Intangible assets IAS38- week 8

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

What is the definition for an intangible asset?

An identifiable non monetary asset without physical substance

What must an intangible asset be?

It is identifiable - it is separable or arises from contractual or legal rights

Controlled by the entity

Probable future economic benefits

What are the 3 sources that intangible assets come from?

Acquired seperately from 3rd parties

Acquired as part of a business combination of another entity

Internally generated

What is the initial measurement for Intangible assets seperately acquired from third parties?

At its cost. This includes purchase price and any costs directly attributable to bringing asset location in which it can operate.

What is the initial measurement for Intangible assets acquired as part of a business combination of another entity?

Measured initially at fair value

What is the definition for fair value?

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

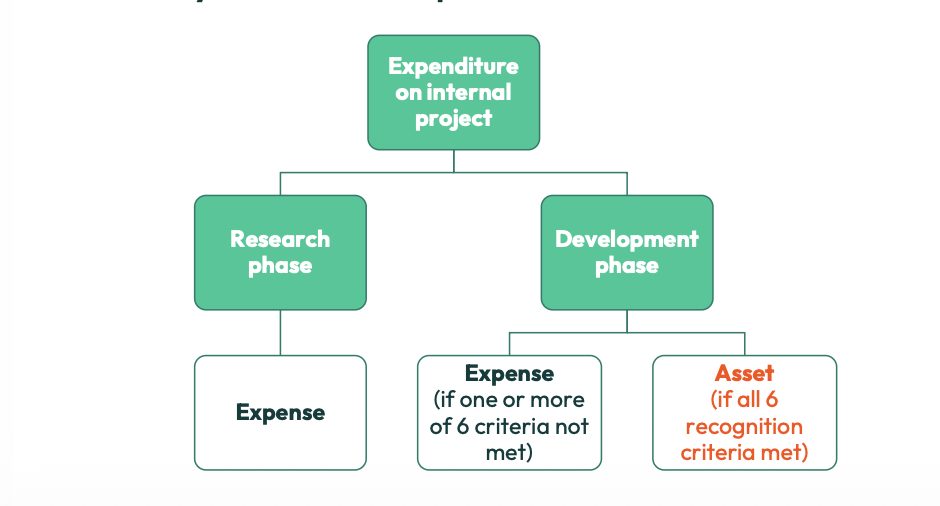

Should all internally generated Intangible assets be recognised as assets?

NO, only development costs if they meet 6 specific criteria

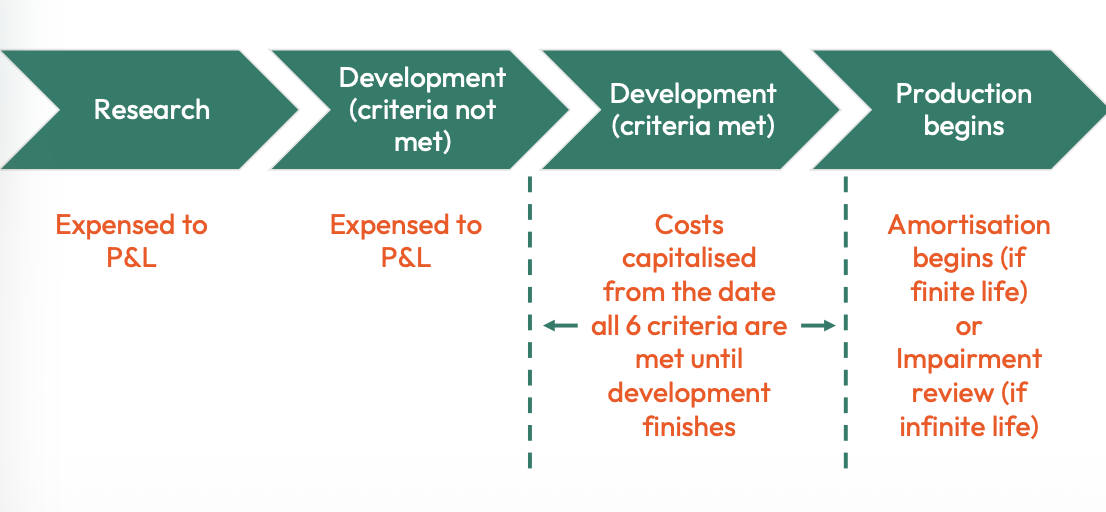

What is the definition for research? (Internally generated IA’s)

Original and planned investigation undertaken to gain new scientific knowledge and understanding.

Research costs should always be expensed as incurred

What is the definition for development costs?

The application of research findings to produce new or substantially improved items before commencement of commercial production.

What are the 6 specific criteria that must be met for development to be classed as an asset?

Probable future economic benefits and existence of market

Intention to complete

Resources are adequate

Ability to use/sell

Technical feasibility

Expenditure can be measured reliably

What is the summary of research and devlopment expenditure?

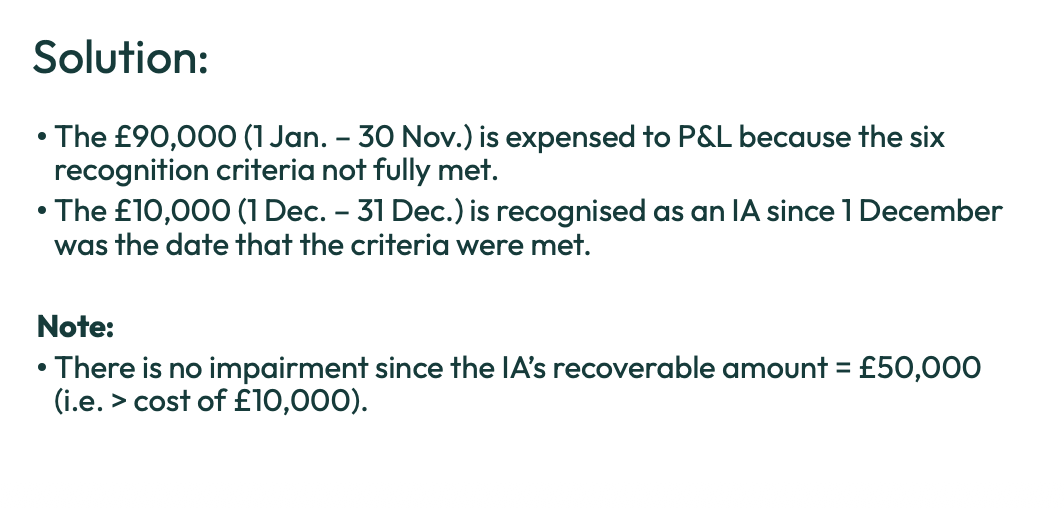

After initial recognition what are the two ways to measure Intangible Assets?

When we revalue at fair value what must fair value be measured reliably with reference to?

An active market

A market where the items traded are homogenous and the willing buyers and sellers can normally be found at any time and the prices are available to the public

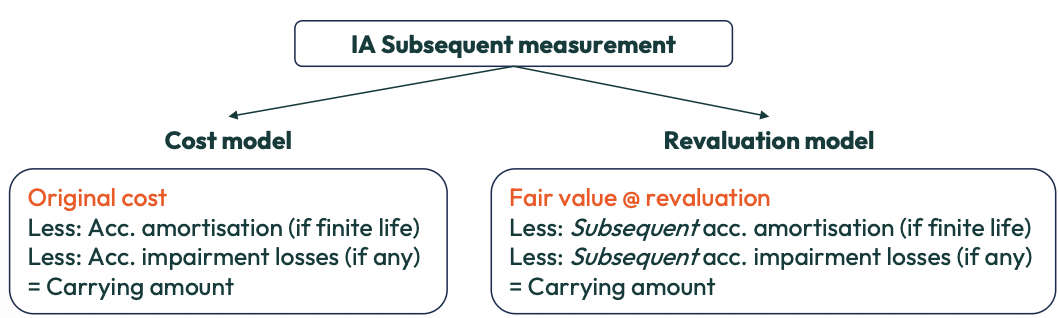

Should an entity assess the useful life of an intangible asset?

Yes

What are the two types of useful life of an intangible asset?

Finite

Indefinite- when there is no forseeable limit to the period over which the asset is expected to generate economic benefits for the entity

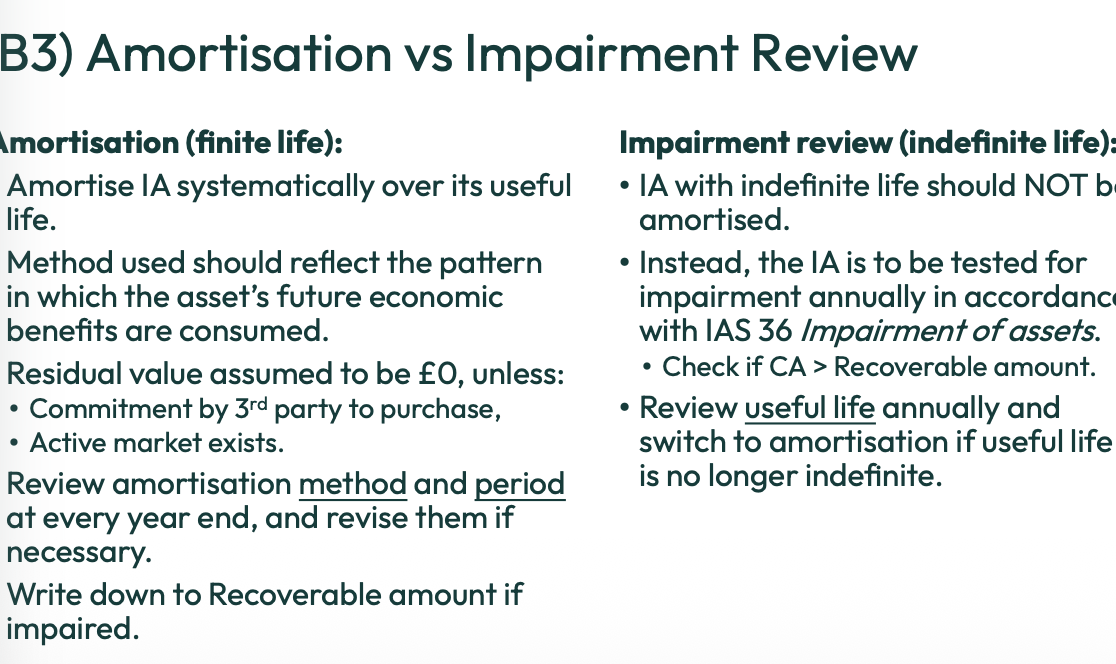

When do we carry out amortisation?

When the useful life of an intangible asset is finite

Amortised over useful life

Tested for impairment when indicators exist

When do we carry out impairment review?

When an intangible asset has an indefinite useful life.

Not amortised

Tested for impairment annually

What is the amortisation vs impairment review?

What is the summary of the accounting treatment?

What does it mean to capitalise a cost?

Instead of recording the cost as an expense immediately, you record it as an asset on the balance sheet because it will provide future economic benefits

The cost is then expensed gradually over time, usually via depreciation or amortization

What are some examples of IA’s with finite useful lives?

Patents

copyrights

software

customer contracts

When should an intangible asset be derecognised?

It is disposed of

No further economic benefits are expected from its use.

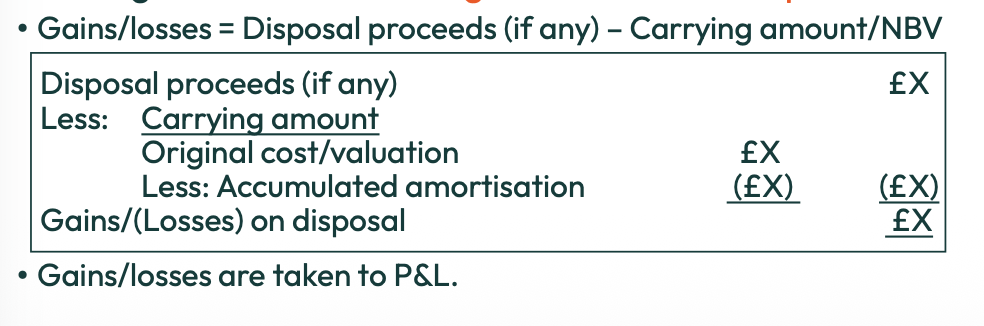

What does derecognition lead to?

Gains or loss on derecognition: Disposal proceeds- Carrying amount

Recognised in profit or loss

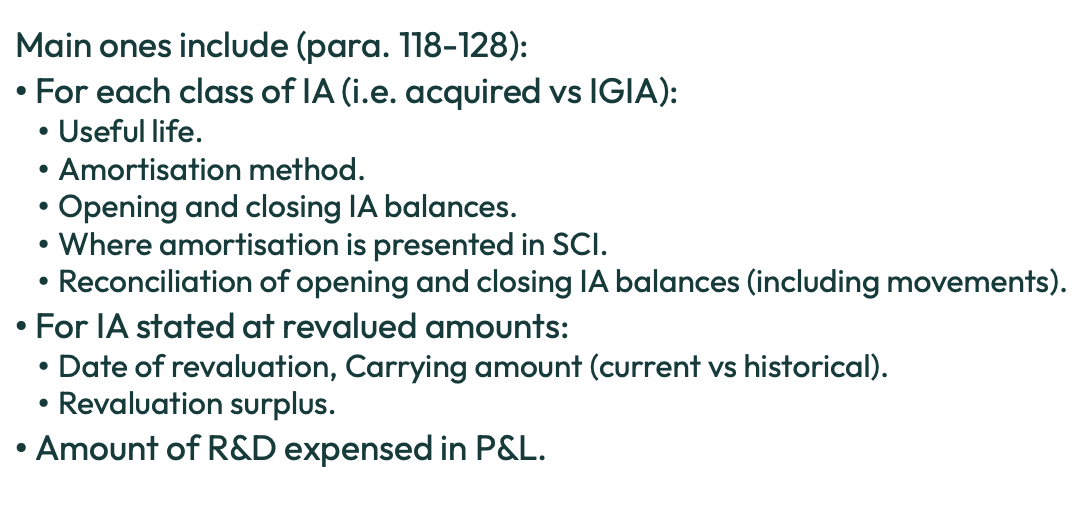

What must be disclosed for intangible assets?

What do IAS38 state about amortisation?

The cost less residual value of an intangible asset with a finite useful life should be amortised on a systematic basis over that life, and that the amortisation method should reflect the pattern of benefits consumed.

When would we change the amortisation method?

If the pattern of consumption benefits has changed. E.g. future reductions in sales could be indicative of a higher rate of consumption of the future economic benefits embodied in an asset.

When we have an impairment what do we write it down to?

The recoverable amount which is the higher of fair value less costs of disposal and value in use.

An impairment loss is taken to SPL

What does IAS38 say about internally generated brands?

Internally generated brands shall not be recognised as intangible assets because costs incurred on the masthead cannot be distinguished from the costs of developing the business as a whole.

What do we recognise as expenses when they occur, research or development costs?

Research costs

(only with development costs if fails to meet 6 specific criteria)

What must occur for development costs to be recognised as assets?

Six specific criteria must be met.

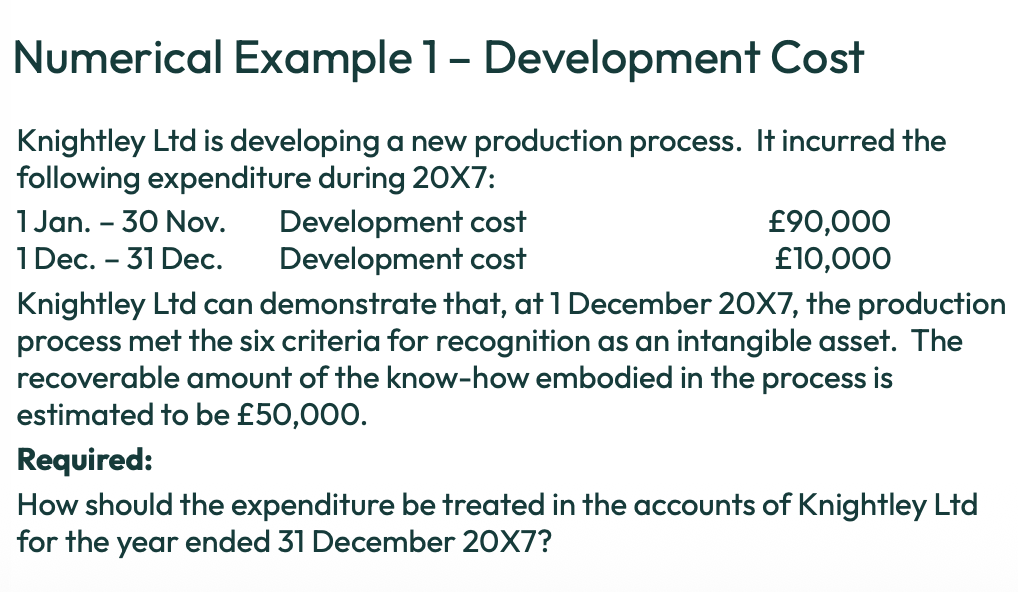

Explain the accounting treatment for this project, Project C – Recyclable tableware

Work on this project started in the current year. Out-There PLC is using circular economy research to create recyclable tableware that will be acceptable to business class and first- class passengers. If successful, it has the potential to generate significant income. Costs incurred during the current year amount to £50,000.

This project is clearly in its research phase

There is no certainty regarding the ultimate success or viability of the project, and therefore all of the costs incurred during the current year of £50k are recognised as a research expense in the SOPL/

Explain the accounting treatment for this project,

Work on this project has started in the current year. Samples of the carpet have been made, and tests have shown that stains can be wiped clean with water. At least ten national airlines have expressed interest in the new carpet. It is expected that the carpet will be available for fitting during the second half of 20X7. The project is expected to cost £700,000, for which the company has set aside funds to finance. Of the £550,000 total costs incurred during the current 20X6 financial year, £100,000 relates to the initial investigation into the feasibility of the project, and £450,000 relates to the application of the findings and the manufacture of carpet samples for demonstration purposes. Expected income is estimated at £800,000 per year for at least the next five years.

Project appears to be technically feasible (tests have shown that stains can be cleaned with water)

There is an intention to complete (completion expected during 20X7)

There is an ability to sell the product (airlines have expressed an interest)

It will generate future economic benefits (estimated income of 800k per year)

There is available resource to complete (the company has set aside funds)

The entity is able to measure the expenditure reliably (current year costs are recorded and estimated future costs are available)

The project meets the recognition criteria in IAS38 for development cost to be recognised as an asset

Explain the accounting treatment for this project,

Work on this project started in 20X4. Out-There PLC has been commissioned by a major airline group to transform the business class experience with a new business class capsule incorporating a lie-flat seat, entertainment with quality sound and a more comfortable dining provision. The design is complete, and a prototype has been made. The airline group likes the concept, but there are significant issues with the weight of the capsule. Out-There PLC currently does not have the expertise or financial resources to commit to redesigning the capsule with a different material. External consultants will need to be hired, and bridging finance obtained. However, the directors of Out-There PLC are committed to delivering on this project. Costs incurred during the years ended 31 December 20X4 and 31 December 20X5 amounted to £1.5 million. Costs incurred during the current 20X6 financial year amount to £800,000. Future redesign costs are estimated to be at least £2 million. If successful, the expected income is estimated to exceed £12 million.

The project appears to be technically feasible (a prototype has been made)

There is an intention to complete (management committed to deliver on the project)

There is an ability to sell the product ( project commissioned by an airline group

It will generate future economic benefits (estimated income exceeding £12m)

The entity does not have the available technical and financial resources to complete

The entity is able to measure the expenditure reliably (past and current year costs are recorded, and estimated future costs are available)

The project meets 5 out of 6 recognition criteria so the costs incurred in the current year of £800k are recognised as a development expense in the SOPL

How do we recognise and measure this,

The company purchased a brand on 1 January 20X0 for £2,000,000. At acquisition, the estimated useful life of the brand was 20 years, and this has remained unchanged. There is no commitment from a third party to acquire the brand at the end of its useful life. At 31 December 20X3, the directors believe that the brand is now worth £5,000,000.

The brand was acquired on 1 Jan 20X0 and would have been accounted for as a (seperately acquired) intangible asset at a cost of £2m initially

Given there is no active market, the brand should be measured using the cost model

The brand has a finite useful life of 20 years and an estimated residual value of 0 so use straight line methods

amortisation charge: 2-0/20 = 100k per annum for 20X0 and 20X2

20X3 the amortisation charge remains the same. The directors own assessment of the brand value (£5m) is irrelevant since it is not a fair value from an active market

Carrying amount at 31 Dec 20X3 = 2 - (100k x 4) = 1.6 m

How do we recognise and measure this,

In the past, the company began a research and development programme (known as the Super Tin project) for a new vacuum-sealed tin that extends the shelf life of tinned food. During the current year, £300,000 was incurred on research costs from 1 January 20X3 to 31 March 20X3. On 1 April 20X3, the R&D director announced that all the development phase recognition criteria stipulated by IAS 38, Intangible Assets, had been met. A further £1,500,000 was incurred on development costs from 1 April 20X3 to 31 December 20X3. At this stage, the directors believe that the Super Tin project will have an indefinite useful life. The recoverable amount of the Super Tin project at 31 December 20X3 is estimated at £2,000,000.

IAS requires research costs to be expensed whilst development costs to be capitalised (as an asset) if and only if all 6 criteria are met

The £300k research cost incurred from 1 Jan to 31 March should be treated as an expense in the P&L

The development project met the 6 criteria on 1 April, hence any development cost incurred from that date (£1.5m) must be capitalised as an asset on the SFP

The development project has an indefinite useful life, no amortisation should be charged

Instead, the capital cost should be reviewed for impairment. The Recoverable amount of £2m is > £1.5m carrying amount so no impairment write down.

How do we recognise and measure this,

A large advertising promotion was carried out during the second half of the 20X3 year at a cost of £220,000. The costs relate to the creation of advertising brochures and the recording of a radio advert. The directors believe that the main benefits of this programme will occur during the 20X4 year. In addition, an amount of £25,000 was paid in advance to the BBC to air the adverts during 20X4.

The costs of the advertising of £220k must be recognised as an expense

IAS38 prohibits the recognition of advertising costs as an asset because the costs incurred and the future economic benefits that may flow from these costs cannot be reliably distinguished from the costs of developing the business as a whole.

The £25k advertising expense is a prepayment because the advertisement is to be aired in 20X4. Prepayment is recognised as a current asset as it is a resource controlled by the entity (the slot on BBC) that arose from a past event ( paid in cash).

How do we recognise and measure this,

The company publishes its own consumer magazine and has incurred costs of £270,000 in previous years in promoting the magazine and its masthead, ‘Food Matters’. A further £30,000 was incurred in the current 20X3 financial year. The directors believe that the masthead is very valuable and can be sold for at least £1,300,000.

This is an internally generated masthead that may never be recognised as intangible assets.

The £270k incurred in previous years and the £30k incurred in the current year must be expensed.

Since the masthead is not recognised as an asset it cannot be revalued

Can internally generated brands be recognised as an intangible asset (capitalised)?

No

Not identifiable (cannot be seperated or sold on its own)

Cannot be measured reliably

Arises from a mix of reputation,staff skills etc

What is the definition for residual value?

The estimated amount that an entity would obtain from disposal of an asset, at the end of its useful life, after deducting estimated costs of disposal.

Can research costs be capitalised?

NO, research costs are always expensed

Occur before technical and commercial feasibility is proven

Future benefits are highly uncertain

Are intangible assets current or non current assets?

Non current

Non monetary assets without physical substance that are identifiable and expected to provide future economic benefits over more than one year.

Explain to me why intangible assets cannot be current assets?

They provide long term benefits

Current assets are expected to be used,sold or realised within 12 months

If a project is still in its research phase do we recognise it as an intangible asset?

No, the costs would be recognised as a research expense in the SOPL

There is no certainty regarding the ultimate success or viability of the project

Why are research costs always expensed ?

No reliably measurable future economic benefit because in research you are investigating new ideas

High uncertainty

If there is no active market what is the subsequent measurement?

The cost Model

What is NOT an intangible asset?

Internally generated goodwill

Training costs

advertising and promotion costs

Start up costs

Research costs (these are expensed)

When can an intangible asset be recognised?

It is probable that future economic benefits will flow to the entity

The cost of the asset can be measured reliably

What is impairment?

Carrying amount > recoverable amount - impairment loss

Loss recognised in profit or loss