CHAPTER 7 - Trading Profits

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Melanie started trading on 1 January 2025. She decided to make up accounts to 31 October each year.

Her taxable trading income is as follows.

Period ended 31 October 2025 | £3,000 |

Year ended 31 October 2026 | £23,760 |

What is Melanie’s Trading profit for 2024/25?

£900

Melanie started trading on 1 January 2025. She decided to make up accounts to 31 October each year.

Her taxable trading income is as follows.

Period ended 31 October 2025 | £3,000 |

Year ended 31 October 2026 | £23,760 |

What is Melanie’s Trading profit for 2025/26?

£12,000

Nikolai has been trading as a sole trader for many years, preparing accounts to 30 April each year. His recent tax-adjusted profits are:

Year ended 30 April 2025 | £54,660 |

Year ended 30 April 2026 | £61,200 |

What is Nikolai's assessable trading profit for 2025/26?

£60,655

Jason commenced trading on 1 July 2024, preparing his first accounts to 30 September 2025. The tax-adjusted trading profits for the period ended 30 September 2025 were £37,500.

What is Jason's assessable trading profit for 2024/25?

£22,500

Sharmila has been trading as a sole trader for many years, preparing accounts to 31 December each year.

Her recent tax-adjusted profits are:

Year ended 31 December 2025 | £15,000 |

Year ended 31 December 2026 | £18,000 |

What are Sharmila's assessable trading profits for 2025/26?

£15,750

Connor commenced trading on 1 January 2025, preparing his first accounts to 31 December 2025. The tax-adjusted trading profits for the year ended 31 December 2025 are expected to be £42,860.

What is Connor's assessable trading profit for 2024/25?

£10,715

Jacob commenced trading on 1 July 2024, preparing his first accounts to 31 December 2024. The tax-adjusted trading profits for the first two periods of account are:

6 months ended 31 December 2024 | £4,800 |

Year ended 31 December 2025 | £22,640 |

What is Jacob's trading profit assessment for 2024/25?

£10,460

Kateryna ceased trading on 31 May 2024. Her recent tax-adjusted profits are:

Year ended 31 December 2023 | £32,000 |

Period ended 31 May 2024 | £25,600 |

What is Kateryna’s taxable trading profit for 2024/25?

£10,240

Harsha started trading on 1 March 2025, preparing her first accounts to 31 August 2025. The tax-adjusted trading profits for the first two periods of account are:

Period ended 31 August 2025 | £5,200 |

Year ended 31 August 2026 | £17,356 |

What are Harsha's trading profit assessments for 2024/25?

£867

Harsha started trading on 1 March 2025, preparing her first accounts to 31 August 2025. The tax-adjusted trading profits for the first two periods of account are:

Period ended 31 August 2025 | £5,200 |

Year ended 31 August 2026 | £17,356 |

What are Harsha's trading profit assessments for 2025/26?

£14,457

Cameron started trading on 1 July 2024. He decided to make up his accounts to 30 April each year.

In the 10 months to 30 April 2025, Cameron had tax-adjusted profits of £16,450. He estimates that his tax-adjusted profits for the year to 30 April 2026 will be £27,840.

What is the profit taxed in 2024/25?

£14,805

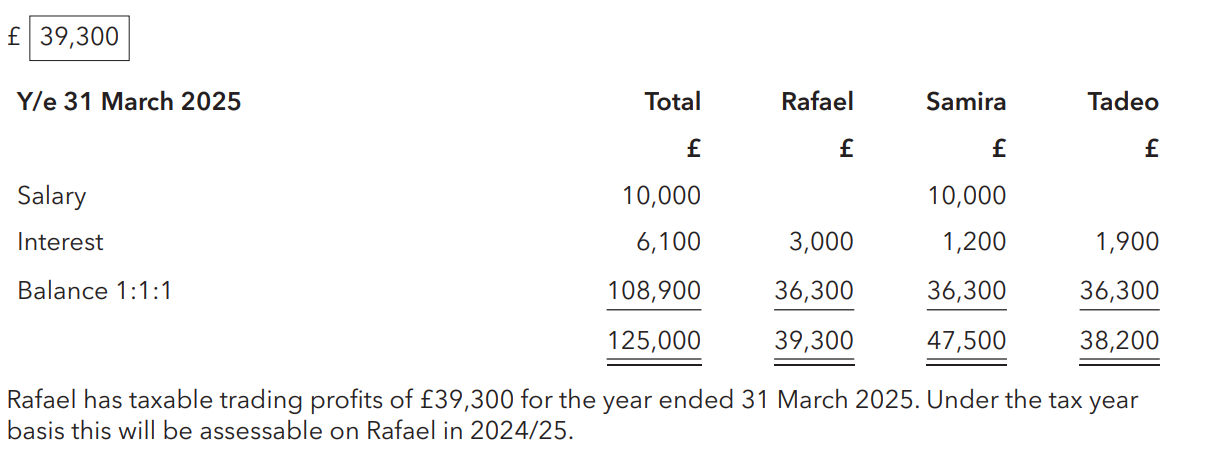

Rafael, Samira and Tadeo have been in partnership for many years. The partnership agreement allocates a salary of £10,000 per annum to Samira and all partners receive 5% per annum on their capital invested. The balance of any profits is shared equally. During the year ended 31 March 2025 Rafael's capital account had a balance of £60,000, Samira's balance was £24,000 and Tadeo's was £38,000. The partnership made tax-adjusted trading profits of £125,000 in the year ended 31 March 2025.

What are the trading profits assessable on Rafael in 2024/25?

Rafael = £39,300

Townshend ceased trading on 30 November 2025. The recent tax-adjusted trading profits of the business are as follows.

Year ended 30 April 2024 38,000

Year ended 30 April 2025 34,000

Period ended 30 November 2025 23,000

What is Townshend's trading profit assessment for 2024/25?

£34,333

Townshend ceased trading on 30 November 2025. The recent tax-adjusted trading profits of the business are as follows.

Year ended 30 April 2024 38,000

Year ended 30 April 2025 34,000

Period ended 30 November 2025 23,000

What is Townshend's trading profit assessment for 2025/26?

£25,833

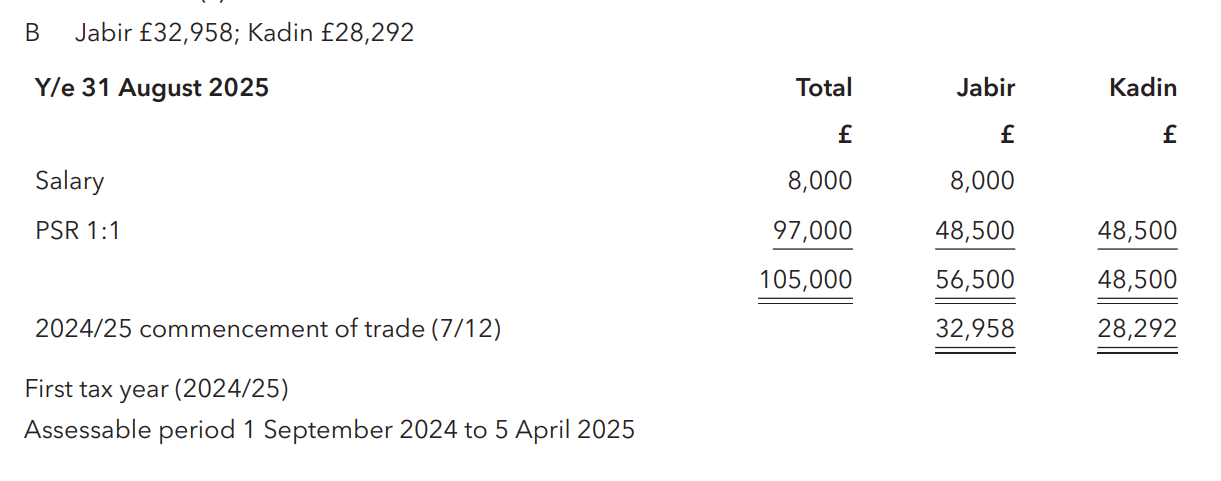

Jabir and Kadin began trading in partnership on 1 September 2024, sharing profits equally. The partnership agreement allocates an annual salary to Jabir of £8,000. For the year ended 31 August 2025 the partnership had a tax-adjusted trading profit of £105,000.

Jabir £32,958; Kadin £28,292

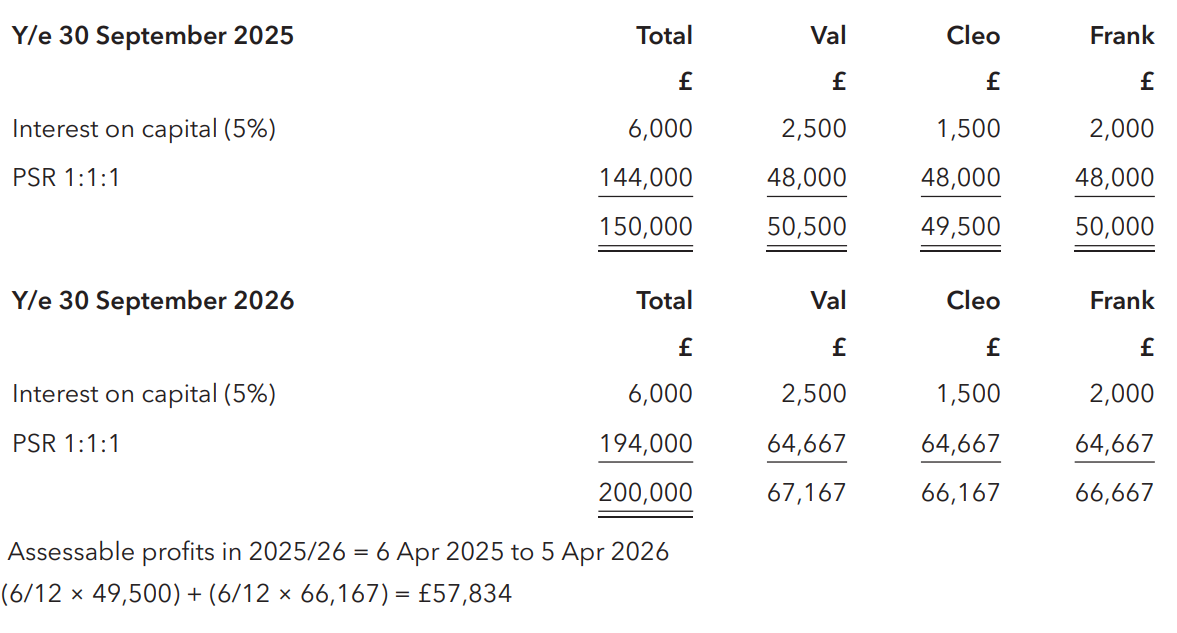

Val, Cleo and Frank have been in partnership for many years preparing accounts to 30 September each year. The partnership agreement indicates that all partners receive 5% per annum on their capital invested. The balance of any remaining profits is shared equally. Val's capital account had a balance of £50,000, Cleo's balance was £30,000 and Frank's was £40,000. The partnership made tax-adjusted trading profits of £150,000 in the year ended 30 September 2025, and £200,000 in the year ended 30 September 2026.

What are the trading profits assessable on Cleo in 2025/26?

£57,824

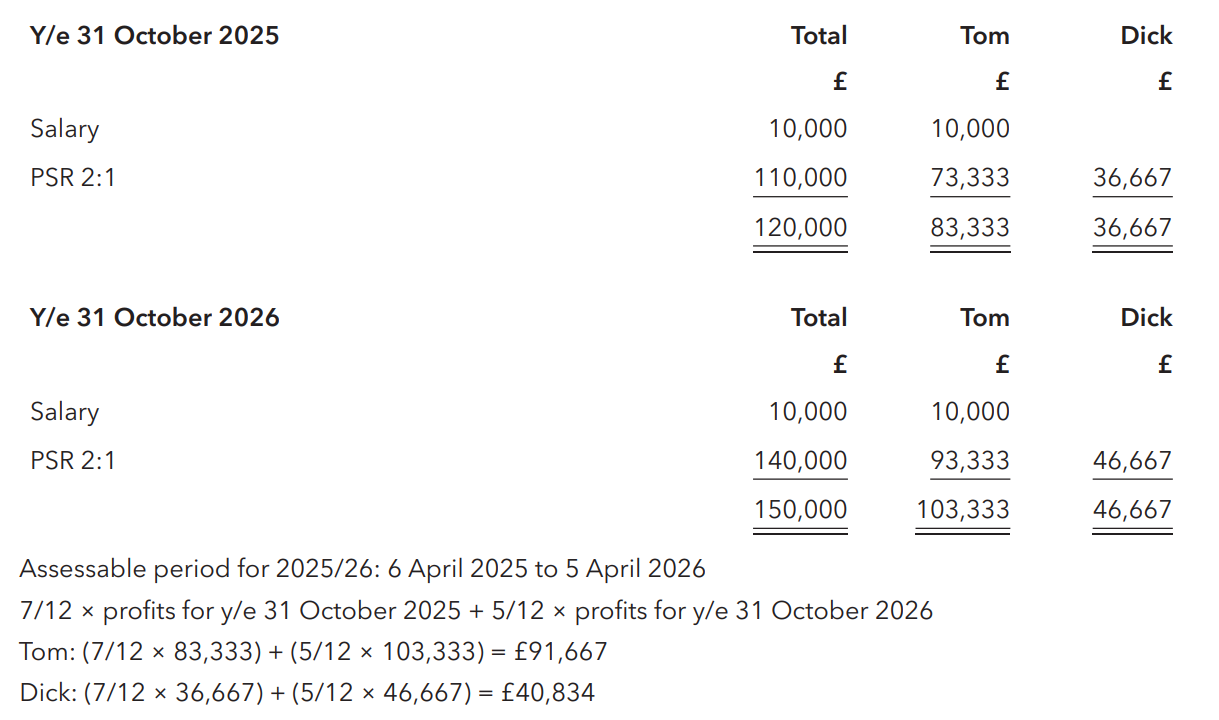

Tom and Dick have been trading in partnership for many years, sharing profits in the ratio 2:1. The partnership agreement allocates an annual salary to Tom of £10,000. The partnership had the following results. Year ended 31 October 2025: £120,000 Year ended 31 October 2026: £150,000

What are the partners' assessable trading profits for 2025/26?

Tom £91,667; Dick £40,834

Raanan ceased trading on 31 December 2024. The recent tax-adjusted trading profits of his business are as follows.

Year ended 31 January 2023 40,000

Year ended 31 January 2024 25,000

Period ended 31 December 2024 15,000

What is Raanan's trading profit assessment for 2024/25?

£12,273

Johanna started trading on 1 January 2024, but her business quickly ran into cash flow problems and she ceased to trade on 28 February 2026. The accounts for the year ended 31 December 2024 showed taxable trading profits of £6,000, and those for the period from 1 January 2025 to 28 February 2026 showed taxable trading profits of £2,800.

What is Johanna's taxable trading profit for 2025/26?

£2,200

Trevor's business ceased trading on 30 April 2024. The recent tax-adjusted trading profits of his business are as follows.

Year ended 30 September 2022 24,000

Year ended 30 September 2023 30,000

Period ended 30 April 2024 25,000

What is Trevor's assessable trading profit for 2024/25?

£3,571

Obed began trading on 1 July 2024, preparing his first accounts to 30 June 2025. The adjusted trading profits for the year ended 30 June 2025 were £24,000.

What is Obed's assessable trading profit for 2024/25?

£18,000

Belinda began trading on 1 January 2024, preparing her first accounts to 30 June 2025. The adjusted trading profits for the period ended 30 June 2025 were £42,000.

Which of the following statements is correct?

A £28,000 is taxable in 2024/25, representing the period 6 April 2024 to 5 April 2025.

B £28,000 is taxable in 2024/25, representing the year ended 30 June 2025.

C £7,000 is taxable in 2024/25, representing the period 1 January 2024 to 5 April 2025.

D £42,000 is taxable in 2024/25, representing the period to 30 June 2025.

A £28,000 is taxable in 2024/25, representing the period 6 April 2024 to 5 April 2025.

Ray began trading on 1 July 2024, preparing his first accounts to 31 December 2024. The adjusted trading profits for the first two periods were:

6 m/e 31 December 2024 60,000

12 m/e 31 December 2025 (estimate) 100,000

£85,000

Audrey and Elaine have been in partnership for many years. Both partners are allocated interest of 5% per annum on their capital invested. The balance of any profits is shared equally. During the year ended 31 March 2025 Audrey's capital account had a balance of £50,000, Elaine's was £20,000. The partnership made adjusted trading profits of £100,000 in the year ended 31 March 2025.

What are the trading profits assessable on Audrey in 2024/25?

£50,750

David and Doreen started in partnership together on 1 July 2024 sharing profits in the ratio 2:1. The partnership taxable trading profit for the year ended 30 June 2025 is £120,000.

What is the amount of trading profits taxable on Doreen in 2024/25?

£30,000

Florian ceased trading on 30 September 2024. The recent tax-adjusted trading profits of his business are as follows:

Year ended 31 January 2023 28,500

Year ended 31 January 2024 21,200

Period ended 30 September 2024 17,430

What is Florian's taxable trading income for 2024/25?

£13,073

Leroy and Annabelle have been in partnership for many years. The partnership agreement allocates partners' interest at 5% pa on capital invested. The balance of any profit is shared in the ratio 2:3. On 31 March 2024 Leroy's capital account had a balance of £35,000 and Annabelle's balance was £23,000. For the year ended 31 March 2025 the partnership had a tax-adjusted trading profit of £98,500.

What is Leroy's assessable trading profit for 2024/25?

£39,900

Parminder began trading on 1 January 2024 making up her first set of accounts to 28 February 2025. Her tax-adjusted profits after capital allowances are as follows.

Period ended 28 February 2025 £53,208

Year ending 28 February 2026 (estimate) £31,740

£44,451

Raeleen began trading on 1 January 2025, preparing her first accounts to 30 June 2025 and she will prepare them to every following June. The adjusted trading profits are as follows.

6 months ended 30 June 2025 10,000

Year ended 30 June 2026 (estimated) 25,000

What is the Taxable Profit for 2025/26?

£23,750

Raeleen began trading on 1 January 2025, preparing her first accounts to 30 June 2025 and she will prepare them to every following June. The adjusted trading profits are as follows.

6 months ended 30 June 2025 10,000

Year ended 30 June 2026 (estimated) 25,000

What is the Taxable Profit for 2024/25?

£5,000

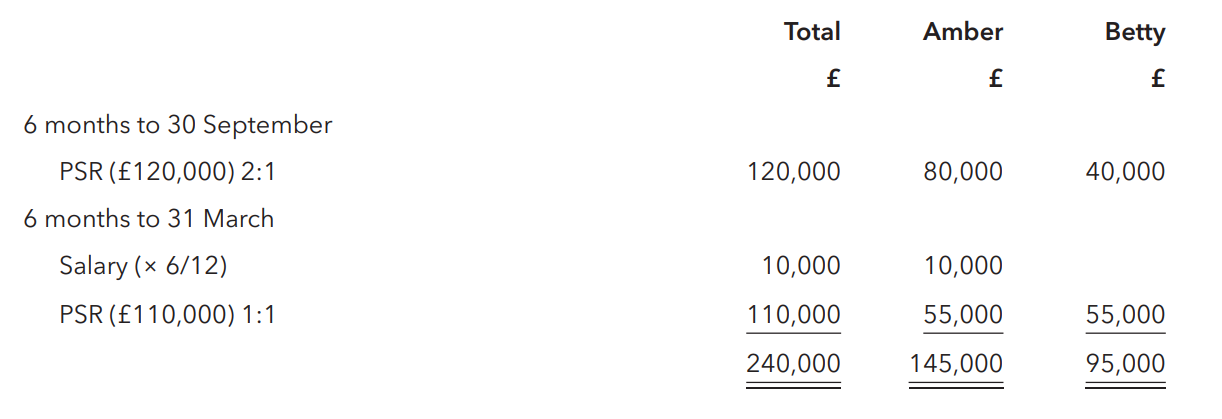

Amber and Betty have been trading in partnership for many years, sharing profits in the ratio 2:1. On 1 October 2024 they changed the arrangement so that a salary of £20,000 pa is allocated to Amber and the remaining profits are shared equally. The partnership made adjusted trading profits of £240,000 in its year ended 31 March 2025.

What are the partners' assessable trading profits for 2024/25?

Amber £145,000; Betty £95,000