11.0 Economic Performance (All in 1)

1/63

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

64 Terms

Why does a positive output gap lead to inflation

Excess demand over capacity causes firms to raise prices

Why does a negative output gap reduce inflation

Unused resources mean low demand pressures, keeping prices stable or falling

How do output gaps affect unemployment

Negative output gaps increase unemployment; positive gaps reduce it

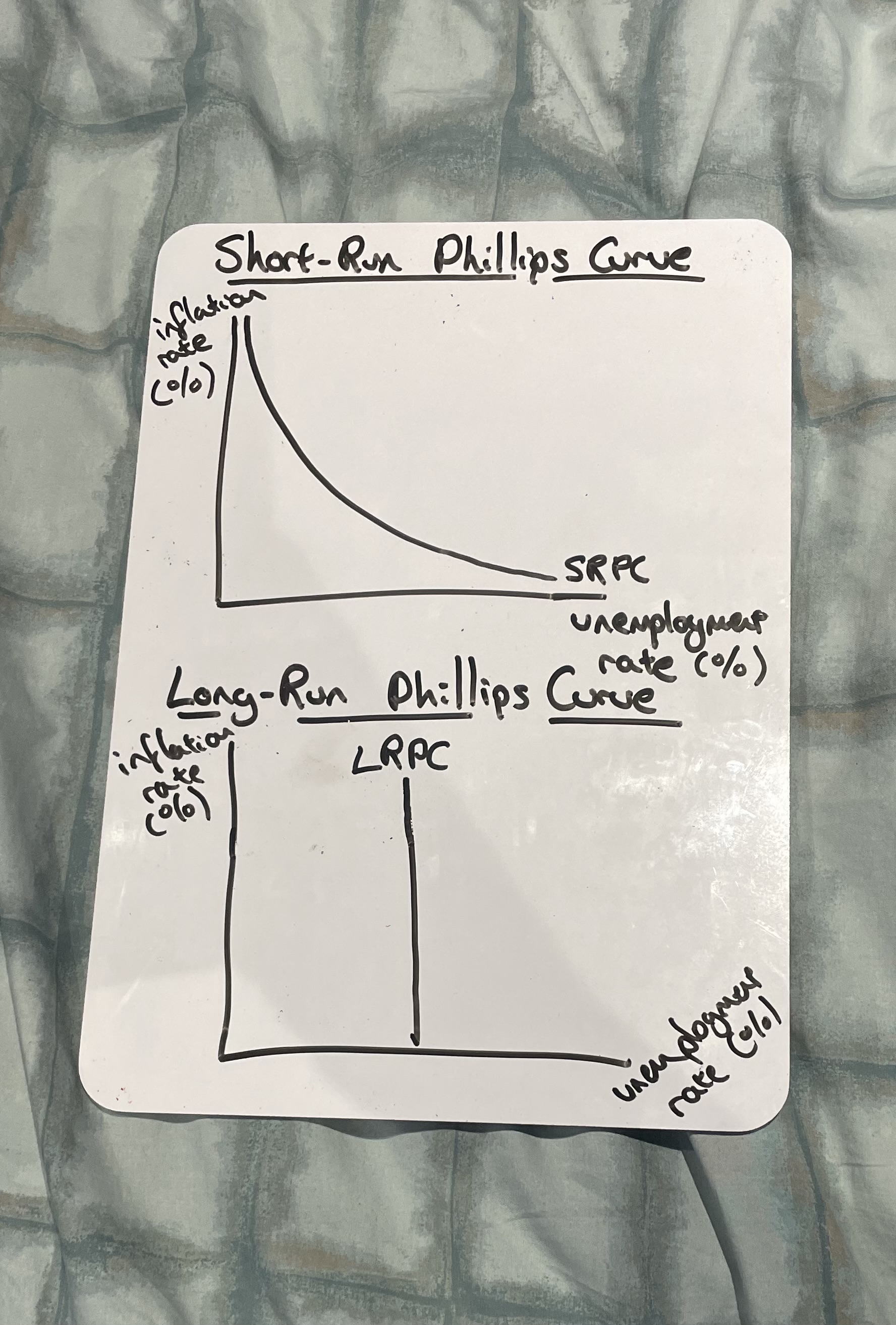

Draw the short-run and long-run Philips curve

What happens when demand-side policies reduce unemployment in the short run according to Bill Phillips

Inflation rises due to increased consumer spending and wage pressure

Why is the long-run Phillips curve vertical

Because in the long run, unemployment returns to its natural rate, regardless of inflation

Why are demand-side policies ineffective at reducing unemployment in the long run

Because any gains in employment are offset by rising inflation, with unemployment returning to its natural rate

What kind of policies are recommended to reduce long-term unemployment

Supply-side policies like education,training, and labour market reforms to improve workforce skills and flexibility

What is the ‘natural rate of unemployment’

The level of unemployment that persists in the long-run when the economy is at full capacity

Why can economic growth conflict with inflation control

Rapid growth raises aggregate demand, which can lead to demand-pull inflation if the economy is near full capacity

How does economic growth potentially worsen a country’s current account

Increased incomes raise demand for imports, leading to a larger current account deficit, especially in countries like the UK with high import propensities

In what way can economic growth harm the environment

It often leads to higher emissions, pollution, and the depletion of non-renewable resources due to increased industrial actitivity

How does cutting a budget deficit potentially reduce economic growth

It involves reducing government spending or raising taxes, which lowers aggregate demand and slows growth

What is short-run economic growth

It is the annual percentage increase in a country’s real GDP, caused by increases in aggregate demand

What is long-run economic growth

It occurs when the productive capacity of the economy increases, caused by an increase in aggregate supply

What is potential output

The level of output an economy can produce if all resources are fully employed

What is an output gap

The difference between actual and potential levels of output

What characterises a negative output gap

Actual output is less than potential output, leads to unemployment and downward pressure on inflation

What characterises a positive output gap

Actual output is greater than potential output, resources are overused, causing upward pressure on inflation

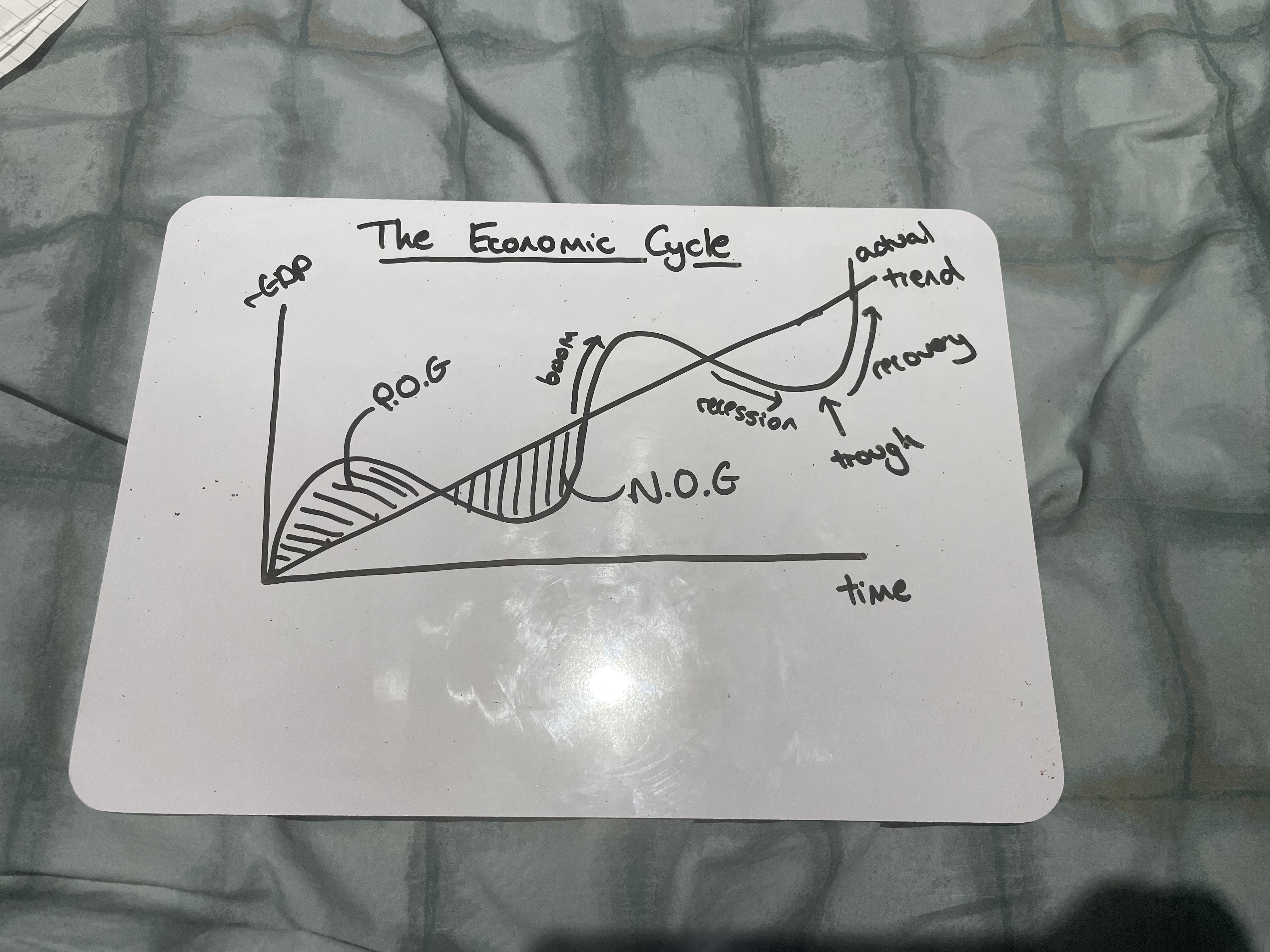

What is the economic cycle

The fluctuations in economic growth over time, including booms and recessions

Draw the Economic Cycle

What happens during a boom

Fast economic growth, near full employment, positive output gaps, demand-pull inflation

What happens during a recession

Negative growth over two consecutive quarters, spare capacity, rising unemployment, and lower inflation

How might government respond to a recession

Increase spending, cut taxes, raise welfare benefits to stimulate demand

What benefits do consumers gain from economic growth

Growth increases confidence, leading to higher consumption and living standards

What are consumer costs of economic growth

Higher inflation, greater inequality

What benefits do firms gain from economic growth

Higher profits, investment, economies of scale, better export opportunities

What are menu costs

The costs to firms of changing prices frequently due to inflation

How does economic growth benefits the government

Increased tax revenues, reduced welfare spending which improves the budget

What is the Claimant Count?

It counts the number of people claiming unemployment-related benefits like Job Seeker’s Allowance (JSA), who must prove they are actively seeking work

What are the drawbacks of the Claimant Count

It underestimates unemployment since not all unemployed are eligible for or claim benefits

What is the Labour Force Survey (LFS)?

A survey used by the ILO that asks people if they’ve been out of work for 4+ weeks, are available to start in 2 weeks, and can work at least 1 hour/week

How does the LFS differ from the Claimant Count?

The LFS generally shows a higher unemployment figure because it includes those who are not claiming benefits

What is structural unemployment

Unemployment caused by a mismatch between the skills that workers in the economy can offer and the skills demanded of worker by employers

What is frictional unemployment

Temporary unemployment when people are between jobs or just entering the workforce

What is seasonal unemployment

Unemployment that occurs at certain time of the year

What is cyclical unemployment

Unemployment caused by a fall in aggregate demand, often during economic downturns or recessions

What is real wage unemployment

When wages are above market equilibrium, causing labour supply to exceed demand

What is voluntary unemployment

When someone chooses not to work at current wage levels

What is involuntary unemployment

When people willing and able to work at current wages cannot find employment - often due to cyclical factors

How does unemployment affect consumers?

Reduces disposable income, lowers living standards, and can cause psychological stress

How does unemployment affect firms?

Increases labour supply (lower wages), but reduces consumer spending and may require retraining workers.

How does unemployment affect workers?

Leads to a waste of labour resources and skill loss due to underutilisation.

How does unemployment affect the government?

Increases spending on JSA, reduces tax revenues, and carries an opportunity cost.

What is the natural rate of unemployment

The unemployment level when labour market is in equilibirum, with no cyclical unemployment

What causes the natural rate of unemployment

Supply-side factors - frictional and structural unemployment

What is NAIRU

The Non-Accelerating Inflation Rate of Unemployment - when inflation is stable

Why is the natural rate also called full employment

Because there’s no demand-deficient unemployment - only unavoidable types like frictional or structural

What is inflation

Inflation is the sustained rise in the general price level over time, leading to a decrease in purchasing power of money

What is deflation

Deflation is the opposite of inflation, where the average price level in the economy falls, and there is a negative inflation rate

What is disinflation

Disinflation is the falling rate of inflation, where the price level is still rising, but at a slower rate than before

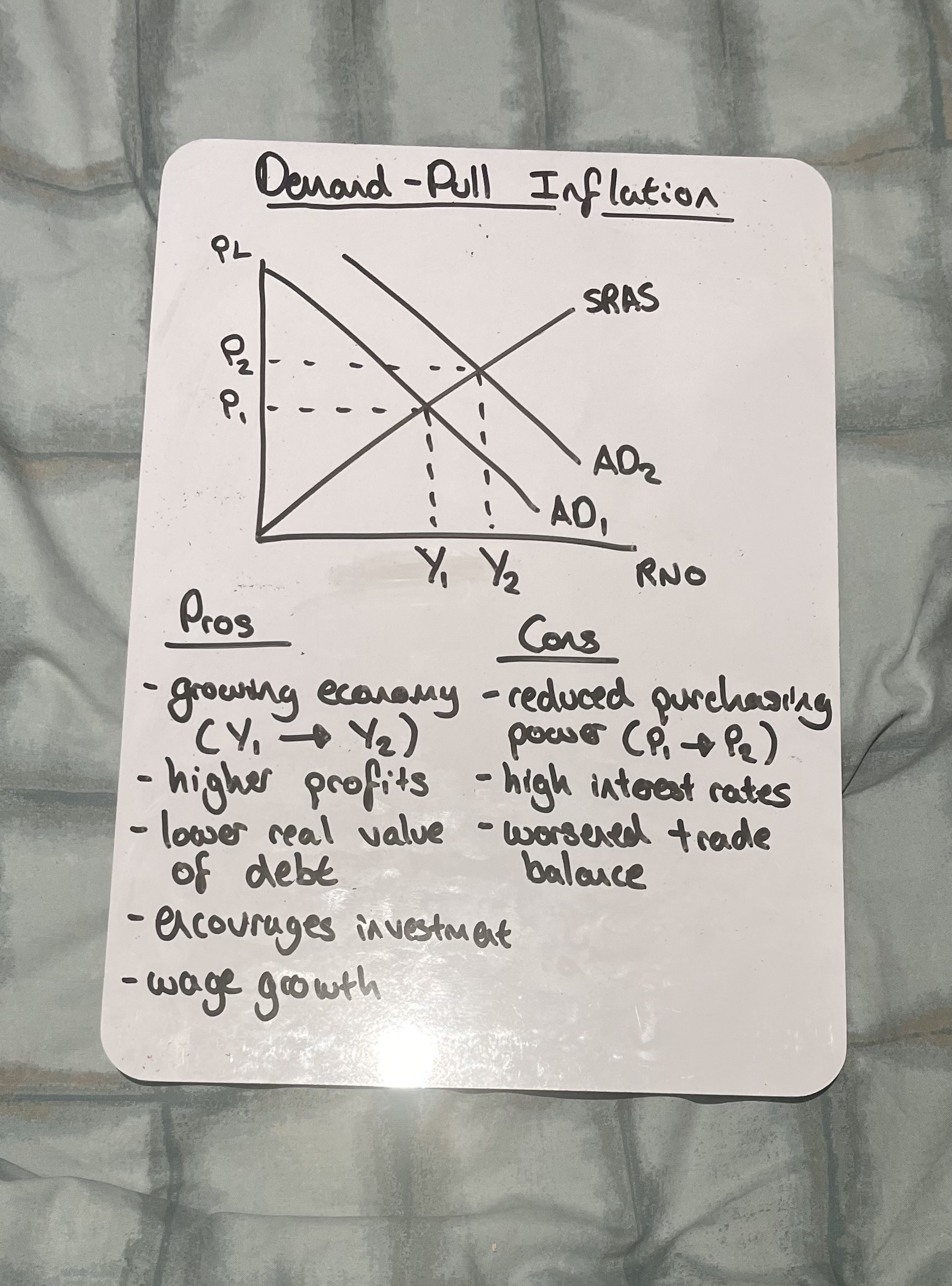

What is demand-pull inflation

Demand-pull inflation occurs when aggregate demand grows unsustainably, putting pressure on resources and causing producers to increase prices

Draw demand-pull inflation

What are the key trigger for demand-pull inflation

Depreciation of the exchange rate

Fiscal stimulus (Lower taxes or more govt spending)

Lower interest rates

High growth in export markets

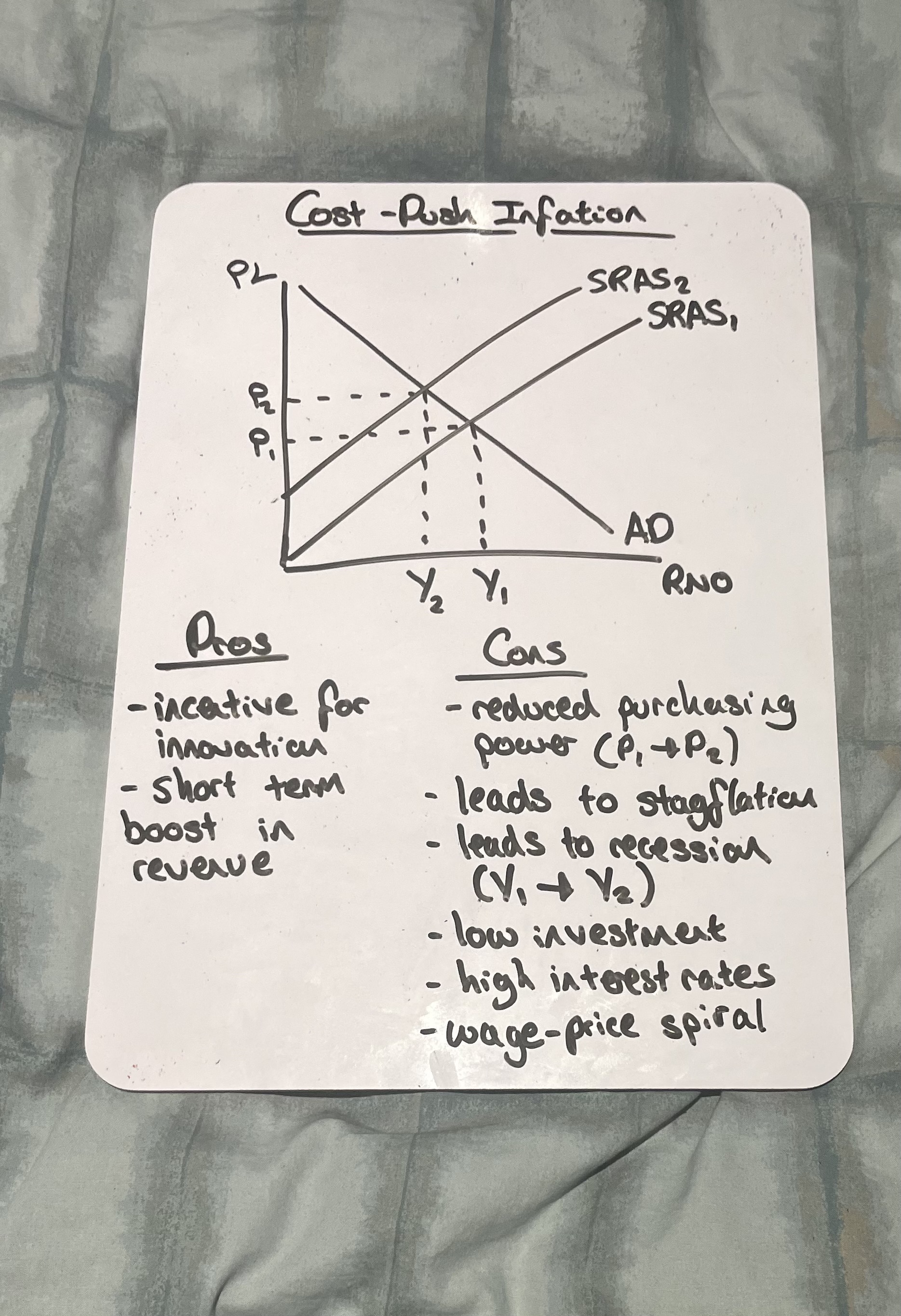

What is cost-push inflation

Cost-push inflation occurs when firms face rising costs of production, pushing up the general price level

Draw cost-push inflation

What are the key factors causing cost-push inflation

Rising commodity prices (e.g. oil)

Increased labour costs

Indirect taxes

Depreciation of the exchange rate

Effect of inflation on consumers

Consumers on low and fixed incomes are hardest hit by inflation due to the rising costs of necessities, which reduces their purchasing power

Effect of inflation on loans

Inflation reduces the real value of debt, making it easier for consumers with loans to repay them

Effect of inflation on firms

High inflation can make borrowing and investing less attractive

Workers may demand higher wages, increasing production costs

Firms may lose global competitiveness if inflation is higher than in other countries

Effect of inflation on the govt

The government may need to increase state pensions and welfare payments due to the rising cost of living

Effect of inflation on workers

Real incomes fall, reducing disposable income

Firms may make redundancies to cut costs

Economic effects of deflation

Economic decline and rising unemployment

Consumers with high debt face more difficulty repaying loans

Wages may fall, leading to lower disposable income and spending

What is Fisher’s equation of exchange

Fisher’s equation is: MV = PQ

M= money supply

V = velocity of circulation

P = price level

Q = quantity of real goods sold