ECONOMICS- EXCHANGE RATE

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

42 Terms

Foreign exchange market- why was it established?

established to allow trade between countries with different currencies

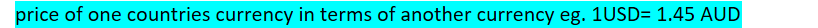

Define exchange rate

price of one countries currency in terms of another currency eg. 1USD= 1.45 AUD

Steps to foreign exchange market- explain

Panel A- Aus exports to US

Aus Exporter sells kangaroo toy to american importer

American importer sends bank transfer in USD to australian exporter

Aus exporter supplies USD to Bank

Aus exporter demands AUD back

Panel B- Aus imports from US

US exporter sells t shirts

Aus importer supplies AUD to bank

Aus importer demands USD back

Aus importer sends bank transfer in USD

Demand for AUD

what relationship is it?

what causes movements and shifts of curve?

negative relo- as price of AUD1 in USD decreases, then Quantity of AUD demanded decreases

movements- caused by reliance on other countries/ exchange rate

shift- caused by no exchange rate factors

2.1 List all the non exchange rate factors

Relative price levels

Real world gdp

Foreign preferences for Aus G&S

Relative interest rates

Commodity prices

Expectation and speculation

2.1.1 non exchange rate factors- relative price levels

If inflation in other countries is greater than aus, ts causing aus g&s will be cheaper= increased demand for AUD and more appealing for foreign importers = shift right

2.1.2 non exchange rate factors- real word gdp

Higher economic growth in world real GDP in australias trading partners= increasing real income of foregn citizens. This increases D for Aus g&s= increase D for AUD= shift right

Eg. Chinas econ growth= increased real income of chinese citizens= increased D for aus iron ore, beef etc-> increased D of AUD and shift right.

2.1.3 non exchange rate factors- foreign preferences

If aus g&s become more popular overseas, then demand for AUD increases= shift right

Eg. If tourism campaign for aus= increased demand for aus tourism= increased D for AUD= shift right.

2.1.4 non exchange rate factors- relative interest rates

define Interest rate differential

explain effect on D

Interest rate differential= the difference between australian interest rate and foreign interest rate

Interest rates reflect the return on financial assets. So when australias interest rate is higher than the US then IRD increases= increased demand for Aus assets= increased demand for AUD= shift right.

2.1.5 non exchange rate factors- commodity prices

Commodity prices determined by demand in world market.

If iron ore prices increase due to increased demand by china= increased value of exports= increased demand for AUD= shift right

2.1.6 non exchange rate factors- expectations and speculations

Foreign currency traders expect movements in currency.

If AUD is believed to appreciate in future- they will purchase now to take advantage of lower prices = increased demand for AUD= shift right.

Supply of AUD

define

law

where aus wants to sell aud to buy foreign currency to purchase g and s from overseas

pos- as ER increased, quantity of AUD supplied increases

3.2 causes of shift/ movement in supply curve

shift= non exchange rate factors

movement- change in ER

3.3 List the factors that cause shift in supply cirve

Relative price levels

AUS real GDP

Aus preference for foreign goods and services

Relative interest rates

Expectations and speculation

3.3.1 Relative price levels

If inflation is lower in other countries relative to aus, then foreign g&s will be more attractibe to aus importers= increased D for foreign g&s = increased Supply of AUD= shift right

3.3.2 Aus real gdp

If econ growth in aus increases= increased domestic income = increased imports from overseas = increased D for imported g and s = increased S of AUD= shift right.

3.3.3 Aus preferences for foreign g and s

If foreign g and s are more attractive- if US released ad for tourism then increased D for foreign g and s= increased S of AUD= shift right

3.3.4 Relative interest rates

If foreign IRD increases, then demand for foreign assets increases= increased S of AUD= shift right

3.3.5 Expectations and speculation

By foreign investors or trackers

If USD is likely to appreciate in future, then australians may sell more AUD to purchase USD now before becomes more expensive = Increased S of AUD = shift right.

4. Floats-

define

2 types

countries use a float/ market determined exchange rate as it is influenced by market forces of SnD.

4.1 Clean float

When a currency is allowed to float free from interference of central bank (RBA)

4.2 Dirty/ managed floats

When interfference of foreign exchange rate by central bank

Act as buyer or seller, influencing exchange rate

Eg. When RBA would buy AUD in market to prevent AUD from falling too low

5. EQ ER

when does EQ occur?

what would happen if ER was higher than EQ

what would happen if ER was lower than EQ

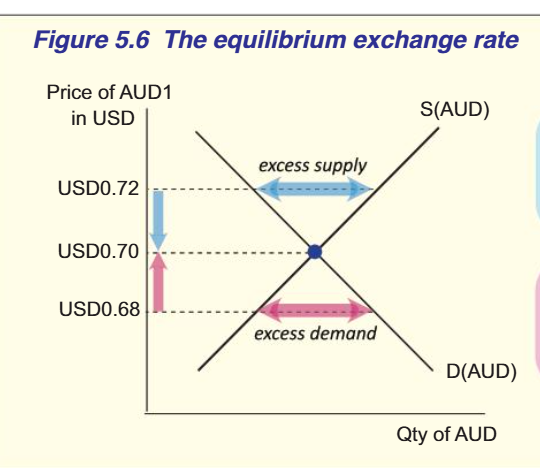

occurs when QD=QS

QS>QD= excess supply causing price to decrease

QS<QD= excess demand causing price to increase

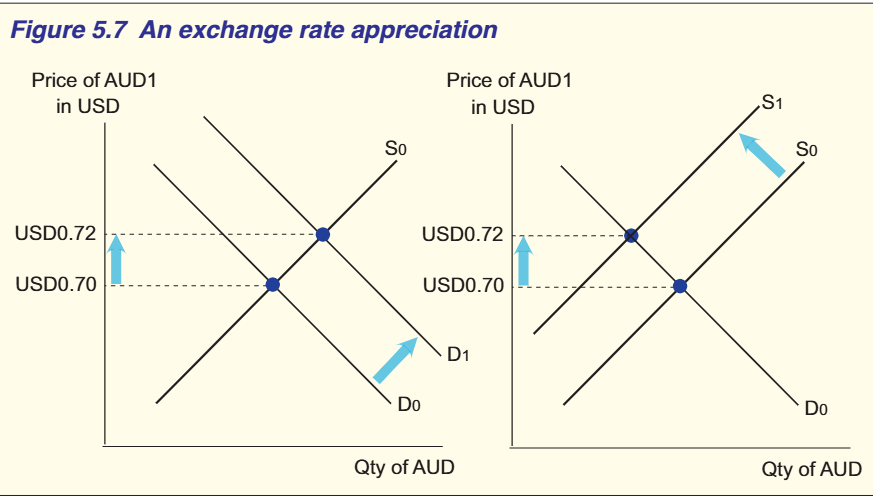

What 2 factors cause appreciation?

Demand of AUD increases= shift right

Supply of AUD decreases= shift left

6.1 Demand of AUD increases= shift right is caused by…

Increased demand for aus exports

Increased commodity prices

Aus IRD increases= increased foreign investment into aus

6.2 Supply of AUD decreases= shift left by

Decreased D for imports

increases in IRD= decrease in aus investment overseas

what 2 factors causes depreciation

decreased demand for AUD= shift left

increased supply for AUD = shift right

7.1 decreased demand for AUD= shift left is caused by…

decreased demand for aus exports

decreased commodity prices

decreased IRD= decreased foreign invest into aus

7.2 increased supply for AUD = shift right is caused by…

increased demand for imports

incrrased inflation in aus

decrease in aus IRD= decreased AUD invest into overseas

summary of determinant of demand and supply

demand is impacted via

supply is impacted via

Demand

exports of g and s

incomr from overseas

capital inflow

Supply

imports of g and s

payment of income to overseas

capital outflow

Effects of movements in the ER impacts…

macroecon

trade balance

consumers and business

8.1 Macroeconomy

how does depreciation impact?

exports

tourism

domestic producers

how does appreciation impact?

DEPRECIATION= EXPANSION IN MACROECON

Increases export advantages because overseas countries can purchase more at lower price, but decreases domestic imports as price decreases

Tourism in aus econ increases

Domestic producers that do not sell imported goods increase competitiveness

APPRECIATION= CONTRACTION

Decreases exports as more expensive

Decreases tourism from overseas, but aus to overseas benefit

Domestic producers lose

8.2 trade balance

depreciation causes-

1. impact on ecports

2. impacts of imports

3. what effect?

Increased quantity of aus exports but no impact on price= increases value

Decreases quantity of aus imports but increases price = increase or decrease value depending on demand

Causes J curve effect- where TB will decrease at first b due to increased import value but then increases due to volume = increased TB

8.3 CONSUMERS AND BUSINESS

what does depreciation cause

DEPRECIATION

Consumers harmed as they pay more for imports or overseas travel

Domestic producers that sell imported goods eg. Petrol will decrease profit due to increases price of imported goods

Firms that export gain as overseas demand increases

Domestic producers that done sell imported goods gain as increased demand for dometic produced goods.

BOP and ER

linked via 2 factors

appreciation and depreciation

protection of econ from external shocks

9.1 Appreciation and depreciation

what causes appreciation

what causes depreciation

Appreciation occurs when-> increased trade balance or increase in capital inflow= demand for AUD increases

Depreciation occurs when-> increased imports or increased capital outflow = increased supply of AUD

9.2 protection from external shocks

explain using examples of positive shock and negative shock

Eg. Positive shock- when china econ growth= increased D for aus g and s/ exports= increased global price= increasd AUS XPI and gdp but can cause inflation. Stronger AUD slowed down the econ and decreased effects of inflation

Eg. Negative shock- global financial crisis= aud depreciated but increased exports and expantion of aus econ= ER prevented recession because depreciated AUD= decreased price of aus g and s and increased competition

10 Recent trends in AUD ER via TWI

define TWI

TWI- weighted average of a basket of currencies that reflect importance of aus trade by country

Most important - chinese yuan, jap yen, euro and USD

10.1 why is AUD 2x as volatile against USD in TWI?

Single currency always flunctuates more than average ER

USD AND TWI ARE DIRECTLY CORRELATED AS USD IS KNOWN AS GLOBAL PRICE AND IS BIGGEST ECON

Key drivers of AUD

list 2 factors

commodity prices

IRD

11.1 Commodity prices

why is aus aka commodity currency?

what do changes in commod prices influence

relationship between the 2

Aus = commodity currency bc over 70% of aus exports are primary commdityes

Changes in com prices infleunce aus gdp and income

AUD and commodity prices are positive relo as increased com prices = appreciation in AUD

11.2 IRD

how is it measured

if AUS IRD with US decreases then…

vise versa

why?

Measured via difference in 3 year bond rates between 2 countries

If AUS IRD with US decreased then AUD depreciates because IRD affects the flow of foreign investment between 2 countries

Investors seek to receive highest returns for their funds- so less FI will flow into aus, decreasing demand for aud and increase supply of AUD as aus investors shift funds into US

If aus IRD increases, then AUD would appreciate as increased D for AUD and decrease supply of AUD