3.7.2 Financial ratio analysis

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

What is liquidity?

Liquidity is concerned with ability of a business to be able to pay its way - to settle liabilities e.g. monthly payroll, amounts due to suppliers & taxes collected on behalf of government etc

What is a liquidity ratio?

Assesses whether a business has sufficient cash or equivalent current assets to be able to pay its debts as they fall due

Where does the data to calculate liquidity ratios come from?

All the financial info you need is contained within the statement of financial position (AKA balance sheet)

What is the statement of financial position (balance sheet)?

Snapshot of business' assets (what it owns or is owed) and its liabilities (what it owes) on a particular day

What is an income statement?

Measures business performance over a given period of time, usually one year

Compares income of business against cost of goods or services & expenses incurred in earning that revenue

What is cash flow statement?

It shows how the business has generated and disposed of cash & liquid funds during period under review

How do we calculate liquidity ratios?

Compare the ratio of current assets and current liabilities

Current assets -> include cash, inventories, trade receivables (or trade debtors - amounts owed by customers)

Current liabilities -> amounts owed to suppliers, bank overdraft balances (money owed to bank)

How do we calculate current ratio? (classic liquidity ratio)

CURRENT ASSETS / CURRENT LIABILITIES

e.g. 2:1

Evaluating current ratio :

A ratio of 1.5 - 2 would suggest acceptable liquidity & efficient management of working capital

Low ratio (e.g. well below 1) indicates possible liquidity problems

High ratio suggets too much working capital tied up in inventories or debtors

However when evaluating current ratios dont forget :

Industry or market matters - they have diff requirements for holding inventories, or approaches to trade debt and credit

How does current ratio compare with competitors?

The trend is more important - sudden deterioration in current ratio is a good indicator of liquidity problems

What is Gearing?

Gearing measures the proportion of a business' capital (finance) provided by debt

What is the capital structure of a business?

It represents the finance provided to it to enable it to operate over the long term

Two parts to capital structure -> equity and debt

Equity finance -> amounts invested by owners of business (shareholders) e.g. share capital, retained profit

Debt finance -> finance provided to business by external parties e.g. bank loans, other long-term loans

What factors influence the mix of equity and debt in a financial structure?

Reasons for higher equity :

Where there is greater business risk (e.g. a startup)

where more flexibility required (e.g. dont have to pay dividends)

Reasons for higher debt :

where interest rates are very low = debt is cheap to finance

where profits & cash flows are strong - debt can be repaid easily

What are key benefits to calculating the gearing ratio?

A useful measure of financial health of a business

focuses on level of debt in financial structure

high gearing ratio can mean higher risk of business failure (but not always)

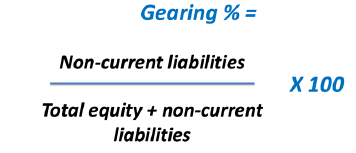

What is the formula for calculating the gearing ratio (%) ?

Gearing ratio

Is having a higher gearing a bad thing?

It depends

a gearing ratio of 50%+ is normally said to be high

gearing ratio of less than 20% normally said to be low

level of acceptable gearing depends on business & industry

What are the benefits of high gearing?

Less capital required to be invested by shareholders

debt can be a relatively cheap source of finance compared with dividends

easy to pay interest if profits and cash flows are strong

What are the benefits of low gearing?

less risk of defaulting on debts

shareholders rather than debt providers "call the shots"

business has capacity to add debt if required

What are Efficiency ratios?

They analyse how effectively a business is managing its assets

Three most commonly used ones :

Inventory turnover = measures how often each year a business sells and replaces inventory

Payables days = measures average length of time taken by a business to pay amounts it owes

Receivables days = measures average length of time taken by customers to pay amounts owed

What are inventories (or stocks)?

The raw materials, work in progress & finished goods held by a business to enable production & meet customer demand

How to calculate the Inventory turnover?

INVENTORY TURNOVER = COST OF SALES / INVENTORIES

Answer expressed as '“times” (a year)

What sectors will typically have a low inventory turnover and which will have high?

Engineering, construction & industrial distribution will have low inventory turnover

Whereas in retailing, fast food, restaurants & motor vehicle production has much higher inventory turnover

This needs to be borne in mind when comparing inventory turnover ratios of diff businesses

What should we remember when evaluating results of inventory turnover calculations?

Inventory turnover varies from industry to industry

Holding more inventory may improve customer service & allow business to meet demand

Seasonal fluctuations in demand during year may not be reflected in calculations

Inventory turnover is not relevant to most service businesses

How can a business improve (increase) its inventory turnover?

One or more of following might be an option :

Sell off or dispose of slow moving or obsolete inventory

Introduce lean production techniques to reduce amounts of inventory held

Rationalise product range made or sold

Negotiate sale or return arrangements with suppliers - so inventory can be returned if it doesn’t sell

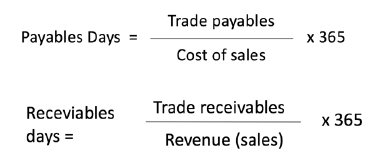

What are Payables and Receivable days ratios concerned with?

How quickly payments are made (to creditors) and received (from customers) & they use similar formulae :

Both ratios expressed as “days”

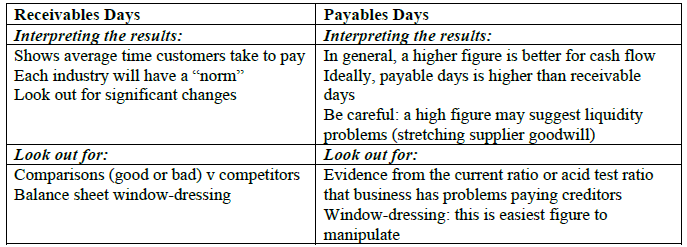

Evaluating Receivables & Payables days :

Evaluations :

What is Return on capital employed (ROCE) ?

A measure of relative profitability

Tells us what returns (profits) the business has made on resources available to it

How is ROCE particularly useful as a ratio?

It helps :

Evaluate overall performance of business

Provide a target return for individual projects

Benchmark performance with competitors

What information do you need to calculate ROCE?

Amount of profit earned in a particular period (usually a year) → get from income statement

To calculate capital employed → need info from balance sheet (statement of financial position)

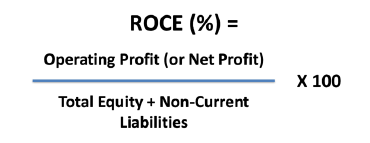

What is the formula used to calculate ROCE (%) ?

ROCE (%)

Evaluating ROCE :

ROCE will vary between industries → particularly important measure in capital intensive industries with significant amounts of capital employed

ROCE is based on a snapshot of a busines's’ balance sheet

Comparisons over time & with key competitors are most useful