3.3.4: Normal profits, supernormal profits and losses

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

what is accounting profit?

total revenue - total costs

where TR = P x Q

TC = cash flows of FC (fixed costs) + VC (variable costs)

what do economists also consider the opportunity cost of being in business?

regarded as a fixed cost

thus included in the TC figures

OC of being in business = ‘normal profit’

what is normal profit?

the minimum return needed for an entrepreneur to stay in business in the long run

= OC (opportunity cost) of capital and enterprise

supernormal profit (abnormal/economic profit)

any profits in excess of normal profit

how to calculate normal profits?

= ask: how much could be earned as return if you invested your capital and enterprise elsewhere?

how to calculate supernormal profit?

= ask: how much is actually being earned as a return for capital and enterprise? Compare this figure to normal profit figure.

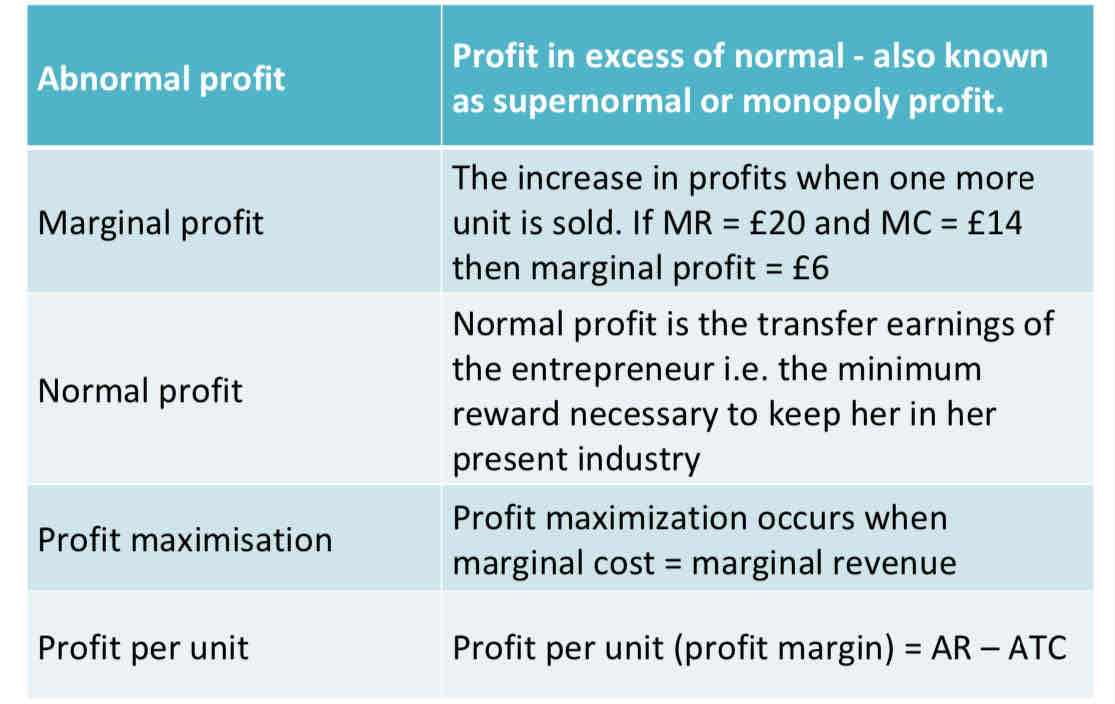

what are the key profit concepts?

what is sub-normal profit?

profit less than normal (i.e. price per unit < average cost)

what are supernormal profits?

Profit achieved in excess of normal profit (known as abnormal profit).

made when price > AC

When firms are making abnormal profits, there is incentive for other producers to enter a market to acquire some of this profit

calculating economic profit example

The data below is for an owner-managed firm for a given year

Total revenue £320,000

Raw material costs £30,000

Wages and salaries £85,000

Interest paid on bank loan £30,000

Salary the owner could have earned elsewhere £32,000

Interest forgone on capital invested in the business £20,000

In a simple accounting sense, the business has total revenue of £320,000 and total costs of £145,000 giving an accounting profit of £175,000.

But profit according to an economist should take into account the opportunity cost of the capital invested and the income that the owner could have earned elsewhere.

Taking these two items into account we find that the economic profit is lower equal to £123,000

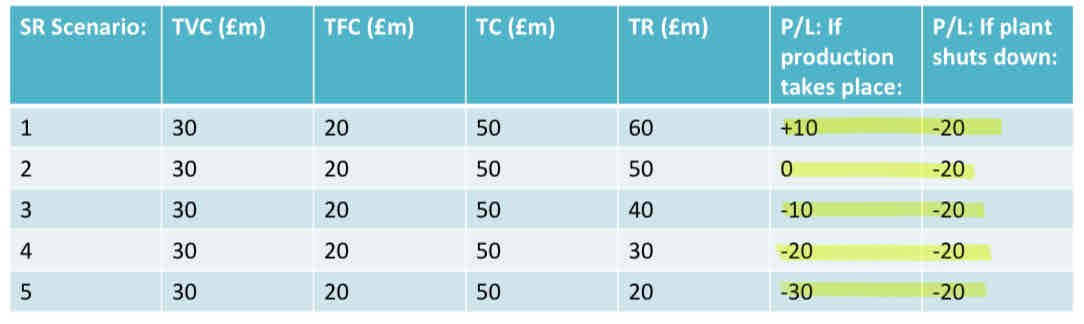

will a firm carry on in business if it is making less than normal profit? (scenario)

A firm faces total costs of £50m (remember: this includes the opportunity cost of being in business)

These costs are split into total fixed costs (£20m) and total variable costs (£30M). The fixed costs in that period are payable even if the plant is shut down.

Will the firm stay in business if it generates total revenue of £40M (i.e. a subnormal profit of £10m)? How does your answer change:

1. In the short run compared to the long run?

2. If total revenue was only £10m?

will a firm carry on in business if it is making less than normal profit?

if TR > TVC or P > AVC

the firm is able to pay all of its VC, and make some contribution towards FC

better to do this in the short-run, than to exit the industry and make no contribution towards FC at all

therefore stays open in the short-run if ATC > P > AVC

AKA loss minimisation

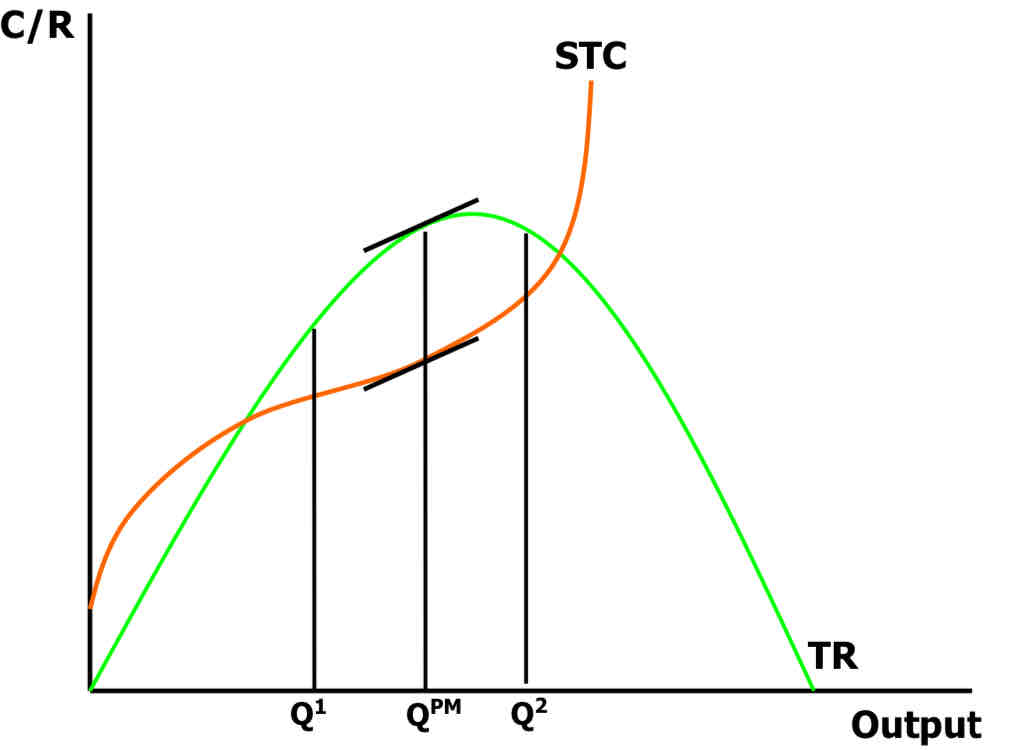

profit maximisation

In order to maximise profits, the firm must:

Choose an output level at which TR is as far above TC as possible (QPM)

…here, the gradients of both curves are equal

…hence MR = MC

Before this point, TR and TC are still diverging, so profits are not yet maximised at Q1 – i.e. can still increase profits by raising output

After this point, TR and TC are converging, so raising output to Q2 will only reduce profits

In other words, when MR = MC:

The cost incurred from producing one more unit of output is equal to the revenue gained from selling it

Hence the profit-maximising potential of the firm has been reached

…and this is where all rational firms will want to operate

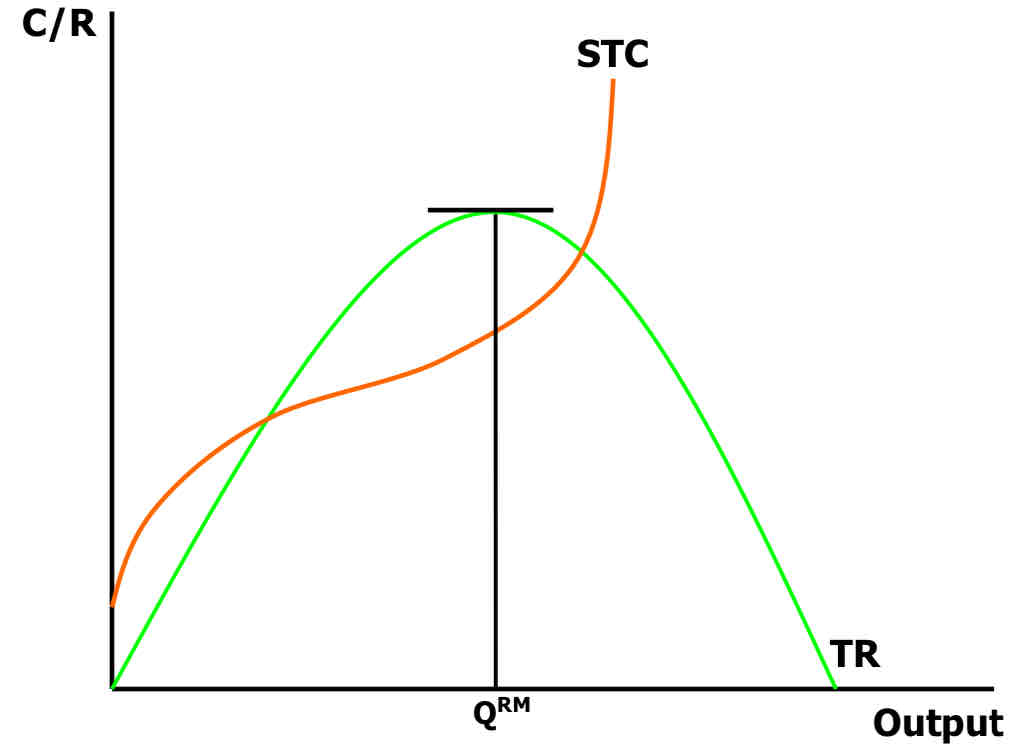

revenue maximisation

In order to maximise revenues, the firm will:

Produce up to the point at which the TR curve is flat (QRM)

…here the slope of the TR curve is zero

…hence MR = 0

sales volume maximisation

In order to maximise sales volumes, the firm will:

Produce the greatest level of output without incurring a loss (QSM)

…hence TR = TC (or AR = AC)

…so the firm covers only TC and returns a normal profit

objectives of the firm

Profit maximisation (MC = MR)

Revenue maximisation (MR = 0)

Sales volume maximisation (AR = AC)

Efficiency Theories:

Productive efficiency (Lowest possible average cost; MC =

AC)

Allocative efficiency (AR = MC)

Why Firms May Not Maximise Profits: The Principal-Agent Problem

The divorce between ownership and control in a PLC firm…

gives rise to the principal-agent problem, which…

…is made possible by information asymmetries between shareholders and management – this may lead to:

Profit satisficing behaviour

Personal ambitions I: Prestige

Personal ambitions II: Pecuniary issues

Whether directors get away with all this will depend on the degree of shareholder activism.

Profit satisficing behaviour

Like all human beings, directors have bounded rationality

So they will make just enough profit to satisfy the demands of shareholders…

…in order to prevent a hostile takeover or a shareholder revolt that would have them sacked

Hence they make satisfactory profits rather than maximum

Personal ambitions I: Prestige

Business press often report on the firm’s revenues and sales volumes more heavily than on profits

∴managers who want to appear successful will focus on boosting sales and revenue – to gain a sense of prestige from running a large firm

Personal ambitions II: Pecuniary issues

Larger firms often have more money floating around – so directors are able to spend more on needless items like large offices, company cars, excess staff, pet projects, etc

Also, director’s bonuses / salaries may be directly linked to revenues or sales volumes – so they will go beyond profit max. to maximise their own rewards