FAR.11_Impairment of non-financial assets (Drill)

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

If the fair value less costs of disposal cannot be determined

a. The asset is not impaired

b. The recoverable amount is the value-in-use

c. The net realizable value is used

d. The carrying value of the asset remains the same

b. The recoverable amount is the value-in-use

Reversal of impairment loss is allowed if

a. The recoverable amount of the asset becomes higher than its carrying amount because of the ‘unwinding’ of the discount.

b. The loss is related to acquired goodwill.

c. Either a or b.

d. Neither a or b.

d. Neither a or b.

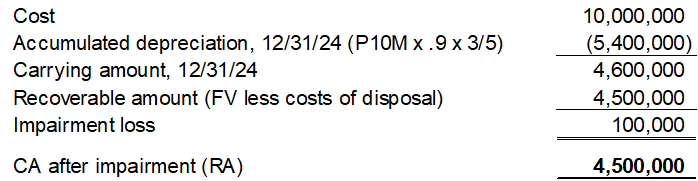

An entity had purchased equipment for P10,000,000 on Jan. 1, 2022. The equipment had a 5-year life and a salvage value of 10%. The entity depreciated the equipment using the straight-line method. On Dec. 31, 2024, the entity had doubts on the recoverability of the carrying amount of this equipment. On Dec. 31, 2024, the discounted expected net future cash inflows related to the continued use and eventual disposal of the equipment totaled P4,300,000. The equipment’s fair value less costs of disposal on Dec. 31, 2024 is P4,500,000. After any loss on impairment has been recognized, what is the carrying amount of the equipment?

a. P4,000,000

b. P4,300,000

c. P4,500,000

d. P4,600,000

c. P4,500,000

Tweed Inc. reported an impairment loss of P150,000 on its income statement for the year ended Dec. 31, Year 1. This loss was related to an item of equipment which Tweed intended to use in its operations. On the company's Dec. 31, Year 1 statement of financial position, Tweed reported this equipment at P920,000 and, as of December 31, Year 1, Tweed estimated that this equipment would be used for another five years. On Dec. 31, Year 2, Tweed determined that the recoverable amount of its impaired equipment had increased by P25,000 over its recoverable amount at Dec. 31, Year 1. The increase in recoverable amount is due to the unwinding of discount. On the company's Dec. 31, Year 2 statement of financial position, what amount should be reported as the carrying amount for this equipment?

a. P761,000

b. P736,000

c. P945,000

d. P856,000

b. P736,000

CA, 12/31/Y1 | 920,000 | ||

Depreciation - Year 2 (P920,000/5) | (184,000) | ||

CA, 12/31/Y2 | 736,000 | ||

An asset’s value in use may become greater than the asset’s carrying amount simply because the present value of future cash inflows increases as they become closer. However, the service potential of the asset has not increased. Therefore, an impairment loss is not reversed just because of the passage of time (sometimes called the ‘unwinding’ of the discount), even if the recoverable amount of the asset becomes higher than its carrying amount. (PAS 36, par. 116)

An entity reported an impairment loss of P250,000 in its income statement for Year 9. This loss was related to an item of property, plant and equipment which was acquired on Jan. 1, Year 1 with a cost of P2,000,000. Depreciation on the asset is computed on a straight-line basis and annual depreciation on cost is P80,000. Depreciation for Year 10 was computed on the asset’s recoverable amount at Dec. 31, Year 9. On Dec. 31, Year 12, the entity decided to measure the asset using revaluation model. This asset was then appraised at a fair value of P1,650,000.

The gain on impairment recovery to be recognized by the entity in Year 12 profit or loss is

a. Nil

b. P203,125

c. P218,125

d. P250,000

b. P203,125

Useful life (P2,000,000/P80,000) | 25 | |||

CA, 12/31/Y9 [P2,000,000 - (P80,000 x 9)] | 1,280,000 | |||

Impairment loss | 250,000 | |||

RA | 1,030,000 | |||

CA, 12/31/Y9 after impairment | 1,030,000 | |||

Less depreciation - Year 10 to 12 [(P1,030,000/16) x 3] | 193,125 | |||

CA, 12/31/Y12 | 836,875 | |||

CA, 12/31/Y12 without impairment [P2,000,000 - (P80,000 x 12)] | 1,040,000 | |||

Less CA, 12/31/Y12 with impairment | 836,875 | |||

Reversal of impairment loss in P/L | 203,125 | |||

Hansel, Inc. acquired Grettel Company in a business combination. As a result of the combination, the following amounts of goodwill were recorded for each of the three reporting units of the acquired company:

Retailing | P300,000 |

Service | 200,000 |

Financing | 400,000 |

Near the end of the current year a new major competitor entered the company’s market and Hansel was concerned that this might cause a significant decrease in the value of goodwill. Accordingly, Hansel computed the implied value of the goodwill for the three major reporting units as follows:

Retailing | P250,000 |

Service | 100,000 |

Financing | 600,000 |

Determine the amount of goodwill impairment that should be recorded by Hansel.

a. P250,000

b. P150,000

c. P100,000

d. P0

b. P150,000

Retailing (P300,000 - P250,000) | 50,000 | ||

Service (P200,000 - P100,000) | 100,000 | ||

Financing | - | ||

Impairment loss | |||

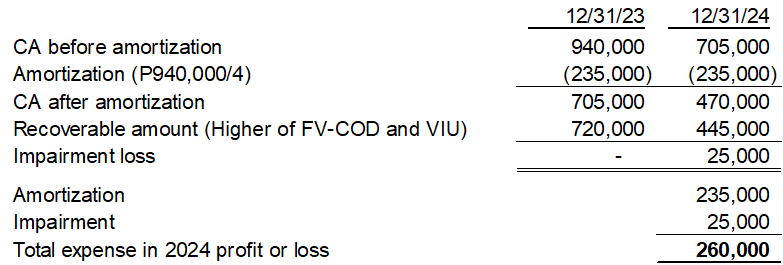

On Jan. 2, 2023, an entity purchased a patent with a cost P940,000 a useful life of 4 years. At Dec. 31, 2023, and Dec. 31, 2024, the entity determines that impairment indicators are present. The following information is available for impairment testing at each year end:

12/31/2023 12/31/2024

Fair value less costs of disposal P715,000 P420,000

Value-in-use P750,000 P445,000

No changes were made in the asset's estimated useful life.

The total expense to be recognized in the entity’s 2024 profit or loss in relation to the patent is

a. P235,000

b. P250,000

c. P260,000

d. P305,000

c. P260,000

An entity computes the recoverable amount of which of the following assets only if there is an indication the asset may be impaired?

a. Intangible asset with an indefinite useful life

b. Intangible asset not yet available for use

c. Property, plant and equipment not yet available for use

d. Goodwill acquired in a business combination

c. Property, plant and equipment not yet availa

On July 1, Year 1, an entity purchased computer equipment at a cost of P360,000. This equipment was estimated to have a 6-year life with no residual value and was depreciation by the straight-line method. On Dec. 31, Year 3, the entity determined that this equipment could no longer process data efficiently, its value had been permanently impaired, and P70,000 could be recovered over the remaining useful life of the equipment. What carrying amount should the entity report on its Dec. 31, Year 4 statement of financial position for this equipment?

a. P 0

b. P50,000

c. P70,000

d. P150,000

b. P50,000

CA, 12/31/Y3 (P360,000 x 3.5/6) | 210,000 | ||

Recoverable amount | 70,000 | ||

Impairment loss - Year 3 | 140,000 | ||

CA, 12/31/Y3 (after impairment) | 70,000 | ||

Depreciation - Year 4 (P70,000/3.5) | (20,000) | ||

CA, 12/31/Y4 | 50,000 | ||

An entity reported an impairment loss of P250,000 in its income statement for Year 9. This loss was related to an item of property, plant and equipment which was acquired on Jan. 1, Year 1 with a cost of P2,000,000. Depreciation on the asset is computed on a straight-line basis and annual depreciation on cost is P80,000. Depreciation for Year 10 was computed on the asset’s recoverable amount at Dec. 31, Year 9. On Dec. 31, Year 12, the entity decided to measure the asset using revaluation model. This asset was then appraised at a fair value of P1,650,000.

The revaluation increase to be recognized by the entity in Year 12 other comprehensive income is

a. P530,000

b. P563,125

c. P610,000

d. P748,125

c. P610,000

Fair value, 12/31/Y12 | 1,650,000 | |||

CA, 12/31/Y12 without impairment [P2,000,000 - (P80,000 x 12)] | 1,040,000 | |||

Revaluation surplus | 610,000 | |||

Alternative computation: | ||||

Fair value, 12/31/Y12 | 1,650,000 | |||

Less CA, 12/31/Y12 with impairment | 836,875 | |||

Revaluation increase | 813,125 | |||

Less reversal of impairment | 203,125 | |||

Revaluation surplus | 610,000 | |||