Business unit 1

1/71

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

72 Terms

challenges for starting a business

lack of finance

unestablished customer base

cash flow problems

marketing problems

people management problems

production problems

legalities

high production costs

poor location

not able to handle external influences

opportunities for starting a business

growth— increase in value

earnings—profit

transference and inheritance— something you can pass onto your children

personal challenge

autonomy

security— you’re your own boss

hobbies

public sector

owned by the government

private sector

controlled and owned by private individuals rather than by the government

aims of private sector companies

earn profit

aim of public sector companies

provide essential goods and services that would be underprovided or inefficiently provided by private sector.

reasons for public sector business activity

ensure everyone has access to basic services such as education, health care, etc.

avoid wasteful competition as gov. is able to achieve huge economies of scale.

protect citizems and businesses through institutions such as the police

create employment opportunities

sole trader

an individual who owns their personal business. Unincorporated(no difference between person and their business)

sole trader advantages

few legal formalities

profit taking

being your own boss

personalised service to customers

privacy(dont have to make financials public)

quicker decision-making

sole trader disadvantages

unlimited liability

limited sources of finance

high risks

workload and stress

limited economies of scale

lack of continuity

partnership

for-profit private sector business owned by 2-20 persons

silent/sleeping partners

raise money from owners who do not actively take part in the running of the partnership but have a financial stake in it

advantages of partnerships

financial strength

specialisation and divison of labour

financial privacy

cost-effectiveness

disadvantages of partnerships

unlimited liability

lack of continuity

prolonged decision-making

lack of harmony

privately held companies

businesses owned by their shareholders

limited liability that cannot raise share capital from the general public via stock exchange

shares only sold to friends and family

shareholders

individuals who have invested money to provide share capital for a company or corporation

owners of a limited liability company. shares in a company can be held by individuals or other organisations

Annual general meeting

shareholders vote on resolutions

re election of BOD

ask questions to CEO

approve financial accounts

limited liability

shareholders do not stand to lose personal belongings if the company goes into bankrupcy or liquidation.

advantages of limited liability companies

raising finance— can raise lots by selling shares

limited liability— easy to attract investors

continuity— business is a separate legal entity

benefit from economies of scale

productivity— can hire directors + specialists to run firm— no need for owner’s direct involvement

tax benefits

disadvantages of limited liability companies

communication problems— as it becomes larger, more impersonal

added complexities

compliance costs

disclosure of information— more bureaucracy

loss of control

publicly held companies

shares many similarities with privately held companies

able to advertise and sell shares to general public via stock exchange

flotation

when a publicly held company first sells all or part of its business to external investors(shareholders) (IPO)

Initial public offering

makes the publicly held company listed on a public stock exchange

social enterprise

revenue-generating businesses with social objectives at the core of their operations.

main goals:

achieve social objectives

earn revenues in excess of their costs

benefits of social enterprises

use financial surplus to benefit others in society, beyond personal rewards for shareholders and owners

create employment opportunities, thereby improving the economic and social landscape of local communities

run in a transparent way, providing tangible benefits

can be private sector, public sector or a cooperative

private sector for-profit social enterprise

reinvest or donate any surplus to create positive social change

ethical business practises

public sector for-profit social enterprises

state-owned social enterprises run in a commercial way

help raise gov. revenue and provide essential services that may be inefficient or undesirable if left to private sector

cooperatives

for-profit social enterprise owned and run by their members, such as employees or customers, with the common goal of creating value for their members by operating in a socially responsible way.

advantages of cooperatives

incentives to work bc have a stake in cooperative— enhances self-motivation and productivity

decision-making power— employees have a say in how business is run

social benefits— run on socially responsible principles

public support— people want to help them succeed

disadvantages of cooperatives

disincentive effects— inefficient management bc cooperatives do not pay high

limited sources of finance

slower decision-making bc democratic

limited promotional opportunities

non-governmental organisations (NGOs)

private organisations that pursue activities to relieve suffering, promote basic social services or undertake community development.

private sector or not for profit social enterprises

vision statement

outlines an organisations aspirations in the distant future

mission statement

simple declaration of the underlying purpose of an organisation’s existence and its core values. clearly defined and realistically achievable

differences between mission and vision statements

vision addresses ‘what do we want to become’ while mission addresses ‘what is our business’

mision statements updated more frequently than vision statements

objectives

The goals or targets an organisation strives to achieve.

why are organisational objectives important

to measure and control— help to control a firm’s plans

to motivate— can help inspire managers and employees to reach a common goal

to direct— provide a clear focus

advantages of having ethical objectives and practices

improved corporate image

increased customer loyalty

cost cutting

improved staff morale and motivation

disadvantages of having ethical objctices and practices

compliance costs high

lower profits

stakeholder conflict

subjective nature or business ethics

stakeholder

an individual, group, or organisation with a direct interest or involvement in the operations and performance of a business

corporate social responsibility

conscientious consideration of ethical and environmental practise related to business activity

internal stakeholders

members of the business namely employees, managers and directors, and shareholders

external stakeholders

not part of the business but have a direct interest or involvement in the organisation. comprised of customers, suppliers, financiers, pressure groups, competitors, the government

conflict between stakeholders

differences in the varying needs and priorities of the various stakeholder groups of a business

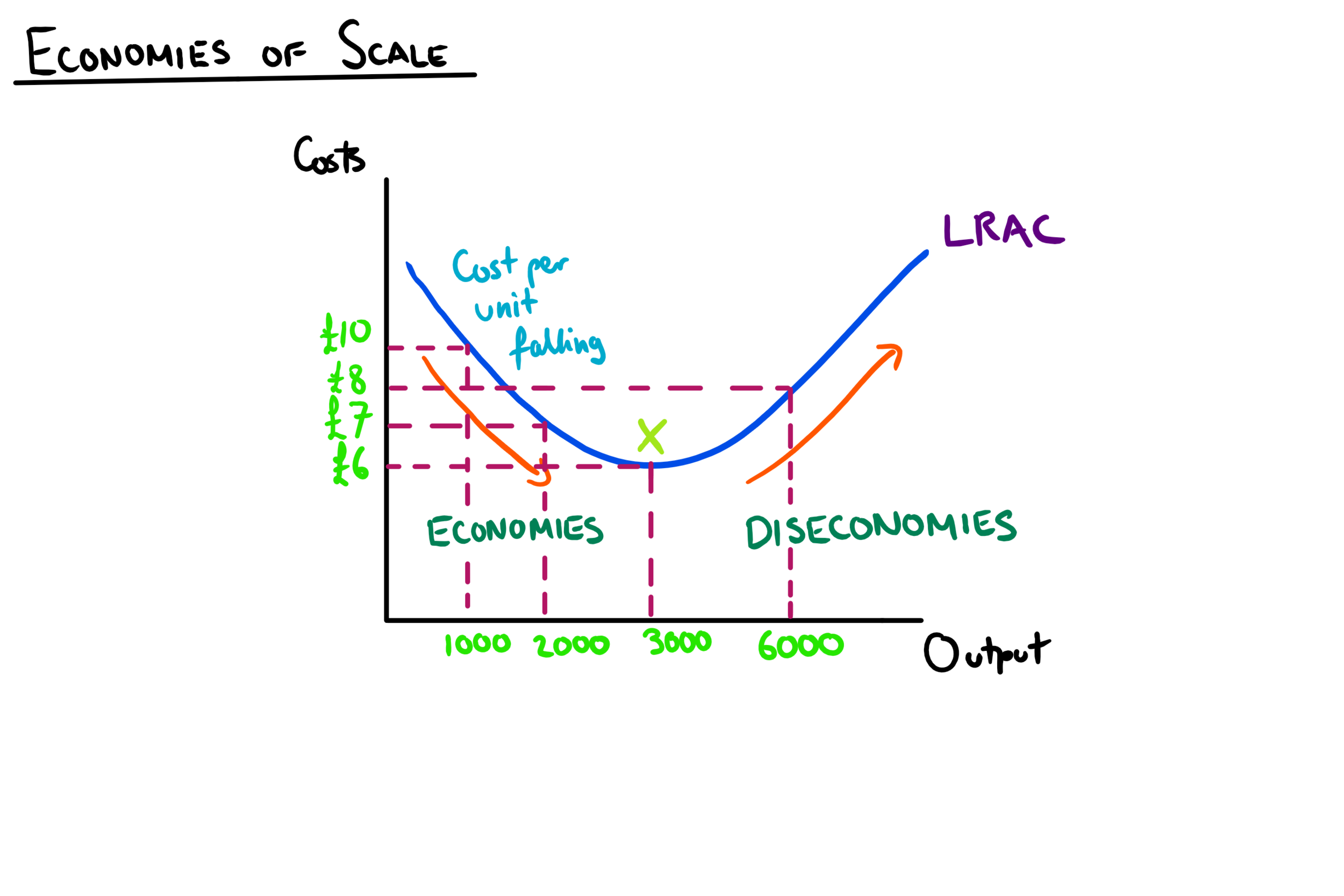

economies of scale

lower average cost of production as a firm operates on a larger scale due to an improvement in its productive efficiency

types of economies of scale

technical economies of scale— big companies use sophisticates capital and machinery to mass produce

financial economies— large firms can borrow large sums of money

managerial economies

specialisation economies— division of workforce rather than management

diseconomies of scale

in a larger firm, managers lack control and coordination

likely to be poorer working relationships in an oversiyed business

workers become bored with repeating tasks within larger workforce with high specialisation leads to lower productive efficiency

amount of bureaucracy grows as a business does

internal growth usually generated by

Gaining greater market share

Product diversification

Opening a new store

International expansion

external growth takes place in one of three ways:

Vertical integration (forward or backwards)

Horizontal integration

Conglomerate integration

advantages of internal growth

The pace of growth is manageable

Less risky as growth is financed by profits & there is expertise in the industry

Avoids diseconomies of scale

The management know & understand every part of the business

disadvantages of internal growth

The pace of growth can be slow & frustrating

Not necessarily able to benefit from economies of scale

Access to finance may be limited

advantages of external growth

quicker than organic growth

synergies

reduced competition

economies of scale

spreading of risks

disadvantages of external growth

more expensive than internal growth

greater risks

regulatory barriers

potential diseconomies of scale

conflict

possible loss of control

merger and acquisition

A merger is a mutual agreement between two or more businesses to join together as a single business

An acquisition occurs when one company takes complete control over another by acquiring more than 50 per cent of its share capital

A friendly takeover is where acquisition has the approval and support of the directors of the target company

A hostile takeover occurs against the will of the target company's board of directors

advantages for mergers and acquisitions

increased market share

economies of scale

entering new markets

less competition

disadvantages of mergers and acquisitions

diseconomies of scale

culture clash

inefficiencies

possible lack of expertise in new products/ industries

joint venture

A joint venture occurs when two businesses join together to share their knowledge, resources and skills to form a separate business entity for a specified period of time

Businesses may choose a joint venture to reach a new market as it may be more cost effective than exporting, licensing and franchising

advantages of a joint venture

Economies of scale gained from costs spread over larger output can lead to increased profit margins

Both businesses retain their own identity as the joint venture is set up as a separate business for a limited period of time

When the joint venture comes to an end the partners continue to operate their original businesses as before

Opportunity to enter new markets which otherwise may be closed to the business

Joint ventures often involve the exchange of technology, expertise, or specialised knowledge

This can enhance the capabilities of the venture and provide access to new opportunities

disadvantages of a joint venture

In a joint venture both businesses have a say in decision-making

This shared control can lead to conflict especially if the partners have different management styles or strategic goals

Reaching agreement may require extensive negotiations which can slow down the decision-making process

Sharing sensitive information such as trade secrets can be a concern if the partners are competitors

A culture clash between the two businesses can affect the quality of the business, leading to poor sales

Joint venture partners share both profits and costs

If one partner contributes more resources or effort than the other there may be disagreements about the distribution of profits leading to conflicts

strategic alliances

Strategic alliance agreements are similar to joint ventures

Businesses collaborate for a period of time to achieve a specified goal

They agree to work together for their mutual benefit

Resources are often shared

advantages of strategic alliance

limit risk

share resources

access to new markets

less competition

disadvantages of strategic alliance

culture clash

conflicts of interest

share profit

expose trade secrets

franchising

Franchising is a business model where an individual (franchisee) buys the rights to operate a business model, use its branding and software tools and receive support from a larger company (franchisor) in exchange for an initial lump sum plus ongoing fees

Franchising is a popular way to achieve rapid global growth

The franchisee operates the business under the franchisor's established system and receives training, marketing support, access to software and other systems and ongoing assistance

advantages for the franchisor

rapid growth without having to risk large amounts of money

allows company a national or international presence

rapid growth without having to worry about running costs such as recruitment, training and development, staff salaries, etc.

advantages for franchisee

low start up costs

low risk

likely to benefit from large scale advertising by franchisor

disadvantages for franchisor

huge risk in allowing other parties to use franchise’s name

can be difficult to control daily operations of all franchisees

franchising slower than M&A

disadvantages for franchisee

franchisee cant use own initiative to try out new ideas

buying a franchise very expensive

franchisees have to pay significant percentage of their sales revenues to franchisor

multinational company(MNC)

a business that is registered in one country but has manufacturing operations/outlets in different countries

reasons for MNC(multinational company) growth

Factors such as globalisation and deregulation have contributed to the growth of MNC’s

Globalisation has made it easier for firms to do business on a global scale and the number and size of MNCs continues to increase

Deregulation through trade liberalisation and the harmonisation of financial and technical standards has made it easier for businesses to operate in diverse locations

reasons for becoming an MNC

risk management

economies of scale

increased profit

create employment

enter new markets

transportation

avoid trade barriers

tax incentives

impact of MNCs on host countries

Many governments are in favour of MNCs establishing in their country as there are benefits to the wider economy

MNCs offer both advantages and disadvantages for a host country with regard to:

Employment, wages and working conditions

The impact on local businesses

The impact on the local community and environment

The impact on the national economy

advantages of an MNC to host country

boost local economy creating jobs + opportunities for local businesses

MNCs often invest to improve infrastructure

MNCs can bring new technologies and skills to local businesses

disadvantages of MNCs to the host country

MNCs may exploit local workers

may not create jobs for local workers as may just relocate workers from their own country

MNCs can push domestic businesses out of the marker