IB Economics HL - Exchange Rate

1/106

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

107 Terms

Exchange rate

Exchange rates are the value of one currency expressed in terms of another currency.

Background on exchange rate

The money that is used within an economy can be referred to as legal tender or currency. Owing to different levels of scarcity, currencies of different economies have different values, therefore they are not exchanged at parity (that is, a one-for-one basis). The rate at which they are exchanged is referred to as that currency’s exchange rate. It is important to note that the value of a currency is always measured in terms of another currency or basket of other currencies. The value of a currency is always measured in terms of another currency.

One dollar will always be worth one dollar within the domestic economy, but it will command different values in relation to other currencies.

Floating exchange rate

A floating exchange rate is where the value of a currency is determined by the demand for and supply of the currency in the foreign exchange market.

Floating exchange rate system details

In a floating exchange rate system, there should be no deliberate attempts by a government to influence the value of its currency. Naturally, a government will influence the demand and supply of a currency when it purchases other currencies for administrative reasons as part of its own expenditure, but the purpose of these purchases must not be to influence the value of its own currency.

The value of currencies in a floating exchange rate system are determined by the --

The value of currencies in a floating exchange rate system are determined by the market forces of demand and supply.

Appreciation

Appreciation is a sustained increase in the value of one currency in terms of another under a floating exchange rate system.

Depreciation

Depreciation is a sustained decrease in the value of one currency in terms of another under a floating exchange rate system.

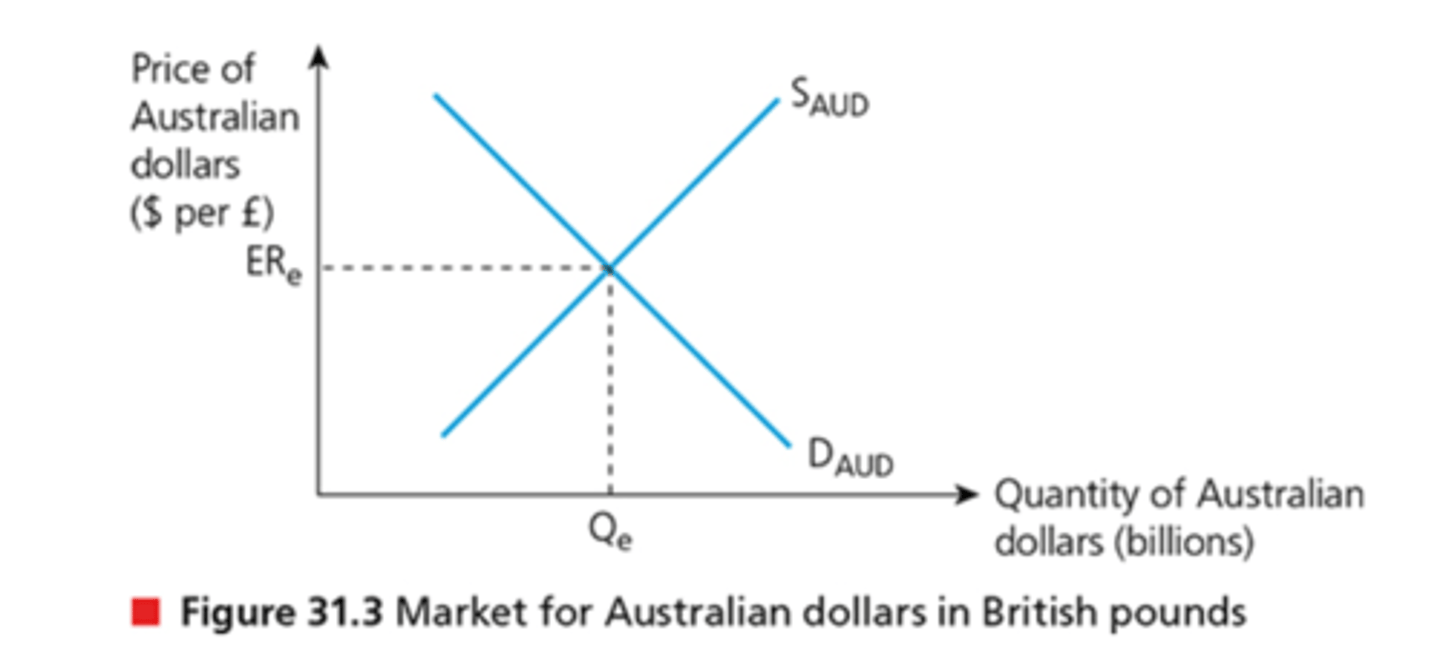

Graph: Market for the domestic currency against the foreign currency

Graph explanation: Market for the domestic currency against the foreign currency 1

In this diagram, the y-axis is labelled the Price of Australian dollars ($ per £), as we are measuring the price of the Australian dollar expressed in terms of another currency (£ in this case). The x-axis is labelled Quantity of Australian dollars and in this case the units are likely to be in terms of billions (as billions of dollars are exchanged between these countries).

Graph explanation: Market for the domestic currency against the foreign currency 2

The supply curve represents the supply of Australian dollars in the foreign exchange market, which comes from holders of Australian dollars willing and able to sell at a range of exchange rates. The demand for Australian dollars on the foreign exchange market comes from those wishing to purchase Australian dollars at a range of exchange rates. The market forces of demand for a currency and the supply of the currency determine the equilibrium exchange rate (ERe) and quantity (Qe).

Graph explanation: Market for the domestic currency against the foreign currency 3

In the diagram, assume there is an increase in the demand for Australian dollars from D1($) to D2($) caused by higher demand in the UK for Australian goods. This is matched by an increase in the supply of British pounds from S1(£) to S2(£) by British buyers who exchange their pounds for dollars to complete their transactions. This means that an increase in the value of the Australian dollar against the British pound from ER1($) to ER2($) is matched by a fall in the value of the British pound against the Australian dollar from ER1(£) to ER1(£). In other words, an appreciation of the Australian dollar against the British pound must result in the pound depreciating in value against the dollar.

Graph explanation: Market for the domestic currency against the foreign currency 4

When changes in demand and supply occur in a currency market, the changes in the value of a currency are determined by the price mechanism, that is, buyers and sellers on the foreign exchange market. This works in the same way that the price and quantity of any other good or service is determined in a perfectly competitive market without government intervention.

Graph: appreciation of the domestic economy's currency against the foreign economy's currency

Graph explanation: appreciation of the domestic economies currency against the foreign economy's currency

In the case of an appreciation of the Australian dollar in this diagram, the increase in demand for the AUD results in excess demand for Australian dollars from Q2 to Q1. This causes the rationing process to begin and signals to holders of Australian dollars that the price of the AUD is about to increase. This generates an incentive for holders of Australian dollars to increase the quantity supplied of AUD in anticipation of a better price. The rationing process causes those wanting to purchase AUD to bid-up what they are willing to exchange for them. This will lead to a new equilibrium exchange rate of ER2($) and Q2 billions of AUD traded.

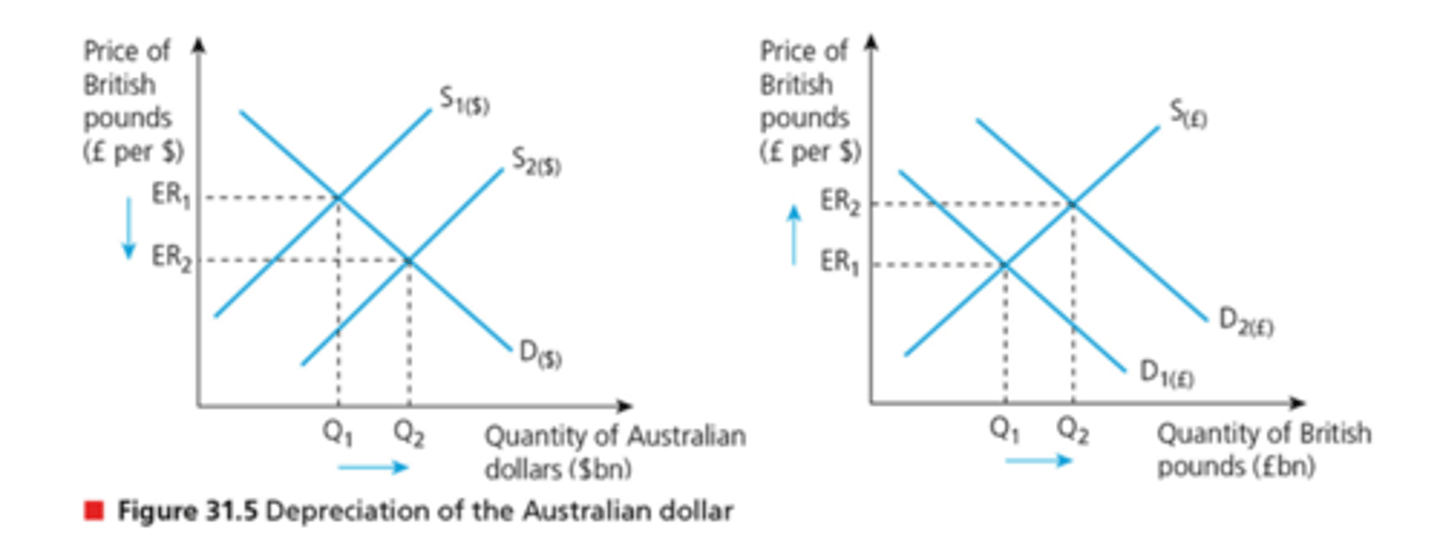

Graph: Depreciation of the domestic currency against a foreign currency

Graph explanation: Currency depreciation

In the case of a currency depreciation, as shown in the diagram, holders of Australian dollars wish to purchase British pounds. To do so, they must first exchange (sell) their Australian dollars, which causes an increase in the supply of Australian dollars from S1($) to S2($). This causes a fall in the value of the Australian dollar as the exchange rate drops from ER1 to ER2. In response to this, holders of Australian dollars will accept lower bids for their dollars, as they are less scarce. This signals to the market that the price of Australian dollars is likely to fall. This results in an expansion in the quantity demanded for Australian dollars, leading to the new equilibrium of exchange rate of ER2 and Q2 quantity traded.

Demand for a currency and inflow

The demand for a currency can be seen as an inflow of money into an economy.The only reason why consumers would purchase a foreign currency is to spend it on foreign goods or services in overseas markets. The supply of a currency can be seen as an outflow of money from an economy, as the only reason consumers sell their own currency is to demand another.

The value of a currency is determined by--

The value of a currency is determined by changes in demand and supply in the currency market (or the foreign exchange market). These changes result in a change in the value of a currency through the price mechanism. This is the same way that the price and quantity of any other good or service is determined in a perfectly competitive market without government intervention.

The demand for one currency increases the -- of another currency in terms of which it is expressed

Any factor that generates demand for a currency will cause an increase in the supply of another currency. After all, the definition of exchange rates is the value of one currency in terms of another. Buyers of a currency must first exchange their own currency in order to buy the foreign currency. Another factor to consider is that of ceteris paribus. An increase in the demand for an economy’s currency will cause an appreciation of that currency only if it is not matched by a factor increasing the supply of that currency.

10 factors that cause a change in the demand for and supply of a currency list

- foreign demand for exports

- domestic demand for imports

- inward versus outward foreign direct investment

- inward versus outward portfolio investment

- remittances

- speculation

- relative inflation rates

- relative interest rates

- relative growth rates

- central bank intervention.

factors that cause a change in the demand for and supply of a currency 1 - foreign demand for exports 1

When foreign consumers wish to purchase goods or services from a foreign economy, they must first purchase the currency of that economy to make the transaction (via a foreign currency market). This is because domestic producers are highly unlikely to accept purchases made in foreign currencies as the money is not legal tender in the domestic economy.

factors that cause a change in the demand for and supply of a currency 1 - foreign demand for exports 2

Therefore, it can be said that whenever a foreign consumer purchases a good or service exported from a foreign economy, they will have to demand that economy's currency and supply their own. This leads to an appreciation in the currency of the foreign economy and a depreciation of their own currency, ceteris paribus. Likewise, should there be a fall in the demand for an economy's exports, then there will be a fall in the demand for that economy's currency and ultimately a depreciation will occur.

factors that cause a change in the demand for and supply of a currency 2 - domestic demand for imports 1

It is logical that an economy's exports are another economy's imports. Therefore, when a good is imported into the domestic economy, this creates an increase in the supply of that economy's currency and a demand for the overseas economy's currency. Naturally, it would be an odd experience for consumers going to the supermarket in N ew York, London or Tokyo and paying in euros for Greek grapes and in lira for Turkish tomatoes.

factors that cause a change in the demand for and supply of a currency 2 - domestic demand for imports 2

However, the suppliers of these imported goods will have been paid in their domestic currencies by the purchaser, such as distributors, supermarkets or other suppliers in the supply chain. Therefore, higher demand for imports will increase the supply of the domestic currency and lead to a currency depreciation, whereas it will increase the demand for the foreign currency and cause that to appreciate in value, ceteris paribus.

factors that cause a change in the demand for and supply of a currency 2 - Inward/outward foreign direct investment (FDI) 1

Foreign direct investment (F DI) is the spending by multinational corporations (MN Cs). Inward F DI refers to foreign MN Cs expanding their operations in the domestic economy, such as investments in production facilities. For example, Manulife is a Canadian financial and insurance company with operations in 1 5 countries, serving more than 2 6 million customers worldwide. Therefore, its operations in overseas markets including Malaysia, Singapore and Hong K ong represent inward F DI for these economies. The result of this would be an increase in the supply of the Canadian dollar to demand the Malaysian ringgit, the Singaporean dollar and Hong Kong dollars.

factors that cause a change in the demand for and supply of a currency 2 - Inward/outward foreign direct investment (FDI) 2

Outward F DI refers to domestic MN Cs expanding their operations in overseas markets. In the above example, the spending by Manulife in overseas markets represents outward F DI for Canada. Therefore, it can be said that outward F DI for one country creates inward F DI for another. Inward F DI creates higher demand for a currency leading to its appreciation, ceteris paribus. Outward F DI leads to the supply of the domestic currency causing it to depreciate, ceteris paribus.

factors that cause a change in the demand for and supply of a currency 3 - Inward/outward portfolio investment 1

Portfolio investment is the purchase of financial investments abroad, such as stocks, shares and bonds of overseas companies and governments. When investments are made in a foreign economy, the investors or their representatives will need to purchase the currency of that economy to complete the investment.

Inward portfolio investment

Inward portfolio investment represents spending in the domestic economy by foreign investors. Those investors must supply (sell) their own currencies on the foreign exchange market and demand (buy) the currency of the economy that they are investing in. This will cause a depreciation in the currency held by those investors and an appreciation of the currency in the economy that these investors are investing in.

Outward portfolio investment

Outward portfolio investment represents spending by an economy's investors in overseas markets. All things being equal, this will result in an increase in the supply of the domestic economy's currency and an increase in the demand for the currency of the other economy that investors are investing in. This will lead to a depreciation of the domestic currency and an appreciation of the currency in the other economy, ceteris paribus.

factors that cause a change in the demand for and supply of a currency 4 - remittances 1

Remittances refer to the movement of money when nationals working abroad send money back to their home country, thereby impacting the exchange rate. In an increasingly globalized world, it is not uncommon for citizens of one economy to work temporarily in another economy. These citizens, known as expatriates, may be attracted by higher salaries or favourable working conditions in overseas countries. F or these citizens to be considered expatriates (or expats), there must be an assumption that they will return ' home' after a period of time. An example is teachers working overseas in international schools.

factors that cause a change in the demand for and supply of a currency 4 - remittances 2

While expats are working abroad, they may send some of their income back to their home country, either to their own bank accounts or to family members. Expats will need to supply the currency of the economy, and demand their country of origin's currency. This will result in a depreciation of the currency of the economy that they are working in and an appreciation of the currency of their home economy, ceteris paribus.

factors that cause a change in the demand for and supply of a currency 5 - speculation 1

Speculation occurs when a financial asset is purchased in the hope or anticipation that the resale value will be higher. It is said that the vast majority of currency trades are speculative, which means that currency traders are purchasing different currencies in the hope that their value will increase, and they can sell these currencies at a favourable exchange rate. Similarly, if speculators expect a currency to fall in value, they will tend to sell (supply) this in favour of other stronger or more stable currencies or other assets such as gold.

factors that cause a change in the demand for and supply of a currency 5 - speculation 2

F oreign exchange traders and investment companies move money around the world to take advantage of variations in exchange rates to earn a profit. As huge sums of money are involved owing to currency speculation, this can itself cause exchange rate fluctuations.

factors that cause a change in the demand for and supply of a currency 6 - relative inflation rates

Inflation is a sustained increase in the general price level of an economy. An increase in the price of goods and services caused by domestic inflation will tend to decrease the demand for exports. According to the law of demand, this will lead to a reduction in the demand for a currency and therefore a depreciation of that currency. Speculators holding that currency may choose to sell it and purchase another more stable currency. This will lead to an increase in the supply of the domestic currency, further depreciating the value of that currency.

factors that cause a change in the demand for and supply of a currency 6 - relative interest rates 1

Interest rates are the costs of borrowing money and the rewards for saving money (see Chapter 2 3 ). Investors may wish to save in an economy that has higher interest rates than in their own country. To do this, investors will need to purchase the currency of the foreign country that they will be saving their money in. This will cause an increase in the supply of the domestic currency of the investors but lead to an increase in the demand for the foreign currency.

factors that cause a change in the demand for and supply of a currency 6 - relative interest rates 2

By contrast, a cut in interest rates will tend to reduce incentives for investors, so they sell that currency in search of investments with better returns, ceteris paribus. This will therefore reduce the exchange rate of that currency.

factors that cause a change in the demand for and supply of a currency 7 - relative growth rates 1

Economic growth is an increase in a country's real national income over time. Higher levels of economic growth in a foreign economy, represented by increases in real GDP, are indicative of rising wages and rising domestic consumer expenditure leading to an increase in aggregate demand (AD). The increase in AD can cause demand-pull inflation and will increase the likelihood of contractionary or tight monetary policy.

factors that cause a change in the demand for and supply of a currency 7 - relative growth rates 2

The resulting higher interest rates will generate an increase in the demand for the currency of that economy, which is likely to lead to an appreciation in the value of that currency. Hence, economic growth tends to cause the central bank to raise interest rates thereby causing the exchange rate to also appreciate, ceteris paribus.

factors that cause a change in the demand for and supply of a currency 8 - central bank intervention 1

The central bank is the monetary authority in a country (see Chapter 2 3 ). In addition to the setting of interest rates, a central bank may also introduce measures to restrict the supply or sale of its currency in order to control its money supply.

factors that cause a change in the demand for and supply of a currency 8 - central bank intervention 2 - examples

A good example of this is the current policies of the People's Bank of China, where the Chinese yuan (or renminbi) can be legally traded only from approved outlets. This prevents governments or large groups of investors from manipulating China's currency and therefore gaining a competitive edge in export markets. Currencies that are subject to these controls are likely to face lower levels of demand as they become less desirable to speculators.

Fluctuations in exchange rates cause changes in --

Fluctuations in exchange rates cause changes in the price of imports and exports, and therefore the demand for imports and exports. Recall that net exports, the value of exports minus the value of imports, are part of the aggregate demand equation (and GDP). Therefore, changes in net exports will have macroeconomic consequences. In particular, changes in the exchange rate impact on economic indicators, such as the inflation rate (price stability), economic growth, unemployment, the current account balance and living standards.

List of Consequences of changes in the exchange

rate on economic indicators

- the inflation rate

- economic growth

- unemployment

- the current account balance

- living standards

Consequences of changes in the exchange

rate on economic indicators 1 - the inflation rate: demand-pull and cost-push inflation

Changes in the exchange rate can impact both cost-push and demand-pull inflation. Demand-pull inflation is a sustained increase in the general price level due to an increase in the components of factors of production (increased consumption, investment, government spending and net export expenditure). Cost-push inflation is a sustained increase in the general price level due to an increase in the costs of production in an economy.

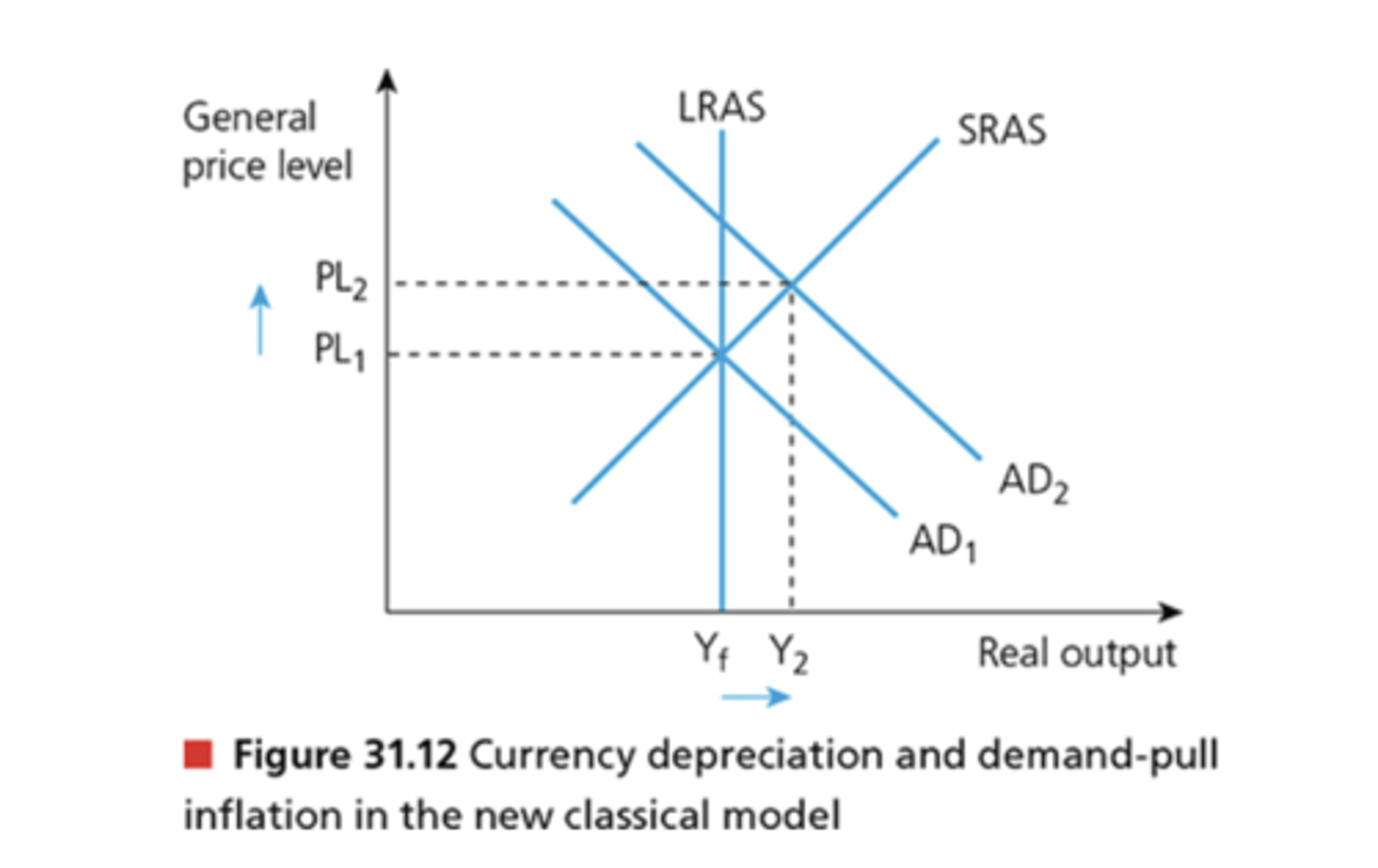

graph: currency depreciation and demand-pull inflation in the new classical model

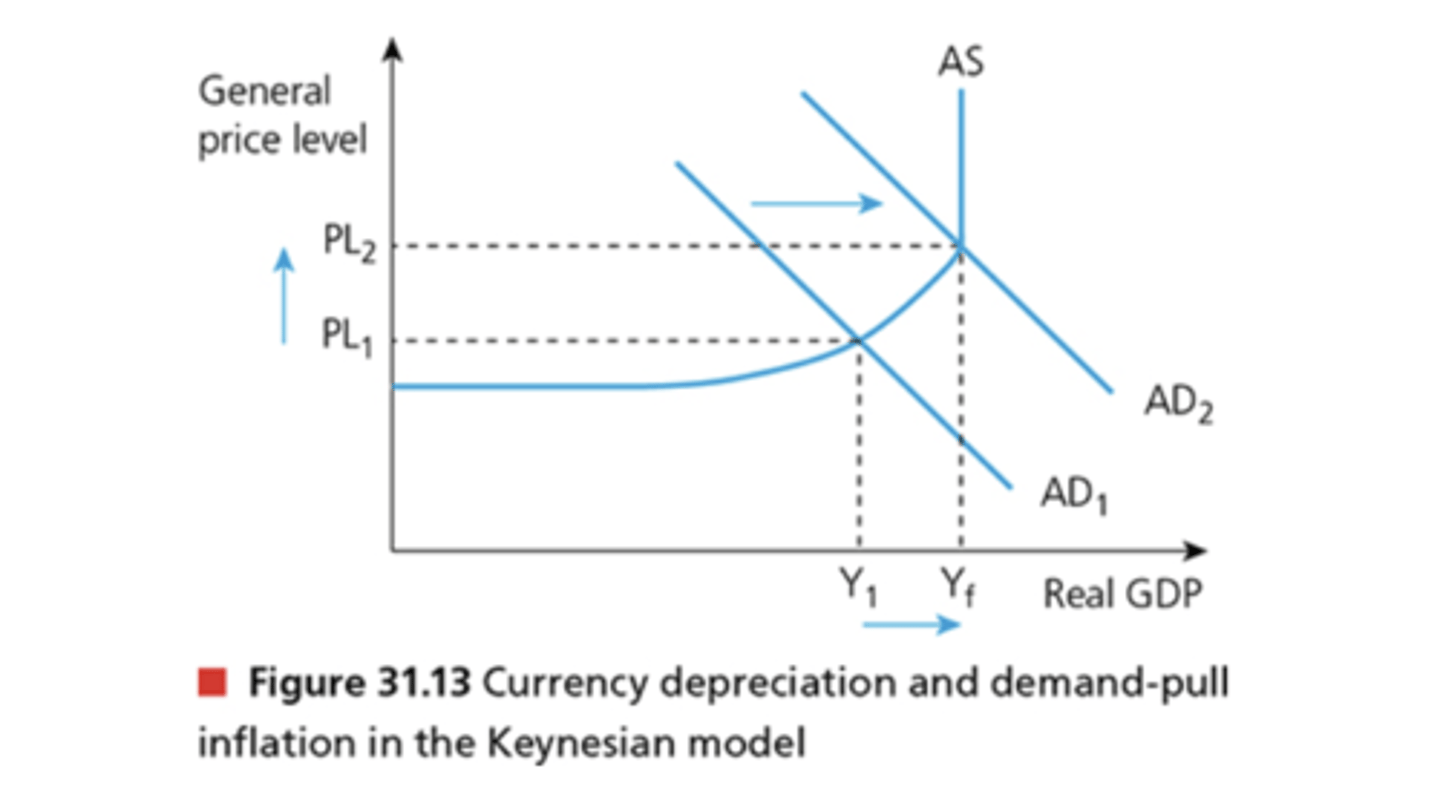

graph: currency depreciation and demand-pull inflation in the Keynesian model

graph explanation: currency depreciation and demand-pull inflation in the new classical and Keynesian model

As illustrated in the graph, a currency depreciation will generally lead to a reduction in the quantity demanded of imports and an increase in the quantity demanded of exports. This is because the relative price of exports becomes cheaper, whereas there is a relative increase in the price of imports. This would increase the value of net exports (X - M). As a component of aggregate demand, this will increase AD from AD1 to AD2 and causes real output to increase from Yf to Y2 and from Y1 to Yf respectively, ceteris paribus. However, it also results in an increase in the general price level of PL1 to PL2 .

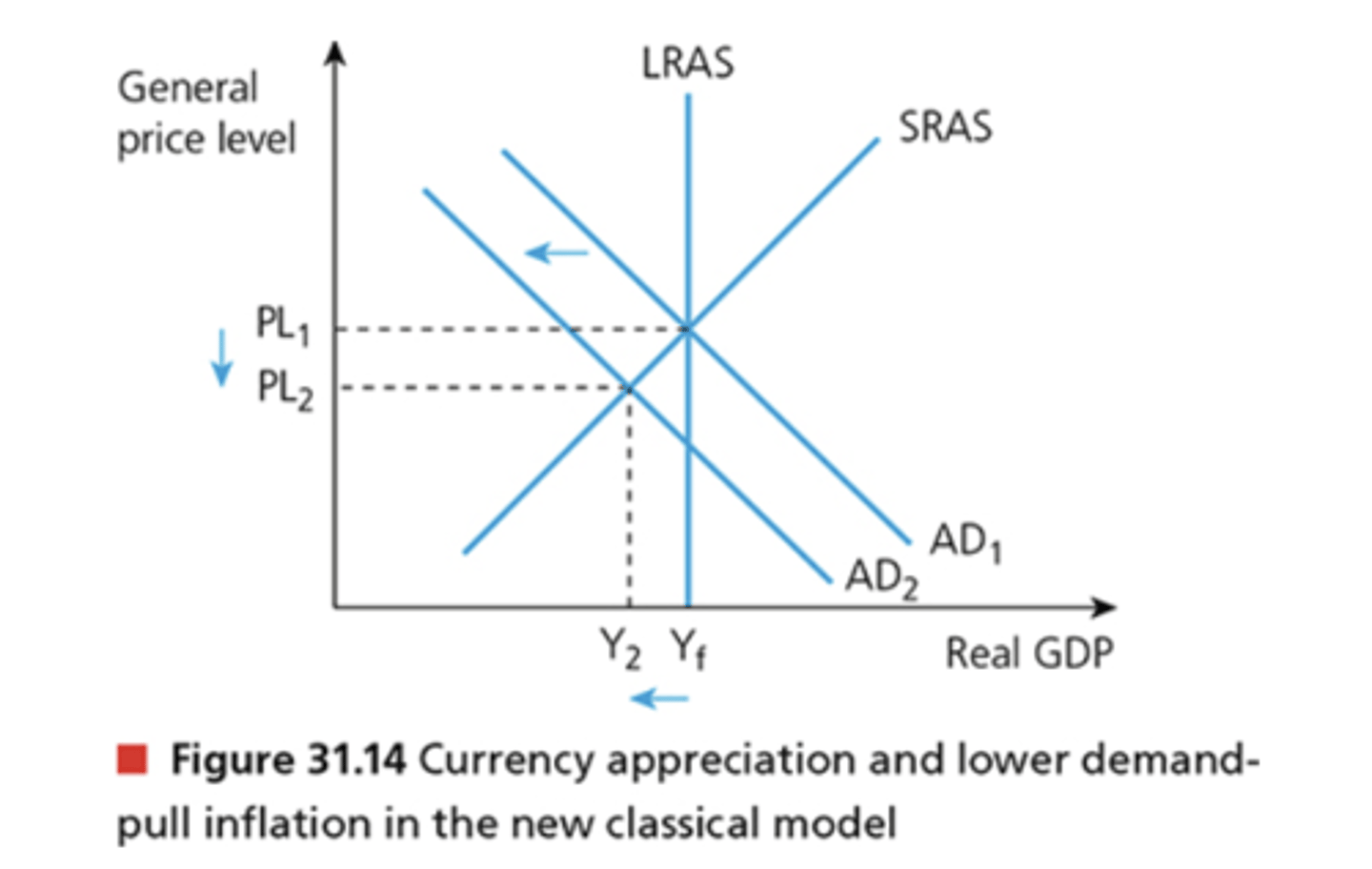

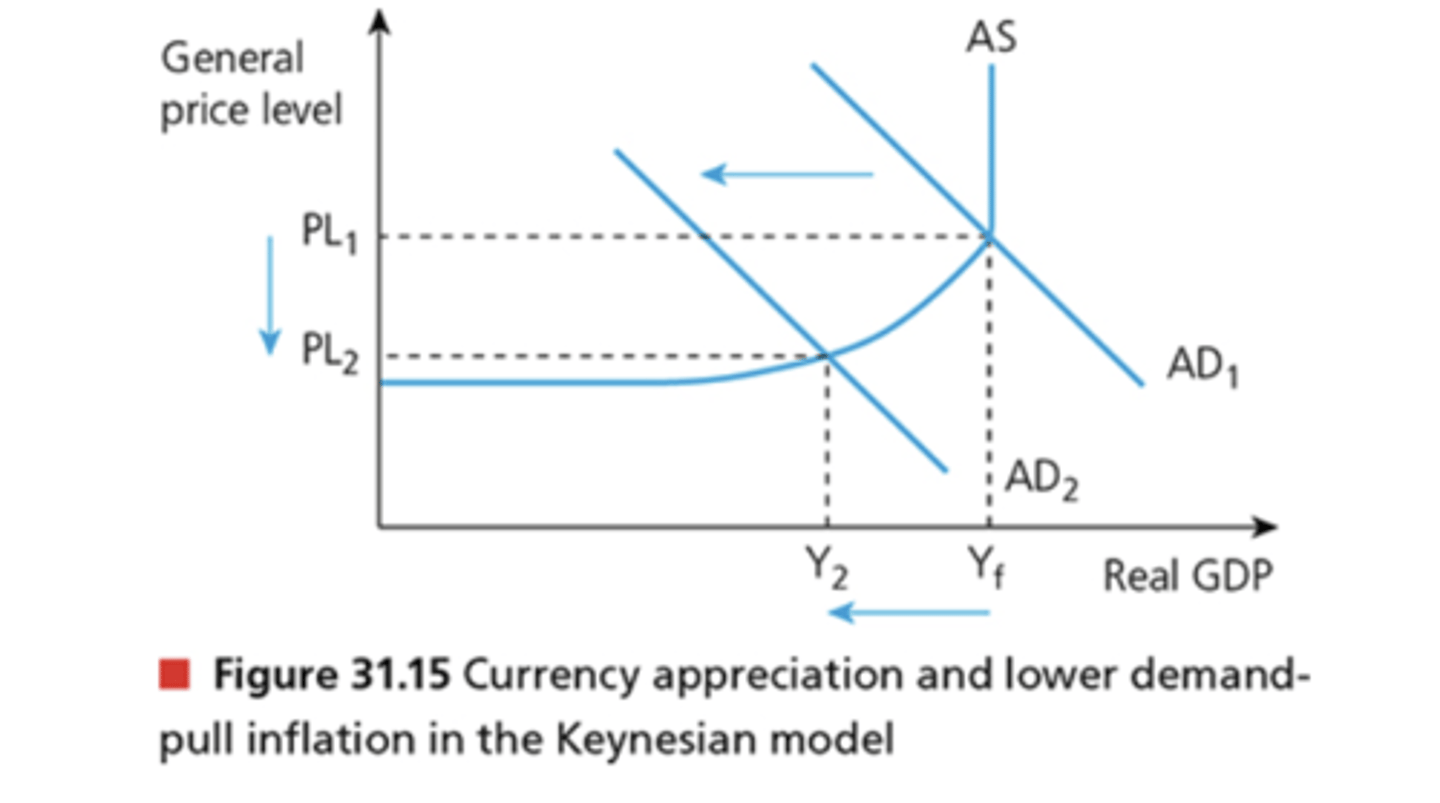

graph: Currency appreciation and lower demand-pull inflation in the new classical model

graph: Currency appreciation and lower demand-pull inflation in the Keynesian model

graph explanation: Currency appreciation and lower demand-pull inflation in the new classical and Keynesian model

In the case of an appreciation of the domestic currency, the price of exported goods will increase, and the price of imported goods will decrease. This is likely to lead to a reduction in net exports (X - M). Hence, aggregate demand is likely to fall from AD1 to AD2 as shown in the graph. All things being equal, the fall in net exports causes the level of real output to decline from Yf to Y2 . This will lower the

general price level in the economy from PL1 to PL2.

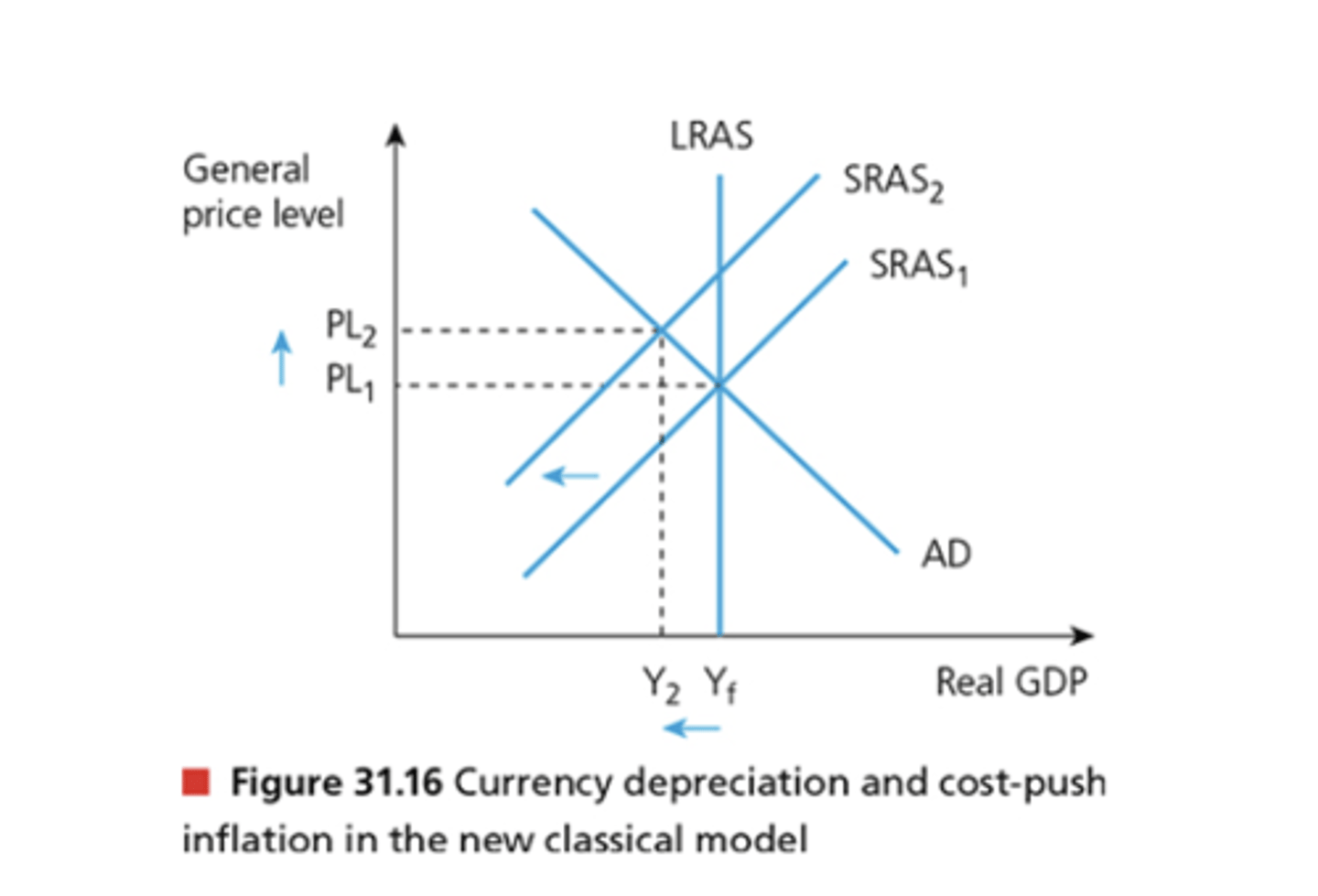

graph: currency depreciation and cost-push inflation in the new classical model

graph explanation: currency depreciation and cost-push inflation in the new classical model 1

A depreciation in the value of a currency can also be a cause of cost-push inflation. As firms may need to rely on the import of raw materials and components, for example, a lower value of the currency will lead to an increase in the price of imports and therefore an increase in the costs of production for these firms. This will cause a reduction in short run aggregate supply, causing a shift in the SRAS curve from SRAS1 to SRAS2.

graph explanation: currency depreciation and cost-push inflation in the new classical model 2

This will result in scarcity and therefore an increase in the general price level from PL1 to PL2 . This is representative of cost-push inflation. In this scenario, the higher production costs caused by the currency depreciation leads to lower economic growth as real GDP contracts from Yf to Y2 .

Note that the change in the exchange rate, such as depreciation, can have a positive or negative impact on the level of real national output. This will largely depend on the extent to which the country relies on imports for production.

Consequences of changes in the exchange rate on economic indicators 2 - economic growth 1

Economic growth is an increase in the value of real national income over time. An appreciation of the currency will lead to an increase in the price of exports and a decrease in the price of imports. The result of this may be a decrease in net exports, although this will depend on the value of price elasticity of demand for the country's exports. N et exports (X - M) are a component of aggregate demand.

Consequences of changes in the exchange rate on economic indicators 2 - economic growth 2

So, the decrease in the price of imports caused by the currency appreciation could lead to a higher value of import expenditure if the PED for imports is price elastic. If this materializes, there will be a net leakage from the circular flow of income (see Chapter 1 ), which reduces the value of aggregate demand in the economy. This could lead to economic decline, or even a recession. This would be represented by a reduction in real GDP in an AD-AS diagram.

Consequences of changes in the exchange rate on economic indicators 3 - Unemployment 1

An appreciation of a currency may lead to a significant reduction in the demand for exports, as they are now more expensive in foreign economies. This reduction in export revenues may eventually result in firms reducing their demand for labour (due to derived demand). This will generate some unemployment in the economy. This could be classified as cyclical due to a lack of aggregate demand caused by the fall in net exports, but some economists may argue that it is structural in nature if it occurs in the long run.

Consequences of changes in the exchange rate on economic indicators 3 - Unemployment 2

For example, the tourism industry is particularly vulnerable to fluctuations in the exchange rate; tourists are more likely to visit a foreign country if their own currency is relatively higher in value due to a currency appreciation, ceteris paribus.

Consequences of changes in the exchange rate on economic indicators 3 - Unemployment 3

The above analysis suggests that a fall in the value of a currency tends to be beneficial for economy. This is because net export sales are likely to rise, leading to greater derived demand for those working in export-driven industries. Hence, a currency depreciation is likely to cause less unemployment in the economy, ceteris paribus.

Consequences of changes in the exchange rate on economic indicators 4 - The current account balance 1

The current account on the balance of payments (see Chapter 3 2 ) is a record of all exports and imports of goods and services, plus net investment income from overseas assets plus the net balance of transfers made between countries by individuals and governments. Given the current account balance (or value) is dependent on the international flow of money in and out of a country, fluctuations in the exchange rate will have a direct impact on the account.

Consequences of changes in the exchange rate on economic indicators 4 - The current account balance 2

To assume that an appreciation of a currency will lower export revenue and increase import expenditures, economists assume that the price elasticity of demand for exports and imports is greater than one, that is, price elastic. This ensures that the reduction in the demand for exports as a result of an increase in their price will lead to a greater than proportionate decrease in the quantity demanded of exports. Similarly, for the currency appreciation to lead to an increase in import expenditure, the reduction in the relative price of imports must lead to a greater than proportionate increase in the quantity demanded of imports.

Consequences of changes in the exchange rate on economic indicators 4 - The current account balance 3

Should these conditions exist (the PED for exports and imports being price elastic), the result of a currency appreciation will be a reduction in the value of the current account. This means a worsening in the current account balance, or a movement towards a deficit.

Consequences of changes in the exchange rate on economic indicators 4 - The current account balance 4

The opposite is true in the case of a currency depreciation. A fall in the value of a currency will, assuming an elastic PED value for imports and exports, lead to an increase in the value of the current account balance, that is, an improvement or a move towards a surplus. This is because imports will be relatively more expensive for domestic firms and consumers, while exports will be relatively cheaper for overseas buyers.

Consequences of changes in the exchange rate on economic indicators 4 - The current account balance 5

However, it is important to note that currency fluctuations can also be a result of current account imbalances. Should a current account be in deficit, this would mean that the value of imports exceeds the value of exports, which should mean that the supply of the economy's currency will exceed its demand, thus causing a depreciation. In the case of a current account surplus, where the value of exports exceeds the value of imports, the demand for that economy's currency will exceed the supply of it, meaning that there should be an appreciation. Remember that all of this analysis assumes that the economy has a freely floating exchange system.

Consequences of changes in the exchange rate on economic indicators 5 - Living standards 1

The value of a country's currency can have a significant impact on the standard of living in that economy. A strong currency will bring benefits to consumers of imported goods and services as they will need to exchange less of their own currency or money to purchase the imported items. In more economically developed economies, these imported items are more likely to be wants (desires) and luxury goods and services. Hence, it could be argued that a strong currency can be a cause of high living standards rather than just an effect.

Consequences of changes in the exchange rate on economic indicators 5 - Living standards 2

Alternatively, it could be argued that a strong currency will reduce the competitiveness of the exports of that economy owing to relatively higher export prices. This could lower export revenues and reduce the demand for labour from local firms. This could eventually lead to an increase in unemployment in the economy, reduce consumption expenditure, lower economic growth and cause a reduction in standards of living.

Consequences of changes in the exchange rate on economic indicators 5 - Living standards 3

However, a relatively weak currency could bring cost-push inflation to the economy as domestic firms and consumers have to pay more for essential imported goods. In the case of some economically less developed countries (ELDCs), this could make it difficult for them to access essential goods that are typically imported, along with imports of physical capital needed to diversify their production away from low-value agricultural products.

Consequences of changes in the exchange rate on economic indicators 5 - Living standards 4

By contrast, a weaker currency could make an economy's exports more competitive and therefore increase export revenues. This has a positive impact on the demand for labour, therefore increases employment and incomes in the economy. This is likely to then lead to increased economic growth and an improvement of living standards.

Consequences of changes in the exchange rate on economic indicators 5 - Living standards 5

Unfortunately, in the case of some ELDCs, their overreliance on agriculture for export revenues means that the depreciation of their currency could lower export revenues as many primary products have a low (inelastic) price elasticity of demand. This means that the percentage increase in the quantity demanded for their exports will be less than the percentage reduction in price, thus causing a reduction in export revenues. This will then cause a drop in living standards in these ELDCs.

fixed exchange rate system

A fixed exchange rate system exists when the central bank (or central monetary authority) of a country buys and sells foreign currencies to ensure the value of its currency stays at a single fixed or predetermined rate against another currency or basket of other currencies.

Fixed exchange rate system example

For example, since 15 October 1983, the Hong Kong dollar has been fixed against the US dollar at a rate ofHK $7.80 to US$1. The government can maintain this single rate by buying (demanding) or selling (supplying) foreign currency reserves as needed.

Foreign currency reserves (or reserve assets)

Foreign currency reserves (or reserve assets) are stocks of foreign currencies held by central banks, typically used to influence the value of a currency.

Why would a government wish to fix the value of its currency against one, or a basket of other currencies?

Two common reasons for doing so relate to export competitiveness and the current account balance. The value of a currency helps to determine the price of an economy's exports and the price of its imports. This, along with price elasticity of demand, can impact the revenues received from exports and the economy's expenditure on imports. Hence, the economic stability created by fixed exchange rates tends to have a positive impact on the current account balance, economic growth and employment in the domestic economy.

Devaluation

Devaluation occurs when the price of a currency operating in a fixed exchange rate system is officially and deliberately lowered against another currency or basket of currencies.

Revaluation

Revaluation occurs when the price of a currency operating in a fixed exchange rate system is officially and deliberately increased.

International competitiveness and currency devaluation

In theory, the international competitiveness of a country can be improved by a currency devaluation. This is because exports will become relatively cheaper and imports become more expensive. As domestic consumers and firms must exchange more of their own currency to buy imported goods and services, this is likely to reduce the expenditure on imports. Bycontrast, the devaluation will make exports relatively cheaper for foreign customers. Hence, a devaluation will improve the value of the country's net exports, ceteris paribus.

When would a country want to revalue its currency?

However, at other times, governments may wish to revalue their currency when they wish to import more essential goods and services. This can often occur after natural disasters, when the government needs to import resources for large reconstruction projects. These projects can cost hundreds of billions of dollars, so even a 5 per cent revaluation can lower the government's expenditure significantly.

How is the value of a currency in a fixed exchange rate regime is determined?

As with a freely floating exchange rate system, the value of a currency in a fixed exchange rate regime is determined by the market forces of demand and supply.

In a freely floating exchange rate system, a currency should always be--

In a freely floating exchange rate system, a currency should always be moving from one equilibrium position to another. In the short run, excess demand or supply for a currency may exist but the price mechanism will use the signalling, rationing and incentive functions to return the currency to a point of equilibrium. However, in a fixed exchange rate system the government needs to match changes in the supply or demand for a currency in order to keep it at the fixed rate.

Fixed exchange rate system example 2

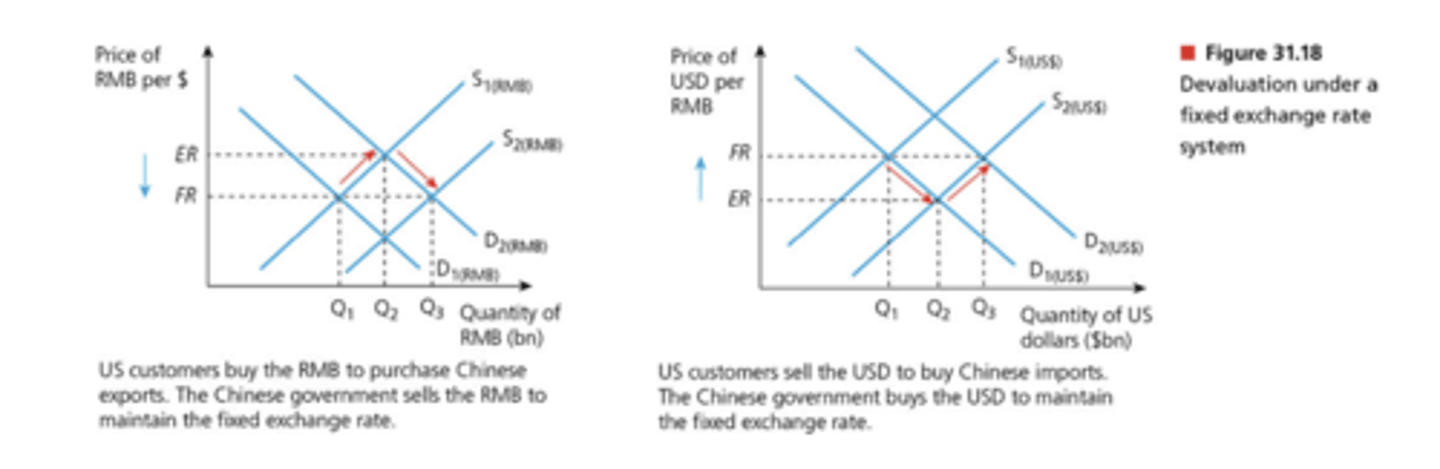

This can be explained through a hypothetical example, using the Chinese yuan renminbi (RMB) and the U S dollar. These two countries are each other's largest trading partners. China exports vast amounts to the U SA each year and may therefore wish to mitigate the impact of exchange rate fluctuations on the competitiveness of its exports. One method China has used to ensure this is to devalue its currency against the US dollar.

Graph: Devaluation in a fixed exchange rate system

Graph explanation: Devaluation in a fixed exchange rate system 1

In this diagram, the Chinese government via the People's Bank of China (the nation's central bank) fixes the value of the RMB against the U SD at a fixed rate of F R. This means that one RMB will be worth F R units of U SD. Suppose there is an increase in the demand from the U SA for Chinese exports, which will lead to an increase in the demand for the RMB to purchase these exports. In a floating exchange rate system, this would lead to an appreciation of the RMB from F R to ER, but a potential loss of China's export competitiveness.

Graph explanation: Devaluation in a fixed exchange rate system 2

To maintain the value of the RMB at the fixed rate (F R), the to D2 RMB) with an increase in the supply of the RMB from S1 (RMB) to S2 (RMB). It does this through the purchase of the U SD (that is, selling the RMB and buying theU SD). When the Chinese government purchases more U SD, they will increase the supply of RMB, thus lowering the value, but also increase the demand for U SD, therefore increasing its value. The deliberate attempt by the Chinese government to shift the exchange rate from ER back down to

FR is referred to as a devaluation.

Graph explanation: Devaluation in a fixed exchange rate system 3

Note that it is important that the Chinese government matches the increased demand for its currency with the supply exactly and simultaneously to maintain the fixed rate. If the government is unable to do this, then the exchange rate will not be fixed so it will fluctuate, causing uncertainty in the export market.

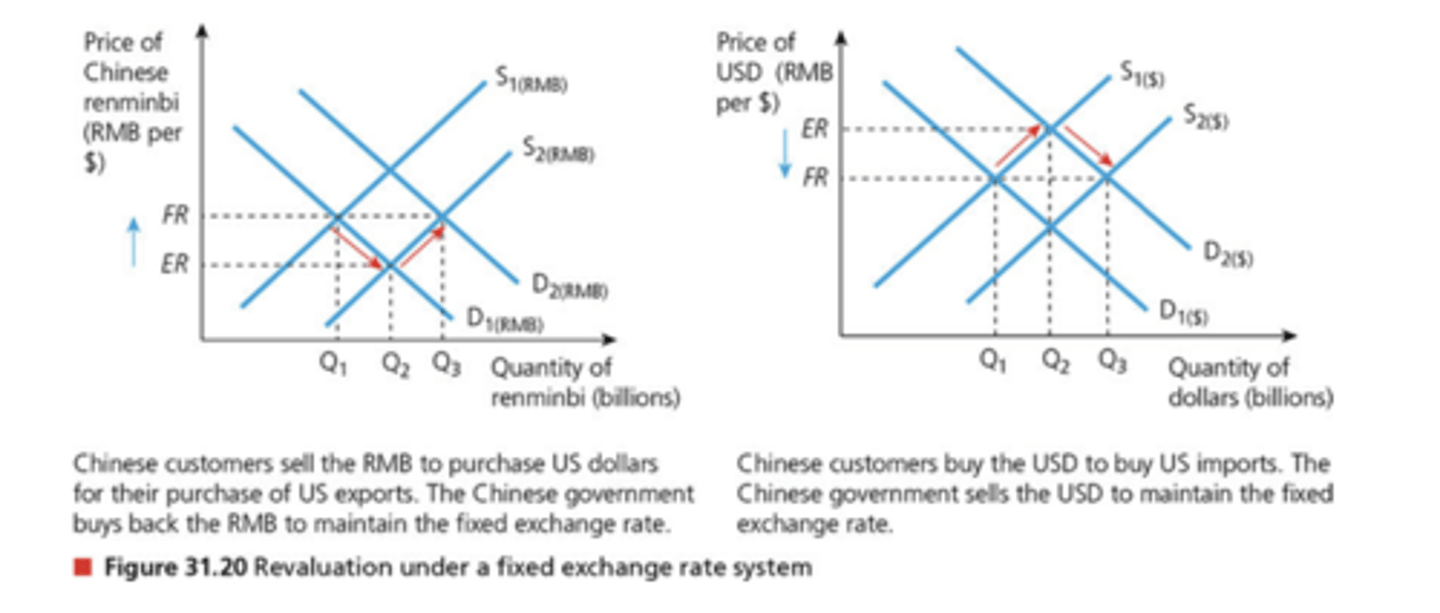

Graph: Revaluation under a fixed exchange rate system

Graph explanation: Revaluation under a fixed exchange rate system 1

In this diagram, suppose the Chinese government, or the People's Bank of China, wishes to fix the value of its currency at a rate above the market equilibrium (revaluation). A common reason for this is the need for Chinese firms to import a large amount of their factors of production. When customers in China wish to purchase imports from the U SA, this increases the supply of Chinese RMB on the foreign exchange market so should, in a freely floating exchange rate system, lead to a depreciation of the RMB against the US dollar.

Graph explanation: Revaluation under a fixed exchange rate system 2

To prevent this, the Chinese government must sell its foreign reserve assets of U SD and buy RMB instead. This will increase the supply of U SD on the foreign exchange market from S1 ($ ) to S2 ($ ), thus depreciate the U S dollar, and increase the price of the Chinese renminbi from ER back to F R. The deliberate attempt by the Chinese government to shift the exchange rate from ER back up to F R is referred to as a revaluation.

managed exchange rate

A managed exchange rate is a system where the government or central monetary authority intervenes periodically in the foreign exchange market to influence the exchange rate.

What is the exchange rate under a managed system primarily determined by?

The exchange rate under a managed system is primarily determined in the foreign exchange market by the market forces of demand for and supply of a currency. The government intervenes only occasionally when deemed necessary to influence the exchange rate. The government achieves this by influencing the demand for and supply of the domestic currency. The main reason for such intervening when necessary is to prevent large and sudden or unexpected fluctuations in the exchange rate, which could happen if currencies were left entirely to the market forces of demand and supply. Hence, managing the exchange rate helps to create or maintain certainty and confidence in the economy.

Common method of managing a currency

A common method of managing a currency is through a ' crawling peg' system.

crawling peg

A crawling peg is a form of fixed exchange rate system in which a currency is permitted to fluctuate within predetermined bands of exchange rates. This involves the setting of two bands or limits, which the government strives to keep the currency value within by periodic intervention.

crawling peg example

The State Bank of Vietnam (SBV) uses a crawling peg system where it allows the Vietnamese dong (VN D) to fluctuate against the U S dollar by + /− 3 % .

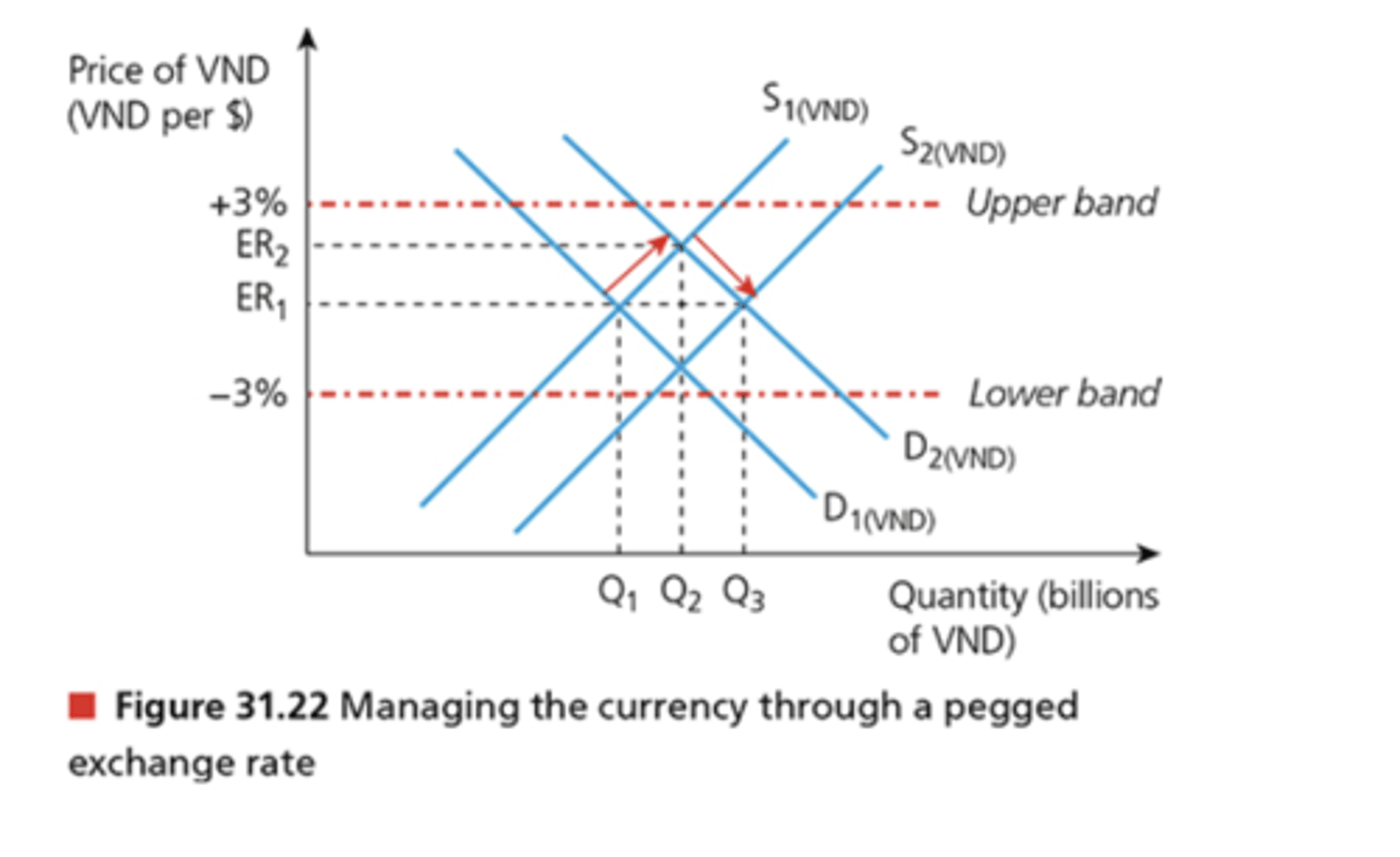

graph: managing the currency through a pegged exchange rate

graph explanation: managing the currency through a pegged exchange rate

In this diagram , it can be seen that the State Bank of Vietnam is periodically intervening to keep the value of the Vietnamese dong within the two predetermined bands. Should there be a series of increases in the demand for the VN D (cumulatively represented by the shift in the demand curve for the VN D from D1 to D2 ), thus pushing the exchange rate up from

ER1 to ER2 . In response, the SBV will increase the supply of VN D from S1 (VN D) to S2 (VN D)by purchasing other currencies, thereby reducing the value back to ER1. On the contrary, if the exchange rate were to drop from ER1 towards the

lower band, the SBV would buy the Vietnamese dong using its currency reserves to increase the demand, thereby raising the exchange rate.

how often should a central bank make adjustments to the exchange rate

It is important that these interventions by the central bank are done on a periodic or ad-hoc basis in order to keep the currency within the upper and lower range, rather than at a fixed point. When a currency is overvalued, the government or central monetary authority will seek to reduce its value by selling the currency. By contrast, if the currency is undervalued, the government or central monetary authority will seek to increase the value by purchasing the currency. Through managing the exchange rate in this way, the government helps to prevent wild fluctuations in the exchange rate and build confidence in the economy.

overvalued currency

An overvalued currency occurs when the value of a currency is above its equilibrium value in the long run.

In a freely floating currency exchange system, no currency should be --

In a freely floating currency exchange system, no currency should be overvalued in the long run. This is because the price mechanism will use the signalling, rationing and incentive functions to change the quantity demanded and supplied in order to bring the currency back to its equilibrium. In a fixed or managed system, the government or central monetary authority will intervene to correct this position.

As a result of an overvalued currency, --

As a result of an overvalued currency, imported goods become cheaper while exports become relatively more expensive. This puts downward pressure on the rate of inflation in the economy. Domestic producers are forced to be more efficient in order to compete with the cheaper products from foreign producers and suppliers. Exports become less competitive, causing lower profits in export industries. As imports become cheaper and exports more expensive, there can also be a negative impact on the country's balance of payments.

Undervalued currency

An undervalued currency occurs when the value of a currency is below its equilibrium value in the long run.

As a result of an undervalued currency in an economy, --

As a result of an undervalued currency in an economy, exports become relatively cheaper, leading to economic growth and employment in export industries in the long run. Imports become more expensive for domestic consumers and firms, so they switch to buying domestic goods, ceteris paribus. This can lead to fewer leakages (withdrawals from the economy's circular flow of income). F or some countries, this can lead to imported inflation when essential imports become more expensive, where imported raw materials and components are more costly, thus affecting the general price level.

In a freely floating exchange rate system, an undervalued currency is corrected by --

In a freely floating exchange rate system, an undervalued currency is corrected by the forces of demand and supply in the foreign exchange market. However, in a fixed or managed exchange rate system, the government or central monetary authority will intervene to correct this disequilibrium.

General comparison between freely floating and fixed exchange rate system

In general, fixed exchange rate systems bring greater benefits to firms than they do to governments. The disadvantages of fixed exchange rate systems can be seen as the advantages of a floating exchange rate system and vice versa.