Ch. 6 - Takeover Tactics

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Typical Tactics for mergers

Bear hugs/bypass offers

Tender offers

Proxy fights

Streetsweep

Creeping tender offer

A takeover is only considered “hostile” if target directors __________

vote against it

4 influences to the Choice of Tactic

Attitude of Target Management and board

Distribution of voting power

Strength of target’s defenses in place

Presence of competing offers and/or a white knight

Casual Pass

Where bidder attempts a friendly overture prior to initiating a hostile bid

Sometimes done when bidder is unsure of target’s response

May backfire as it gives advance warning to target

Management of target is often advised not to discuss such deals with bidder so as that the bidder may not misinterpret target’s intentions

Toehold

When a company buys less than 5% of the company’s shares, but still a significant amount

May lower the average cost of the takeover

May also give bidder leverage with target management (bidder now a shareholder; may help in litigation; also more credible threat of a proxy fight)

Discourages white knights and may circumvent supermajority provisions

Why don’t bidders max out toeholds?

Danger of being caught holding shares if bid is unsuccessful - worrisome if management appears to be entrenched

Can alert target management/market of a forthcoming bid

May appear unfriendly from the start

Bear Hugs

Bidder brings offer directly to target’s directors and/or management (through bypass management)

Implies a hostile bid is incoming

Strong Bear Hug: Public announcement

Super Strong Bear Hug: Threat to reduce offer price in the event of opposition/delay

If target rejects friendly bid and does not bring it to shareholders for decision, then the target directors may face lawsuits from target shareholders

Less expensive/time consuming than a tender offer, but ultimately requires board acceptance

Tender Offers

Two-tiered tender offer: Tender offer of two tiers, usually first with cash and then by merger

Courts have found them to be illegal

Best Price Rule renders them ineffective

Tender offers are more expensive than negotiated deals due to legal costs, publication costs, information costs, etc…

Creeping Tender Offer

Open market purchases which may lead to a tender offer

Repeated purchases of shares by a party which may do a full takeover

Required 13D filing, with updates for every 1% addition, but courts do not require a Schedule TO filing as this isn’t a tender offer

Street Sweeps

Sweeping up large blocks of target firm stock which remain after a cancelled tender offer

Even if tender offer doesn’t work, arbitrageurs will have purchased large holdings of stock. Ending the tender offer still keeps the target “in play”, because arbs will need to sell and easier now to accumulate large holdings

After crossing 5% threshold, acquiring company must file 13D

Main Types of Proxy Fights

Contests for Seats on the Board of Directors

Insurgent group may be trying to replace management

Contests about management proposals

Mergers or acquisitions

Anti-takeover amendments

Characteristics that Increase Likelihood of Proxy Fight Success

Management has insufficient voting support

Management does not hold many votes

Poor operating performance

The worse it is, the more likely shareholders are unhappy with management

Sound alternative operating plan

Insurgents have good plan to improve shareholder returns

Proxy Fight Costs

Generally less expensive than a tender offer or revised bid, but still expensive

Professional Fees: Proxy silicitors, attorneys and public relations professionals

Printing, Mailiing, and Communications Costs

Litigation costs: Proxy Fights tend to actively litigated

Riskless Arbitrage

Buying and selling same asset in different markets and different prices

Risk Arbitrage

Buying shares in potential/actual targets and possibly selling shares in acquirers

Arbitragers cause more shares to be concentrated in large blocks

Role of arbitrageurs

They acquire shares in the hope that the deal will close and they will get the difference between their purchase price of the target’s shares and the closing price with its premium

They may also sell acquirer’s shares short knowing the bidder’s stock price often declines after M&A announcements AND if consideration of the offer includes stock

Risk Arbitrage Rrturn

RAR = GSS/I * (365/IP)

RAR = Risk Arbitrage Return

GSS = Gross Stock Spread

I = Investment by arbitrager

IP = Investment period (days between investment & closing date)

Risks of Risk Arbitrage

Deal may be cancelled

Financing Environment may change

Regulatory/Antitrust Approval May not be secured

Material Adverse Change (MAC) Clause may be Activated

Bidder may contend that something important changed at the target hwich enabled the bidder to back out

Merger Consideration Analysis

A collar is simply a way to hedge against uncertainty about the value of the buyer and/or target

It may grant either or both of the merging firms the right to renegotiate the deal if the buyer’s stock price falls outside the bounds of either strike price

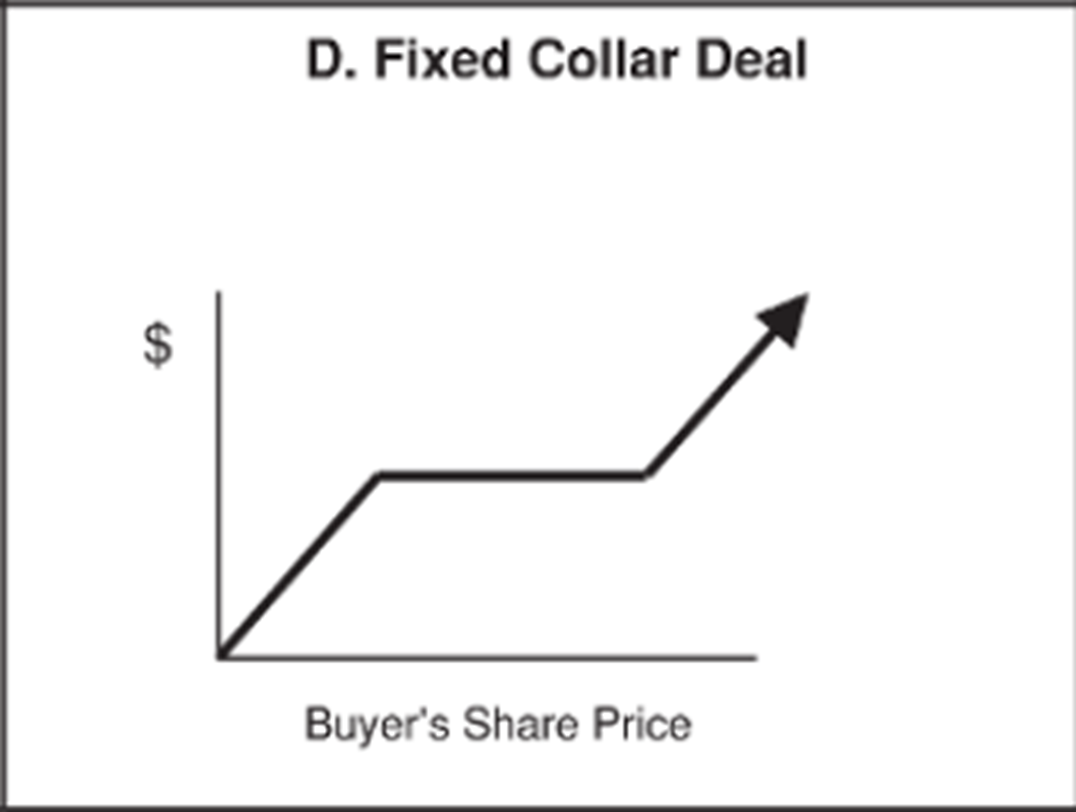

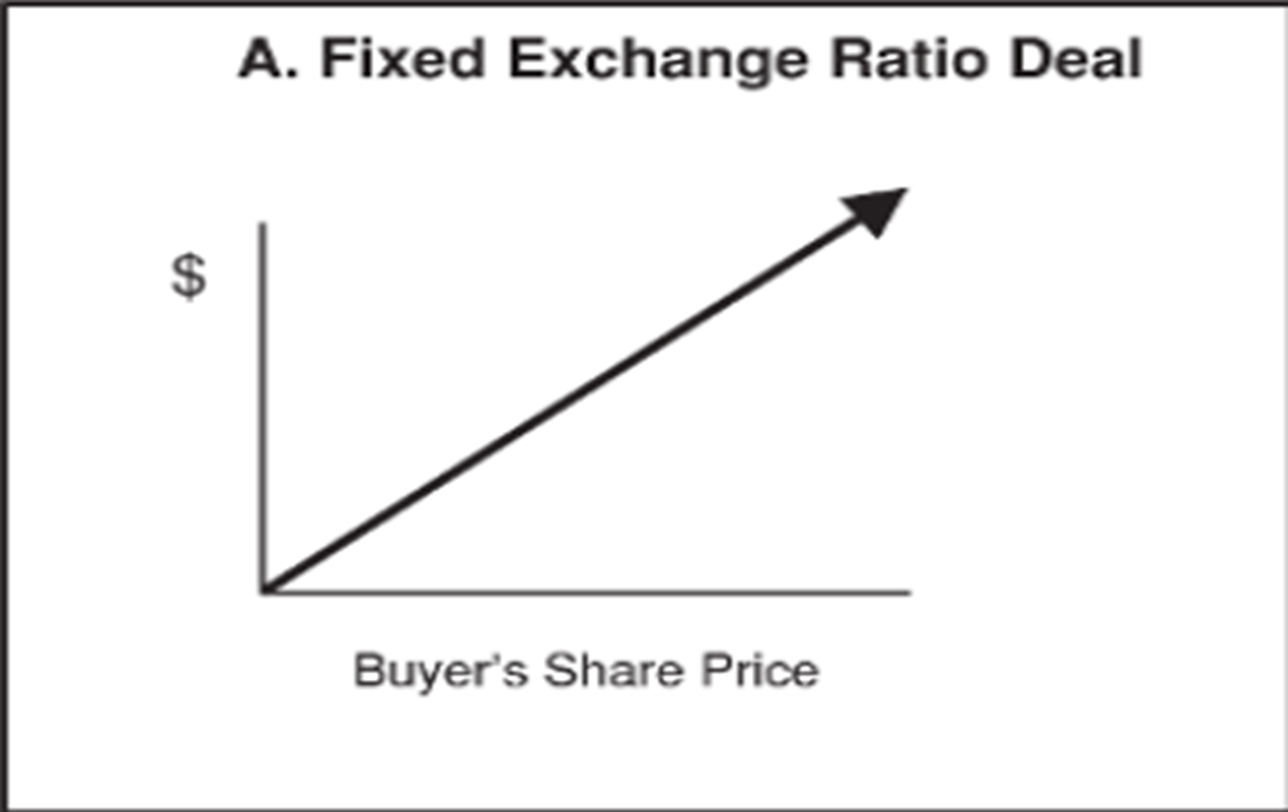

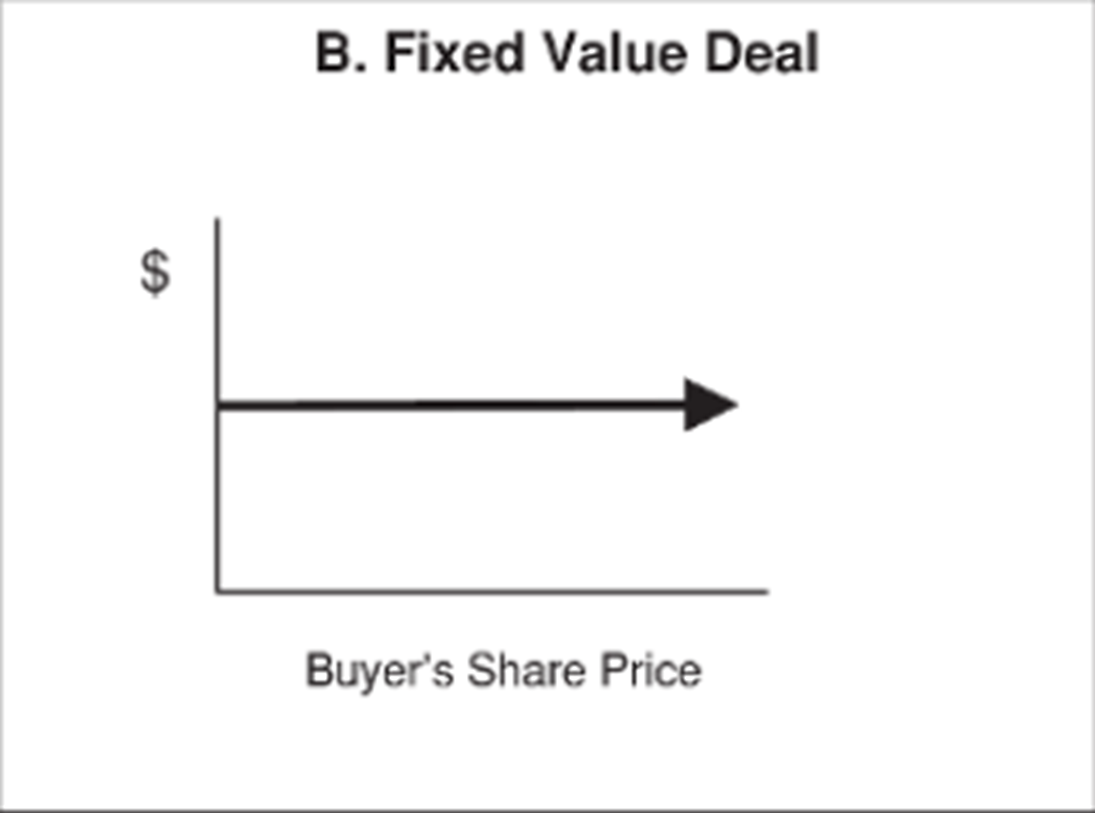

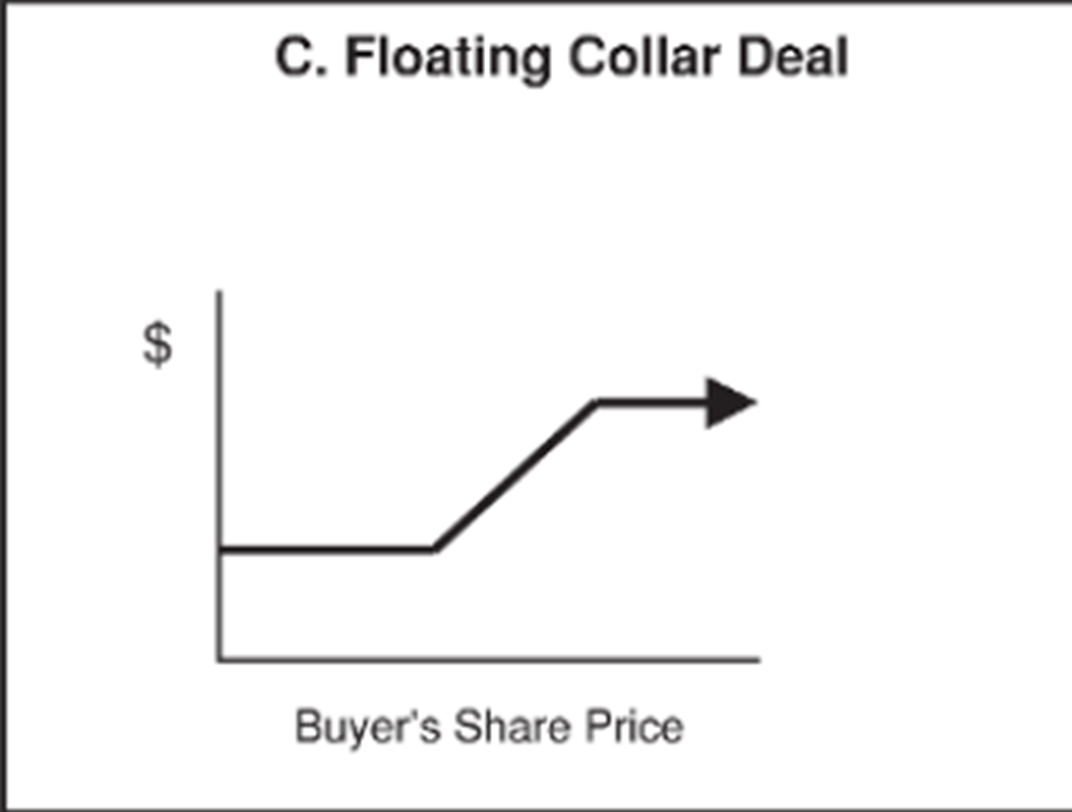

4 Classic Profiles of Payment

Those graphs show the values paid by the buyer for 4 stock-for-stock deals: horizontal axis gives share price of the buyer, vertical axis gives value received by target shareholders

Fixed Exchange Ratio deal

Fixed value deal

Floating collar

Fixed Collar

Fixed Exchange Ratio deal

As buyer’s share price rises/falls, shareholder of the target feels the value of its expected paymnet in shares grow and shrink. The buyer knows for sure how many shares must be issued to consummate the deal. However, neither the buyer or seller may by happy with the uncertainty about how much the deal is really worth.

Buyer’s stock price could fall, leaving target shareholders with less value than they may have thought they would receive. Or the buyer’s share price could rise at the announcement, making this a more expensive deal than anticipated from the buyer’s perspective.

Fixed Value deal

There is great uncertainty about the number of shares to be issued, since as the buyer’s share price falls, the exchange raito must rise in order to keep the value constant.

Floating Collar deal

Predesignated floor (pleases target shareholders)

Upside gains capped (pleases buyer shareholders)

Solution against uncertainty

Fixed Collar Deal

Solves uncertainty

As long as buyer’s share price remains in a reasonable range, with the idea that:

gains and losses must be shared by both target and buyer beyond that range

Fixed Exchange Ratio Graph

Fixed Value Deal Graph

Floating Collar Deal Graph

Fixed Collar Deal Graph