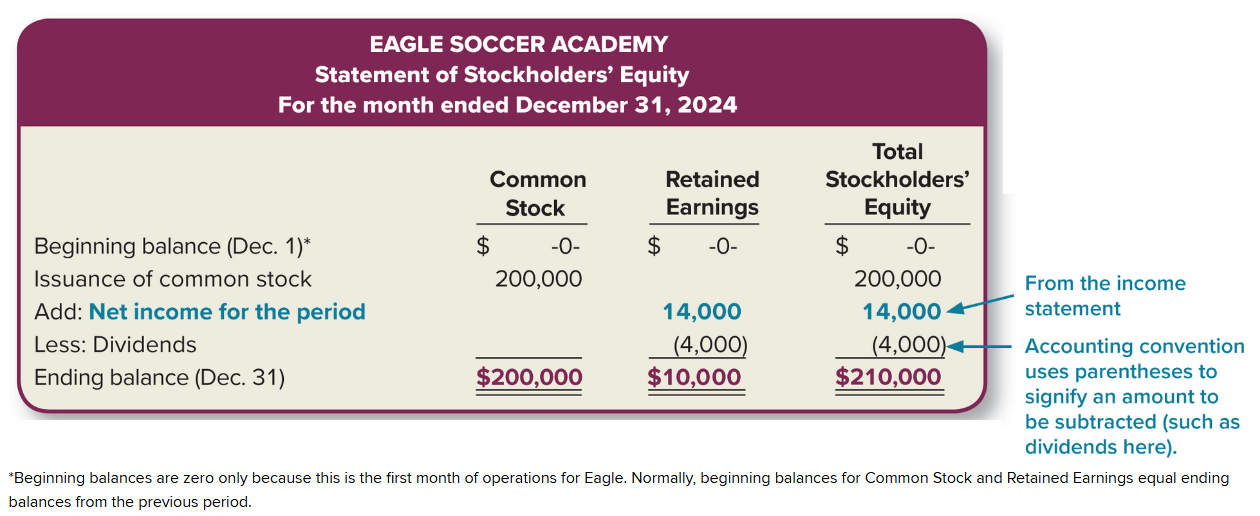

Statement of Stockholders’ Equity

summarizes the changes in stockholders’ equity over an interval of time

Heading: reports the activity for common stock and retained earnings over an interval of time

Issuance of Common Stock: shows starting common stock and the issuance of common stock (first column)

Add (Net income for the period): adds net income under retained earnings (second column)

Less (Dividends): decreases retained earnings (second column)

Ending Balance: sums up the totals for each column (common stock, retained earnings, stockholders’ equity)

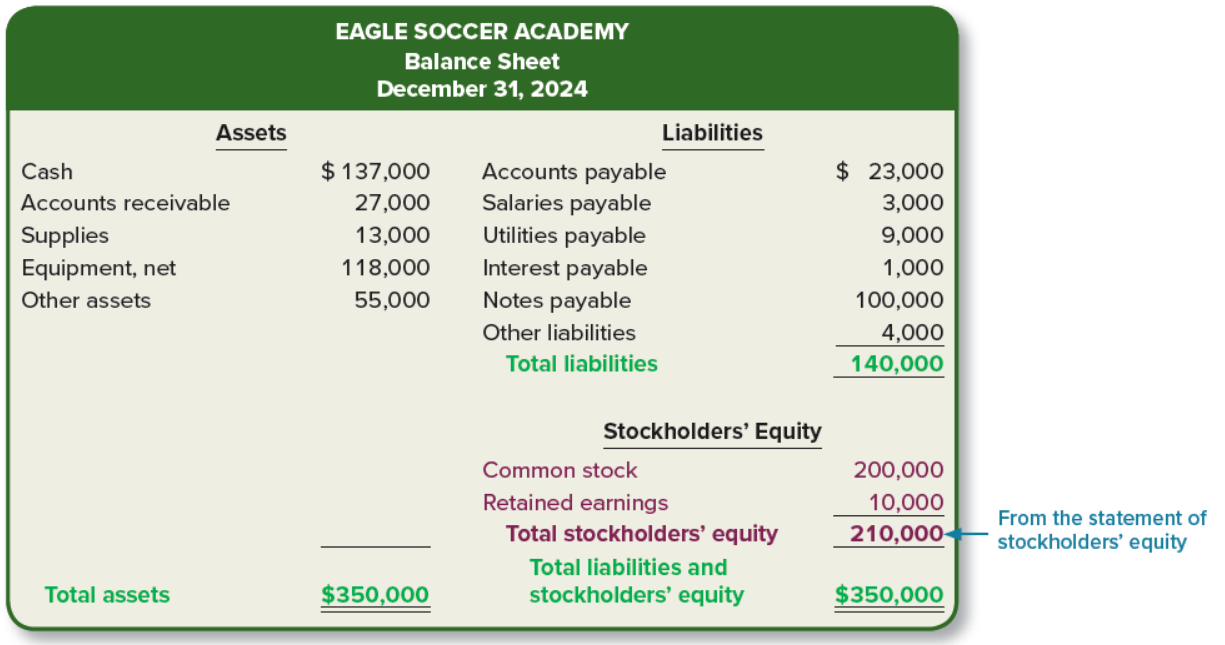

Balance Sheet

presents the financial position of the company on a particular table

Heading: reports assets, liabilities, and stockholders’ equity at a point in time

Assets: resources of the company

Liabilities: amounts owed by a company

Stockholders’ Equity: difference between assets and total liabilities

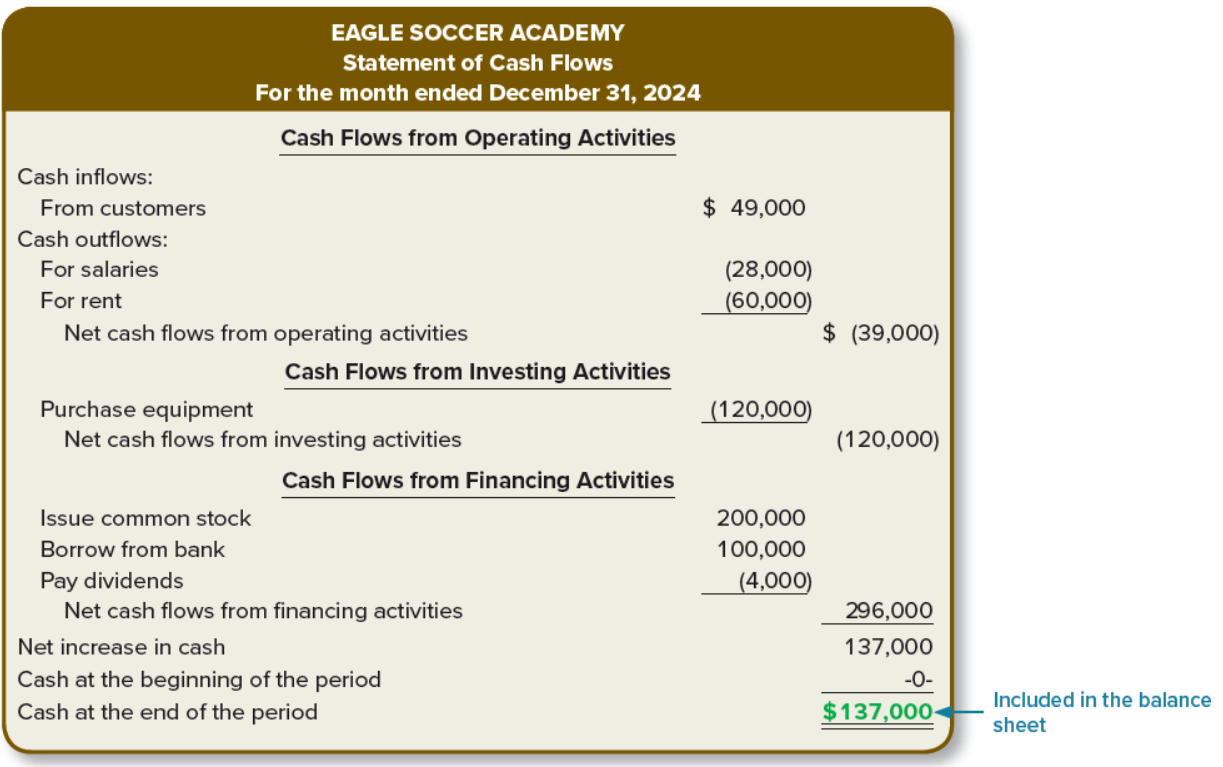

Statement of Cash Flows

measures activities involving cash receipts and cash payments over an interval of time

Operating Cash Flows: cash transactions involving revenue and expense activities (Ex: cash inflows (customers), cash outflows (for salaries, for rent))

Investing Cash Flows: cash transactions for the purchase and sale of investments and long-term assets (purchase equipment)

Financing Cash Flows: cash transactions with lenders and stockholders (issue common stock, borrow from bank, pay dividends,

Reports cash at beginning and end of period, and net increase

Any transaction that affects the income statement ultimately affects the balance sheet through _______ _______.

retained earnings

Change in Cash Formula

operating cash flows + investing cash flows + financing cash flows

Annual Reports

formal document that details a company’s activities and financial performance

Management Discussion and Analysis

includes management’s views on significant events, trends, and uncertainties pertaining to the company’s operations and resources

Note Disclosures

offer additional info either to explain the info presented in the financial statements or to provide info not included in the financial statements

No other single piece of company information better explains companies’ stock price performance that does financial accounting ________ ________.

net income

Company’s _____ ______ is an important indicator of management’s ability to respond to business situations and the possibility of bankruptcy

debt level

Generally Accepted Accounting Principles (GAAP)

the rules of financial accounting

Financial Accounting Standards Board (FASB)

an independent, private-sector body with full-time voting members and a very large support staff that establishes financial accounting and reporting standards in the U.S.

International Accounting Standards Board (IASB)

standard-setting body responsible for eliminating differences in accounting standards around the world

Securities and Exchange Commission (SEC)

government agency that requires companies that publicly trade their stock to prepare periodic financial statements for distribution to investors and creditors

Primary responsible for setting accounting standards to the private sector

Auditors

hired by the company as an independent party to express a professional opinion of the extent to which financial statements are reported in compliance with GAAP and are free of material misstatement

Play a major role in investors’ and creditor's’ decisions by adding credibility to a company’s financial statements

Public Company Accounting Oversight Board (PCAOB)

ensures that auditors follow a strict set of guidelines when conducting their audits of public companies’ financial statements

Sabanes-Oxley Act (SOA)

provides for the regulation of auditors and the types of services they furnish to clients, increases accountability of corporate executives, addresses conflicts of interest for securities analysts, and provides for stiff criminal penalties for violators

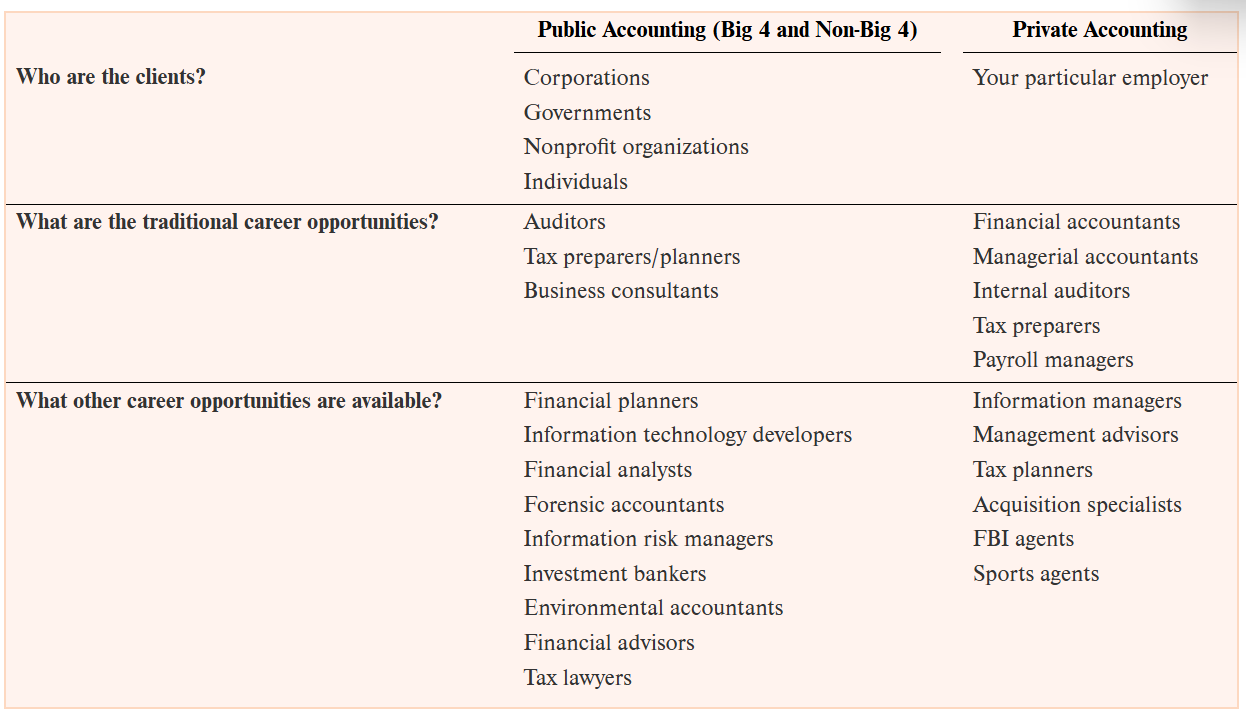

Public and Private Accounting

public: professional service firms that traditionally have focused on three areas (auditing, tax preparation/planning, business consulting)

private: providing accounting services to the company that employs you

External Transactions

transactions conducted between the company and a separate entity

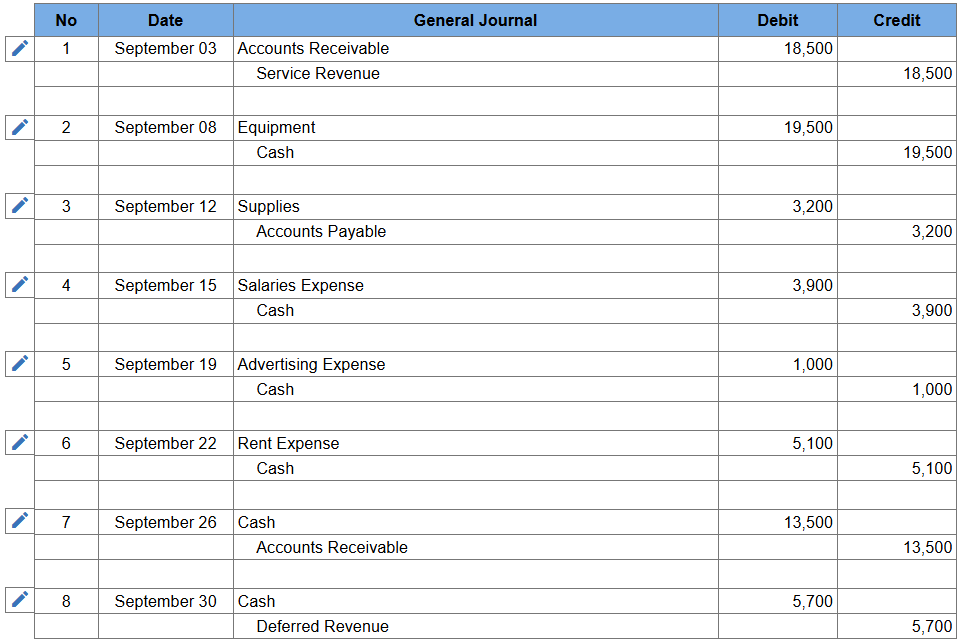

Steps in Measuring External Transactions

Use source documents to identify accounts affected by an external transaction

Analyze the impact of the transaction on the accounting equation

Assess whether the transaction results in a debit or credit to account balances

Record the transaction in a journal using debits and credits

Post the transaction to the general ledger

Prepare a total balance

Account

record of all transactions related to a particular item over a period of time

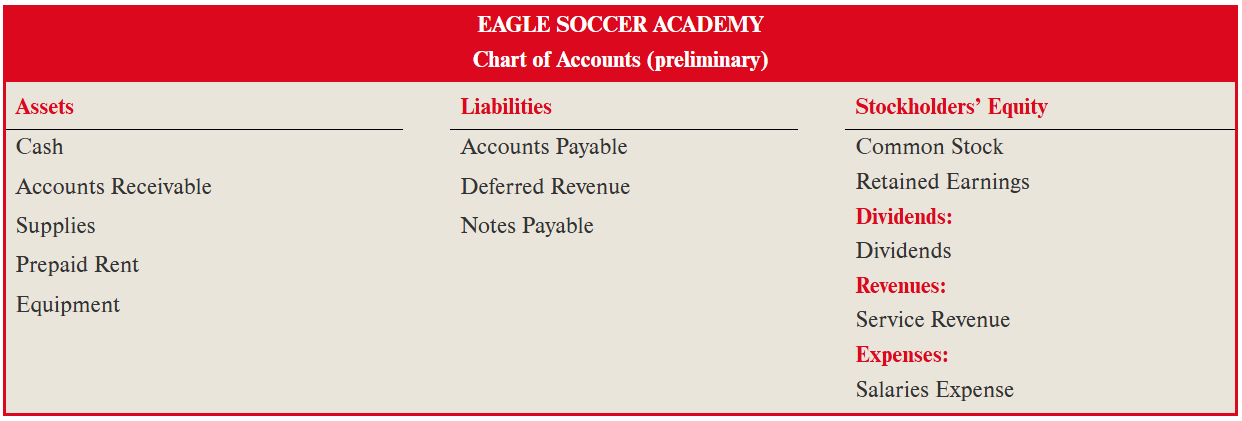

Chart of Accounts

list of all account names used to record transactions

Debits

increases in assets, decreases in liabilities and stockholders’ equity

Credits

decreases in assets, increases in liabilities and stockholders’ equity

What type of balance is retained earnings

Normally has a credit balance

Three components: revenue (increases by credits), expenses (increases by debits), and dividends (increases by debits)

Net income increases the balance of retained earnings, dividends vice versa

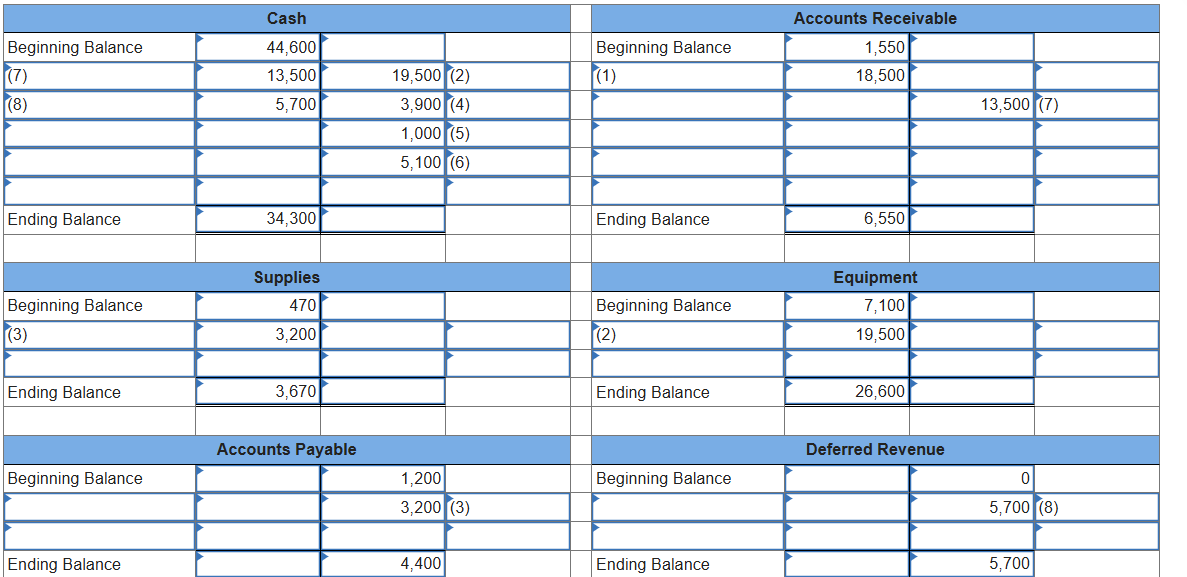

General Ledger

provides, in a single collection, each account with its individual transactions and resulting account balance

Posting

the process of transferring the debit and credit information from the journal to individual general ledger accounts

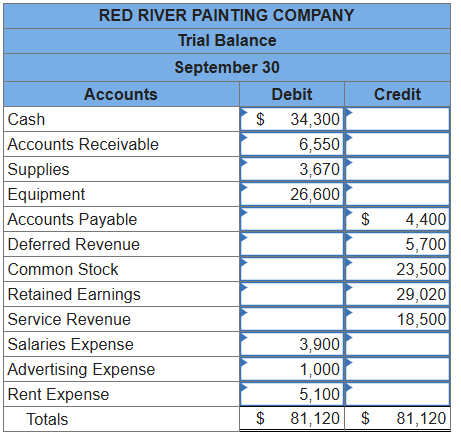

Trial Balance

a list of all accounts and their balances at a particular date, showing that total debts equal total creditsR

Revenue Recognition Principle

companies record revenue at the time goods are provided to customers

Journal

a chronological record of all economic events affecting a firm