everything on the financial literacy exam in one quizlet

1/306

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

307 Terms

Goal

Something you want to accomplish

An aim or desired result

Goal Setting

This helps you choose where you want to go in life

Short-term Goal

A goal that can be achieved in the near future (days or weeks)

Long-term Goal

A goal that can be achieved further in the future and requires time and planning (months or years)

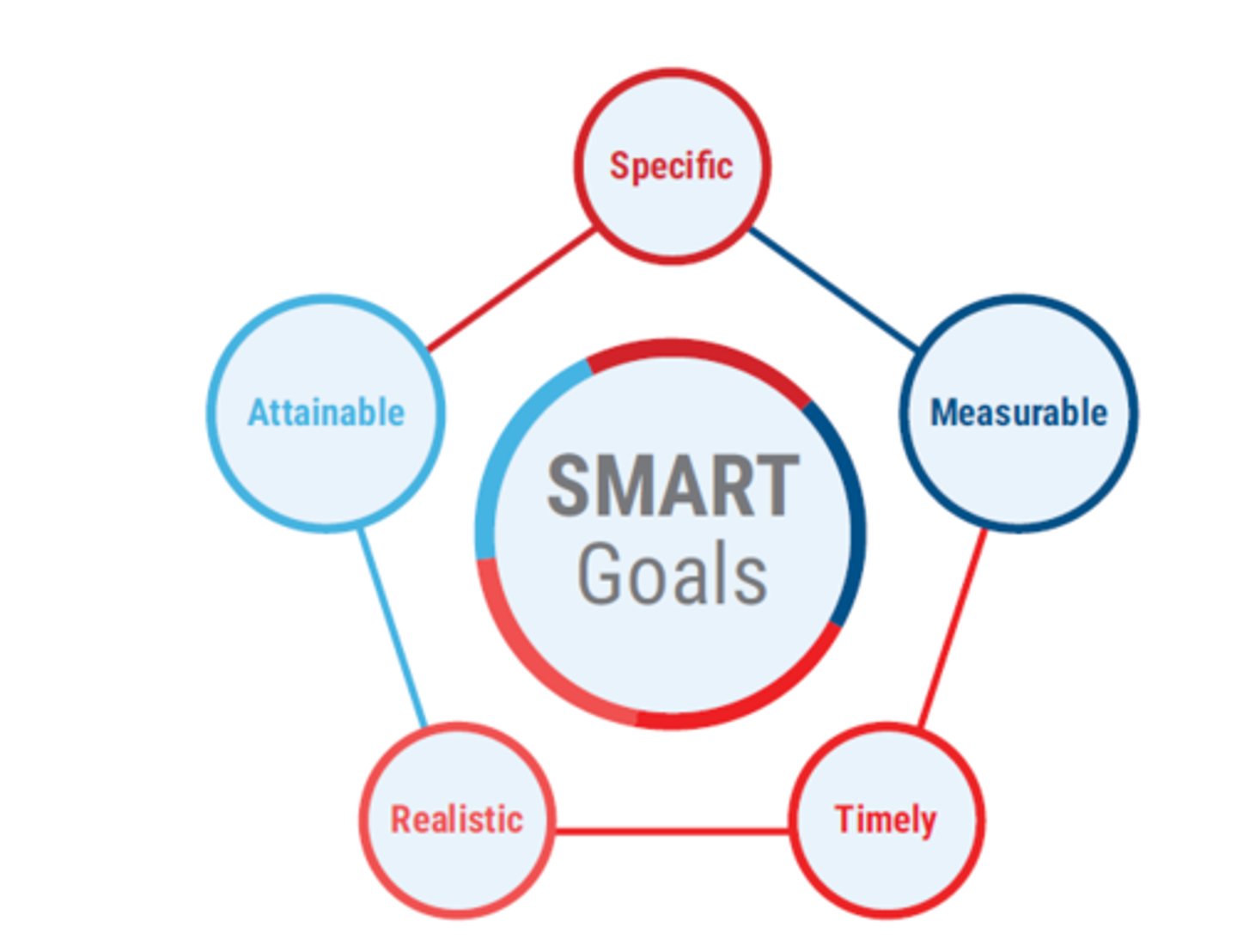

S.M.A.R.T. Goal stands for

Specific

Measurable

Attainable/Achievable

Realistic/Relevant

Time-Bound

Specific

Clearly defined or identified, with details

Measurable

Being able to track your progress when working on a goal and knowing when you've reached your goal

Attainable/Achievable

Refers to the fact that the goal is possible to fulfill. A goal should not be so wild that you can never hope to achieve it. It must be achievable, but should also be a bit of a stretch to accomplish.

Realistic/Relevant

Is the goal something that interests you, is important and something that is possible to achieve.

Timely

Putting an end point on your goal gives you a clear target and time frame to work towards.

Why is it important to set goals?

Setting goals gives you a clearer focus on what is important, it gives you control of your future, provides motivation, and gives you a sense of purpose in life.

Can goals be modified (changed) as needed?

Yes, as needed to accomplish goals

What can happen when you tell someone about your goal?

It makes it more likely that you will work towards achieving the goal. It makes you accountable/responsible.

obstacle

Something that gets in the way of you accomplishing your goal.

want

Something you desire

Something you think you need

need

Basic requirement for survival

Get on a budget; be a good steward

first biblical money principle

Get out of debt; debt equals risk

second biblical money principle

Foster high quality relationships

third biblical money principle

Save and invest

fourth biblical money principle

Be incredibly generous

fifth biblical money principle

What are some things we should save and invest for?

Emergency fund, paying cash for things, charity, stock, future, college

Give

sixth biblical money principle

Why should we give?

Because God cares about her character and our heart

What does following the five biblical money principles give us?

God's growth plan for a successful future and a change in our family tree.

If we follow the five biblical money principles, what does that make us?

Wise Stewards

What does money make us?

Money makes us more of who we are, it doesn't add value it's just gives us the opportunity to do more things for Gods glory

What is the type of world we live in?

It is a cause and effect world. You reap what you see and you grow what you plant.

Why shouldn't we borrow money?

The borrower is slave to the lender. It is a curse. You cannot serve two masters.

How did Financial Peace get started?

Dave and Sharon started with 30 people in a Sunday School in their church. It grew from there.

What does oil represent in the Bible? What was the difference in the rich and poor in Mediterranean back in the Old Testament?

Oil represents the Holy Spirit. If you were rich in the Mediterranean in the Old Testament, you had oil to use as a medium for exchange. The poor did not. The rich ate what we eat every day and the poor ate mostly hummus and olives, fish on occasion.

What did grandma say to save for? What are the two reasons we should save?

Grandma said to save for a "rainy day" because it will rain. We should save for unexpected events and retirement.

generosity

a spirit. You decide to be generous which changes everything in your life.

What are the characteristics of generous people?

Generous people smile, are not grouchy, are more attractive, leave tips and are helpful.

What can you change by following the five biblical principles for money?

You can change your family tree.

What was Dave's degree in from college?

finance

saver

get a genuine rush from saving money

spender

get a rush from purchasing things, doesn't matter the cost of items

risk taker

have love of the next adventure, more excited about the possibility of an idea versus the actual idea

security seeker

needs to know the future is safe and secure, excellent and consistent planners, value order and predictability in their finances

flyers

don't think about the money components in situations, no emotional response to money, no attachment to money, content with financial status

strengths of savers

-Rarely spend money

-Not impulse shoppers

-Good at finding deals

-Are organized

-Are trustworthy

-Are responsible

-Avoid debt

weaknesses of savers

-Lack of spontaneity

-Not ready to spend causes them to be a joy st-ealer/killer

-See money as a means to an end

-Labeled as cheap

strengths of spenders

-Great gift giver

-Generous to charities/churches/any cause that is important to them

-Good at living in the moment

-Living in the moment causes them to be creative in ways to create memories for themselves and others

weaknesses of spenders

-Impractical - impulse buyers

-Non - Communicative

-Full of regrets

-Budget breaking/life altering decisions

-Get buyer's remorse especially during the holiday season

strengths of risk takers

-Very good at listening to their gut

-Not afraid to make quick decisions in the moment

-Doesn't hesitate to make or miss a deal

weaknesses of risk takers

-Can be blindsided by the possibility

-Focus on the big picture so they don't think of details which can hinder relationships

-Can come off as impatient and insensitive

-Charge ahead and deal with relationship fall-outs later

-Don't communicate and compromise

strengths of security seekers

-Ability to investigate any financial decision thoroughly

-Trustworthiness in finances

-Willingness to sacrifice today for tomorrow

-Ability to be prepared

weaknesses of security seekers

-Doesn't take risks

-Overly negative and stifle partner's ideas and themselves

-Can be controlling

-Stop looking at possibilities out there and stick to what they know

-Get bogged down from details (can be paralyzing)

-Get stuck in a research rut

(paralysis by analysis)

strengths of flyers

-Big on relationships

-Less motivated by money

-Make decisions based on what they want not what it costs

weaknesses of flyers

-Tend to be reactionary

-Don't solve any financial problems

-Tend to be unorganized and unresponsible (not irresponsible)

-Not trying to be lazy, just don't think about money

Credit Industry Commercials

These commercials entice you to buy now and pay later, 90 days same as cash.

$15,000

average household credit card debt

$30,000

average student loan debt

Before 1917

Buying things on credit was extremely rare because there were laws preventing lenders from charging high enough interest to make money

In 1920

World War I ended and consumer demand for big ticket items skyrocketed and lawmakers relaxed credit laws to make it more profitable for respected banks

1920s

Birth of the American Credit Industry

1929

Great Depression and credit laws became more relaxed in an attempt to help improve the economy.

1939

World War II ended and the economy grew because the war brought more jobs.

1950s

Birth of the credit card

1970 - Present

Debt is more socially acceptable and banks continually come up with ways to get more money from consumers (us).

The first foundation

Save a $500 Emergency Fund

The second foundation

Get out of debt

The third foundation

Pay cash for your car

The fourth foundation

Pay cash for college

The fifth foundation

Build wealth and give

$500

The first foundation is _____ in an emergency fund. You should do this as quickly as possible.

Parents

When you're in high school, you won't have the same emergency expenses as your _____ (like needing to put a new roof on the house). For you, a surprise expense might be fixing a flat tire or replacing a broken cell phone.

Expenses

An emergency fund allows you to have money available for any surprise _____.

Debt

If you don't have money saved to pay for these things, then _____ will start looking like an easy answer.

Never

Debt _____ solves problems. At best, it just delays one problem while creating another one (trap)!

Grow/six

When you're older and out of school, you'll need to _____ your emergency fund into a full three to _____ months' worth of expenses.

Bank

Make sure this money is kept in the _____ and then you ONLY use it for emergencies. You can't keep the bank money handy, because it will get spent.

Separate

Keep your emergency fund in a _____ savings account away from your spending money.

Three

Save money for _____ basic reasons

Emergency

1st reason: _____ fund

Emergencies

_____ are going to happen. Count on it. The First Foundation, a beginner fund, is $500.

Purchases

The second thing you save for is _____.

Borrowing/sinking

Instead of _____ to purchase, pay cash by using a _____ fund approach.

Wealth

The third thing you save money for is _____ building.

Discipline

_____ is the key ingredient when it comes to wealth building.

Marathon

Building wealth is a _____, not a sprint.

Compound interest/now

_____ _____ is a mathematical explosion. You must start _____.

Interest-bearing account

An account that generates interest income on the available balance in the account.

The five foundation

The five steps to financial success.

Emergency fund

A savings account that is set asides to be used only for emergency expenses.

Compound interest

Interest paid on interest previously earned.

Interest rate

A rate which is either charged or paid (on investment accounts) for the use of money.

Inflation

The persistent increase in the cost of goods and services or the persistent decline in the purchasing power of money.

False

When it comes to saving money, the amount you save if determined by how much you have left at the end of the month once all of your spending is done.

False

Your income level greatly affects your saving habits.

Have money available to lend to friends

Which of the following is not one of the three basic reasons for saving money?

Sinking fund

Instead of borrowing money for large purchases, you should set money aside in a _____ over time and pay with cash.

First foundation

It's putting $500 in an emergency fund. When you get older it'll grow into a greater expense.

Ben > Arthur

Ben invested his earlier than Arthur which made Ben come out ahead even though he invested more money than Arthur.

Inflation and interest rate

What two things do you consider when evaluating the time value of money?

Emergency fund at your age

So you can have $500 available at this age available in case of an emergency.

bank reconciliation

The process of matching your checkbook register with the bank statement

blank endorsement

The signature of the payee written exactly as his or her name appears on the front of the check.

canceled check

A check that has cleared your account