Variable Costing for Management Analysis(Chapter 21)

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

78 Terms

Absorption Costing

Includes fixed and variable factory costs in inventory.

Variable Costing

Includes only variable manufacturing costs in inventory.

Operating Income

Profit calculated after deducting costs from revenue.

Manufacturing Margin

Sales minus variable cost of goods sold.

Contribution Margin

Manufacturing margin minus variable selling and administrative expenses.

Fixed Factory Overhead

Costs not included in variable costing inventory.

Period Expense

Costs treated as expenses in the period incurred.

Units Manufactured

Total number of units produced during a period.

Units Sold

Total number of units sold to customers.

Inventory Change

Affects operating income under different costing methods.

EBITDA

Earnings before interest, taxes, depreciation, and amortization.

Segment Analysis

Evaluating performance by product, territory, or salesperson.

Sales Price

Selling price per unit, e.g., $50 for Martinez Co.

Direct Materials

Raw materials directly used in manufacturing goods.

Direct Labor

Labor costs directly associated with production.

Variable Selling Expenses

Costs that vary with sales volume.

Operating Income Comparison

Differences between absorption and variable costing methods.

Cost of Goods Sold

Total cost of manufacturing sold products.

Increase in Inventory

Occurs when units manufactured exceed units sold.

Decrease in Inventory

Occurs when units manufactured are less than sold.

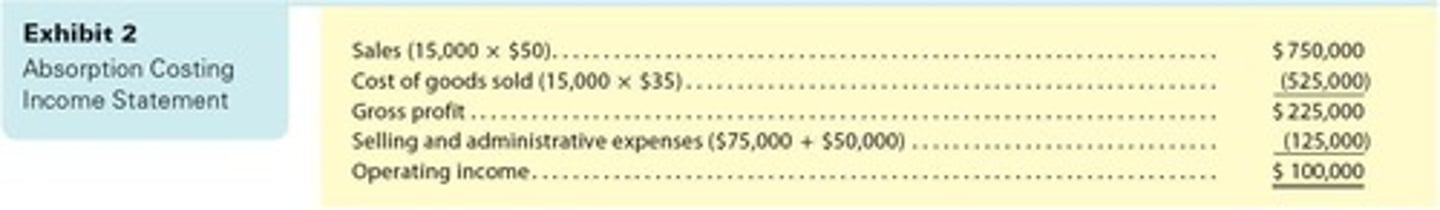

Absorption Costing Income Statement

Financial statement reflecting absorption costing results.

Variable Costing Income Statement

Financial statement reflecting variable costing results.

Operating Income Variance

Difference in income based on inventory levels.

Market Segment Analysis

Evaluating performance across different market segments.

Service Businesses

Businesses that provide services rather than goods.

Cost Structure

Composition of fixed and variable costs in operations.

Units Manufactured

Total units produced during a specific period.

Units Sold

Total units sold to customers in a period.

Fixed Factory Overhead Costs

Costs not variable with production volume.

Variable Costing

Costing method treating fixed overhead as period expense.

Absorption Costing

Costing method including fixed overhead in product costs.

Operating Income

Profit after deducting operating expenses from revenue.

Contribution Margin

Sales revenue minus variable costs.

Period Expenses

Costs incurred regardless of production levels.

Controllable Costs

Costs influenced by management at a specific level.

Noncontrollable Costs

Costs managed by higher levels of management.

Sales Volume

Total quantity of products sold.

Finished Goods Inventory

Completed products ready for sale.

Cost of Goods Manufactured

Total production costs of goods completed.

Pricing Products

Setting prices based on costs and market factors.

Planning Production

Determining production levels based on forecasts.

Analyzing Market Segments

Evaluating performance of different market divisions.

Operating Income Under Variable Costing

Remains constant regardless of production changes.

Inventory Effects on Income

Changes in inventory impact reported income levels.

Management Decisions

Strategic choices based on financial information.

Absorption Costing Income Statement

Financial report showing costs absorbed by products.

Variable Costing Income Statement

Financial report showing only variable costs.

Sales Estimate

Projected sales based on market analysis.

Production Levels

Quantity of units produced in a time frame.

Fixed Manufacturing Costs

Costs that do not change with production volume.

Cost Control

Monitoring and managing costs to improve profitability.

Income Misinterpretation

Incorrect conclusions drawn from income variations.

Inventory Increase Impact

Raising inventory can inflate operating income.

Fixed Costs

Costs that cannot be avoided regardless of production.

Variable Costs

Costs that vary directly with production volume.

Minimum Selling Price

Price covering at least variable costs.

Absorption Costing

Includes fixed and variable costs for long-term analysis.

Variable Costing

Focuses on variable costs for short-term analysis.

Market Segment

A portion of a company analyzed for profitability.

EBITDA Margin

EBITDA expressed as a percentage of sales.

Operating Income

Income from normal business operations.

Depreciation Expense

Reduction in value of assets over time.

Amortization Expense

Gradual write-off of intangible assets.

Sales Territories

Geographical areas assigned for sales activities.

Product Segments

Different product lines analyzed for profitability.

Salespersons Segments

Performance analysis based on individual salespersons.

Public Companies

Companies whose shares are traded publicly.

Segment Disclosures

Financial information about specific business segments.

Strengths and Weaknesses

Analysis of segment performance indicators.

Operating Decisions

Choices made regarding production and sales operations.

Short Run

Period where production capacity is fixed.

Long Run

Period allowing for capacity expansion.

Financial Statements

Reports summarizing financial performance.

Footnote Disclosure

Additional information provided in financial statements.

Camelot Fragrance Company

Example company used for segment analysis.

Amazon Web Services (AWS)

Amazon's cloud computing segment.

Comparative Analysis

Evaluating performance across different segments.

Profitability

Ability to generate profit from operations.