Economics, Microeconomics 2.5-2.6 Elasticities

1/46

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

47 Terms

Elasticity measures

how much demand or supply changes when there is a change in one of the determinants--it is a measure of responsiveness

Price Elasticity of Demand (PED)

is a measure of how much the quantity demanded of a product changes when there is a change in price

If quantity demanded is highly responsive to a change in price

it is said to be price elastic

If quantity demanded is not very responsive to a change in price

it is referred to as price inelastic

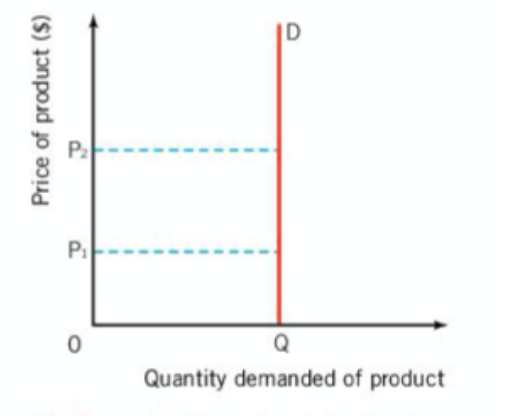

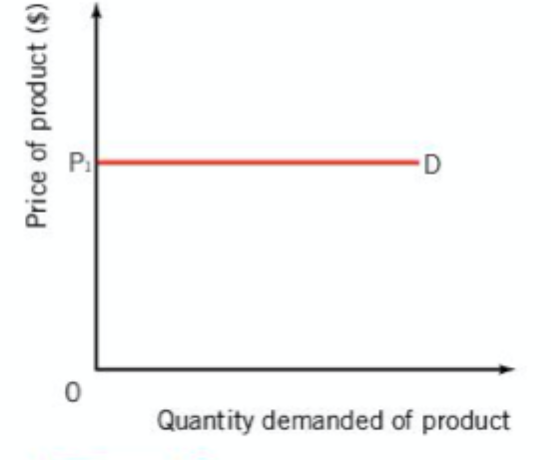

if PED is 0

it is perfectly inelastic

A change in price will have no effect on quantity demanded

Therefore, the demand curve will be vertical

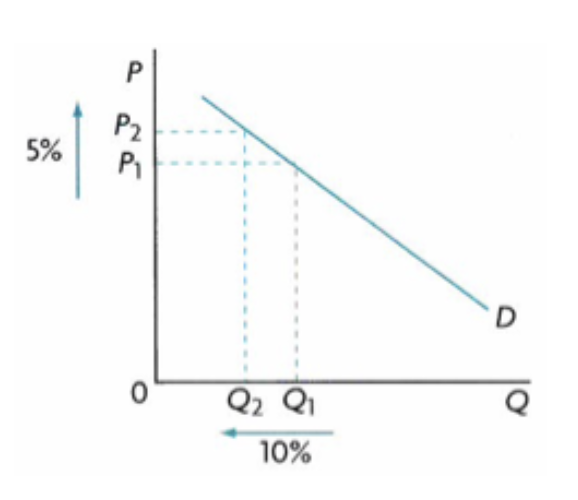

If PED is greater than zero but less than one

it is said to be price inelastic

A change in price will lead to a proportionally smaller change in quantity demanded

An increase or decrease in price will not have a major effect on quantity

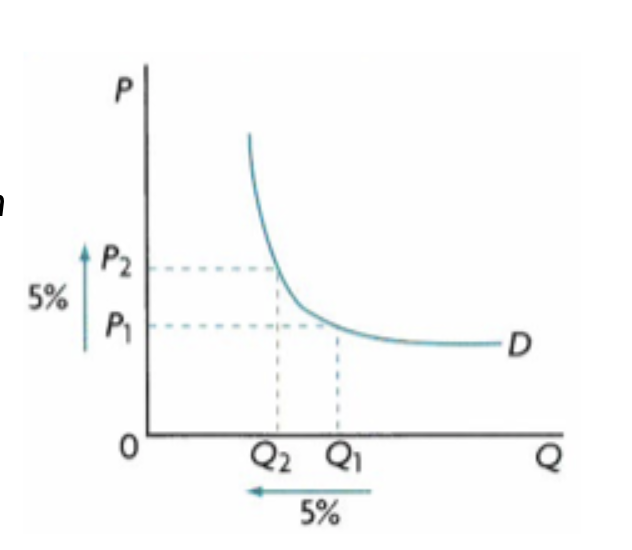

If PED is equal to 1, it is said to be

unit elastic

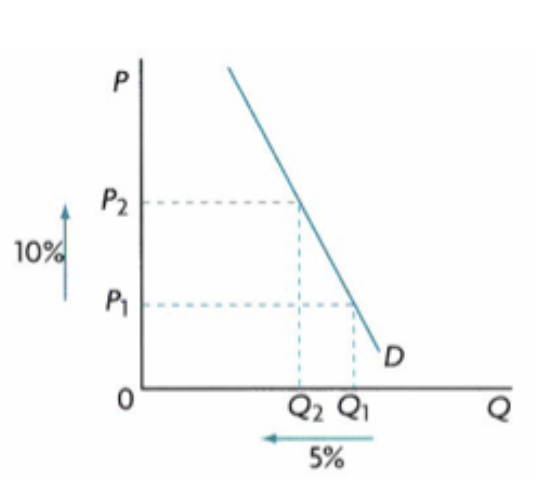

If PED is greater than 1, but less than infinity it is

price elastic

If PED is ∞, it is

perfectly elastic

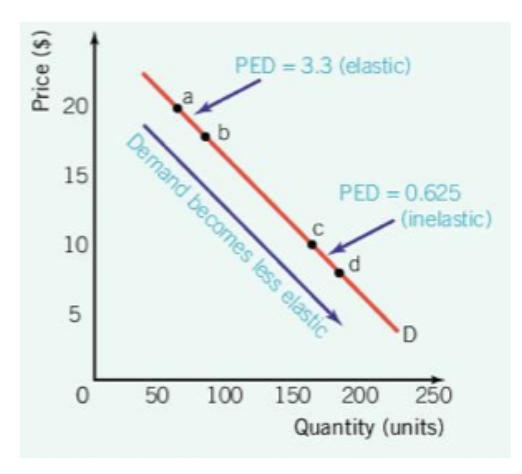

the slope or “steepness” of the demand curve is

NOT a measure of elasticity

low-priced products have a more inelastic demand than high-priced products, because

consumers are less concerned when the price of something cheap increases than when the same occurs for something more expensive

PED values change

along a straight-line demand curve

Determinants of PED (TINS)

The T stands for

Time period considered

As price changes, it takes consumers time to adjust consumption habits. PED is more inelastic in the short run, but more elastic in the long run

Determinants of PED (TINS)

The I stands for

Income (proportion of)

If a good costs little, and takes only a small proportion of a consumer’s budget, a change in price may cause very little change in quantity demanded (and vice versa)

Determinants of PED (TINS)

The N stands for

Necessity of the product

The higher the necessity of the product, the more inelastic it will be (e.g., food, water, housing, etc.)

Determinants of PED (TINS)

The S stands for

Substitutes (number and closeness of)

The more substitutes there are for a product, the more elastic it is likely to be

Products with few (or no) substitutes will have more inelastic demand

the knowledge of PED allows firms to

predict the effects of their pricing decisions on quantity demanded and on total revenue

Price elastic: Higher price = less revenue, and vice versa

Price inelastic: Price and revenue move in the same direction

the knowledge of PED allows governments to

predict the consequences of imposing taxes on certain goods (taxes always increase the price of goods)

e.g., a tax on alcohol (inelastic) will increase tax income, while a city tax on soda (elastic) will result in less tax income (people switch to substitutes, or travel to get their soda)

primary commodities are raw materials (e.g., cotton, wood, oil, agricultural products, etc.)

These goods are

highly inelastic because they are necessities and have few or no substitutes

small fluctuations in the supply of primary commodities can result in

large price fluctuations (price volatility) for manufacturers, and can negatively affect producer incomes

Manufactured goods are finished products (e.g., hamburgers, pens, furniture items, etc.)

These goods are

more elastic because of the availability and closeness of substitutes

due to larger availability and substitutes this results in

smaller price fluctuations

Income elasticity of demand (YED)

a measure of how much the demand for a product changes when there is a change in consumer income

YED values correspond to the

elasticity of demand for certain types of goods

Necessity goods (0 < YED < 1)

These goods are highly inelastic, and demand will change little if income rises (e.g., bread, rice, milk, etc.)

Luxury goods (YED > 1

These goods are highly elastic, as demand changes significantly as income rises (e.g., nonessentials such as foreign holidays, jewelry, luxury cars, etc.)

Inferior goods (YED < 0)

Demand decreases as income increases (e.g., used clothing, store-brand foods, etc

The YED value for inferior goods is negative because of

the inverse relationship between demand and income

The Engel Curve illustrates the relationship between

income and quantity demanded

the engel curve shows

whether a good is normal or inferior, and whether the good is income elastic or inelastic

firms having knowledge of YED helps

firms target certain consumer groups when planning on which market to enter and which product to sell (e.g., smartphone sales in developing economies)

Firms often sell different versions of products to cater to different income levels; YED allows them to make production decisions

As a general rule, the higher the YED, the greater the expansion of the future market (and vice versa)

governments having knowledge of YED helps

explain sectoral changes in the economy

Economic production is usually divided into three sectors: primary (raw materials), secondary (manufacturing), and tertiary (services)

As incomes grow and living standards increase, the secondary and tertiary sectors often increase output, and this is reflected by the high YED values for products produced by those sectors

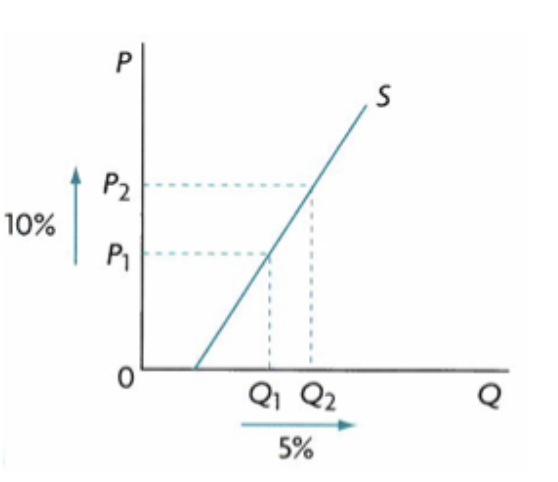

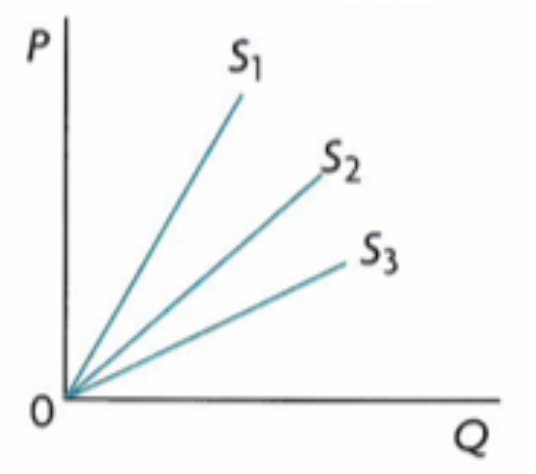

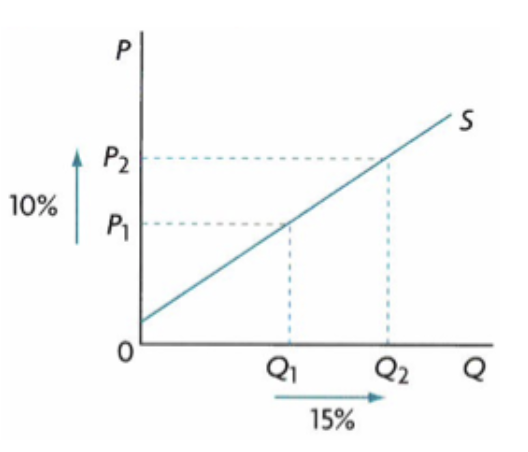

Price elasticity of supply (PES)

a measure of responsiveness to supply when there is a change in price

there is a positive relationship between price and quantity supplied, so PES values will always be

positive

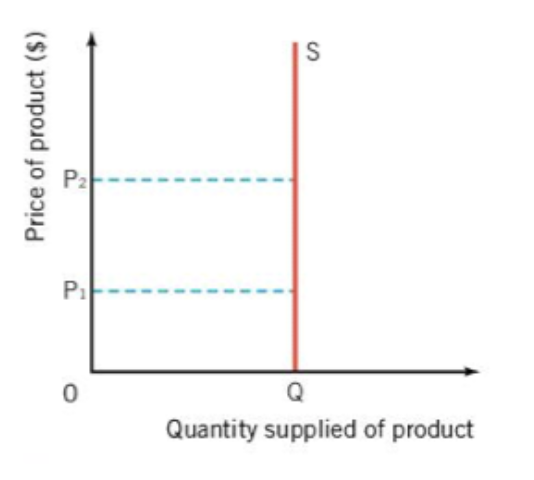

If PES is 0, it is

perfectly inelastic

If PES is greater than zero but less than one, it is

price inelastic

If PES is equal to 1, it is

unit elastic

If PES is greater than 1, but less than infinity, it is

price elastic

If PES is ∞, it is

perfectly elastic

Determinants of PES (FACTS)

the F in facts stand for

Factors of production (mobility)

The more easily and quickly resources can be shifted towards producing another product, the greater responsiveness of quantity supplied to changes in price (higher PES, more elastic)

E.g., farm workers can more easily move from corn to strawberry production than from farm work to car production

Determinants of PES (FACTS)

the A in facts stand for

Ability to store stocks

Firms that have the ability to store stocks, and therefore more quickly supply a product in response to price changes, have a higher PES for their products (more elastic)

Remember, some products can’t be stored for very long because they go bad! (e.g., milk, cheese, fruit, grains, etc.)

Determinants of PES (FACTS)

the C in facts stand for

Costs (rate of increase)

If costs increase rapidly, then PES will be inelastic because of the firm’s inability to increase their output in the short run , and they will not want to incur higher costs of production

Firms will be better able to increase their output if costs increase slowly, so PES will be more elastic

Determinants of PES (FACTS)

the T in facts stand for

Time

The amount of time firms have to adjust their output in response to changes in price

Over a short time, it is more difficult for firms to adjust output, so supply will be highly inelastic

Over a longer period of time, firms are better able to adjust output, so supply becomes more elastic

Determinants of PES (FACTS)

the S in facts stand for

Spare capacity of firms

Sometimes firms have unused factors of production (e.g., factories or equipment that remain unused for a period of time)

If the firm can utilize unused factors of production to adjust output in response to price changes (elastic), but if all factors are being used then it will be more difficult to respond (inelastic)