Securities Industry Essentials (SIE) | Study Guide

1/563

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

564 Terms

Preemptive Rights (“Rights”)

Are distributed to shareholders before the issuance of new shares to the public. They are short-term securities that give the owner the option to buy a certain number of shares at a reduced price over a short period of time. Typically, rights are issued for 30-60 days and then expire.

Cash Dividends

Enable a company to share a part of the corporation’s profits with shareholders.

Stock Dividends

Involve giving additional shares to existing stockholders. The total number of shares outstanding increases, but the value of each outstanding share decreases.

Stock dividends are defined as any stock distribution that involves less than 25% of the outstanding shares. A larger distribution of shares would be considered a stock split.

Stock Split

A larger distribution of shares, more than 25% of the outstanding shares. No economic value. No taxable event, but an adjustment in cost basis.

Forward Stock Split

Increases the number of shares outstanding. No economic value. No taxable event, but an adjustment in cost basis.

Reverse Stock Split

Decreases the number of shares outstanding. No economic value. No taxable event, but an adjustment in cost basis.

A right gives the shareholder the option to do one of three things. What are the three things?

Exercise their right and buy new shares at a price below the current market price.

Sell the right to another investor.

Do nothing and let the right expire worthless.

Balance Sheet

The balance sheet of a company is a “snapshot” of all of the company’s assets and liabilities at one point in time.

What is the formula for the balance sheet?

Total Assets - Total Liabilities = Net Worth

Total Assets = Net Worth + Total Liabilities

Basic Rights of Common Shareholders

Inspect books and records

Transfer ownership

Preemptive right

Corporate distribution

Corporate assets upon dissolution

Vote

Right to inspect books and records:

Common Shareholder Basic Right.

Corporations must provide shareholders with audited annual reports that include the company’s financial statements.

Right to transfer ownership:

Common Shareholder Basic Right.

Shares are liquid, meaning that they can be bought and sold.

Preemptive Right:

Common Shareholder Basic Right.

The right to proportional ownership of the company if new shares are issued.

Right to corporate distributions:

Common Shareholder Basic Right.

Shareholders have the right to receive distributions such as dividends if declared by the board of directors.

Right to corporate assets upon dissolution:

Common Shareholder Basic Right.

In the event of a liquidation, shareholders have a residual claim to the company’s assets. This means that they will be paid after all other claims have been satisfied.

Right to vote:

Shareholders have the right to approve certain corporate decisions.

Items That Require a Shareholder Vote

Declare a stock split

Declare a reverse stock split

Issue convertible bonds or preferred stock

Issue stock options to officers on a preferential basis

Items That Do Not Require a Shareholder Vote

Declare a cash dividend

Declare a stock dividend

Declare a preemptive rights distribution

Straight / Statutory Voting:

One vote per share per voting item.

More common than cumulative voting.

Votes must be evenly cast.

Cumulative Voting:

(1 Vote Per Share) x (# of Open Seats on Board of Directors)

Shareholder may divide their total votes in whatever manner they choose.

Company Asset Entitlement -after liabilities are settled (order of priority)

Secured Creditors (have a claim on specific assets of the company i.e., equipment, machinery)

Unsecured Creditors (banks, employees, partners, suppliers)

Preferred Stockholders

Common Stockholders

Why is Cumulative Voting an advantage for the “small investor”?

They can vote disproportionately to exert more influence in the election of individual directors.

Protect minority shareholder interest.

Proxy Voting

A stand-in that will cast votes on behalf of the shareholders who choose not to attend annual shareholder meeting

“Piercing the corporate veil” (rare exceptions)

Courts hold shareholders liable.

When the company does not act as a separate entity, instead acts more like an extension of the individual shareholders.

It can also occur if the company is undercapitalized or a fraud or injustice are involved.

Preferred Stock Basic Features:

Senior status

Par value

Stated dividends

Differences and similarities with bonds:

Differences:

Bonds mature on a set date, Preferred Stock has an indefinite life

Bondholders have a priority of claim to interest payments and corporate assets upon liquidation ahead of preferred shareholders

Bondholders have a legal right to interest payments; preferred dividends are only paid if declared by the board of directors

Similarities:

Receive fixed interest rates and do not have voting or preemptive rights

Types of Preferred Stock:

Cumulative

Callable

Convertible

Participating

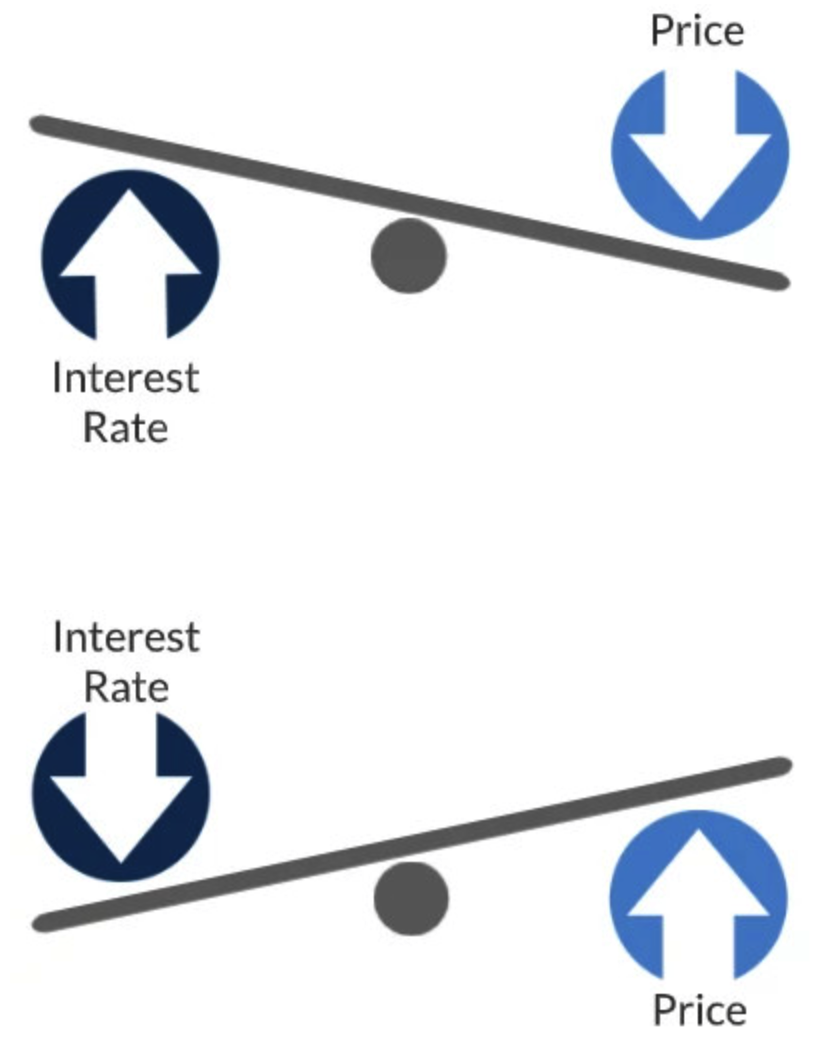

Interest Rate Movements and Preferred Stock Prices

Impact on the value of preferred stock, concept of current yield

Inverse relationship:

Interest rates rise, prices fall

Interest rate fall, prices rise

Unlike common stock, Preferred Stock does not have the right to:

Vote and does not have Preemptive Rights

Differences between Bonds and Preferred Stocks:

Bonds mature on a set date while preferred stock has an indefinite life

Bondholders have a priority of claim to interest payments and corporate assets upon liquidation ahead of preferred shareholders

Bondholders have a legal right to interest payments; preferred dividends are only paid if declared by the board of directors

Similarities between Bonds and Preferred Stocks:

Both bondholders and stockholders receive fixed interest rates and do not have voting or preemptive rights.

Common Stocks v. Preferred Stocks regarding Market Price, Risk, Voting Rights, and Income Production (dividends) and Appreciation

Market Price

Common: fluctuates with the issuer’s profits and losses

Preferred: fluctuates with interest rates and issuer’s creditworthiness

Risk

Common: Riskier, but more growth potential

Preferred: Less risky, but less growth potential

Voting Rights

Common: One per share

Preferred: None

Income Production (dividends) and Appreciation

Common:

May receive a share in the company’s profits in the form of dividends

Dividends may or may not be paid regularly

Participate in the company’s growth through appreciation in stock price

Preferred:

When dividends are paid, they are paid as a fixed percentage of par (5% of par)

Seniority over common, meaning dividend payments are paid to preferred stockholders before they are paid to common stockholders

Common Stocks v. Preferred Stocks: Market Price

Common:

Market price fluctuates with the issuer’s profits and losses

Preferred:

Market price fluctuates with interest rates and issuer’s creditworthiness

Common Stocks v. Preferred Stocks: Risk

Common:

Riskier, but more growth potential

Preferred:

Less risky, but less growth potential

Common Stocks v. Preferred Stocks: Voting Rights

Common:

One per share

Preferred:

None

Common Stocks v. Preferred Stocks: Income Production (dividends) and Appreciation

Common:

May receive a share in the company’s profits in the form of dividends

Dividends may or may not be paid regularly

Participate in the company’s growth through appreciation in stock price

Preferred:

When dividends are paid, they are paid as a fixed percentage of par (5% of par)

Seniority over common, meaning dividend payments are paid to preferred stockholders before they are paid to common stockholders

Is a Common Stock callable?

No

Cumulative Preferred

If the issuer does not pay, the missed payments accumulate and must be paid before the issuer can resume making any other dividend payments

All accumulated preferred dividends must be paid before a dividend can be paid to common shareholders

Callable Preferred

The issuer has the right to redeem the shares after a set date

When stock is called, the shareholder will typically receive the par amount

Issuers may call in shares when interest rates fall

After retiring the old higher-rate shares, the issuer can issue new preferred shares at the current lower rates

Typically pay dividends higher than noncallable issues

Convertible Preferred

Shareholders can exchange their preferred stock for common stock based on a predetermined price

If the market price of the common stock rises, the convertible’s value is pushed up as well

Issuer can sell convertibles with lower dividend rates because of the value of the conversion feature

The price of Convertible Preferred is typically driven by—

the price of the issuer’s common shares.

Participating Preferred

In addition to the fixed dividend rate, participating preferred shareholders may also be given additional dividends

extra dividends must be declared by the board of directors

This feature enables shareholders to participate in the earnings of the company more fully

If the company has strong earnings, a special dividend may be declared- participating preferred shareholders would receive this dividend

Preferred Stock has a ___ Dividend Rate

Fixed

When Preferred Stock is issued, the dividend rate is set at a level—

comparable with the current market rate of interest for equivalent securities.

Once the preferred stock is issued, what will it’s market price be primarily dependent on?

Current interest rates.

Regardless of the market price of a preferred stock, the dividend pair will still be a—

percentage of the par amount (typically $100).

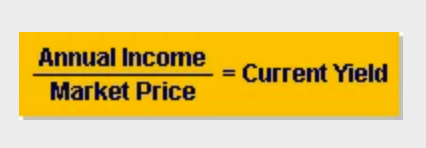

Current Yield Formula

Current Yield = Annual Income from Security / Market Price of Security

What kind of relationship do interest rate movements and preferred stock prices?

An Inverse Relationship:

As rates rise, prices of existing preferred shares will fall

If rates fall, the price of preferred stock will rise

This relationship will also be seen with bond prices.

Warrant

A long-term option to buy stock at a fixed price

Price is usually quite a bit above the market price of the stock when the warrant is issued

Warrants only become valuable if the stock price rises

Warrants are typically attached to a new stock or bond issue as an extra incentive

Warrants are sometimes referred to as “sweeteners” because they sweeten the deal, making the new issue more attractive to investors.

Although received as part of a packaged unit, a warrant is a separate security that can be traded by itself

A warrant usually includes a period before it can be exercised (e.g., 1 year), after the waiting period it can be exercised at the set price until expiration.

Many warrants have a lifetime at issuance of 5 to 10 years, but some are perpetual which means they don’t expire.

American Depositary Receipts (ADRs)

A vehicle to facilitate trading foreign securities in the U.S., “Foreign Investment ADR”

Issued by US banks

Bought and sold in USD

Dividends paid in USD

Listed on US and foreign exchanges

Value can change based on exchange rate

Comply with US exchanges and US GAAP

Similarities between Warrants and Rights:

Warrants and rights are both securities that can be traded, exercised to buy the underlying security, or allowed to expire worthless

Can be traded

Exercised to buy the underlying security

Allowed to expire worthless

Differences between Warrants and Rights:

Warrants

Exercise Price: Above the market price

Expiration: Long-term

Can Be Traded: Yes

Rights

Exercise Price: Below the market price

Expiration: Short-term

Can Be Traded: Yes

Perpetual Warrant

No expiration.

Warrants usually have a life of 5 years, but sometimes perpetual warrants are issued.

How are ADRs created?

Bank buys foreign stock and places it in trust in the country of origin

Then the bank issues American Depositary Receipts (ADRs), which are backed by the securities held in trust

ADRs are registered with the SEC, sold in the U.S., and are priced in U.S. dollars.

What rights does the ADR Receipt Holder have?

Does have the right…

As dividend payments are received, the bank passes these on to the receipt holder in U.S. dollars

Bank sells any preemptive rights and sends the money to the receipt holder

Does not have the right…

Receipt holder does not have voting or preemptive rights

Bank votes the shares that it owns

What kind of currency risk do ADRs face?

Exchange Rate Risk (Currency Risk)

The risk of currency exchange fluctuation.

ADRs are priced in U.S. dollars, the market price will depend on changes in foreign currency markets.

If the foreign currency weakens against the U.S. dollar, the ADR will be worth less in U.S. dollars.

At issuance, the exercise price of a warrant is set at a ____ to the stock’s current market price.

The warrants will only be exercised when the market price ____ ____ the exercise price.

premium

rises above

ADRs are issued by:

US Banks

ABC company has 100,000 shares of common authorized, 20,000 shares of common issued, and 10,000 shares of common outstanding. It has how many shares of treasury stock?

10,000

(20,000 - 10,000 = 10,000)

Treasury Stocks

Shares that have been repurchased by the issuer

An ADR has been issued where each ADR equals 600 ordinary shares of the foreign issuer. If a client wished to buy enough ADRs to cover 6,000 ordinary shares, how many ADRs must be purchased?

10

When is it typical for an ADR to cover a “multiple” of shares?

When foreign shares are inexpensive.

When is it typical for an ADR to cover a “fraction” of shares?

When foreign shares are expensive.

A type of security called a “right” typically allows:

A current shareholder to purchase additional shares at a discount to market price.

settlement date

The date ownership of a security changes

Settlement—

is the date the purchaser pays for the security and the seller makes good delivery.

If a customer buys 100 shares of ABC stock on Wednesday, July 3rd in a regular way trade, the trade will settle on:

July 5th

How many days after the trade date do regular way trades take to settle?

1 business day

XYZ preferred stock pays an annual dividend of 5% and has a par value of $100. If the stock makes all of its payments, how much will an investor who holds 1,000 shares of XYZ receive in dividends this year?

$5,000

How is the annual per-share dividend for a preferred stock calculated?

Multiplying the stock’s par value ($100) by its dividend rate

Par Value x Dividend Rate

ABC 10% $100 par preferred is trading at $120 in the market. The current yield is:

8.33%

$10 / $120 = 8.33%

PDQ Company $1 par common stock currently trading at $34. PDQ is currently paying a quarterly common dividend of $0.75 per share. The current yield of PDQ stock is:

8.8%

Yields are based on — —

annual return

Current Yield formula

Current Yield = Annual Income / Market Price

Callable preferred stock is likely to be redeemed by the issuer if:

interest rates fall

If interest rates fall, issuers can “call in” — — rate preferred and replace it by selling new preferred at the — — —. Thus, calls take place when — — have —.

old high

lower current rates

interest rates

fallen

An investor who wishes to vote at a company’s annual meeting:

can vote by proxy

Subscription rights typically expire after four to eight:

Weeks

Subscription Right

is a right granted by a corporation to its current stockholders, to purchase new stock at a discount during a rights offering

What is the difference between a warrant and a subscription right?

A subscription right is similar to a warrant but has a shorter life, usually four to eight weeks.

ABC 8% $100 par preferred is trading at $120 in the market. The current yield is:

6.7%

$8 / $120 = 6.7%

What are stock dividends?

Additional shares of company stock granted to shareholders

The portion of authorized stock that has been sold to shareholders is called —

Issued Stock

— — represents shares of issued stock that have been repurchased by the company and removed from public circulation.

Treasury Stock

— — is treated as though it is still in the hands of the shareholder, in this case, the corporation, hence it is still considered — —, however, it has — — rights and pays — —.

Treasury Stock

issued stock

no voting

no dividends

issued stock - treasury stock = the amount of stock remaining in circulation; is the number of — —.

shares outstanding

— — represents all shares in circulation and it is this number that is used to determine market capitalization and earnings per share.

Shares outstanding

Shares outstanding represent all shares in circulation and it is this number that is used to determine — — and — — —.

market capitalization

earnings per share

Changes in the equity capitalization of a company require — approval.

shareholder

A stock split changes par value per share, which requires a — —.

shareholder vote

The issuance of convertible securities (which can be converted to equity) is potentially dilutive to the existing — —. They must vote to permit this.

common shareholders

A — — is when someone outside the company makes an offer to the existing shareholders to buy their shares, typically at a — to the current market price.

tender offer

premium

The voting process by which an investor may use their total number of votes (number of shares owned times number of seats) to vote for just one candidate even when there are multiple seats open is known as:

statutory voting

The price of an ADR traded on Nasdaq is strongly linked to:

The value of the underlying shares

A primary determinant of ADR pricing is the —

value of the foreign shares.

A secondary determinant of ADR pricing is the —

currency value/exchange rate

In a reverse split, the number of outstanding shares of the corporation is —. This — reported earnings per share. However, the company’s Price / Earnings ratio will remain — because both the stock market price and the earnings per share will increase in the — proportion, keeping the P/E ratio —.

reduced

increased

constant

same

unchanged

PDQ Company $10 par common stock is currently trading at $40. PDQ is currently paying a common dividend of $0.20 per share quarterly. The current yield of PDQ stock is:

2.0%

Yields are based on annual returns.

This stock is paying a $0.20 dividend quarterly, so the annual dividend rate is $0.80.

The formula for current yield is: Current Yield = Annual Income / Market Price

What is a Bond?

A fixed-income security that represents a loan to an issuer that needs money (often a corporation or government entity) from an investor who has funds to lend.

The issuer promises to pay the lender interest and repay the principal of the loan at maturity.

Term Bonds

A bond issue for which every bond has the same interest rate and maturity.

Corporate bond issues and U.S. government bond issues are typically term bond issues.

Zero-Coupon Bonds

Discount at Purchase

0% Semi-Annual Interest Payments (no interest income)

Premium at Maturity