FRB Week 2 (Intangible Assets)

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

What are the 2 main types of intangible assets?

Finite Life (“Definite Life”)

Infinite Life (“Indefinite Life”)

Finite-Life Intangible Assets (def)

aka “Finite Life Intangible Assets”

intangible assets that:

individually identified

have limited useful lives

What are the 6 main types of Finite-Life Intangible Assets?

Patent

Copyright

Leasehold

Leasehold Improvement

Customer List

Franchise

Indefinite-Life Intangible Assets (def)

aka “Infinite Life Intangible Assets”

intangible assets w/ no identifiable legal, regulatory, contractual, or competitive factors that limit the asset’s revenue-generating term

Are indefinite-life intangible assets subject to amortization?

Nope

3 main categories of infinite-life intangible assets

(excluding goodwill of ind. life intangible assets)

Customer List

indefinite → if relationship is not expected to terminate

Renewable Intangible Assets

assets that are subject to renewal on a regular basis, and renewal is reasonably certain

Trademark or Trade Name

legal right to protect a design, a trade name, a logo, or a symbol from any unauthorized use by outside parties

Also includes Crypto Asset

Goodwill (definition)

an intangible asset whose value is created by factors that are typically difficult to identify and measure

considered as an indefinite-life intangible asset

it’s hard to identify and measure so we don’t record them BUT we are allowed to record it as an asset when we acquire another firm

Fair Value of Net Assets = Fair Value of Assets - Fair Value Liabilities

Goodwill is the amount we pay above the NFV!

Goodwill = Purchase Price - FV of Net Assets (goodwill if it’s positive, bargain purchase price if negative)

General Initial Measurement of:

Internally-Generated Assets

Purchased Assets

Assets Acquired in a Business Combination

Internally-Generated Assets

generally not recorded due to measurement issues

sometimes direct costs may be capitalized (e.g., legal fees for defending a copyright)

Purchased Assets

capitalized at cost

Assets Acquired in a Business Combination

capitalized at Fair Value (like all other assets and liabilities)

How is goodwill measured?

only measured if we acquired through M&A

measured as: the amount paid for the company - the fair value of the net assets, where:

Net assets = assets - liabilities

What if we purchase an asset for less than the fair value of the net asset?

this is a Bargain Purchase

The difference is recorded as a gain and is included in the income from continuing operations

Which F/S does goodwill go to?

B/S not I/S

How is goodwill recorded on the JE? How about bargain purchase?

Goodwill

has normal debit balance

Dr: Goodwill [$xxx]

Bargain Purchase

normal credit balance

JE: Cr: “Bargain Purchase gain” [$xxx]

Amortization (def)

systematic & rational allocation of the cost of FINITE-LIFE assets to expense over the:

expected useful life, -or-

legal life

(whichever is shorter)

Derecognition - when do firms remove intangible assets from their books? How do they remove the accounts from their books?

Firms remove upon disposal or when they expect no further economic benefits from the use (or disposal) of the asset

Gains/losses computed the same as PPE

Derecognition recorded the same as PPE

How are Crypto Assets measured?

Fair Value Accounting → Adjust asset such that its carrying value = its fair value

the difference = gain(loss)

!! Gains or losses are included in Net Income

If a crypto asset was bought for $40k on 1/1 and is worth $50k on 12/31 of the same year, how much should be reported for this crypto asset on the B/S at year end?

$50k since we report the fair value!

Research Phase Activities (def)

activities that include an original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding

Development Phase Expenditures (def)

expenditures that relate to the application of research findings or other knowledge to a plan or design for the production of new or substantially improved materials, devices, products, processes, systems, or services before the start of commercial production or use

Exclusions to R&D

Is R&D capitalized or expensed?

Under US GAAP, R&D is usually expensed

doesn’t matter if it’s development

Recording: Acquired In-Progress Research & Development

aka IPR&D

recorded as Fair Value

(FV at acquisition, not at cost or estimate of future spending)

recorded as an indefinite-life intangible asset until the project is completed:

If project successful → amortize asset

because it’s not longer indefinite

If unsuccessful → write off

What makes a project successful?

A project is considered successful (completed) when it

achieves technological feasibility and

is ready for its intended use or sale

How do you record a successful IPR&D?

Will amortize the asset for the (Fair Value less Any impairment)

How do you record an unsuccessful IPR&D?

We’ll have to write off the IPR&D

Debit IPR&D Write-off

(Last step, bc we calculate based off the accounts below)

This is = IPR&D total expense - Accumulated Amortization

Debit Accum. Amort.

Credit IPR&D for the total expense/cost

How does an impairment occur?

When an asset’s total future cash-generating ability falls below its carrying value

Reporting: Impairments

Report loss on Income Statement

Reduce Asset’s carrying value on the Balance Sheet

Can an asset’s value be increased again after a loss is recorded?

No (per US GAAP)

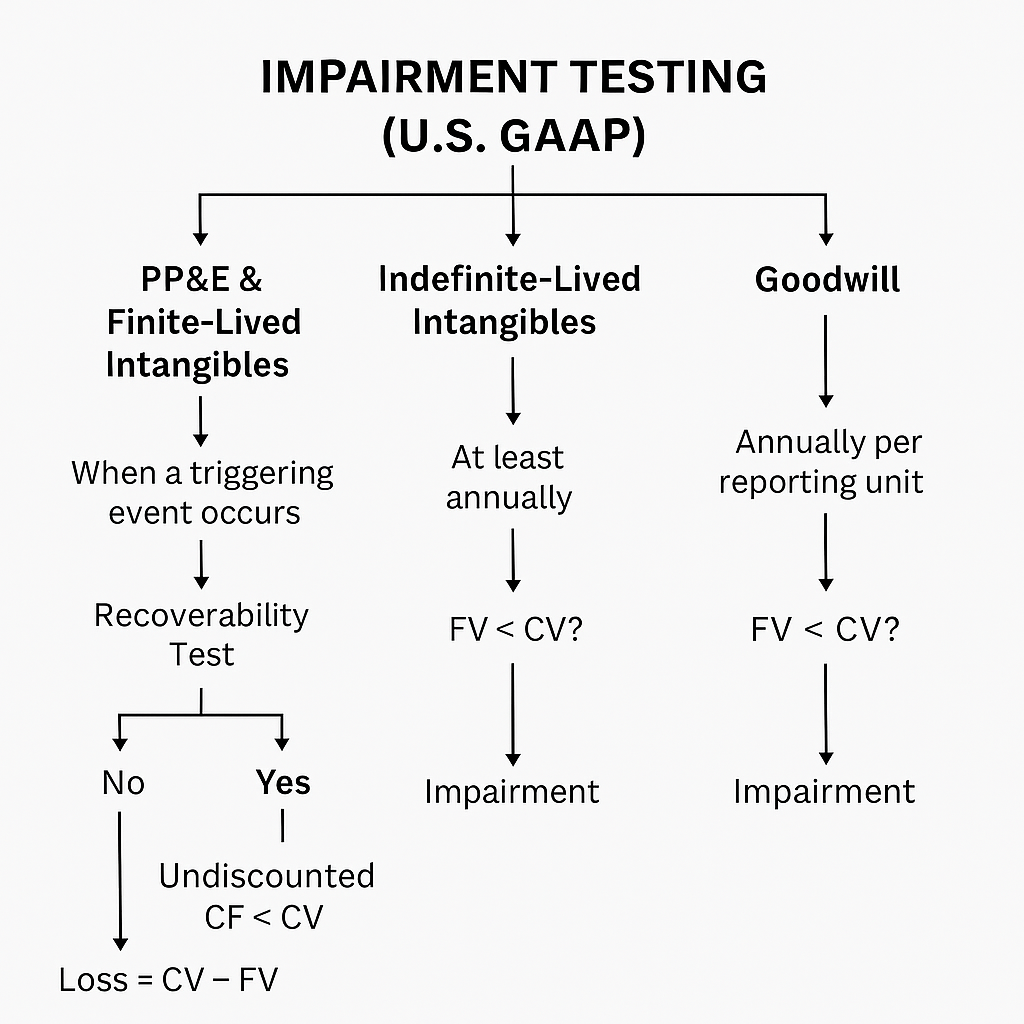

When to test for impairment

whenever “impairment indicators” indicate that an asset may be impaired

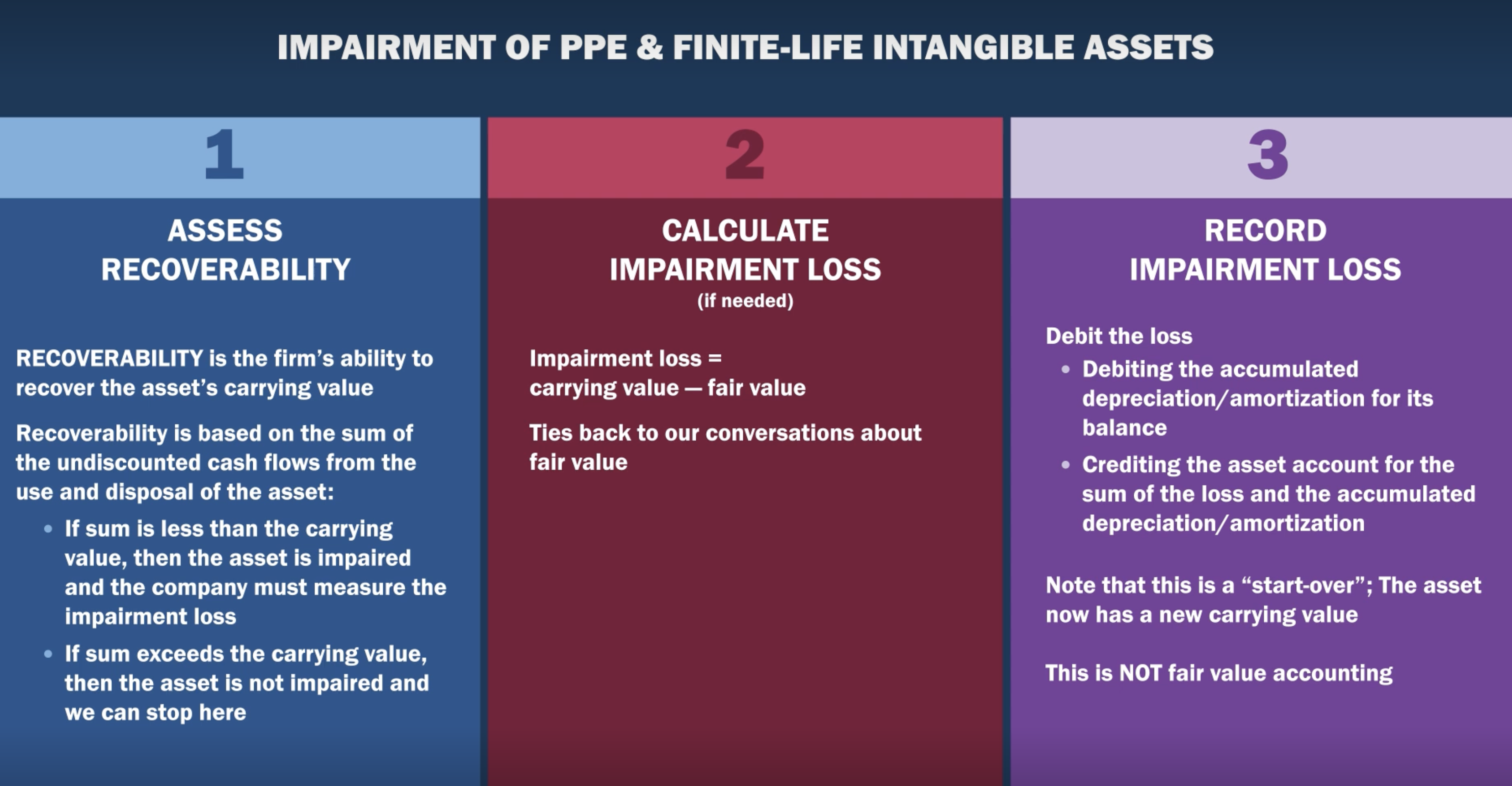

Recoverability

the firm’s ability to recover the asset’s carrying value

Steps for Impairment Testing (PP&E and Finite-Life Intangibles)

Assess Recoverability

Calculate Impairment Loss (If impaired)

Record Impairment Loss

How do we test for impairment? (PP&E and Finite-Life Intangibles)

add up the undiscounted cash flows from the use and disposal of the asset:

if sum < carrying value → asset is impaired

company must measure the impairment loss

if sum > carrying value → asset is not impaired

STOP HERE

Calculating: Impairment Loss

Impairment loss = Carrying value - Fair Value

Recording: Impairment Loss (PP&E and Finite-Life Intangibles)

Debit Loss on Impairment

Debit accumulated depreciation/amortization for its entire balance

Credit [asset account] for sum of loss and accumulated depreciation/amortization

Note:

this is a “start over” → the asset now has a new carrying value

this is NOT fair value accounting

Impairment of Infinite-Life Intangibles

One step impairment test

Determine if carrying value > fair value

no need for undiscounted cash flow bc it’s indefinite (cash flow extends far into future)

Impairment = carrying value - fair value

Record Impairment Loss

Debit Loss

no accumulated amort bc it’s infinite

Credit [asset account]

What is the carrying value for an infinite-life intangible?

Since it’s infinite life, the carrying value == original cost (it does not get amortized)

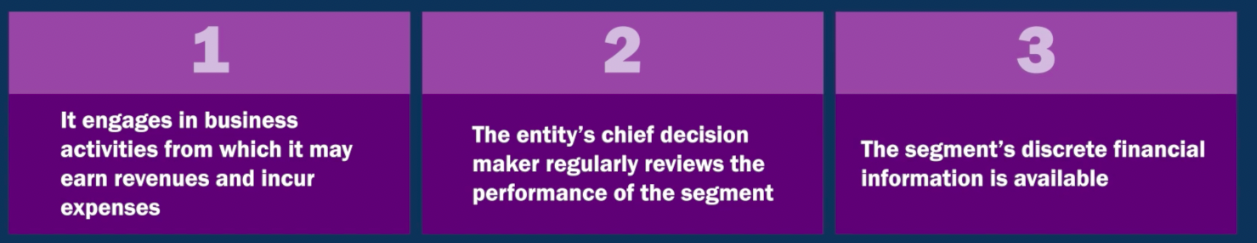

Operating Segment

Public entity with characteristics:

For goodwill, how often do they need to be evaluated for impairment?

It is required every year.

But it does not have to be year end, but the entity must disclose when they evaluated their goodwill.

Impairment of Goodwill

Impairment Test

Compare fair value of reporting unite (including goodwill) to carrying value of reporting unit (including goodwill)

FV < CV → impairment

Impairment loss = CV of RU (incl. GW) - FV of RU (including GW)

!Loss cannot exceed the balance of goodwill

Record Impairment Loss

Dr Loss

Cr goodwill

Disclosures of Intangible Assets

US GAAP required disclosures:

the asset/asset group that was impaired

events and circumstances that led to the recognition of the impairment (based on the impairment indicators)

amount of impairment loss in the notes to the F/S (if the firm does not separately disclose this amount on the income statement)

the method(s) used to estimate the fair value of the asset

Impairment Flow Chart