Chapter 6 - Deductions and Losses: In General HW Quiz Questions

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

If a residence is used primary for personal use (rented for than 15 days per year), which of the following is correct?

a. No income is included in AGI.

b. Expenses must be allocated between rental and personal use.

c. No expenses are deductible.

d. Only “No income is included in AGI” and “No expenses are deductible” are correct.

a. No income is included in AGI - Expenses that would otherwise be deductible (e.g., property taxes and interest on mortgage of personal residence) can be claimed (“No expenses are deductible”).

Which of the following statements is correct in connection with the investigation of a business?

a. That business must be related to the taxpayer’s present business for any expense ever to be deductible.

b. If the taxpayer is not already engaged in the trade or business, the expense incurred are deductible if the project is abandoned.

c. Expenses may be deducted immediately by a taxpayer engaged in a similar trade or business, regardless of whether the business being investigated is acquired.

d. Regardless of whether the taxpayer is already engaged in the trade or business, the expenses must be capitalized and amortized.

c. Expenses may be deducted immediately by a taxpayer engaged in a similar trade or business, regardless of whether the business being investigated is acquired.

Which of the following is incorrect?

a. Contributions to a traditional IRA are a deduction for AGI.

b. The expenses associated with a proprietorship are a deduction for AGI.

c. Property taxes on taxpayer’s personal residence are a deduction from AGI.

d. The expenses associated with rental property are a deduction from AGI.

d. The expenses associated with rental property are a deduction from AGI.

For a president of a publicly held corporation hired in the current year, which of the following is not subject to the $1 million limit on executive compensation?

a. Premiums on group term life insurance of $50,000.

b. Contribution to pension plan.

c. Contribution to medical insurance plan.

d. “Contribution to medical insurance plan”, “Contribution to pension plan”, and “Premium on group term life insurance of $50,000” are not subject to the limit.

d. “Contribution to medical insurance plan”, “Contribution to pension plan”, and “Premium on group term life insurance of $50,000” are not subject to the limit.

For a activity classified as a hobby, the expenses are categorized as follows:

(1) Amounts that affect adjusted basis and would be deductible under other Code sections if the activity has been engaged in for profit (e.g, depreciation, amortization, and depletion).

(2) Amounts deductible under other Code sections without regard to the nature for the activity, such as property taxes and home mortgage interest.

(3) Amounts deductible under other Code sections if they activity had been engaged in for profit, but only if those amounts do not affect adjusted basis (e.g., maintenance, utilities, and supplies).

a. (3), (2), (1).

b. (1), (2), (3).

c. (2), (3), (1).

d. (1), (3), (2).

c. (2), (3), (1) - Before 2018, the last two categories of deduction were deductible from AGI as miscellaneous itemized deductions (to the extent they exceeded 2% of AGI). From 2018 thorough 2025, miscellaneous itemized deductions are not deductible.

Paula is the sole shareholder of Violet, Inc. For 2024, she receives from Violet a salary of $450,000 and dividends of $100,000. Violet’s taxable income for 2024 is $100,000. On audit, the IRS treats $100,000 of Paula’s salary as unreasonable. Which of the following statements is correct?

a. Violet’s taxable income will not be affected by the IRS adjustment.

b. Paula’s gross income will decrease by $100,000 as a result of the IRS adjustment.

c. Violet’s taxable income will increase by $100,000 as a result of the IRS adjustment.

d. Paula’s gross income will increase by $100,000 as a result of the IRS adjustment.

c. Violet’s taxable income will increase by $100,000 as a result of the IRS adjustment. - $100,000 of salary is reclassified as a dividend. Thus, Violet’s taxable income increases by $100,000 because dividends are not deductible. Paula’s gross income remains the same. Her salary income decreases by $100,000, but her dividend income will increase by $100,000

Melba incurred the following expenses for her dependent daughter during the current year.

Payment of principle on daughter’s automobile loan - $3,600

Payment of interest on daughter’s automobile loan - $2,900

Payment of daughter’s property taxes - $1,800

Payment of principle on daughter’s personal residence loan - $2,800

Payment of interest on daughter’s personal residence loan - $7,000

How much may Melba deduct computing her itemized deductions?

$0 - None of the items is incurred for the taxpayer’s (Melba) benefit or as a result of the taxpayer’s obligation (payments made on behalf of another are not deductible by the payor).

Tom operates an illegal drug operation and incurred the following expenses:

Salaries - $75,000

Illegal Kickbacks - $20,000

Bribes to Border Guards - $25,000

Cost of Goods Sold - $160,000

Rent - $8,000

Interest - $10,000

Insurance - $6,000

Utilities and Telephone - $20,000

Which of the following amounts reduces his taxable income?

$160,000 - Cost of goods sold is $160,000 is treated as a negative item in calculating gross income rather than as a deduction. For a drug dealer, all deductions are disallowed.

Which of the following is a deduction for AGI?

a. Safe deposit box rental fee in which stock certificates are stored.

b. Contributions to a traditional IRA.

c. Property tax on personal residence.

d. Roof repairs to a personal use home.

b. Contributions to a traditional IRA. - “Property tax on personal residence” is a deduction from AGI. “Roof repairs to a personal use home” is a personal expense and not deductible. “Safe deposit box rental fee in which stock certificates are stored” is a miscellaneous itemized deduction and not deductible in 2018 through 2025.

During 2023, the first year of operations, Silver, Inc., pays salaries of $175,000. At the end of the year, employees have earned salaries of $20,000, which are not paid by Silver until early in 2024. What is the amount of deduction for salary expense?

a. If Silver uses the cash method, $0 in 2023 and $195,000 in 2024.

b. If Silver uses the cash method, $175,000 in 2023 and $0 in 2024.

c. If Silver uses the accrual method, $175,000 in 2023 and $20,000 in 2024.

d. If Silver uses the accrual method, $195,000 in 2023 and $0 in 2024.

d. If Silver uses the accrual method, $195,000 in 2023 and $0 in 2024.

Priscilla pursued a hobby of making bedspreads in her spare time. Her AGI before considering the hobby is $40,000. During 2024, she sold the bedspread for $10,000. She incurred expenses as follows:

Fabric and Other Supplies Needed to Make Bedspreads - $4,000

Interest on Loan to Get Business Started - $500

Advertising - $6,500

Assuming that the activity is deemed a hobby, how should she report these items on her tax return?

a. Include $10,000 in income and deduct nothing.

b. Include $10,000 in income and deduct $11,000 for AGI.

c. Include $10,000 in income and deduct $4,000 for AGI as cost of goods sold.

d. Ignore both income and expenses as hobby losses are disallowed.

c. Include $10,000 income and deduct $4,000 for AGI as cost of goods sold. - Beginning in 2018, expenses other than cost of goods sold related to a hobby are not deductible (except for property taxes and home mortgage interest which are deductible as itemized deductions).

Which of the following is deductible in 2024?

a. Tax return preparation fess of an individual.

b. Moving expenses in excess of reimbursement.

c. Cash contribution to the Salvation Army, a qualified charity.

d. Allowable hobby expenses in excess of hobby income.

c. Cash contribution to the Salvation Army, a qualified charity. - Miscellaneous itemized deductions subject to the 2% of AGI floor are not deductible in 2024. Moving expenses are deductible by military personnel.

Which of the following may be deductible?

a. Fines paid for violations of the law.

b. Expenses associated with monitoring legislation.

c. Campaign contribution to a candidate for mayor.

d. Illegal bribes that relate to a U.S. business.

b. Expenses associated with monitoring legislation. - Bribes paid domestically to government officials, fines, and political contributions are not deductible.

Andrew, who operates laundry business, incurred the following expenses during the year:

Parking Ticket of $250 for one of his delivery vans that parked illegally.

Parking ticket of $75 when he parked illegally while attending a rick concert in Tulsa.

DUI ticket of $500 while returning from the rick concert.

Attorney’s fees of $600 associated with the DUI ticket.

What amount can Andrew deduct for these expenses?

$0 - None of these expenses are deductible. The $75 parking ticket, the $500 DUI ticket, and $600 attorney fees are all personal expenses. The $250 parking ticket, although related to his laundry business, is not deductible because it is a violation of public policy.

Hannah is a teacher, single, had a gross income of $50,000, and incurred the following expenses in 2024:

Charitable Contribution - $2,000

Taxes and Interest on Home - $7,000

Legal fees incurred in a tax dispute - $1,000

Medical expenses - $3,000

Supplies for her third grade class - $350

Her AGI is:

$49,700 - [$50,000 (Gross income) - 300 (Deduction for AGI; Supplies for her third grade class (limit was 300 in 2024)]

Karen, a salesperson employed by an auto dealership, is considering opening a fast-food franchise. If Karen decides not to acquire the fast-food franchise, any investigation expenses are:

a. A deduction for AGI.

b. Deductible up to $50,000 in the current year with the balance being amortized over a 180-month period.

c. A deduction from AGI.

d. Not deductible.

d. Not deductible - As Karen is not in a business that is that same as or similar to the one being investigated and did not acquire the new business, her investigation expenses cannot be deducted.

Cory, a college professor, incurred and paid the following expenses in 2024:

Tax return preparation fee - $600

Moving expenses - $2,000

Investment expenses - $500

Expenses associated with rental property - $1,500

Interest expense associated with loan to finance tax-exempt bonds - $400

Calculate the amount that Cory can deduct (before any percentages limitations).

$1,500 - Only the rental property expenses are deductible.

Trade or business expenses of a self employed taxpayer should be treated as:

a. Deductible for AGI on Schedule C.

b. An itemized deduction if not reimbursed.

c. Deductible for AGI on Schedule E.

d. A deduction from AGI.

a. Deductible for AGI on Schedule C.

Which of the following can be claimed as a deduction for AGI?

a. Investment interest expenses.

b. Personal casualty losses.

c. Expenses associated with royalty income.

d. Property taxes on personal use real estate.

c. Expenses associated with royalty income. - All of the other expenses are classified as itemized deductions (from AGI deductions).

Petal, Inc. is an accrual basis taxpayer. Petal uses the aging approach to calculate the reserve for bad debts. During the current year, the following associated with bad debts occur.

Credit Sales - $400,000

Collections on credit sales - $250,000

Amount added to the reserve - $14,000

Beginning balance in the reserve - $0

Identifiable bad debts during the current year. $12,000

The amount of the deductions for bed debt expense for Petal for the current year is:

$12,000 - Only the specific charge-off method can be used. Reserves for estimated expenses are not allowed for tax purposes because the economic performance test cannot be satisfied.

Al is single, age 60, and has gross income of $140,000, of which $120,000 is salary and $20,000 is rental income. His deductible expense are as follows:

Charitable contributions - $4,000

Contribution to a traditional IRA - $7,000

Expenses paid on rental property - $7,500

Interest on home mortgage and property taxes on personal residence - $7,200

State income tax - $2,200

What is Al’s AGI?

$125,000 [$140,000 (Gross income) - (7,000 {IRA} + 7,500 {Expenses on rental property})]

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year. The rental income is $6,000 and the expenses are as follows:

Mortgage interest - $9,000

Real estate taxes - $3,000

Utilities - $2,000

Maintenance - $1,000

Insurance - $500

Depreciation (rental part) - $4,000

Using the IRS approach, total expenses that Robyn can detect on her tax return associated with he beach house are:

$12,000 - As the property is classified as personal/rental use, the general rule is that the deductible expenses cannot exceed the gross income. Thus, under the general rule, the deductible expenses would be limited to $6,000. However, this ceiling does not apply to expenses that otherwise would be deductible as itemized deductions. Consequently, all the mortgage interest and real estate taxes can be deducted. [$9,000 + $3,000]

Benita incurred a business expenses on Dec. 10, 2024, which she charged on her bank credit card. She paid the credit card statement that included the charge on Jan. 5, 2025. Which of the following is correct?

a. If Benita is an accrual method taxpayer, she can deduct the expense in 2024.

b. If Benita is a cash method taxpayer, she cannot deduct the expense until 2025.

c. If Benita uses the accrual method, she can choose to deduct the expense in either 2024 or 2025.

d. Only “If Benita is an accrual method taxpayer, she can deduct the expense in 2024” and “If Benita uses the accrual method, she can choose to deduct the expense in either 2024 or 2025” are correct.

a. If Benita is an accrual method taxpayer, she can deduct the expense in 2024.

Which of the following is not a required test for the deduction of a business expense?

a. Unavoidable.

b. Necessary.

c. Ordinary.

d. Reasonable.

a. Unavoidable - Business expenses must be ordinary and necessary to be deductible. In addition, they must be reasonable in amount. Unavoidable is not a requirement.

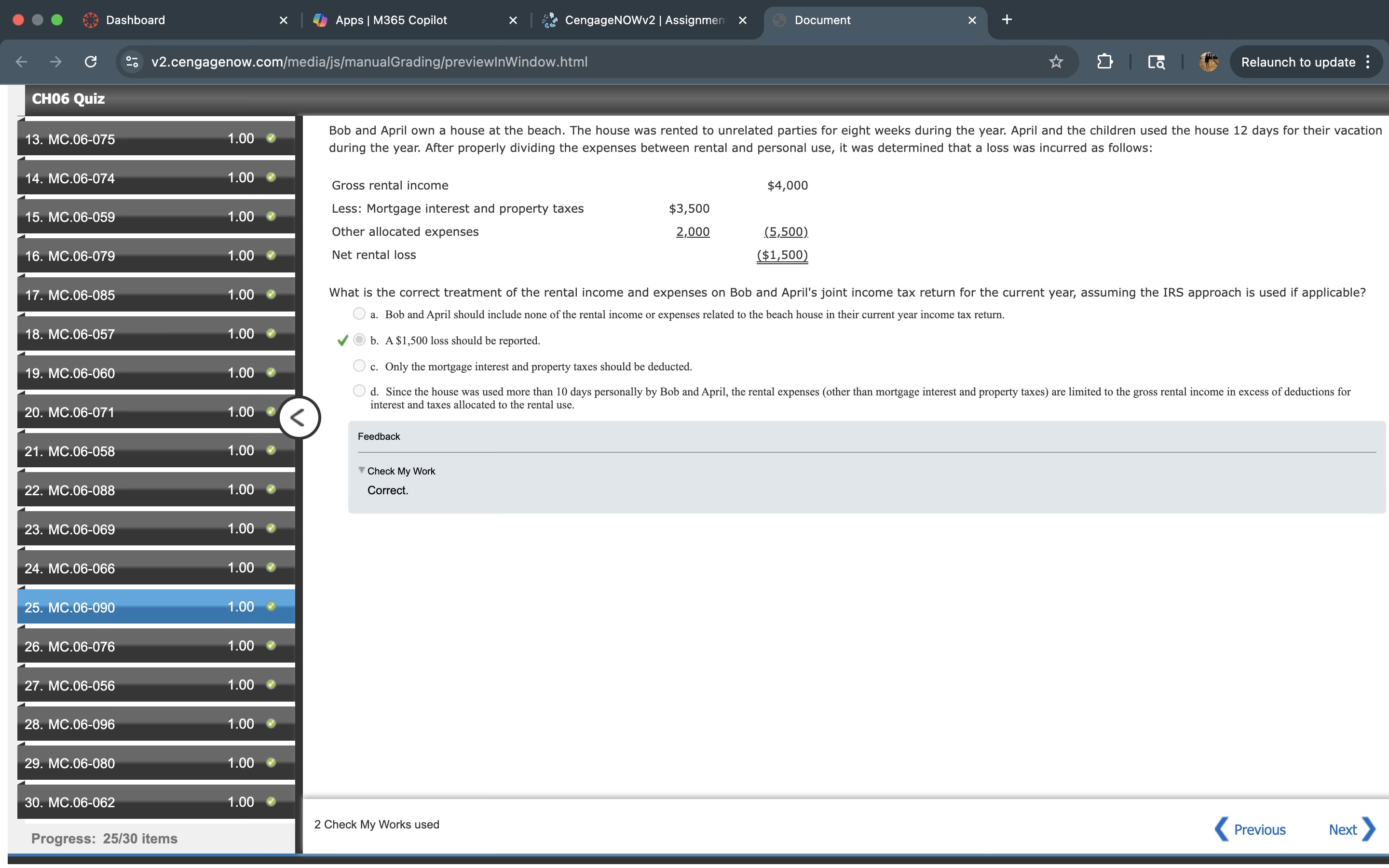

Bob and April own a house at the beach. The house was rented to unrelated parties for eight weeks during the year. April and the children used the house 12 days for their vacation during the year. After properly dividing the expenses between rental and personal use, it was determined that a loss was incurred as follows:

What is the correct treatment of the rental income and expenses on Bob and April’s joint income tax return for the current year, assuming the IRS approach is used if applicable?

b. A $1,500 loss should be reported.

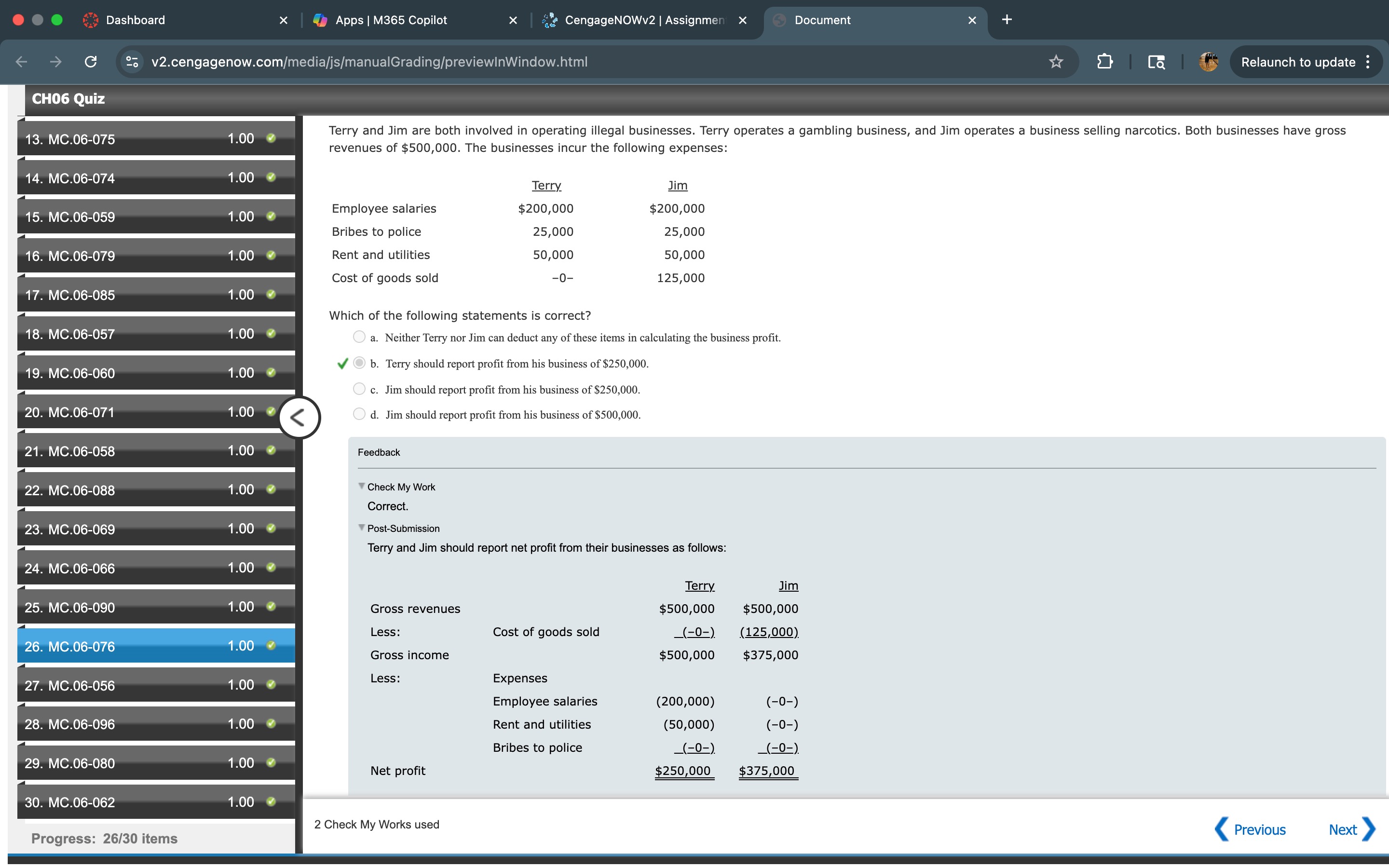

Terry and Jim are both involved in operating illegal businesses. Terry operates a gambling business, and Jim operates a business selling narcotics. Both businesses have gross revenues of $500,000. The businesses incur the following expenses:

Which of the following statements is correct?

b. Terry should report profit from his business of $250,000

Sammy, a calendar year cash basis taxpayer who is age 66, had the following transactions in 2024:

Salary from job - $90,000

Alimony received from ex-wife (2021 divorce) - $10,000

Medical expenses - $6,500

Based on this information, Sammy has:

d. Deduction for medical expenses of $0 - Sammy’s AGI is $90,000, his salary. The alimony is excluded from his income (post-2018 divorce). [Sammy’s deduction for medical expenses, an itemized deduction, is $0 [$6,500 - 6,750 (7.5% * $90,000)].

In January, Maurice sold stock with a cost basis of $26,000 to his brother, James, for $24,000, the fair market value of the stock on the date of sale. Five months later, James sold the same stock through his broker for $27,000. What is the tax effect of these transactions?

a. Disallowed loss to James of $2,000; gain to Maurice of $1,000.

b. Disallowed loss to Maurice of $2,000; gain James of $1,000.

c. Deductible loss to Maurice of $2,000; gain to James of $3,000.

d. Disallowed loss to Maurice of $2,000; gain to James of $3,000.

b. Disallowed loss to Maurice of $2,000; gain James of $1,000. - Maurice’s realized loss of $2,000 ($24,000 - $26,000) is disallowed. James may reduce his realized gain of $3,000 ($27,000 - 24,000) by Maurice’s disallowed loss of $2,000. so James’ recognized gain is $1,000.

Iris, a calendar year cash basis taxpayer, owns and operates several TV rental outlets in Florida and wants to expand to other states. During the current year, she spends $14,000 to investigate TV rental stores in South Carolina and $9,000 to investigate TV rental stories in Georgia. She acquires the South Carolina operations but not the outlets in Georgia. AS to these expenses, Iris should:

a. Capitalize $23,000.

b. Expense $23,000 in the current year.

c. Capitalize $14,000 and not deduct $9,000.

d. Expense $9,000 in the current year and capitalize $14,000.

b. Expense $23,000 in the current year.

Which of the following is correct?

a. A personal causally loss incurred from a presidentially declared disaster is classified as a deduction from AGI.

b. An expense associated with rental property is classified as a deduction for AGI.

c. Real estate taxes on a taxpayer’s personal residence are classified a deduction from AGI.

d. “A personal causally loss incurred from a presidentially declared disaster is classified as a deduction from AGI.”, “An expense associated with rental property is classified as a deduction for AGI.”, and “Real estate taxes on a taxpayer’s personal residence are classified a deduction from AGI” are correct.

d. “A personal causally loss incurred from a presidentially declared disaster is classified as a deduction from AGI.”, “An expense associated with rental property is classified as a deduction for AGI.”, and “Real estate taxes on a taxpayer’s personal residence are classified a deduction from AGI” are correct.