Economics, Microeconomics, 2.7 Government Intervention

1/32

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Productive efficiency

A society is not wasting resources and producing with the lowest possible cost/fewest resources

Allocative efficiency

producing the perfect combination of goods wanted by society

Indirect tax =

Tax imposed on expenditure (e.g., an excise tax; sales taxes such as a “goods and services tax” [GST] or “value added tax” [VAT])

indirect taxes cause two things:

Allows government to gain extra revenue

Discourages consumption of a certain good or service

There are two types of indirect taxes:

Specific tax: fixed amount of tax imposed on a product (e.g., $1 per unit)

Ad valorem (percentage) tax: tax is a percentage of the selling price (increases as price of product rises)

Taxes will raise firms’

cost of production which will affect the supply curve on graphs

Tax incidence refers to

who pays what share of a tax

Who pays what share of a tax depends on the elasticity of the product

If PED is greater than PES

producers bear the majority of the tax burden

If PES is greater than PED

consumers bear the majority of the tax burden

The more price inelastic a product is

the more consumers pay the tax burden

The more price elastic a product is

the more producers pay the tax burden

A Subsidy is

money paid by the government to a firm

subsidies are given to firms so that:

Lower prices for consumers

Guarantee supply of products the government thinks are necessary for the economy

Enable domestic producers to compete with international producers

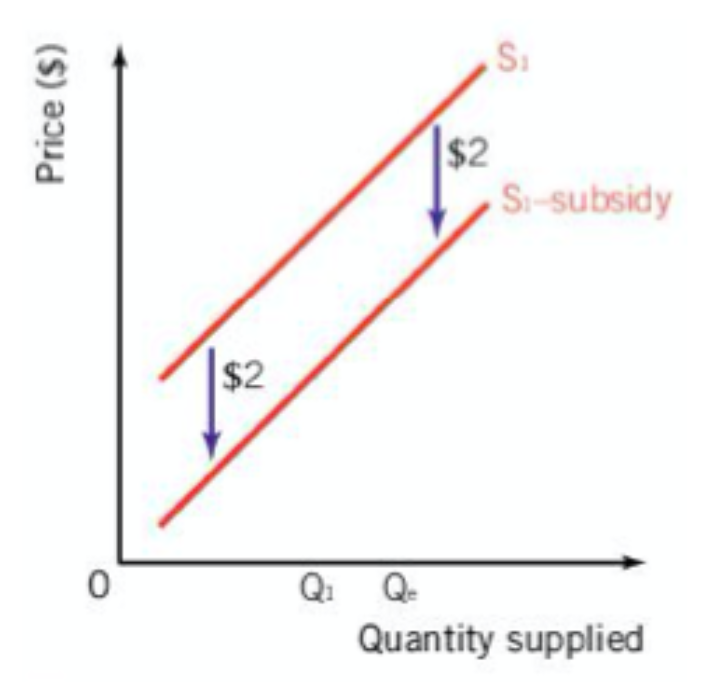

A subsidy reduces production costs for firms

causing a rightward (or outward) shift of the supply curve

subsidies for producers result in

lower prices and increased output

subsidies for consumers result in

consumers paying lower prices but there may be an increase in expenditure that may offset it

subsidies for the government result in

consumers paying lower prices for goods

from subsidies, both consumers and producers gain

surplus

when subsidies are implemented there is an opportunity cost on the

government

due to over-allocating resources because of the subsidy

allocative inefficiency occures

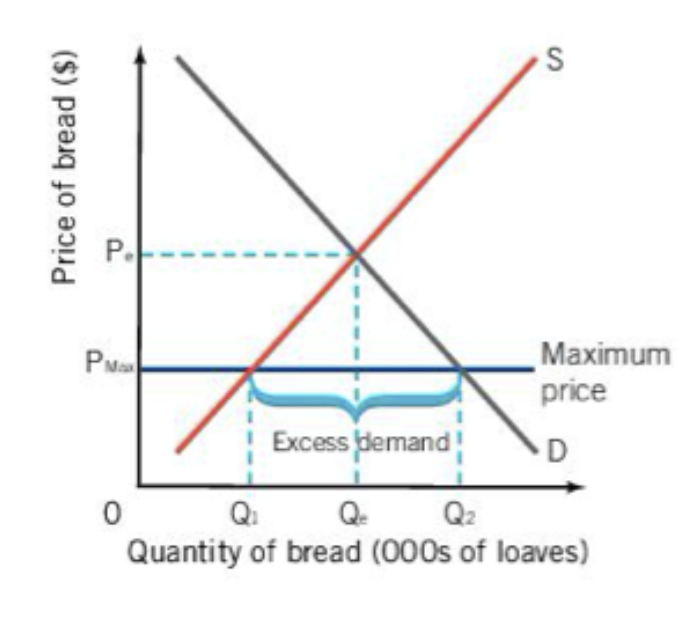

when governments set a maximum price on a product it is a called a

price ceiling

price celings are usually placed on

necessities (merit goods)

A price ceiling usually creates a

shortage--demand is much higher than supply

price ceilings will also lead to

parallel markets

long lines/waitlists for certain products

a government can reduce a price ceiling induced shortage by

Offer subsidies to firms to encourage production

Government production of the product (direct provision)

Release stored goods on the market (only for non-perishable goods, and given they had previously stored some of the product)

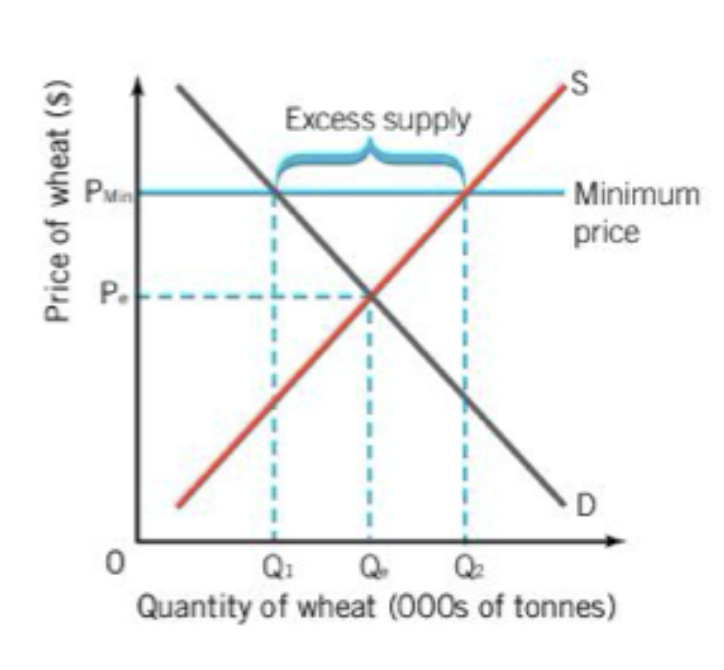

when governments set a minimum price on a product it is called a

price floor

price floors are done to benefit

producers and workers

producers see the benefit from price floors by

Raising income for producers and can be a protection against supply shocks, especially producers of commodities

workers see the benefit from price floors by

Having a minimum wage to ensure a higher standard of living

Governments will also impose minimum prices to

discourage consumption of demerit goods (products that can have harmful effects to society and are overprovided by the free market)

Price floors usually lead to

excess supply, or a surplus, that will lead to reduced consumption (demand)

there are problems with a surplus such as

Reduced demand leads to less revenue for companies

Surplus will eventually cause firms to try to get around the price controls to get rid of the surplus

Inefficiency/waste of resources

governments can solve the surpluses with actions such as

Government can buy the surplus and store it (if it is non-perishable, but storage is expensive)

Impose a quota

Attempt to increase demand for the product

“Dump” the surplus by selling on the international market