4.1.7 The distribution of income and wealth: poverty and inequality

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

Income (def + eg)

money you receive over a period of time, flow concept, e.g. salary received by teacher, interest received of holding Gilt (UK gov bonds), dividends declared from owning the shares of Microsoft

Wealth (def + eg)

Assets, stock concept, valuable things you own at a particular point of time, e.g. qualification of a Master degree, Balance in Natwest, US 10 years treasury

Wealth inequality creates an … inequality of income

immediate

Inequality of income leads to … inequality over a ……

wealth, period of time

Wealth inequality is more serious than income inequality because ….. e.g. shares in companies or multiple rented out properties

the wealth is inherited between generations and the wealth itself can generate incomes

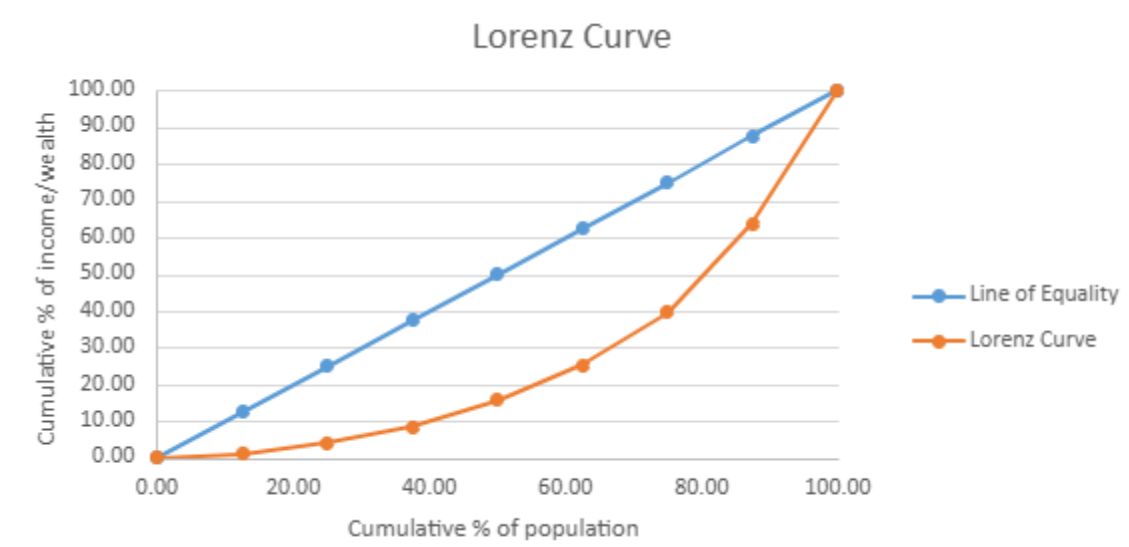

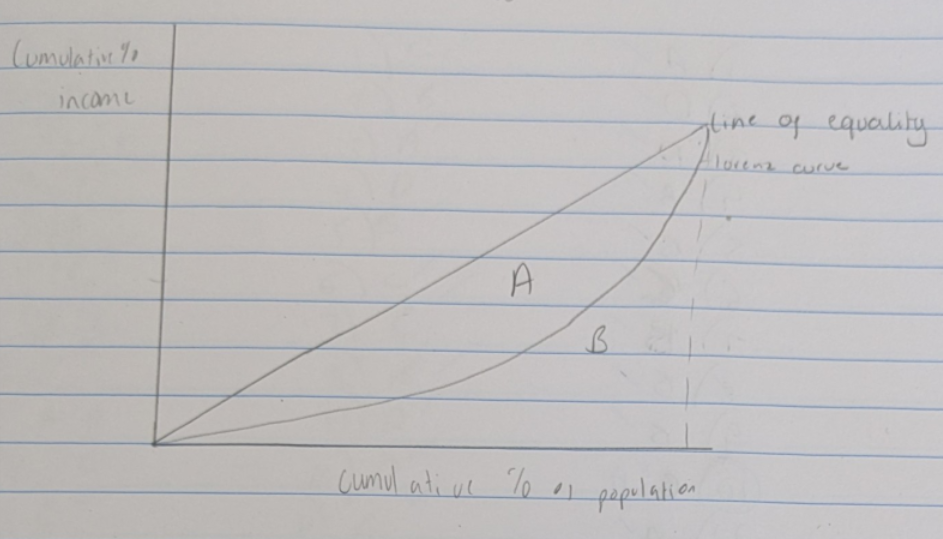

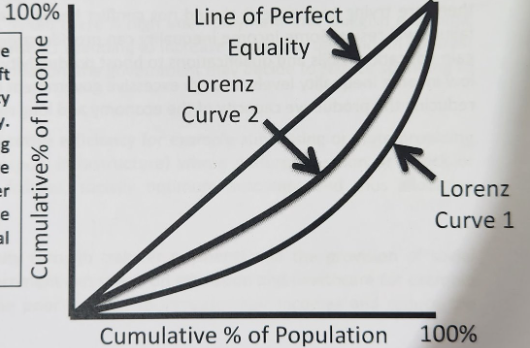

The Lorenz Curve purpose

Shows cumulative % of income on Y-axis and cumulative % of population on the X-axis

The Lorenz Curve graph

Blue line – Line of Equality, means everybody is earning the same income

Orange line – Lorenz Curve, a measure of income/wealth inequality

Gini Coefficient

In a world of perfect equality Gini Coefficient = 0

In a world of perfect inequality Gini Coefficient = 1

Costs of income inequality

Higher level of debt, costs to the gov, social costs, lower economic growth

Benefits of income inequality

Promote strong incentive to gain qualifications and skills, encourage enterprise, promotes a work and not welfare attitude

Positive impacts of the rising AI

democratisation of education and skills development, access to educational resources and personalised learning experiences → more people acquiring skills for higher-paying jobs → potentially reducing income inequality

Negative impact of the rising AI

acceleration of job automation, disproportionately affect lower-wage, less-skilled jobs → potentially increasing unemployment or pushing workers into lower-paying roles, pace of change may favour those with the skills to work alongside or develop AI tech

Causes of income inequality in a society

Age, education, one sector dominant and capital intensive production, globalisation and free movements of labour and trade, tech development, ownership of financial assets and property, corrupt governance

Absolute poverty

Household does not have sufficient income to sustain even a basic acceptable standard of living and to meet people’s essential, core needs

Thresholds vary between developed and developing countries

Extreme poverty measure now used by the World Bank is the % of population living on less than $1.90 a day (PPP) or £533 per year (exchange rate at 13/5/2024)

Relative poverty

Level of household income that is considerably lower than the median level of income within a country

Official UK relative poverty line is household disposable income (adjusted for household size) of less than 60% of median income

Causes of poverty

Low productivity, population growing faster than GDP, severe savings gap, absence of basic gov/public services, corruption, high levels of debt and high interest rates, civil war, absence of basic property rights

Microeconomic impacts of poverty

Decrease in CS, impact on Human capital, changes in savings and investment behaviour, increased vulnerability to economic shocks

Macroeconomic impacts of poverty

Reduced economic growth, fiscal pressure on gov, inequality and social unrest, decline in human development indicators (HDI), adverse effects on trade balance

Factors limiting the value of labour productivity in LICs

Low rates of urbanisation – externalities of high density

Weaknesses in human capital / “know-how” (Hausman)

Chronic critical infrastructure gaps

Gender inequalities

Debilitating impact of malnourishment

Limited economies of scale within key economic sectors

Heavy dependence on low value-added sectors

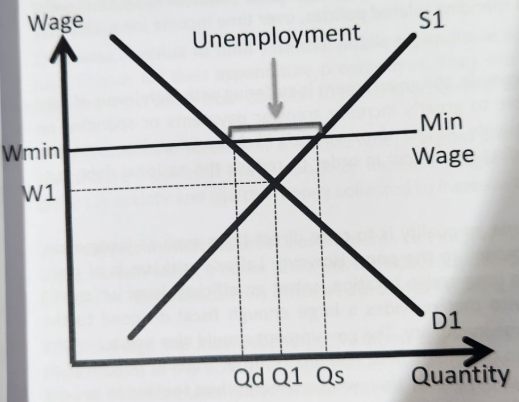

Policy to lower inequality - higher minimum wage

boosts work incentives and take-home pay

might cost some jobs and lead to higher prices

Policy to lower inequality - free provision of services

access to merit goods not based on ability to pay

universal access not as effective as targeted provision

Policy to lower inequality - higher rates of income tax

progressive taxes on the rich lower inequality and raise revenue

risk of a brain drain and increased tax avoidance

Policy to lower inequality - investment in training

helps to raise productivity, jobs and real wages

effective in the LR but risk of the free rider problem

Policy to lower inequality - subsidies for childcare

improve incentives for parent to look for and take work

effective, but quality of childcare needs improving

The triple lock was introduced to the UK … pension in … It was a guarantee that the …. pension would not lose value in … terms, and that it would increase at least in line with ….

state, 2010, state, real, inflation

Three-way guarantee, 2010 from triple lock which state pension would increase by the greatest of the following 3 measures

average earnings growth rate, prices (as measured by the Consumer Prices Index, CPI), 2.5%

Policy to redistribute income - transfer payments

child support assistance, unemployment benefits and payments to the disabled, prevent those unfortunate enough not to have the skills for work.

Allows a decent standard of living, increasing incomes for the poor and helping to close large income disparities

Policy to redistribute income - gov spending on essential goods and services

health care, education, water supplies

poorer members of the economy have access to essential goods and services increasing living standards

allows the poor a means to increase their skills, productivity and therefore incomes

Evaluation of gov spending and transfer payments to redistribute income

cost the gov large sums where funding would carry severe OC

if money borrowed → taxes increase

if regressive, indirect taxes (e.g. VAT) → increase

if gov funded → spending cut e.g. public transport

Poor will suffer

Policy to redistribute income - increase progressive tax

adjust progressive income tax, increase tax on workers with salaries in highest income tax bands using extra tax revenue to finance transfer payments + extra gov spending

Would reduce disposable incomes of rich and increase incomes at lower end for poor

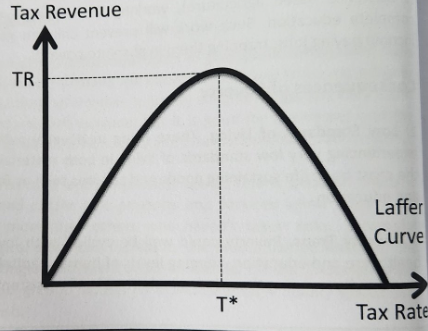

Evaluation of increase progressive tax to redistribute income

Distorts incentives in the labour market → preventing entrepreneurial risk taking to the detriment of the economy

Shown by Laffer curve

The Laffer curve

Raise income taxes on the rich → tax revenue fall as tax rates increase.

Workers lose incentive to work for higher incomes that will be heavily taxed.

The income effect becomes negative whereby workers work and earn less to reach a satisfactory target income reducing income tax revenue. Higher taxes promote tax evasion and/or tax avoidance by individuals whilst also incentivizing the highly skilled workers and entrepreneurs to emigrate to countries where tax rates are lower. Not only will this reduced expected tax revenue for governments to use in redistributing income but it could also dampen the productive potential of the economy as innovation and entrepreneurial spirit is limited and hours worked fall.

Policy to redistribute income - minimum wage

can directly boost incomes of poorest

producers burdened without impacting the gov’s fiscal position

set above Eq wage in labour market

With higher wages, those at lower end of income spectrum able to move out of relative poverty by improving material and non-material standards of living

Evaluation of minimum wage to redistribute income

distorts efficient labour market outcomes

increase unemployment = harming those it is supposed to protect

low skills = difficult to find work at a higher wage rate bc low productivity

Effect of redistributive policies

Shift Lorenz curve left = reduction in income inequality

Gini coefficient would move closer to 0 - smaller distance between the Lorenz curve and line of perfect equality

General eval of policies to redistribute income

Inequality depends on level of income tax

Income tax set too high = working less, moving country

in SR may be quick rise in tax revenue

Income tax set too low = no guarantee that enough revenue generated to fund transfer payments + gov spending

If regressive tax rise LR to fund spending = income inequality may rise

Incentives

Laffer - … taxation is needed to set an … level which still promotes work and … … activity but also that provides a large enough … dividend to the government which can be used to reduce income inequality.

Gov should also beware of the incentives as it may promote a welfare …and dependency rather than workers themselves seeking to get out of … poverty by finding work. LR impact on government finances and on the productive potential of the economy.

Progressive, efficient, risk taking, fiscal, mentality, relative

Does income inequality have to come down?

Income inequality → impacts gov finances to help the poor and social costs

Normative consideration = gov perceives Gini to be too high, trying to reduce it should not conflict heavily with economic efficiency or else gov failure will result

Some income inequality = incentive to gain education and skills

Targeting low income inequality levels through excessive gov intervention = remove incentive to gain skills, reducing productive capacity of economy and LR growth rates

Marginal revenue product (MRP)

Additional revenue a firm earns from employing one more worker