PINNACLE - Cost Accounting

1/130

Earn XP

Description and Tags

Combined set

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

131 Terms

Activity-Based Costing (ABC)

Allocates overhead to multiple activity cost pools and assigns the activity cost pools to products and services by means of cost drivers.

Traditional Costing System

Allocates overhead to products on the basis of predetermined plantwide or departmentwide volume of unit-based output rates such as direct labor or machine hours.

Activity (in ABC)

Any event, action, transaction, or work sequence that causes the incurrence of cost in producing a product or providing a service.

Cost Driver

Any factor or activity that has a direct cause-effect relationship with the resources consumed.

Four Steps of Activity-Based Costing

Identify and classify the major activities involved in the manufacture of specific products and allocate manufacturing overhead costs to the appropriate cost pools.

Identify the cost driver that has a strong correlation to the costs accumulated in the cost pool.

For each cost pool, compute the activity-based overhead rate per cost driver.

Assign manufacturing overhead costs for each cost pool to products, using the overhead rates (cost per driver).

Primary benefit of ABC

More accurate product costing because:

ABC leads to more cost pools being used to assign overhead costs to products.

ABC leads to enhanced control over overhead costs; companies can trace many overhead costs directly to activities under ABC.

ABC leads to better management decisions; more accurate product costing should contribute to desired product profitability levels.

Limitations of ABC

ABC can be expensive to use; identifying multiple activities and applying numerous cost drivers results in increased costs.

Some arbitrary allocations continue; certain overhead costs still have to be allocated by some arbitrary volume based cost driver (i.e.-labor hours).

When to Use ABC

The presence of one or more of the following factors:

Product lines differ greatly in volume and manufacturing complexity.

Product lines are numerous, diverse, and require differing degrees of support services.

Overhead costs constitute a significant portion of total costs.

The manufacturing process or the number of products has changed significantly.

Activity-Based Management (ABM)

An extension of ABC from a product costing system to a management function that focuses on reducing costs and improving processes and decision making.

Value-Added Activities

Increase the worth of a product or service to customers.

Non-Value-Added Activities

Product- or service-related activities that simply add cost to, or increase the time spent on, a product or service without increasing its market value.

Unit-Level Activities

Activities performed for each unit of production.

Batch-Level Activities

Activities performed for each batch of products rather than each unit.

Product-Level Activities

Activities performed in support of an entire product line.

Facility-Level Activities

Activities required to support an entire production process.

ABC allocates overhead in a two-stage process

In the first stage, overhead costs are allocated to activity cost pools, rather than to departments. Each is a distinct type of activity.

In the second stage, the overhead allocated to the activity cost pools is assigned to products using cost drivers which represent and measure the number of individual activities undertaken or performed to produce products or provide services.

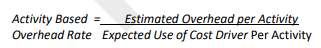

Formula for activity-based overhead rate per cost driver

Estimated Overhead per Activity / Expected Use of Cost Driver Per Activity

Purpose of Activity based management

To reduce or eliminate the time and cost devoted to non-value-added activities.

Classification of Activity Levels

Unit-level activities

Batch-level activities

Product-level activities

Facility-level activities

Nonrecognition of classification of activity levels

One of the reasons that volume-based cost allocation causes distortions in product costing.

Standard Costing

A system that determines product cost by using standards or norms for quantities and/or prices of component elements, allowing cost to be compared against norms for control purposes.

Standard Cost

A planned unit cost of the product, component, or service produced in a period.

Standard

A measure of acceptable performance established by management as a guide in making economic decisions. It is a benchmark or “norm” for measuring performance.

Ideal Standards

Represent optimum levels of performance under perfect operating conditions.

Normal Standards

Represent efficient levels of performance that are attainable under expected operating conditions.

Direct Materials Price Standard

Should be based on the delivered cost of raw materials plus an allowance for receiving and handling.

Direct Materials Quantity Standard

Should establish the required quantity plus an allowance for unavoidable waste and normal spoilage.

Direct Labor Price Standard

Should be based on current wage rates and anticipated adjustments.

Direct Labor Quantity Standard

Should be based on required production time plus an allowance for rest periods, cleanup, machine setup, and machine downtime.

Total Standard Cost Per Unit

The sum of the standard costs of direct materials, direct labor, and manufacturing overhead.

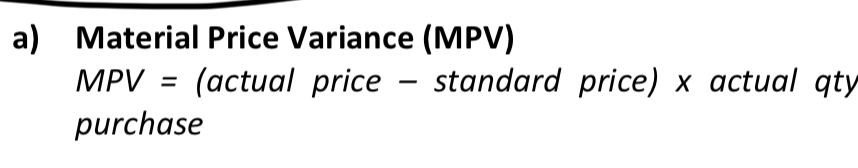

Material Price Variance (MPV) formula

(actual price – standard price) x actual quantity purchased

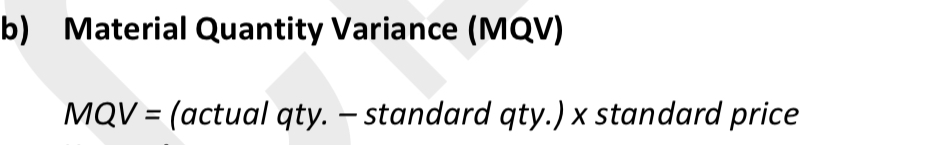

Material Quantity Variance (MQV) formula

(actual quantity – standard quantity) x standard price

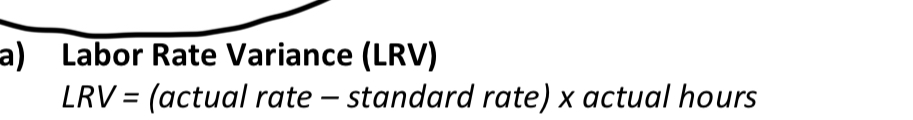

Labor Rate Variance (LRV) formula

(actual rate – standard rate) x actual hours

Labor Efficiency Variance (LEV) formula

(actual hours – standard hours) x standard rate

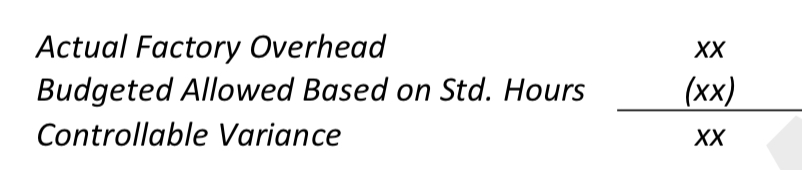

Controllable Variance formula

Actual Factory Overhead - Budgeted Allowed Based on Standard Hours

Volume Variance formula - two way analysis

Budgeted Allowed Based on Standard Hours - Standard Factory Overhead

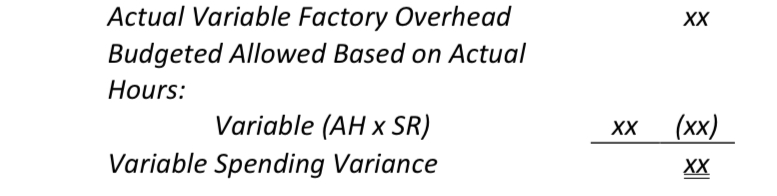

Spending Variance

Actual Factory Overhead - Budgeted Allowed Based on Actual Hours: [Fixed as budgeted + Variable (AH x SR)]

![<p>Actual Factory Overhead - Budgeted Allowed Based on Actual Hours: [Fixed as budgeted + Variable (AH x SR)]</p>](https://knowt-user-attachments.s3.amazonaws.com/a49830d9-c7d5-4989-bd55-57fa35e296a4.jpg)

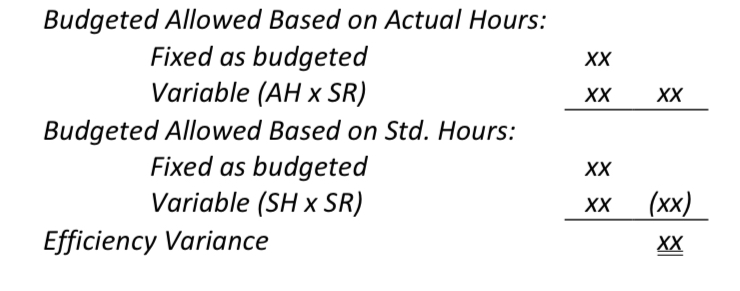

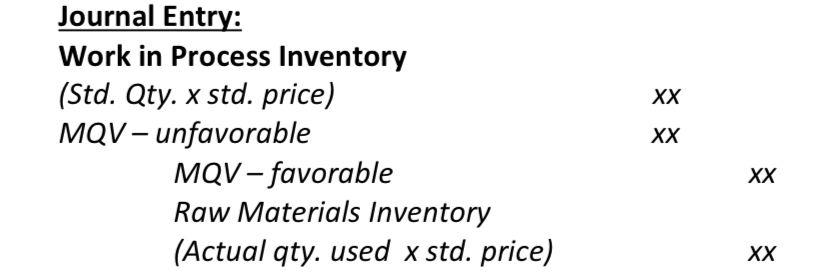

Efficiency Variance - three-way variance

Budgeted Allowed Based on Actual Hours: [Fixed + Variable (AH x SR) - Budgeted Allowed Based on Standard Hours: [Fixed + Variable (SH x SR)

Variable Spending Variance

Actual Variable Factory Overhead - Budgeted Allowed Based on Actual Hours: Variable (AH x SR)

Fixed Spending Variance

Actual Fixed Factory Overhead - Budgeted Allowed Based on Actual Hours: Fixed as budgeted

Standard costs advantages to an organization

They facilitate management planning

They promote greater economy by making employees more “cost-conscious”.

They are useful in settling selling prices

They contribute to management control by providing a basis for evaluation of cost control.

They are useful in highlighting variances in management by exception

They simplify costing of inventories and reduce clerical costs.

Companies set standards at one of two levels:

Ideal standards and normal standards

Standard predetermined overhead rate

It is based on an expected standard activity index such as standard direct labor hours or standard machine hours.

Types of Manufacturing Variance

Direct Materials Variance

Direct Labor Variance

Factory Overhead Variance

Types of Direct Materials Variance

Material price variance

Material quantity variance

Purchasing agent

Generally responsible for the price variance because he has the control over the price paid for the acquisition of the materials.

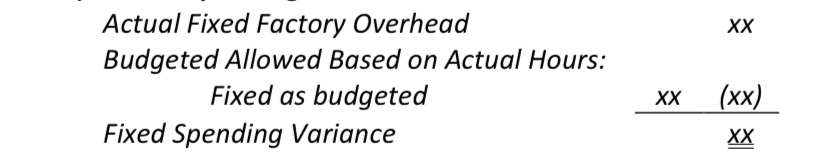

Journal entry for Material price variance

Dr. Raw materials inventory (AQ Purchase x Standard Price)

Dr. MPV - unfavorable

Cr. MPV - favorable

Cr. Accounts payable (AQ Purchase x Actual Price)

Production manager

Generally responsible for the quantity variance because he has the control over the use of the materials. Also, responsible for the labor rate variance because he has the responsibility for seeing that labor price/rate variance are kept under control. Finally, responsible for the labor efficiency variance since he has the control over the staffs which are directly involved in the production.

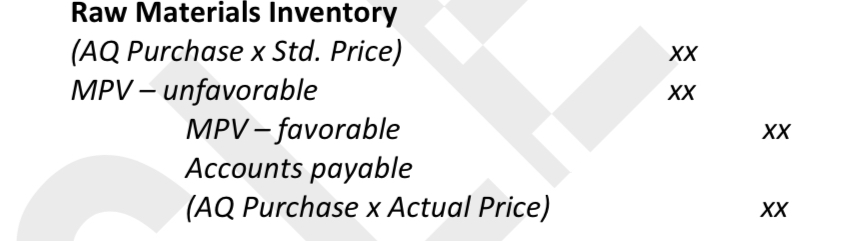

Journal entry for Material quantity variance

Dr. Work in Process Inventory (Standard Quantity x Standard price)

Dr. MQV - unfavorable

Cr. MQV - favorable

Cr. Raw materials inventory (Actual quantity used x Standard price)

Type of Direct Labor Variances

Labor rate variance

Labor efficiency variance

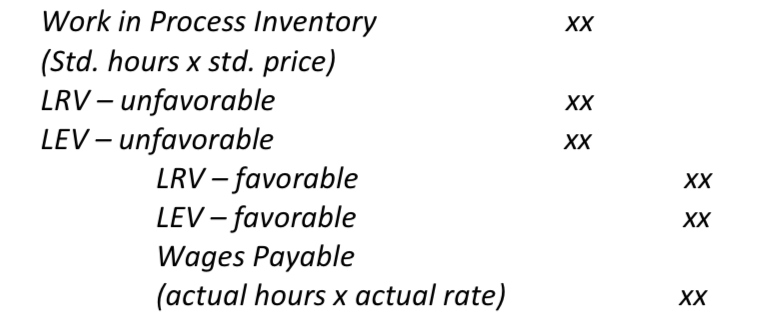

Journal entry for Labor rate and efficiency variance

Dr. Work in process inventory (Standard hours x standard price)

Dr. LRV - unfavorable

Dr. LEV - unfavorable

Cr. LRV - favorable

Cr. LEV - favorable

Cr. Wages Payable (actual hours x actual rate)

Type of Factory overhead variance

Two-way analysis

Three-way variance

Four-way variance

Type of Two-way analysis

Controllable variance

Volume variance

Controllable variance

It is the responsibility of the production department manages to the extent that they exercise control over the costs to which the variances relate.

Volume variance

It is the responsibility of the executive and departmental management

Types of Three-way variance

Spending variance

Efficiency variance

Volume variance

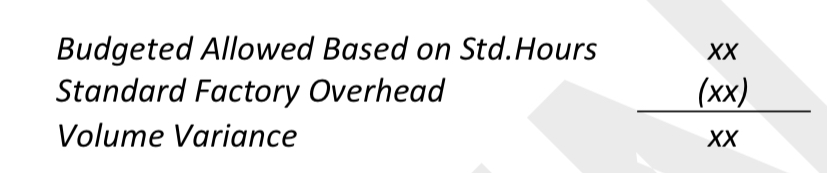

Volume variance formula - three way variance

Budgeted Allowed Based on Standard Hours: [Fixed + Variable (SH x SR)] - Standard Factory Overhead

![<p>Budgeted Allowed Based on Standard Hours: [Fixed + Variable (SH x SR)] - Standard Factory Overhead</p>](https://knowt-user-attachments.s3.amazonaws.com/655176f9-e0d8-41d5-9d44-1f55824768bb.jpg)

Types of four-way variance

Variable spending variance

Fixed spending variance

Efficiency Variance

Volume Variance

Efficiency variance formula - four-way variance

Budgeted Allowed Based on Actual Hours: [Fixed as budgeted + Variable (AH x SR)] - Budgeted Allowed Based on Standard Hours: [Fixed as budgeted + Variable (SH x SR)]

![<p>Budgeted Allowed Based on Actual Hours: [Fixed as budgeted + Variable (AH x SR)] - Budgeted Allowed Based on Standard Hours: [Fixed as budgeted + Variable (SH x SR)] </p>](https://knowt-user-attachments.s3.amazonaws.com/e5196649-40ee-4e09-9dce-b8b09c299fc3.png)

Volume variance formula - four-way variance

Budgeted Allowed Based on Standard Hours: [Fixed as budgeted + Variable (SH x SR)] - Standard Factory Overhead

![<p>Budgeted Allowed Based on Standard Hours: [Fixed as budgeted + Variable (SH x SR)] - Standard Factory Overhead</p>](https://knowt-user-attachments.s3.amazonaws.com/3c5c45da-f27c-474f-be2b-0a7f5b0f2d2f.png)

Journal entries in Factory Overhead Variance

Dr. Factory Overhead Control

Cr. Various Accounts

Dr. Work in process (std. costs)

Cr. Applied Factory Overhead x

Journal entry under Two-way Method

Dr. Applied Factory Overhead

Dr. Controllable Variance – unfavorable

Dr. Volume Variance – unfavorable

Cr. Controllable Variance – favorable

Cr. Volume Variance – favorable

Cr. Factory Overhead Control

Reporting Variances

All variances should be reported to appropriate levels of management as soon as possible.

Variance reports facilitate the principle of “management by exception” by highlighting significant differences.

Top management normally looks for significant variances. These may be judged on the basis of some quantitative measure, such as more than 10% of the standard or more than P1,000.

Statement Presentation of Variances

In income statements prepared for management under a standard cost accounting system, cost of goods sold is stated at standard cost and the variances are disclosed separately.

When there are no significant differences between actual costs and standard costs, companies report their inventories atstandard costs.

If there are significant differences between actual and standard costs, the financial statements must report inventories and cost of goods sold at actual costs.

Just-In-Time (JIT) System

Involves the elimination of waste and excess by acquiring resources and performing activities only as they are needed by customers at the next stage in the process.

JIT System Requirements

An attitude that places emphasis on the following:

Cooperation with a value chain perspective

Respect for people at all levels

Quality at the source

Simplification or just enough resources

Continuous improvement

A long-term perspective

Practices Incorporated in a JIT System

Just-in-time purchasing

Focused factories

Cellular manufacturing

Just-in-time production

Just-in-time distribution

Simplified accounting

Process-oriented performance measurements.

Backflush Costing

A variety of simplified cost accumulation methods that tend to be used by companies that adopt JIT systems.

Periodic Inventory Systems

Most cost systems that include the backflush method are these type of inventory systems because perpetual inventory records are eliminated.

Raw and in Process

The Materials and Work in Process accounts are combined into an account referred to as this, or RIP.

Conversion Costs

The Direct Labor and Overhead accounts are replaced by this single account.

Cost of Goods Sold

Purchases of direct materials, along with direct labor and overhead costs are charged to this account as incurred.

Backflushed Costs

Inventory costs charged in a backward direction from COGS to FG, RIP and Conversion cost accounts. Costs that are usually based on budgeted or standard costs per unit.

Trigger Points

Three trigger points

Purchase

Completion

Sale

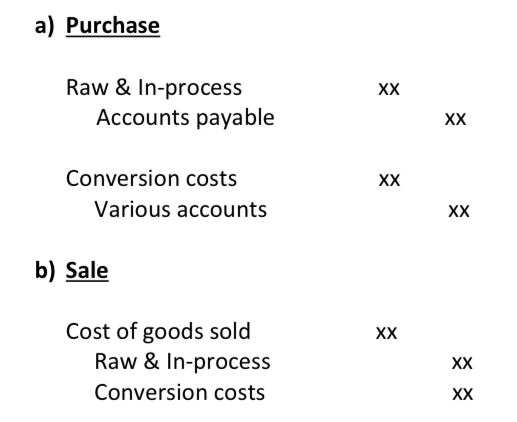

Two trigger points

Purchase

Sale

Ultimate Just-in-time

Sale

Two Trigger Points

Purchase

Dr. Raw and in-process

Cr. Accounts payable

Sale

Dr. Cost of Goods Sold

Cr. Raw and in-process

Cr. Conversion costs

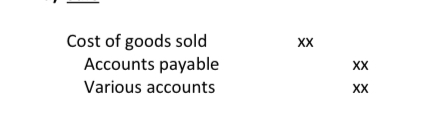

Ultimate Just-in-time

Sale

Dr. Cost of Goods Sold

Cr. Accounts payable

Cr. Various Accounts

Inventory buffers

Viewed as an “evil” in that they hide problems such as defective parts, production bottlenecks, long machine set-ups and competitive behavior within the company.

Simplified set of accounts in backlush systems

Raw and in Process

Conversion costs

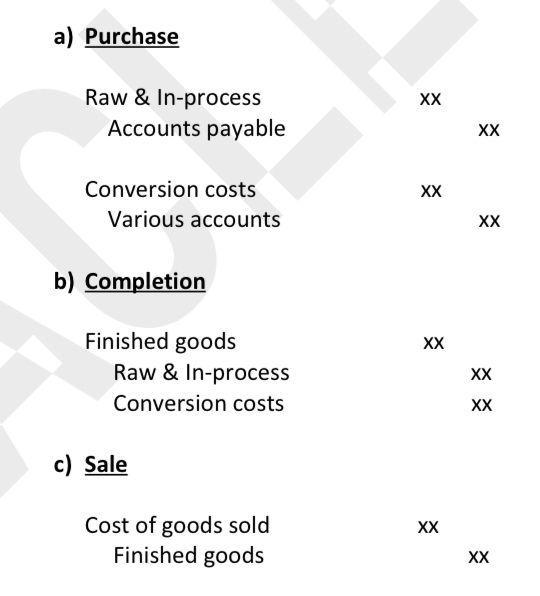

Three trigger points

Purchase

Dr. Raw and in-process

Cr. Accounts payable

Completion

Dr. Finished goods

Cr. Raw and in-process

Cr. Conversion costs

Sale

Dr. Cost of Goods Sold

Cr. Finished Goods

Joint Production Process

When two or more different products are manufactured in the same production process.

Joint Products

The major products resulting from a joint production process.

By-Product

A product yield in a joint production process with a relatively small value.

Joint Costs

The costs incurred in the joint production process which are common to all products.

Split-off Point

The point in the production process where the products become identifiable and as a result of their separate identity, their production costs can be measured separately.

Separable Costs

All costs incurred beyond the split-off point that is assignable to one or more individual products.

Units of Production Method

Allocates joint costs based on the number of units produced.

Weighted Average Method

Allocates joint costs based on the weight, units, or other measure.

Sales Value at Split-off

Allocates joint costs to joint products on the basis of the relative sales value at the split-off point.

Net Realizable Value at Split-off

Allocates joint costs on the basis of estimated realizable value at the split-off point.

Approximated Net Realizable Value

Allocates joint costs to joint products on the basis of relative estimated NRV (final sales value minus the expected separable costs).

Constant Margin Approach

Allocates joint costs in such a way that the overall gross margin percentage is identical for the individual products.

Net Realizable Value Approach for By-Products

Products are accounted for during production

Used if the value of the by-product is significant or material

NRV of the by-product is treated as a reduction from the joint costs of the main products.

Any loss of the by-poduct or scrap is added to the cost to the cost of the main products

Realizable Value Approach for By-Products

By-products are accounted for during sale

Used if the value of the by-product is insignificant or immaterial

The realized value of the by-product or scrap maybe reported as other sales revenue or other income.

Methods of Allocating Joint Costs

Allocate joint costs using Physical Measure

Units of Production Method

Weighted Average Method

Allocate joint costs using Market Value

Sales Value at Split-off

Net Realizable Value at Split-off

Approximated Net Realizable Value

Constant Margin Approach

Process cost systems

Systems used to apply costs to similar products that are mass-produced in a continuous fashion. Once production begins, it continues until the finished product emerges, and each unit of finished produt is like every other unit.

Process Cost Flow

The company can add materials, labor, and manufacturing overhead in each production department.

The costs of unit completed are transferred from one department to another as those units move through the manufacturing process

The costs of completed work are transferred to Finished Goods Inventory.

When inventory is sold, costs are transferred to Cost of Goods Sold.

Entries to assign the costs of raw materials, factory labor, and overhead

Debit Work in Process for each department and credit Raw Materials Inventory, Factory Labor, and Manufacturing Overhead.

Entry to record units completed and transferred to the warehouse

Debit Finished Goods Inventory and credit Work in Process.

Entry to record the sale of goods

Debit Cost of Goods Sold and credit Finished Goods Inventory.

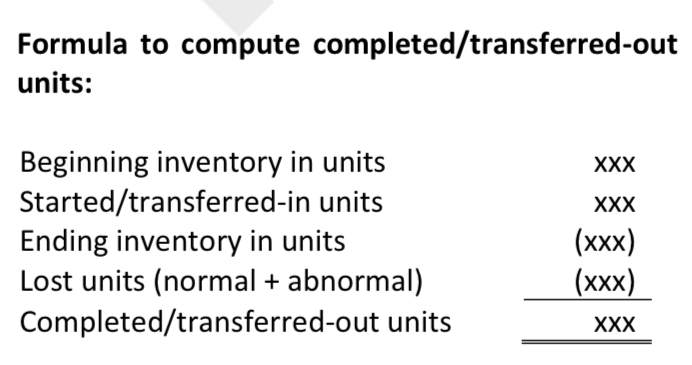

Formula to compute completed/transferred-out units

Beginning inventory in units + Started/transferred-in units - Ending inventory in units - Lost units (normal + abnormal).