FINC 360 Flashcards

0.0(0)Studied by 1 person

Card Sorting

1/28

Earn XP

Description and Tags

Last updated 12:47 AM on 9/20/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

1

New cards

The total dollar return on a share of stock is defined as the:

a. change in the price of the stock over a period.

b. dividend income divided by the beginning price per share.

c. capital gain or loss plus any dividend income.

d. change in the stock price divided by the original stock price.

e. annual dividend income received.

a. change in the price of the stock over a period.

b. dividend income divided by the beginning price per share.

c. capital gain or loss plus any dividend income.

d. change in the stock price divided by the original stock price.

e. annual dividend income received.

c.

2

New cards

When the total return on an investment is expressed on a per-year basis it is called the:

a. capital gains yield

b. dividend yield

c. holding period return

d. effective annual return

e. initial return

a. capital gains yield

b. dividend yield

c. holding period return

d. effective annual return

e. initial return

d.

3

New cards

The additional return earned for accepting risk is called the:

a. inflated return

b. capital gains yield

c. real return

d. riskless rate

e. risk premium

a. inflated return

b. capital gains yield

c. real return

d. riskless rate

e. risk premium

e.

4

New cards

If you multiply the number of shares outstanding for a stock by the price per share, you are computing the firm's:

a. equity ratio

b. total book value

c. market share

d. market capitalization

e. time value

a. equity ratio

b. total book value

c. market share

d. market capitalization

e. time value

d.

5

New cards

Which one of the following had the highest average return for the period 1926-2018?

a. large-company stocks

b. U.S. Treasury bills

c. long-term government bonds

d. small-company stocks

e. long-term corporate stocks

a. large-company stocks

b. U.S. Treasury bills

c. long-term government bonds

d. small-company stocks

e. long-term corporate stocks

d.

6

New cards

The wider the distribution of an investment's returns over time, the _____ the expected average return and the _____ the expected volatility of those returns.

a. higher; higher

b. higher; lower

c. lower; higher

d. lower; lower

e. The distribution of returns does not affect the expected rate of return.

a. higher; higher

b. higher; lower

c. lower; higher

d. lower; lower

e. The distribution of returns does not affect the expected rate of return.

a.

7

New cards

A brokerage account in which purchases can be made using credit is referred to as which type of account?

a. clearing

b. funds available

c. cash

d. call

e. margin

a. clearing

b. funds available

c. cash

d. call

e. margin

e.

8

New cards

The minimum equity that must be maintained at all times in a margin account is called the:

a. initial margin

b. initial equity position

c. maintenance margin

d. call requirement

e. margin call

a. initial margin

b. initial equity position

c. maintenance margin

d. call requirement

e. margin call

c.

9

New cards

Sam purchased 500 shares of Microsoft stock which he has pledged to his broker as collateral for the loan in his margin account. This process of pledging securities is called:

a. margin calling

b. hypothecation

c. leveraging

d. maintaining the margin

e. street securitization

a. margin calling

b. hypothecation

c. leveraging

d. maintaining the margin

e. street securitization

b.

10

New cards

This morning, Josh sold 800 shares of stock that he did not own. This sale is referred to as a:

a. margin sale

b. long position

c. wrap trade

d. hypothecated sale

e. short sale

a. margin sale

b. long position

c. wrap trade

d. hypothecated sale

e. short sale

e.

11

New cards

Walter is trying to decide whether he wants to purchase shares in General Motors, Ford, or Honda, all of which are auto manufacturers. Walter is making a(n) _____ decision.

a. security selection

b. tax-advantaged

c. risk aversion

d. active strategy

e. asset allocation

a. security selection

b. tax-advantaged

c. risk aversion

d. active strategy

e. asset allocation

a.

12

New cards

Brooke has decided to invest 55% of her money in large company stocks, 40% in small company stocks, and 5% in cash. This is a(n) _____ decision.

a. market timing

b. security selection

c. tax-advantaged

d. active strategy

e. asset allocation

a. market timing

b. security selection

c. tax-advantaged

d. active strategy

e. asset allocation

e.

13

New cards

Kay plans to retire in two years and wishes to liquidate her account at that time. Kay has a _____ constraint.

a. resource

b. horizon

c. liquidity

d. tax

e. special circumstance

a. resource

b. horizon

c. liquidity

d. tax

e. special circumstance

b.

14

New cards

An agreement that grants the owner the right, but not the obligation, to buy or sell a specific asset at a specified price during a specified time period is called a(n) _____ contract.

a. futures

b. obligatory

c. quoted

d. fixed

e. option

a. futures

b. obligatory

c. quoted

d. fixed

e. option

e.

15

New cards

The price paid to purchase an option contract is called the:

a. strike price

b. option premium

c. exercise price

d. future premium

e. current yield

a. strike price

b. option premium

c. exercise price

d. future premium

e. current yield

b.

16

New cards

Which one of the following is a derivative asset?

a. common stock

b. option contract

c. government bond

d. preferred stock

e. corporate bond

a. common stock

b. option contract

c. government bond

d. preferred stock

e. corporate bond

b.

17

New cards

Great Lakes Farm agreed this morning to sell General Mills 25,000 bushels of wheat six months from now at a price/bushel of $9.75. This is an example of a:

a. call option

b. put option

c. forward contract

d. money market security

e. fixed-income security

a. call option

b. put option

c. forward contract

d. money market security

e. fixed-income security

c.

18

New cards

You owe thirteen 7.0% coupon bonds with a total maturity value of $13,000. How much will you receive every six months as an interest payment?

a. $213.50

b. $375.00

c. $455.00

d. $540.00

e. $750.00

a. $213.50

b. $375.00

c. $455.00

d. $540.00

e. $750.00

c.

19

New cards

You purchased four put option contracts with a strike price of $34.5 and a premium of $.85. What is the total net amount you will receive for your shares if you exercise this contract when the underlying stock is selling for $31.50 a share?

a. $13,460

b. $13,700

c. $15,740

d. $16,340

e. $16,400

a. $13,460

b. $13,700

c. $15,740

d. $16,340

e. $16,400

a.

20

New cards

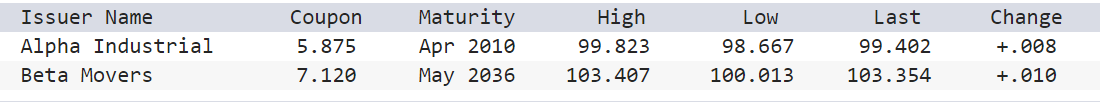

What is the current price of a $1,000 face value Alpha Industrial bond?

a. $986.67

b. $991.04

c. $994.02

d. $998.23

e. $1,000.00

a. $986.67

b. $991.04

c. $994.02

d. $998.23

e. $1,000.00

c.

21

New cards

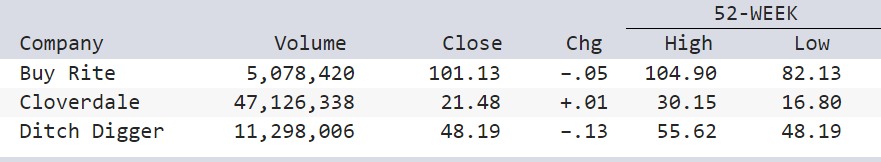

How many whole shares of Ditch Digger stock traded today?

a. 11,298

b. 112,980

c. 11,298,006

d. 112,980,060

e. 1,129,800,600

a. 11,298

b. 112,980

c. 11,298,006

d. 112,980,060

e. 1,129,800,600

c.

22

New cards

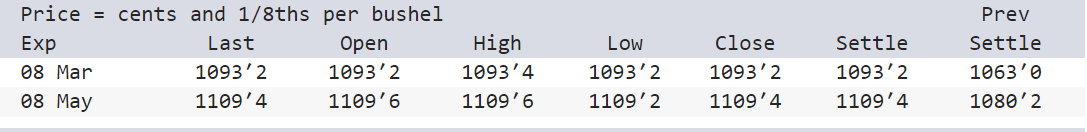

What price would you have paid today per bushel for the Mar 08 wheat futures contract if you bought the contract at the final price of the day?

a. $10.8010

b. $10.8025

c. $10.9320

d. $10.9325

e. $11.0960

a. $10.8010

b. $10.8025

c. $10.9320

d. $10.9325

e. $11.0960

d.

23

New cards

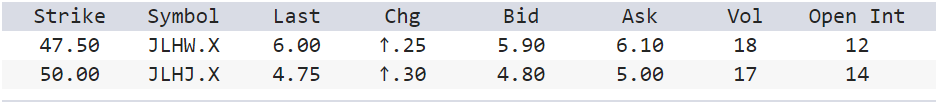

The price you will pay (per underlying share) to buy the 50 call option on JL stock is:

a. $4.75

b. $4.80

c. $5.00

d. $5.90

e. $6.00

a. $4.75

b. $4.80

c. $5.00

d. $5.90

e. $6.00

c.

24

New cards

An investment company:

a. specializes in investing funds on behalf of a financial institution.

b. is a closed-end fund that invests in real estate.

c. pools funds from individual investors.

d. is a specific type of a bank.

e. is a specialized form of a joint stock company.

a. specializes in investing funds on behalf of a financial institution.

b. is a closed-end fund that invests in real estate.

c. pools funds from individual investors.

d. is a specific type of a bank.

e. is a specialized form of a joint stock company.

c.

25

New cards

An investment company that will repurchase shares at any time is called a(n) _____ fund.

a. hedge

b. closed-end

c. open-end

d. public

e. exchange traded

a. hedge

b. closed-end

c. open-end

d. public

e. exchange traded

c.

26

New cards

An investment company that issues a fixed number of shares which can only be resold in the open stock market is called a(n) _____ fund.

a. hedge

b. closed-end

c. open-end

d. public

e. market

a. hedge

b. closed-end

c. open-end

d. public

e. market

b.

27

New cards

A fee that is charged at the time mutual shares are purchased by an investor is called a:

a. contingent deferred sales charge

b. 12b-1 fee

c. back-end load

d. front-end load

e. issuance charge

a. contingent deferred sales charge

b. 12b-1 fee

c. back-end load

d. front-end load

e. issuance charge

d.

28

New cards

A fund that is basically an index fund that trades like a closed-end fund is called a(n):

a. open-end fund

b. money market fund

c. exchange-traded fund

d. mutual fund

e. depository receipt

a. open-end fund

b. money market fund

c. exchange-traded fund

d. mutual fund

e. depository receipt

c.

29

New cards

Today, you are selling shares of an open-end mutual fund and will be charged a CDSC of 3%. The price you will receive per share is equal to:

a. 103% of the opening NAV

b. 97% of the opening offering price

c. 97% of the closing NAV

d. 103% of the closing offering price

e. the closing offering price

a. 103% of the opening NAV

b. 97% of the opening offering price

c. 97% of the closing NAV

d. 103% of the closing offering price

e. the closing offering price

c.