Unit 6: External Business Influences

1/81

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

82 Terms

What does the economy consist of?

Households/consumers: buy things and produce labour

Business: create products and provide jobs

Government: Controls the public sector, sets tax levels, provides infrastructure

Banks: provide loans and stores money

Government objectives

Low inflation

Low unemployment

Healthy balance of payments

Economic growth in terms of GDP

Low inflation

The lowering in value of money, if inflation is high, people’s savings become worth less

Makes people poorer and damages their confidence to buy goods and services

Inflation

Increase in price of products over time

Low unemployment

Governments want everyone to have a job

People will have money to spend on goods and services

Employed people pay taxes which helps develop infrastructure

Creates better environment for business

Healthy balance of payments

Increased exports enriches businesses e.g more jobs, higher tax

Importing gives consumers more choice and satisfies them

Imports

Buying from another country

Exports

Selling to other countries

Economic growth in terms of GDP

Good GDP means healthy economy

GDP

Value of all combined goods and services consumed and sold/produced in a country

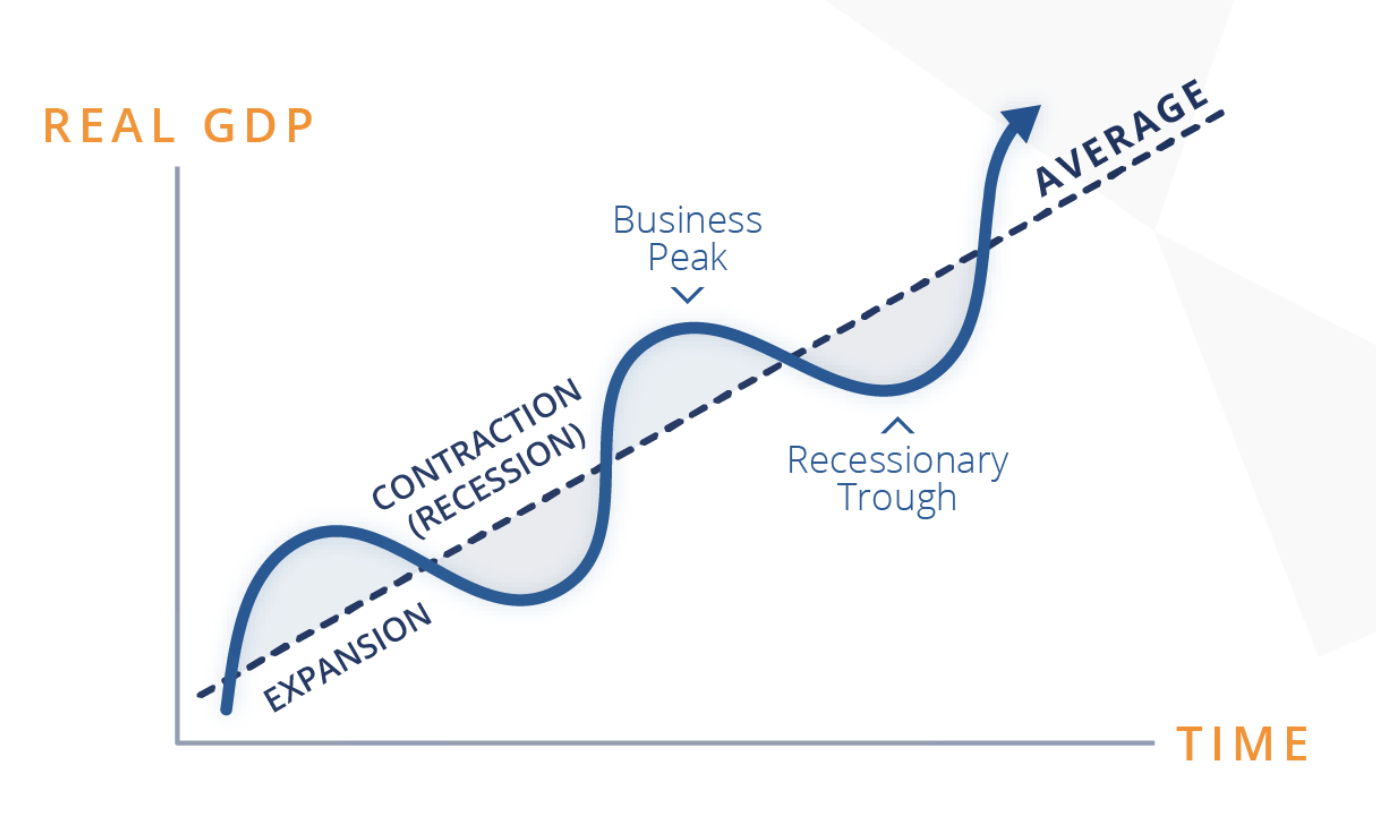

The business cycle

The economy’s development through recession and recovery over time

Growing economy

Unemployment goes down

People spend more as they have more jobs that provide money

Business revenue goes up → more profits

Causes inflation

Tax revenue collection goes up

Government can spend more on services for citizens

Consumer confidence is high

Recession/shrinking economies

Some businesses earn less/fail/close down

Unemployment

Consumer confidence decreases

Government tax revenues decreases

Services get worse and less infrastructure

Less jobs are provided by the government

How can government help an economy grow?

Offer cash grants to citizens

Government spending on infrastructure

provides jobs and gets them spending again

Lower tax

people have more disposable income → boosts demand

Encourage foreign direct investment

look for global businesses to set up in their country

Foreign direct investment

Money invested in one country by a company or government in another country

Fiscal policy

A government policy where they tax businesses and people, and spend money on projects within the country

Advantages of fiscal policy

Consumer confidence increases

Decreasing taxes give people more disposable income to spend in the economy

Building infrastructure leads to short-term employment

but in the long-run, it becomes better for business to utilise the infrastructure

encourages FDI

Disadvantages of fiscal policy

They receive less money from tax and have less to spend on other things

Need to find other sources of finance to fund other projects

Infrastructure is very expensive

tax may need to go up or borrowing money is needed

Income tax

Being taxed on the amount you earn

If we increase income tax, people will have less to spend

When reduced, people will be richer

Corporation tax

Taxing businesses based on how much profit they make

Value added tax

Adding tax onto every product/service sold

Lowering sales tax gives more disposable income

Import tariffs and quotas

Taxes placed on importing goods and services from other countries

Advantages of tariffs

Encourages people to buy local

local businesses will be more successful

higher tax revenue as local businesses makes more profit

more job employment

Generate revenue from sales of foreign goods

Disadvantages of tariffs

Reduces choice for local people as foreign goods become too expensive

Drives inflation, makes country poorer

Quotas

Limits the number of something that can be imported into a country, has similar effects as tariffs

Advantages of quotas

Limits sales opportunities of foreign companies

Local businesses don’t need to compete

keeps market shares and limits competition

Disadvantage of quotas

Consumers have less choice over products

Direct tax

Business and individuals pay from their income and profits

corporation/profits tax and income tax

Indirect tax

Placed on goods, products and services

sales tax/VAT, import tariffs

Monetary policy

A government policy that adjusts bank interest rates

Interest rates

Rewards you for saving or the cost of borrowing

What happens during low interest rates?

People are encouraged to save less and spend more

creates demand

Encourages to borrow money

borrowing is cheap, encourages people/businesses to borrow and spend

What happens during high interest rates?

Encourages saving and discourages borrowing as it is expensive

reduces demand to control inflation

Also encourages businesses not to take loans/invest

less investments → less demand → makes inflation fall

Supply side policies

Policies that increase competitiveness of the economy

improve infrastructure, spend more on education, cut business taxes, remove regulations that restrict businesses

Advantages of supply side policy

Makes country more competitive, this encourages FDI

Good for growing GDP and reduces unemployment

Disadvantages of supply side policy

May reduce tax revenue

High costs to implement

only rich countries can afford large scale infrastructure improvements

Usually takes years for benefits to show

but benefits will be long term

Environmental impacts from business activity

Pollution, landfills, deforestation, extinction, global warming, water usage, shipping

Externalities

When businesses locate in areas that create both costs and benefits to the local community and environment (the external costs and benefits of business activity)

Private benefits

Benefits enjoyed by the business

Increase sales and potentially profit

Improves brand reputation

Creates loyal customers

Private costs

Costs a business has to pay for (not always monetary)

Set-up costs

Cost of labour/salaries

Advertising costs

External benefits

Gains to the rest of society

More choice of options

Job opportunities

Service is provided

Attracts people closer to the business location

Builds foot traffic and benefits local community/other businesses

External costs

Costs to the wider society

Noise pollution

More traffic

Public disruptions

Environment impact

Sustainable development

Development which does not put at risk the living standards of future generations

Unsustainable practices

Nuclear power, single-use plastics, pollution, use of fossil fuels, overfishing

Sustainable development

Circular economy, renewable energy sources, bio-created products, reducing carbon emissions

Pressure groups

Made up of people who what to change unsustainable business decisions and take action to force them through boycotts or protests

Ways pressure groups change business behaviour

Educate the public so they can make better decisions

Protests, petitions to publicise something

Boycotts of products/services

Publicity

Positive business reaction to pressure groups

Changes behaviour or the better

Low sales from boycott

Amount of criticism

Staff may have minds changed

Business will change to improve public image

Negative business reaction to pressure groups

Behaviour will not change

Cost of change is too high

Most of the public don’t care

If demand does not change, they won’t change

Greenwashing

Pretending to be sustainable and to lead better practices, while not actually changing their methods

What can governments do to protect the environment?

Create laws and restrictions

Fines for breach of rules

Bans on specific materials/ingredients

Extra taxes for polluting

Giving subsidies for green alternatives

International cooperation

Carbon trading

Carbon trading

Buying and selling of credits that allow a business to emit a certain amount of CO2

Government subsidies

Where the government pays for a portion of the fee consumers pay to reduce their costs

Ethics

The difference between right and wrong

Ethics in pricing

Price gouging: charging too high for products

Pricing very low for unhealthy products

Ethics in products

Making unhealthy products or dangerous ones

Ethics in production

Child labour or low cost labour

Animal testing

Ethics in promotion

Misleading information

Promotion to children

Ethics in human resources

Discrimination

Bribery

Low wages

Costs of acting ethically for businesses

Business have to spend more

paying for ethically sourced supplies

treat workers better

invest in green technology

more safety equipment

Competition is always high but towards less ethical business

they will be cheaper

Less profitability

Benefits of being ethical for businesses

Better reputation

can charge more for quality

loyal customers

May attract ethical investors

Help attract better employment who will be more motivated

less staff turnover

Unique selling point

competitive advantage

Globalisation

Interconnectedness/Interdependence of national economies

Why has the world become more globalised?

Technology and media

Transportation overseas

Migration

Colonisation

Government policies

Advantage of globalisation for businesses

Wider market

higher potential sales

Better access to raw materials/global resources

Employ people from around the world

more likely to find specialists

Access low-wage labour in developing countries → less costs → higher profits

Advantage of globalisation to people

Access to goods and services has expanded

more choice

prices go down and quality goes up as competition is higher

Travel opportunities

Work/migration opportunities

More FDI → more jobs in home country

Disadvantages of globalisation to businesses

More competition from abroad

for all markets mass and niche

Quotas and tariffs may disrupt businesses

Recession in other countries can disrupt businesses

Disadvantages of globalisation to people

Loss of culture

Possible exploitation of low wage labour

Loss of specific types of jobs in some countries (deindustrialisation)

Loss of jobs to business that are able to move nations

Protectionism

When governments favour local businesses and protect them from foreign firms with quotas and tariffs

Protectionism advantages

Protects local jobs

Potentially boosts economy: local business will make more sales and will provide more jobs

Higher tax revenue for government

Lowers competition

Protectionism disadvantages

Reduces choice for consumers

Drives inflation, foreign goods are more expensive

Multinational businesses

Business that sells goods/services in more than one country and generate revenue from more than one country

Why are multinational businesses so strong?

Globalisation

Well-known/good reputation due to large market budgets

Can afford to be high quality

Benefit from economies of scale

Benefits of multinational businesses to host nation

Increased tax revenues

Lots of chance for consumers in the country

FDI - inflow of money and reinvest in local economy

Lower price due to increased competition

Drawbacks of multinational businesses to host nation

Expatriation of profits

Loss of culture

Competition

Exploitation of natural resources

Expatriation of profits

Sending profits back to their original country rather than to the host country

Exchange rates

The price of one currency in the terms of another

Depreciation

When currency falls in value vs other countries

Appreciation

When currency gains value over other countries

Effects of depreciation on people

Decreases confidence as inflation occurs

People will try to buy local

Drives inflation

Makes holidays to other countries more expensive

Effects of depreciation to businesses

Pay more for imports → higher costs

Inflation

Will consider local supplies

Some businesses benefit such as businesses that target foreigners or exports

Effects of appreciation for people

Lowers inflation

More consumer confidence

Gives people more choice

Effects of appreciation for businesses

Imports are cheaper

More difficult to export

as it is more expensive for foreign customers