Subsidies

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

taxes are used for two main reasons...what are they?

Discourage harmful goods and raise tax revenue

Why does the government spend some of its tax revenue on providing subsidies?

One way the government use this tax revenue is to provide subsidies, which encourage the consumption and production of goods that are good for society e.g. electric cars.

What is the definition of a subsidy?

A subsidy is a grant from the government to a firm to increase the supply of a good.

If a firm is given a subsidy, the firm will supply:

more goods (have an incentive) and are able to sell for a smaller price

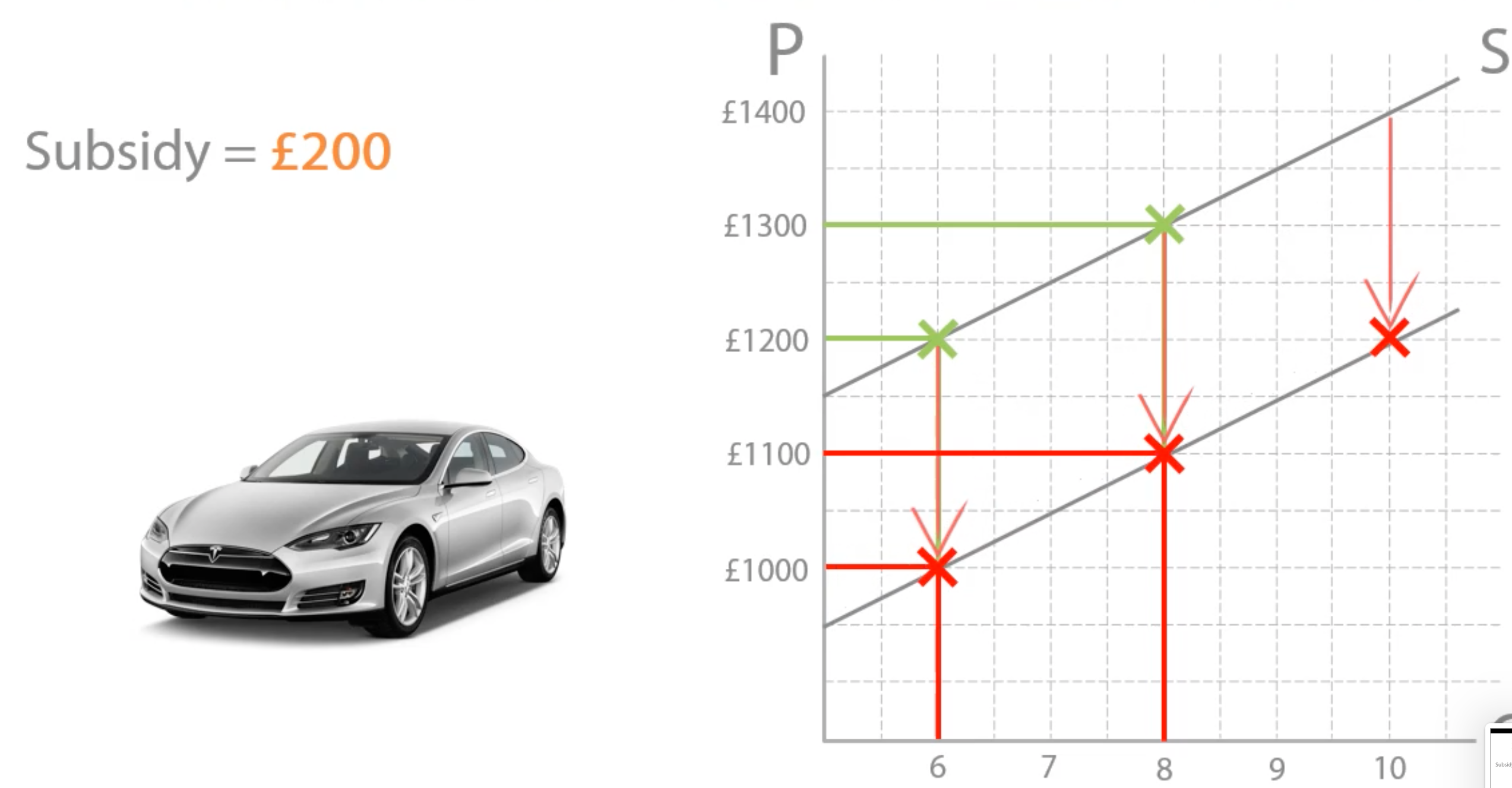

If we introduce a £400 subsidy, what will happen to our supply curve?

It will shift vertically down by £400

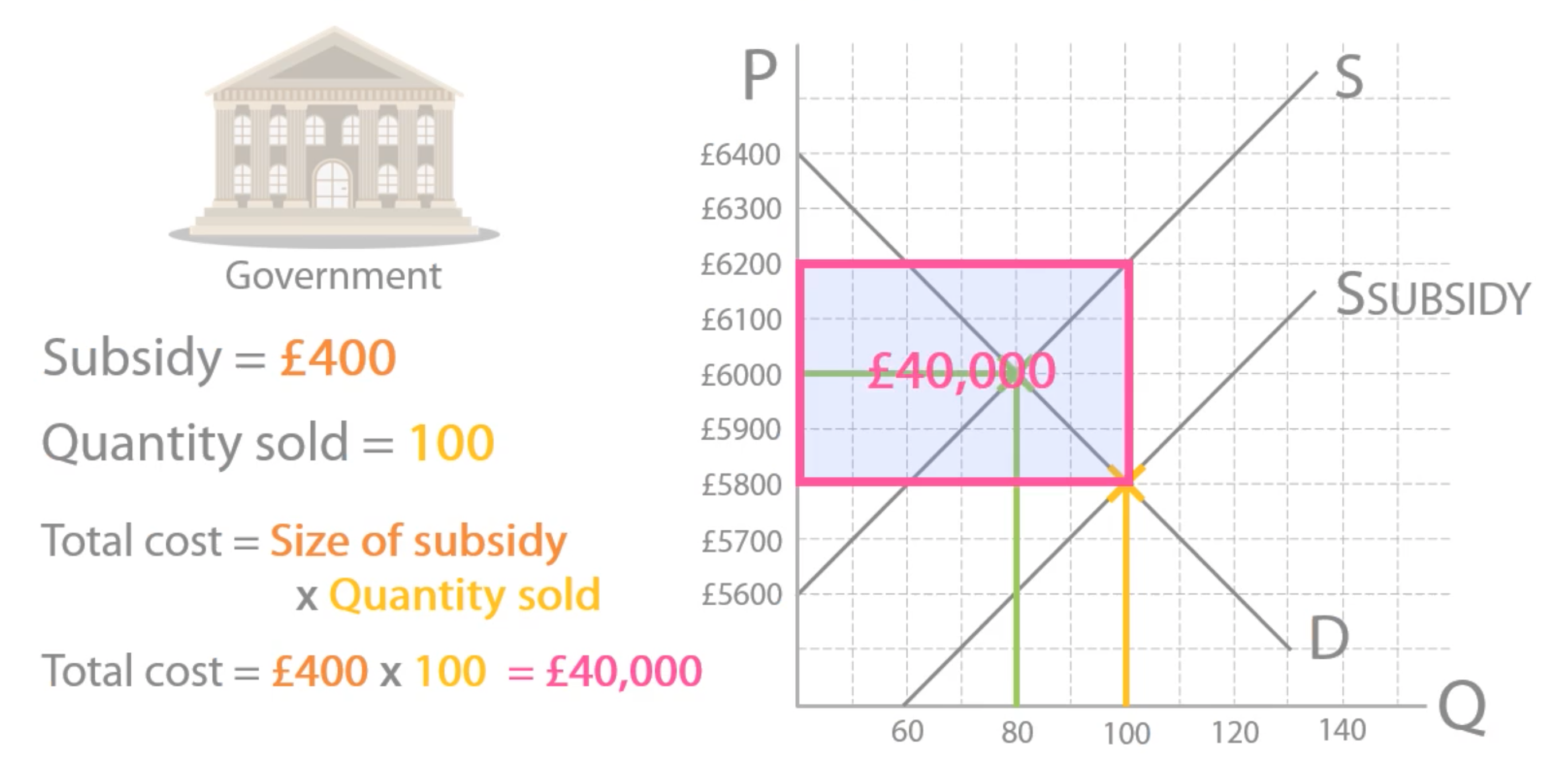

How do you work out the total cost of the subsidy to the government?

size of subsidy x quantity sold

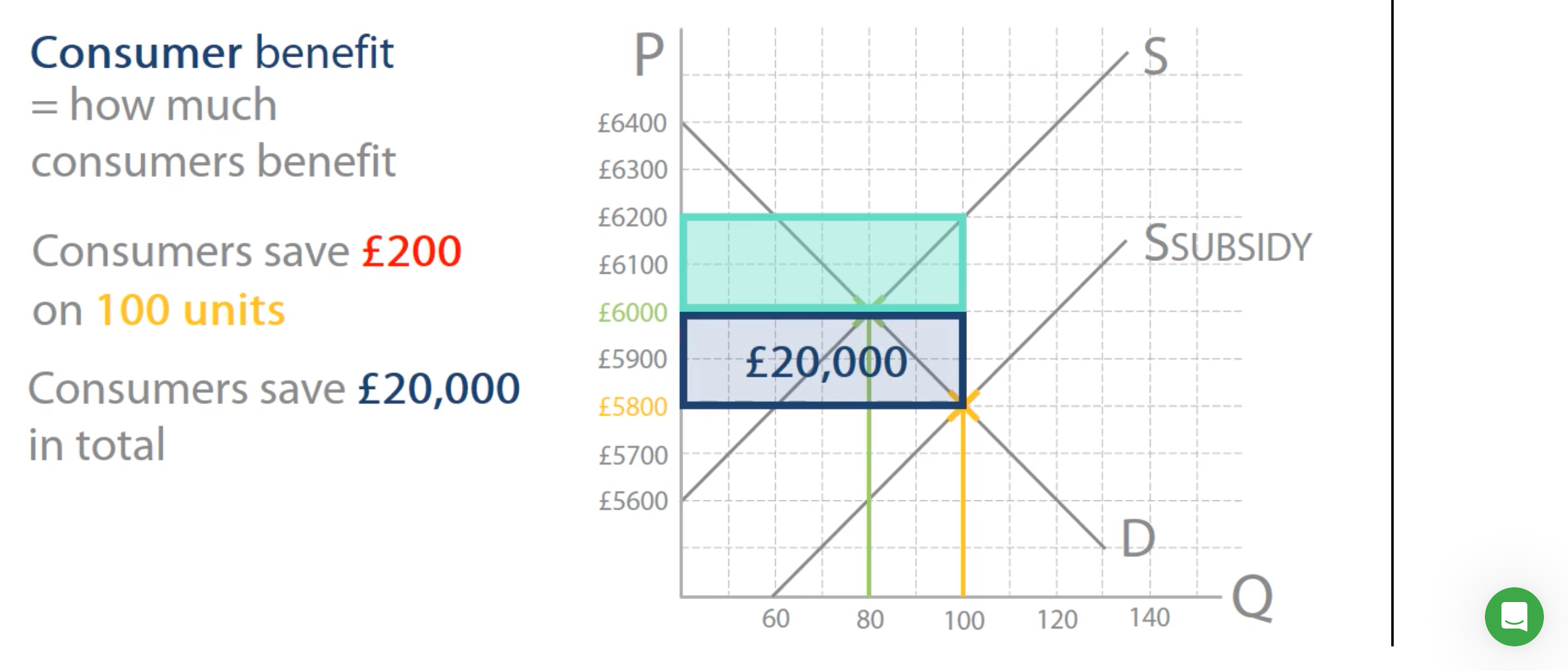

How do you work out the consumer benefit of the subsidy?

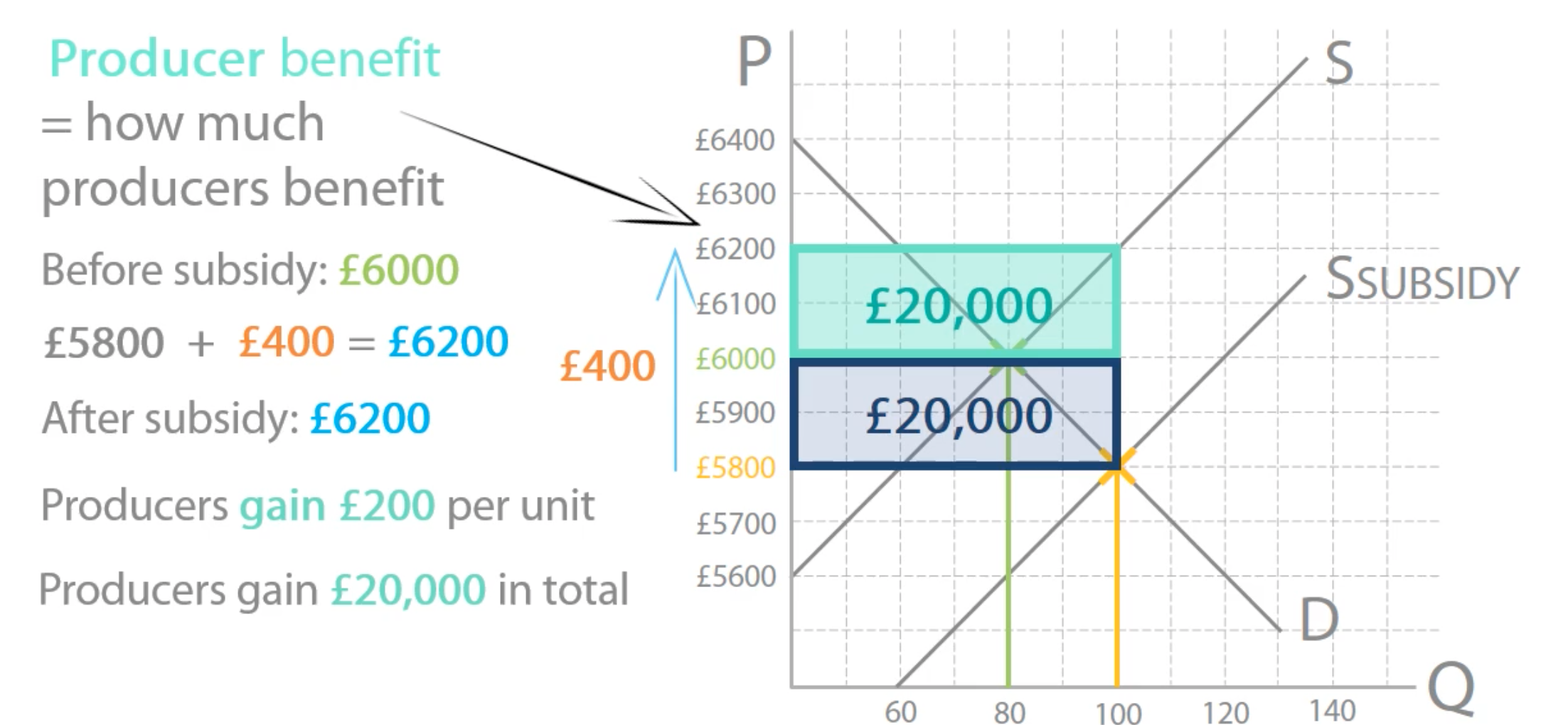

How do you work out the producer benefit of the subsidy?