Personal Finance: Chapter 2 Packet Questions

5.0(7)

5.0(7)

Card Sorting

1/66

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

67 Terms

1

New cards

Ways to Put Money INTO Your Checking Account

Make a cash deposit at your bank

Deposit a check at your bank

Use an ATM to deposit your money

Make a mobile deposit

Use Direct Deposit

Transfer money from another account

Deposit a check at your bank

Use an ATM to deposit your money

Make a mobile deposit

Use Direct Deposit

Transfer money from another account

2

New cards

Ways to Take Money OUT of Your Checking Account

ATM withdrawal using a debit card

Visit a bank teller to make a withdrawal

Make a purchase using a debit card

Write a check

Use online bill pay

Transfer money to another account

Visit a bank teller to make a withdrawal

Make a purchase using a debit card

Write a check

Use online bill pay

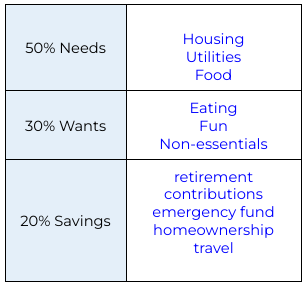

Transfer money to another account

3

New cards

Which are two advantages of having an account at a local community bank versus a national bank?

\

1. Community banks typically have LOWER fees and charges when compared to a national bank

2. Community banks typically give back and support the local community

1. Community banks typically have LOWER fees and charges when compared to a national bank

2. Community banks typically give back and support the local community

4

New cards

True or False: When you deposit your money at a community or online bank, your money is insured by the FDIC up to $250,000.

True

5

New cards

What questions should you ask before opening an account at a national bank, community bank, or credit union?

1. What type of fees are there with this account?

2. Is there a fee for using an ATM? If so, how much?

3. Is there a minimum balance requirement with this account?

4. Do you offer online banking or mobile banking?

6

New cards

Beliefs of opening a bank account

* Keeping your money safe

* More options for paying

* Easier to deal with checks

* Makes paying bills easier

* Makes a paper trail to track your money

* Ability to get cash from an ATM

* More options for paying

* Easier to deal with checks

* Makes paying bills easier

* Makes a paper trail to track your money

* Ability to get cash from an ATM

7

New cards

What is the benefit of making sure your account is FDIC/NCUA insured?

* It covers up to $250,000 per person and makes sure your money is insured

* If the bank goes under, you are insured on every account up to $250,000

* If the bank goes under, you are insured on every account up to $250,000

8

New cards

Why is it important to review your bank statement each month?

* Check for errors

* Check your transactions

* Check your transactions

9

New cards

What is the mathematical formula that you would use to describe the financial activity on a bank statement?

Ending Balance = Previous Balance - Deposits + Withdrawals

10

New cards

What are the main differences between a checking and savings account?

* Savings accounts:

* Earns interest

* Checking account:

* Easy Access

* Might have fees

* Used with debit cards

* Earns interest

* Checking account:

* Easy Access

* Might have fees

* Used with debit cards

11

New cards

How does the age that a person starts saving impact the amount they can earn in compound interest?

* The younger you start, the more interest you will save/earn

12

New cards

Ben is comparing savings accounts at different banks and finds that most are offering an interest rate of about 1%. How does this low interest rate impact the power of compounding?

He won’t earn as much interest throughout the years

13

New cards

What saving account features does the article recommend inquiring about?

Have a mobile app, make electronic deposits, and link other accounts for transfers

14

New cards

What account fees should you avoid with savings accounts?

* Minimum balance fees, transaction fees, maximum withdrawal fees, and maintenance fees

* Should never have to pay a fee

* Should never have to pay a fee

15

New cards

What is a Online Savings Account

* you can typically make a deposit into an online savings account by depositing a check online, through a mobile banking app, or by using an ATM in your online bank's network

* No physical location (all online)

* No physical location (all online)

16

New cards

What is a Traditional Savings Account

* allows you to accumulate interest on funds you've saved for future needs.

* A place to hold your money

* A place to hold your money

17

New cards

What is a Certificate of Deposit

Time deposit account that pays a fixed interest rate over a period of time (30 days to years)

18

New cards

What is a Money Market Account

* You deposit money into a account while earning interest

19

New cards

How much are the average overdraft, maintenance, and out-of-network ATM fees?

* Overdraft: $25

* Maintenance: $5

* Out-of-Network: $1.77

* Maintenance: $5

* Out-of-Network: $1.77

20

New cards

How can you avoid a monthly maintenance fee?

* Open a checking and savings account at the same bank

* Chose a different bank (without a monthly fee)

* Keep a minimum balance

* Chose a different bank (without a monthly fee)

* Keep a minimum balance

21

New cards

What is the average fee charged by large banks for using an out-of-network ATM?

$2.50

22

New cards

What is an excessive transaction fee?

happens when savings account holders withdraw over the federal limit, which is six free withdrawals and transfers per month.

23

New cards

What is an overdraft fee?

charged when a payment or withdrawal from your bank account exceeds the available balance and your bank covers the transaction as part of an overdraft protection service

24

New cards

True or False: Overdraft protection is a required feature of most checking accounts with no ability to opt out.

False

25

New cards

Why do so many people still sign up for overdraft protection when it is not always beneficial for them to do so?

May be a way to avoid the payment recipient from knowing your low bank balance

26

New cards

What is a NSF Fee

* Charged when checks or electronic payments cause your account to go below $0

* This is only charged if no other account protections are in place

* The average fee is around $25.

* All transactions will be declined

* This is only charged if no other account protections are in place

* The average fee is around $25.

* All transactions will be declined

27

New cards

What is a Overdraft Protection

* A service that automatically transfers money from a linked savings account when a transaction would cause your account balance to go below $0

* Transactions are approved and money is transferred from your linked account

* There is sometimes a fee but it will typically be smaller than other options

* Transactions are approved and money is transferred from your linked account

* There is sometimes a fee but it will typically be smaller than other options

28

New cards

What is a Overdraft Coverage

* Charged when any transaction causes your checking account balance to go below $0

* Transaction to be approved and your account will go into negative territory

* The average fee is around $30 per transaction

* Many banks have a limit on the number of these transactions that you can be charged per day

* You can opt out of this outcome

* Transaction to be approved and your account will go into negative territory

* The average fee is around $30 per transaction

* Many banks have a limit on the number of these transactions that you can be charged per day

* You can opt out of this outcome

29

New cards

What is a Low Balance Alert

lets you know when your bank account balance drops to a predetermined amount, which could be $20, $500 or another selected amount

30

New cards

What is a Direct Deposit Alert

lets you know when your paycheck hits your account, which can help in scheduling bill payments and budgeting.

31

New cards

What is a Unusual Account Activity Alert

one that notifies consumers when there’s a change in their account status that’s unusual

32

New cards

What is a Short-term goal

goals you would like to achieve within two months

33

New cards

What is a Medium-term goal

goals you would like to achieve from within two months to three years

34

New cards

What is a Long-term goal

goals you would like to achieve three or more years out

35

New cards

How much are you recommended to save from your paycheck

20%

36

New cards

What categories encompass the portion of your paycheck that is designated for saving?

* 401ks

* 549 Account

* 549 Account

37

New cards

Why does it make sense to start saving or investing right now?

Gives your money time to grow

38

New cards

True or False: When calculating the percentages for each budget category, you should use your pre-tax income

False

39

New cards

What is 50/30/20

50%- Essentials 30%- The “fun bucket” 20%- Financial Goals

40

New cards

When might the 50/30/20 rule not be the best saving strategy to use?

It doesn’t work well with higher income earners

41

New cards

Which strategy will help you save the most money?

As soon as you receive your paycheck, put a fixed amount or percentage of your money directly into your savings.

42

New cards

What is the benefit of automating your savings account contributions?

Your money will be transferred automatically and guarantees you will be contributing to your savings.

43

New cards

What does it mean to "pay yourself first"?

Deposit money into your savings account before spending on anything else.

44

New cards

Why might some people still prefer *manually* saving their money (e.g. manually transfer or deposit money into their savings account)?

So they are able to control where there money goes each month

45

New cards

Why do you think it is recommended that you save 3-6 months of expenses in your emergency fund?

If you lose your job you still want to be able to pay expense while unemployed

46

New cards

Why might it be better to keep your emergency fund money in a separate account?

So you aren’t tempted to touch it

47

New cards

What is the best reason to tap into your emergency fund?

Pay $500 deductible after a car accident

48

New cards

What percentage of Americans could not pay a surprise $400 bill with cash/equivalent?

32%

49

New cards

Main idea of Credit Cards:

People will spend more money when paying with credit cards because they think of it at as a steal or bargain. They will pay it off later

50

New cards

Main idea of Living Paycheck to Paycheck:

* People living Paycheck to Paycheck don’t have a good financial plan or ways to manage their money. Holidays make more people live paycheck to paycheck

* Spending your whole paycheck on necessities causing them to live paycheck to paycheck

* Spending your whole paycheck on necessities causing them to live paycheck to paycheck

51

New cards

Explain how inflation impacts the purchasing power of your money over time.

* The price of the products goes up and you get them same product for more money.

* 1950: have $5- buy 3 burgers

* 2020: have $5- buy 1 burger

* 1950: have $5- buy 3 burgers

* 2020: have $5- buy 1 burger

52

New cards

If inflation causes both prices *and* wages to increase over time, then why would someone need to take inflation into account at all?

They don’t increase at the same rate

53

New cards

How can you counteract the impact of inflation?

Investing your savings/money

54

New cards

Which 3 mobile banking features do consumers consider to be critical?

* Turn card on/off or report lost

* Manage balance or fraud alerts

* Deposit checks

* Manage balance or fraud alerts

* Deposit checks

55

New cards

Which feature is the least important to consumers?

Apple Watch app integration

56

New cards

7 major advantages of online banking

* **Easier bill payments.** You can send payments using your bank’s online banking platform

* **24/7 account access.** Whether you’re on vacation or it’s the middle of the night, you can manage your banking

* **Simpler fund transfers**. It’s easy to move funds between your accounts, such as from checking to savings, using online banking.

* **Better access to bank records.** Whether you need banking records for tax purposes or personal records, you can download statements and transaction records to print them at home.

* **Improved visibility of account balances and transactions.** Knowing your account balances is always a few clicks away.

* **Ability to sync your accounts with your apps**. Online banking allows you to transfer information from your accounts to Quicken, Microsoft Money, Microsoft Excel, and other applications.

* **Use of mobile apps**. Many banks allow you to use your mobile devices for online personal banking.

* **24/7 account access.** Whether you’re on vacation or it’s the middle of the night, you can manage your banking

* **Simpler fund transfers**. It’s easy to move funds between your accounts, such as from checking to savings, using online banking.

* **Better access to bank records.** Whether you need banking records for tax purposes or personal records, you can download statements and transaction records to print them at home.

* **Improved visibility of account balances and transactions.** Knowing your account balances is always a few clicks away.

* **Ability to sync your accounts with your apps**. Online banking allows you to transfer information from your accounts to Quicken, Microsoft Money, Microsoft Excel, and other applications.

* **Use of mobile apps**. Many banks allow you to use your mobile devices for online personal banking.

57

New cards

What is Online Bill Pay

Bill pay is a service offered by many banks and credit unions that lets you set up automatic payments for bills. If you juggle rent or a mortgage, cable and electricity bills, credit card payments and more, online bill pay can save time and help you avoid late fees

58

New cards

What might be the benefit of setting up a recurring payment through online bill pay?

So you don’t have to worry about missing a payment

59

New cards

List at least four people or companies you might want to pay regularly by using online bill pay.

Landlord, Water company, Electric company, Credit card, Car payments

60

New cards

Explain what direct deposit is.

A payment made that is put into a bank account electronically

61

New cards

What information will you need to provide to your employer to set up direct deposit?

Account number, bank routing number, or a voided check

62

New cards

What are the benefits of using direct deposit?

* Not having to go to the bank

* Saving time and paper

* Getting immediate access

* Saving time and paper

* Getting immediate access

63

New cards

Why is it recommended that you avoid doing online banking on public Wi-Fi?

With a public network, you can’t be totally sure who sees what you send online unless each page you visit is encrypted.

64

New cards

How can turning on text and email alerts help keep your account safe?

If they see a purchase or transfer they didn’t make, customers can protect their account against further fraudulent activity by reaching out to the bank immediately.

65

New cards

What is a cashless society?

Cash, paper, and coin currency aren't used for financial transactions. Instead, all transactions are electronic, using debit or credit cards or payment services like PayPal, Zelle, Venmo, and Apple Pay.

66

New cards

How does a cashless society affect your privacy?

* Exposes your personal information to a possible data breach

* The more information you have floating around online, the more likely it is to wind up in malicious hands

* The more information you have floating around online, the more likely it is to wind up in malicious hands

67

New cards

How does a cashless society affect the economically disadvantaged?

* the poor and unbanked will likely have an even harder time in a cashless society. If smartphone purchases become the standard way to transact, for example, those who can't afford smartphones will be left behind.

* They might not have access to a bank account/debit card

* They might not have access to a bank account/debit card