Microfinance W3-W4

1/56

Earn XP

Description and Tags

MF in PH & Int Setting

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

57 Terms

1960

rural banks and cooperatives started the concept and practice of serving small loans. agricultural workers and fisherfolks benefited from this initial access to small credit. banks couldn’t sustain the program because of low repayment rate and some structural problems in their scheme

1970-mid 1980

government mobilized rural banks, development banks, and other government financial institutions to provide highly subsidized credit to the rural poor. through its directed credited programs, they hoped to bring down the cost of credit and help ease poverty

Why does DCPs failed?

didn’t reach the target clientele as subsidies were cornered by big borrowers

bred corruption at different levels as these involved government funds

massive repayment problems resulted in huge fiscal costs for the government

New Approach in Credit Methodology

was develop because of the lesson from the implementation of various government credit programs in the 70s and 80s

Late 80s

NGOs became potent partners of the government against poverty through microfinance. they provided much-needed small loan for small entrepreneurial activities

industry evolved from being in the margins to becoming mainstream with commercial banks eyeing to enter the industry

NGOs

they devised alternative options for non-collateralized loans and savings instruments for the poor

provided individual and group lending but sed group pressure or group accountability as collateral

met the needs of the entrepreneurial poor despite of certain regulatory and prudential issues

Philippine microfinance

began as social development initiative to alleviate poverty

moved from marginal to the mainstream, toward commercialization and microbanking

different from other development approaches

microcredit could be sustained without an endless supply of donor subsidies and resources

a feature that attracted government anti-poverty officials who worked on new legislation and mobilized public resources to bring down barriers to the adoption of microfinance by Philippines semi-formal and formal institutions

1993

formation of a Presidential Task Force on Credit for the Poor

consultative meetings to draw up a Master Plan for Credit for the Poor

Master Plan

identified 3 pronged strategy to alleviate poverty through microfinance

policy reform

financial resource-mobilization

capacity building

1st Thrust

to raise financial resources was embodied in the organization of the People’s Credit and Finance Corporation in 1996

2nd Thrust

area of developing a conducive policy environment, including lobbying for the passage of RA 8425 and the establishment of a government body, the National Anti-Poverty Commission (NAPC)

3rd Thrust

building institutional microfinance capacity through government fund called the People’s Development Trust Fund (PDTF)

1990

microfinance sector has grown dramatically in the PH, characterized by increases in terms of the numbers of borrowers, amount of the loan portfolios, number of areas covered, and number of institutions engaged in microfinance

October 2005

over 2.5 million households had access to financial services with total microfinance loan releases to almost 30 billion pesos since 2001

over 99% women borrowers engaged in some form of economic activity

these entrepreneurial poor comprised the bulk of microfinance clients

most were intro trading and services

some engaged in manufacturing or production-related activities

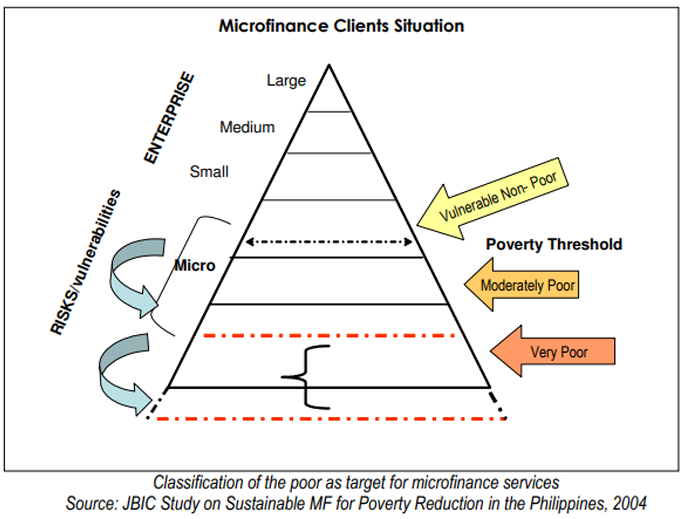

Classification of the poor as target for microfinance services

Microfinance Clients

mostly belong to the moderately poor and vulnerable non-poor, which are below the poverty threshold

Common prevailing MF methodologies adopted in the PH

Grameen Bank Approach

the ASA

microenterprise access to banking services (MABS)

extension of loans

continues to be the most dominant service provided to the poor by MF institutions across types

Savings

primarily consisted of forced savings and capital build-up, which formed part of the lending methodologies

Microfinance Sector

compromised 1,000 MF institutions including branches (rural, thrift, cooperatives, NGOs)

overall impact had been positive according to impact studies

access to financial services allowed poor household to diversify their sources of income through multiple economic activities

better income, assets, and higher household expenditures were reported for clients

among borrowers there was evidence of movement out of poverty over several loan cycles

Microfinance

its concept came into existence in the 15th century but was put into practice in late 1970s by the Grameen Bank of Bangladesh and it was adopted by the developed and developing countries

process of extending financial services to those people who have low income and it becomes hard for them to get finance from banks and other private money lenders

broad concept to provide financial services to those who are getting finance from a bank

available only to the poorer people

revolutionary concept in an economy, and it helps to meet the basic financial needs of the poor people and save them from all kinds of risks

increases the per national capital income and tries to bring equality in the economy

offers loans, savings, insurance, and much more to the underprivileged

an economic and social tool by which a needy people get to finance to meet their need

Microcredit

aspect of the microfinance which is specifically meant to provide credit to the poor customers

main purpose is to use this finance for those who want to come out of the poverty and be self-sufficient and earning ability is very low

given to those who are unemployed, don’t have property, don’t have a sound credit history

will increase the income level of the poor people along with living standard

poor people will get loan without putting anything as collateral security

Definition: Microfinance VS Microcredit

MF indicates a number of financial services provided to the small entrepreneurs and enterprise who don’t get finance from the banks or any other institutions

MC is a small loan facility provided to the people who have less earning and encourage to become self-employed

Components: Microfinance VS Microcredit

MF is whole concept

MC is an aspect or component of MF, an extended service of MF

Microfinance VS Microcredit

both important factors for the development of an economy as there is a high percentage of the population who live in poor condition, this concept helps to improve the condition of this people

BSP defines MF

provision of a broad range of financial services such as deposits, loans, payment services, money transfers and insurance products to the poor and low-income households, for their microenterprises and small businesses, to enable them to raise their income levels and improve their living standards

provision of financial services to low-income clients, including the self-employed

1980

NGOs adopted practices from Bangladesh’s Grameen Bank and Association for Social Advancement (ASA) to follow suit the credit programs

MF programs

began giving non-collateralized credit to grouped clients, targeting entrepreneurial poor

MFIs

provide financial and social intermediation services such as group formation, development of self-confidence, and training in financial literacy and management capabilities among members of a group.

Current Sector of MF

composed of over 2,000 microfinance institutions including branches (rural, thrift, cooperatives, NGOs)

top 10 players comprise 88% of the market share in terms of number of borrowers

number 1 institution in terms of borrowers is ASA Philippines, with its’ clients amounting to 1 million.

ASA Philippines

comprises 25% of the entire market

operates nationwide, providing both financial and non-financial services to its clients

ASA in Ortigas

have branches all over the country

1,073,580 active borrowers

P5,790,323,880 gross loan portfolio

1,073,580 depositors

P3,206,703,390 deposits

CARD NGO

market share of 19%

operates nationwide

CARD situated in Laguna

have branches all over the country

816,620 active borrowers

P5,028,134,100 gross loan portfolio

- depositors

P2,339,217,430 deposits

CARD Bank

16% market share

666,570 active borrowers

P5,537,709,650 gross loan portfolio

1,657,250 depositors

P4,644,624,160 deposits

Pagasa

5% market share

209,110 active borrowers

P1,208,491,020 gross loan portfolio

228,970 depositors

P455,961,440 deposits

NWTF

207,170 active borrowers

P1,313,304,190 gross loan portfolio

216,820 depositors

P468,519,700 deposits

TSKI

176,590 active borrowers

P968,435,050 gross loan portfolio

319,780 depositors

P470,451,740 deposits

TSPI

176,220 active borrowers

P1,670,731,590 gross loan portfolio

180,800 depositors

P781,027,170 deposits

PR Bank

134,900 active borrowers

P9,335,617,280 gross loan portfolio

99,620 depositors

P3,144,878,110 deposits

KMBI

125,850 active borrowers

P652,546,510 gross loan portfolio

136,670 depositors

P311,541,450 deposits

ASKI

102,300 active borrowers

P1,573,646,580 gross loan portfolio

96,670 depositors

P270,772,020 deposits

Variety of MF in the PH

credit unions

commercial banks

NGOs (Non-governmental Organizations)

cooperatives

sectors of government banks

for-profit MFIs

growing

in India, referred as Non-Banking Financial Companies

Credit Unions

member-owned financial cooperative that is created and operated by members and shares profits with owners

a type of financial institution, is a member-owned financial cooperative, controlled by its members and operated on the principle of people helping people, providing its members credit at competitive rates as well as other financial services

financial institutions, like banks, except the members own the credit union

nonprofit entities that aim to serve their members rather than seeking to earn a profit

often offer better savings rates, lower loan rates and reduced fees

Commercial Banks

type of bank that provides services such as accepting deposits, making business loans, and offering basic investment products that are operated as a business for profit

refers to a financial institution that accepts deposits, offers checking account services, makes various loans, and offers basic financial products like certificates of deposit (CDs) and savings accounts to individuals and small businesses

NGOs

microfinance Non-Government Organization (MF-NGO)

non-stock, non-profit organization duly registered with the Securities and Exchange Commission (SEC) with the 30 primary purpose of implementing a microenterprise development strategy and providing microfinance programs, products and services such as microcredit

can get, organize and raise funds from various methods, processes, programs, projects and activities

Getting grants from Funding agencies through Projects

Funding from International Funding Agencies

Funding from Government Schemes

Fund Raising from Corporate under CSR

Student and Child Sponsorship program

Cooperatives

autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly owned enterprise

democratically owned by their members, with each member having one vote in electing the board of director

people-centered enterprises owned, controlled and run by and for their members to realize their common economic, social, and cultural needs and aspirations

bring people together in a democratic and equal way

purpose is to realize the economic, cultural and social needs of the organization's members and its surrounding community

often have a strong commitment to their community and a focus on strengthening the community they exist in or serve

Group Lending

allows a group of individuals - often called a solidarity group to provide collateral or loan guarantee through a group repayment pledge

incentive to repay the loan is based on peer pressure, if one group member defaults, the other group members make up the payment amount

Flexible Payment Schedule

on-the-spot loans that don't come from a traditional lender, like a bank or credit union

loan is typically paid back in monthly installments, depending on the agreement

in some cases, payment plans may help consumers budget their purchases better or provide a lifeline in an emergency

they can come in handy for those with irregular incomes

but like with any loan, flexible payment plans can snowball into debt.

Flexible Payment Plans Example

affirm allows users to shop at select stores online and select them as a payment option upon checkout

buyers can then select the length of their payment schedule and confirm the loan with Affirm

interest rates on Affirm loans range from 10% to 30%, and repayment periods can be three months, six months or 12 months

both Affirm and Afterpay did not respond to requests for comment

Bi-weekly

a payment with principal and interest payments due every two weeks

instead of making 12 monthly payments, a borrower with a biweekly payment will be required to make 26 half-month payments

Monthly

payment with principal and interest payments due every month

Limited Liability

type of legal structure for an organization where a corporate loss will not exceed the amount invested in a partnership or limited liability company (LLC)

investors' and owners' private assets are not at risk if the company fails.

Rural Banks

designed to provide financial services to rural and agricultural communities

MF Products and Services

Microcredit

Microsavings

Microinsurance

Payment and Remittance Services

Role of MF in Agricultural Development

access to capital

financial inclusion

risk management

knowledge and capacity building

sustainable agricultural practices

market linkages

social and gender impact (women empowerment)

Challenges in Farmers’ Access to MF

limited financial literacy

land tenure issues

high interest rates and transaction costs

vulnerability to climate change

limited access to physical banking infrastructure

trust and awareness

Innovative MF Products for Farmers

crop loan with buy-back agreement

mobile-based agri-financing

weather-indexed microinsurance

warehouse receipt financing

cooperative-based microfinance

agri-enterprise financing

livestock and poultry financing