Macroeconomics Theme 4 <3

5.0(2)

5.0(2)

Card Sorting

1/178

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

179 Terms

1

New cards

globalisation

the process by which the worlds economies are becoming closely integrated

2

New cards

causes of globalisation

decreased cost of communication

decreased transport costs (containerisation)

reduction in world trade barriers

growth of trading blocs

increased importance of TNCs

decreased transport costs (containerisation)

reduction in world trade barriers

growth of trading blocs

increased importance of TNCs

3

New cards

\

containerisation

containerisation

decreased cost for shipping

less labour and time

economies for scale

increased output

off shoring

less labour and time

economies for scale

increased output

off shoring

4

New cards

characteristics of globalisation

increased trade to GDP ratio

increased FDI and TNC

decrease in global inequality

increased flow of labour

increased capital flow between countries

increased FDI and TNC

decrease in global inequality

increased flow of labour

increased capital flow between countries

5

New cards

benefits of globalisation in LEDCs

higher living standards

economies of scale

reduced absolute poverty

increased tax revenue

technology transfer / new managerial techniques

economies of scale

reduced absolute poverty

increased tax revenue

technology transfer / new managerial techniques

6

New cards

costs of globalisation in LEDCs

negative externalities

overdependence on exports

increased inequality

exploitation of labour

exploitation of resources

tax avoidance

overdependence on exports

increased inequality

exploitation of labour

exploitation of resources

tax avoidance

7

New cards

benefits of globalisation in MEDCs

higher living standards

economies of scale

lower prices

increased consumer choice

economies of scale

lower prices

increased consumer choice

8

New cards

costs of globalisation in MEDCs

overdependence on imports

increased inequality

increased unemployment

increased inequality

increased unemployment

9

New cards

absolute advantage

the ability to produce a good more efficiently

10

New cards

comparative advantage

the ability to produce a good relatively more efficient with a lower opportunity cost

11

New cards

law of comparative advantage

overall output can be increased if individuals or countries specialise in producing goods they have a comparative advantage in

12

New cards

things that determine the global patterns of trade

trading blocs

bilateral agreements

comparative advantage

exchange rates

factor endowment

bilateral agreements

comparative advantage

exchange rates

factor endowment

13

New cards

terms of trade (TOT)

measures the rate of exchange of one product for another when two countries trade

14

New cards

TOT formula

index prices of exports/index prices of imports x 100

15

New cards

trading bloc

free trade area

customs union

common market

monetary union

customs union

common market

monetary union

16

New cards

free trade area

trade barriers are removed between countries but each country can impose its own restrictions on countries outside the area (NAFTA)

17

New cards

customs union

same as free trade area but with a common external tariff (EAC)

18

New cards

common market

same as customs union but free movement of factors of production (EU)

19

New cards

monetary union

same as common market but with a common currency (eurozone)

20

New cards

benefits of free trade

comparative advantage

export led growth

increases in consumer surplus

increased efficiency

access to larger markets

greater political ties

export led growth

increases in consumer surplus

increased efficiency

access to larger markets

greater political ties

21

New cards

costs of free trade

deterioration in the trade balance

danger of dumping

unemployment

contagion

sectoral imbalance

global monopolies

danger of dumping

unemployment

contagion

sectoral imbalance

global monopolies

22

New cards

benefits of monetary union

lower transaction cost to trade

more FDI

reduced currency fluctuations

more FDI

reduced currency fluctuations

23

New cards

costs of monetary union

loss of independent monetary policy

24

New cards

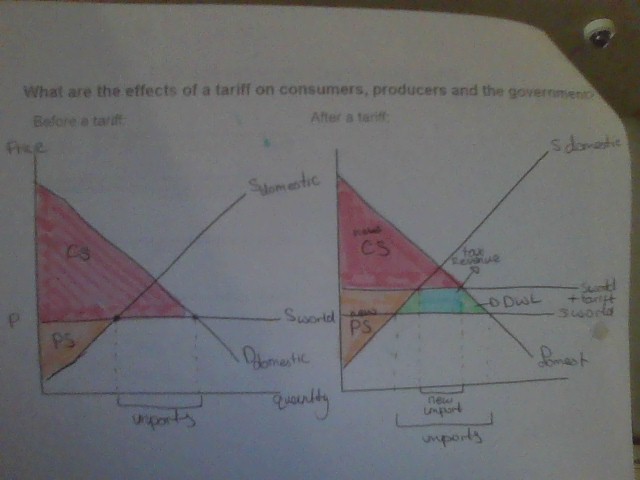

tariff diagram

gain - government through tax revnue - domestic producers (+PS)

loss - consumers (-CS) - global producers

loss - consumers (-CS) - global producers

25

New cards

purpose of protectionism

protect strategic and infant industries

reduced risk of dumping

reduced impact of global monopolies

increased tax revenue

reduced over dependence on imports

reduced risk of dumping

reduced impact of global monopolies

increased tax revenue

reduced over dependence on imports

26

New cards

non tariff barriers

Quotas \n Voluntary Export restraint \n Intellectual property laws \n Technical barriers to trade \n preferential state procurement policies \n domestic subsidies \n currency intervention

27

New cards

balance of payments

record of all payments

monetary transaction between countries

monetary transaction between countries

28

New cards

components of balance of payments

current account

capital account

financial account

capital account

financial account

29

New cards

components of current account

trade in goods

trade in services

current transfers

investment income

trade in services

current transfers

investment income

30

New cards

component of capital account

fixed assets

31

New cards

components of financial account

FDI

hot money

portfolio investment

hot money

portfolio investment

32

New cards

current account deficit causes

structural shift - deindustrialisation \n overvalued exchange rate \n declining TOT \n rising commodity prices

33

New cards

current account surplus causes

export oriented growth \n undervalued exchange rate \n FDI growth \n closed economy \n high domestic savings rates

34

New cards

floating exchange rate

demand and supply of the currency depends on the exchange rate

35

New cards

fixed exchange rate

when the exchange rate is fixed in relation to another country

36

New cards

appreciation

increase in the value of the currency in a floating exchange rate

37

New cards

deppreciation

decrease in the value of the currency in a floating exchange rate

38

New cards

revaluation

increase in the value of the currency in a fixed exchange rate

39

New cards

devaluation

decrease in the value of the currency in a fixed exchange rate

40

New cards

factors influencing exchange rate

relative inflation rates

relative interest rates (hot money)

current account balance

FDI

speculation

relative interest rates (hot money)

current account balance

FDI

speculation

41

New cards

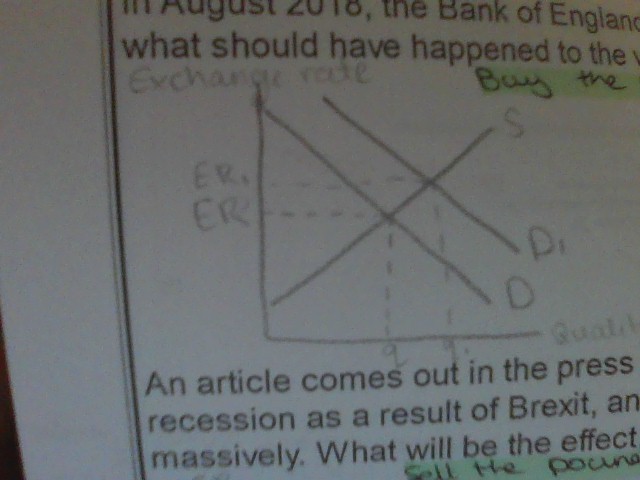

buy the pound

increase IR

return on pound increases

more demand for pound

appreciation of pound

return on pound increases

more demand for pound

appreciation of pound

42

New cards

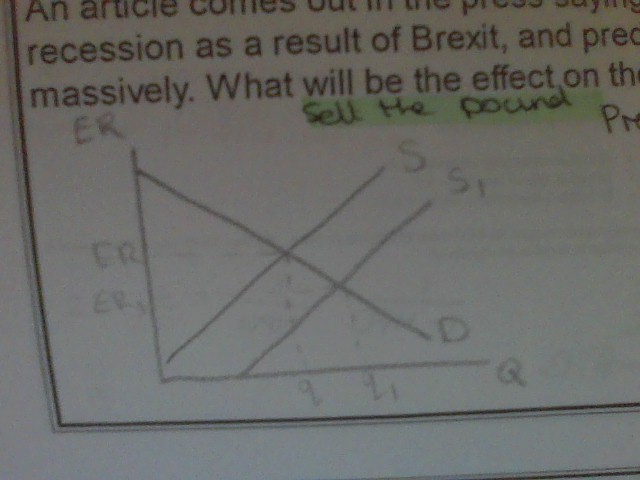

sell the pound

prediction of UK recession

investors sell pound

more supply of pound

depreciation

investors sell pound

more supply of pound

depreciation

43

New cards

arguments for a floating currency

automatic correction of current account deficit

no problem with lack of currency reserves

insulation from external economic events

govt can use IR to change AD

no problem with lack of currency reserves

insulation from external economic events

govt can use IR to change AD

44

New cards

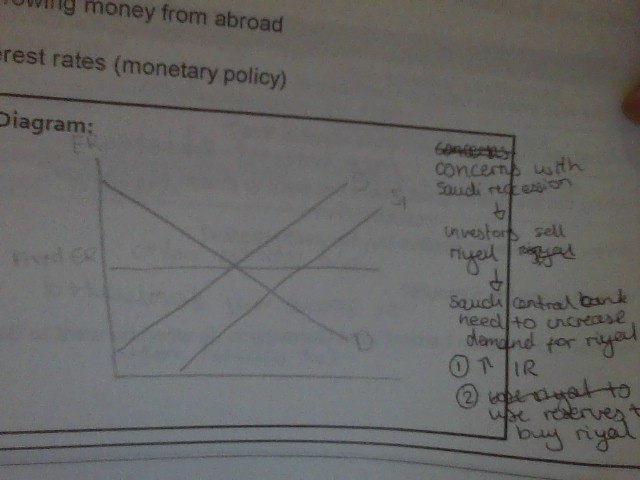

maintaining a fixed exchange rate

using reserves

borrowing money from abroad

interest rates

borrowing money from abroad

interest rates

45

New cards

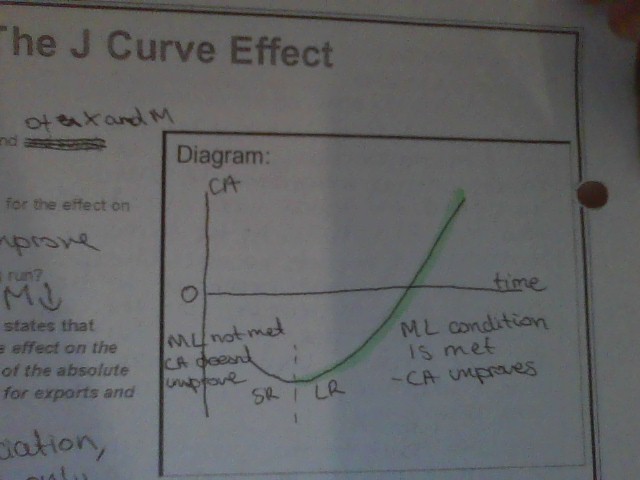

J curve effect

after a currency depreciation

current account will worsen in the short run

then improve in the long run

current account will worsen in the short run

then improve in the long run

46

New cards

marshal lerner condition

if there is a depreciation then the current account will only improve if the PED of exports + the PED of imports > 1

47

New cards

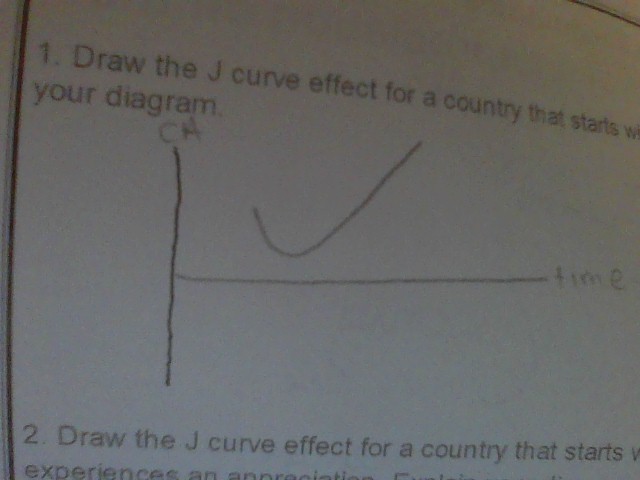

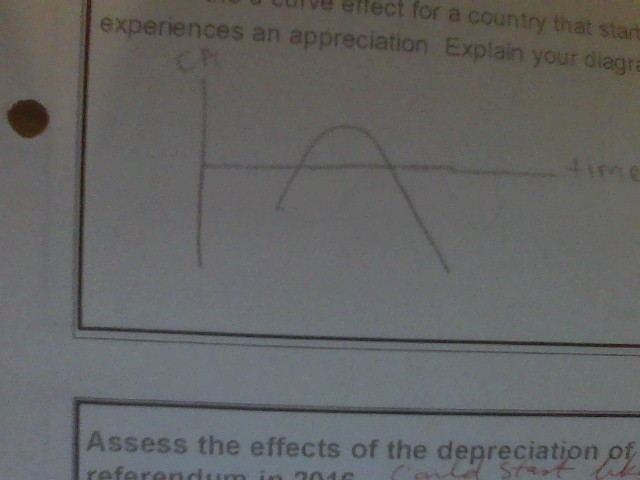

J curve for a current account surplus

48

New cards

J curve for a current account deficit

49

New cards

depreciation leading to inflation COR

depreciation of currency

increase price of importing raw materials or capital goods

increased cost for firms

decrease SRAS

cost push inflation

increase price of importing raw materials or capital goods

increased cost for firms

decrease SRAS

cost push inflation

50

New cards

depreciation causes TNC

depreciation of currency

cheaper for TNC to invest (china-belt and road)

build bridges, roads and dams

increase AD and LRAS

long run economic growth

cheaper for TNC to invest (china-belt and road)

build bridges, roads and dams

increase AD and LRAS

long run economic growth

51

New cards

competitiveness

measure of a countries ability to sell its goods on international markets at a price attractive in those markets

52

New cards

measuring competitiveness

relative export prices

relative unit labour cost

relative unit labour cost

53

New cards

pillars of the Global competitive index (GCI)

institution

infrastructure

ICT adoption

health

macroeconomic objectives

labour market

market size

innovation capability

infrastructure

ICT adoption

health

macroeconomic objectives

labour market

market size

innovation capability

54

New cards

factors influencing competitiveness

unit labour cost

productivity

exchange rate

labour taxes or subsidies

govt laws and regulations

research and development

productivity

exchange rate

labour taxes or subsidies

govt laws and regulations

research and development

55

New cards

UK tax breaks for R+D to improve competitiveness COR

tax breaks for R+D

incentives to investment in R+D

technological spill over

gain a comparative advantage in tech

increase in FDI

increase productivity

increase in relative export prices

increase in competitiveness

incentives to investment in R+D

technological spill over

gain a comparative advantage in tech

increase in FDI

increase productivity

increase in relative export prices

increase in competitiveness

56

New cards

UK tax breaks for R+D to improve competitiveness EV

uk govt has a high national debt

they cant be sure all firms will use the tax breaks effectively

this leads to a high opportunity cost

they cant be sure all firms will use the tax breaks effectively

this leads to a high opportunity cost

57

New cards

UK deregulation improve competitiveness COR

leaving the EU

allows the UK the ability to cut regulation (in financial sector)

lowers compliance cost

fall in COP

fall in relative export prices

increase in competitiveness

allows the UK the ability to cut regulation (in financial sector)

lowers compliance cost

fall in COP

fall in relative export prices

increase in competitiveness

58

New cards

UK deregulation improve competitivenes EV

market failure

negative externalities are a risk in the financial sector

can affect growth of competitiveness in the future

negative externalities are a risk in the financial sector

can affect growth of competitiveness in the future

59

New cards

improving access to vocational education improve competitiveness COR

increases access to apprenticeship scheme

help young people get specialised skills (digital literacy)

increases quality of human capital

increases productivity

decreases unit labour cost

increases competitiveness

help young people get specialised skills (digital literacy)

increases quality of human capital

increases productivity

decreases unit labour cost

increases competitiveness

60

New cards

improving access to vocational education improve competitiveness EV

rapid automation

risk of unemployment for those with vocational training

occupational mobility of labour (too specialised and jobs may be replaced)

risk of unemployment for those with vocational training

occupational mobility of labour (too specialised and jobs may be replaced)

61

New cards

improving infrastructure to improve competitiveness COR

infrastructure project (financed by china)

attracts FDI

belt and road initiative

decrease transport costs

attracts further FDI

increase geographical mobility of labour

increase knowledge transfer and technological spillover

increases productivity

increases competitiveness

attracts FDI

belt and road initiative

decrease transport costs

attracts further FDI

increase geographical mobility of labour

increase knowledge transfer and technological spillover

increases productivity

increases competitiveness

62

New cards

improving infrastructure to improve competitiveness EV

countries may be dependent on chinese imports in the future as part of the agreement

63

New cards

absolute poverty

when a person has insufficient resources to meet basic human needs

64

New cards

absolute poverty figure

less than $2.15 PPP a day

65

New cards

causes of absolute poverty

population growing faster than GDP in low income countries

severe savings gap

absence of basic public services

effects of corruption

high levels of debt and high interest rates

damaging effects of civil wars and natural disasters

low employment rates, vulnerable jobs and poverty wages

absence of basic property rights

severe savings gap

absence of basic public services

effects of corruption

high levels of debt and high interest rates

damaging effects of civil wars and natural disasters

low employment rates, vulnerable jobs and poverty wages

absence of basic property rights

66

New cards

relative poverty

when a person is poor compared to others in society

67

New cards

relative poverty figure

below 60% of median household income

68

New cards

reasons for a fall in relative poverty

increase of age of leaving school from 16 to 18

furlough scheme

more uni students

lower unemployment

furlough scheme

more uni students

lower unemployment

69

New cards

reasons for a rise in relative poverty

economic consequences of brexit

wages not rising in proportion to inflation

increase in tuiton fees

increase in zero hour contracts

increase in automation

austerity

wages not rising in proportion to inflation

increase in tuiton fees

increase in zero hour contracts

increase in automation

austerity

70

New cards

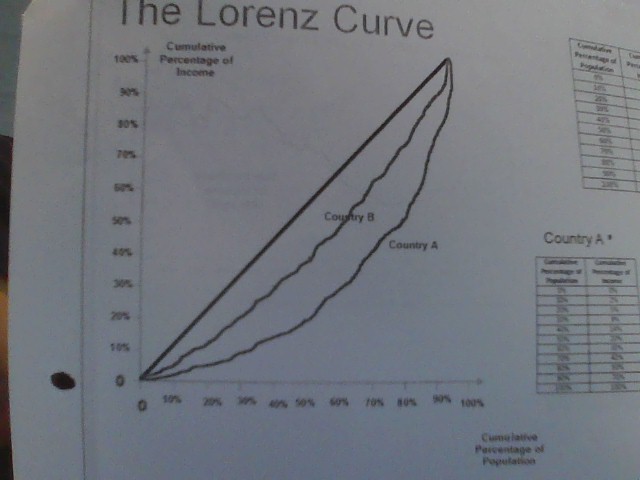

lorenz curve

used to compare inequality between countries

71

New cards

gini coefficient

A/A+B

value of 0 is total equality (line of perfect equality)

value of 1 is total inequality

higher the gini coefficient the more unequal

value of 0 is total equality (line of perfect equality)

value of 1 is total inequality

higher the gini coefficient the more unequal

72

New cards

causes of inequality for a developed economy

austerity

automation

access to higher education

unemployment

deindustrialisation (lack of secondary sector)

inheritance tax

automation

access to higher education

unemployment

deindustrialisation (lack of secondary sector)

inheritance tax

73

New cards

causes of inequality for a developing economy

corruption

access to finance

property laws

TNCs (monopsony power to set wages)

access to primary/secondary education

prevalence of subsistence farming

savings gap

access to finance

property laws

TNCs (monopsony power to set wages)

access to primary/secondary education

prevalence of subsistence farming

savings gap

74

New cards

causes of inequality

war/conflict

tax system

social protection (pensions + benefits)

trade unions

healthcare

globalisation

tax system

social protection (pensions + benefits)

trade unions

healthcare

globalisation

75

New cards

austerity

deliberate cuts to government spending

rises in taxes to reduce national debts

rises in taxes to reduce national debts

76

New cards

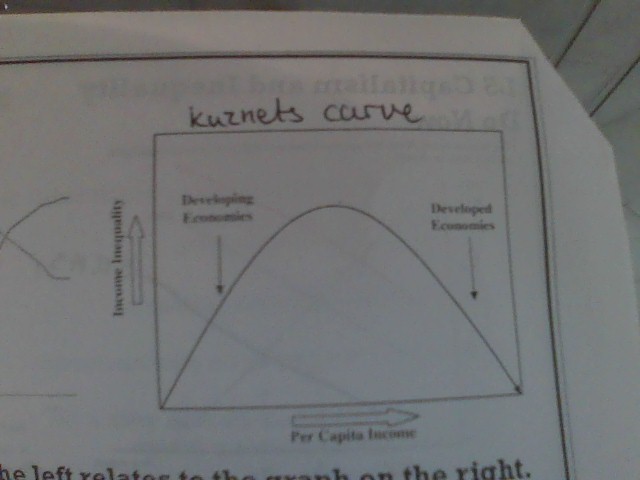

kuznets curve

as income per capita increases in a developing economy then income inequality increases

as income per capita increases in a developed economy then income inequality decreases

as income per capita increases in a developed economy then income inequality decreases

77

New cards

human development index (HDI)

measurement of how developed an economy is

78

New cards

Human development indicator

life expectancy index - long and healthy life - life expectancy at birth

education index - knowledge - expected years of schooling and mean years of schooling

GNI index - decent standard of living - GNI per capita

education index - knowledge - expected years of schooling and mean years of schooling

GNI index - decent standard of living - GNI per capita

79

New cards

advantages of HDI

takes into account remittances

80

New cards

disadvantages of HDI

doesnt take into account

\-distribution of income

\-gender equality

there is a risk of missing data

\-distribution of income

\-gender equality

there is a risk of missing data

81

New cards

primary product dependence (PPD)

when an economy main exporter is primary product

82

New cards

extreme price fluctuations (PPD) COR

primary products experience high levels of price volatility

PED inelastic (neccessity)

PES inelastic (havest once a year)

large fluctuations in price

uncertainty about revenue

lack of investment in capital good

lower productivity

lower growth

PED inelastic (neccessity)

PES inelastic (havest once a year)

large fluctuations in price

uncertainty about revenue

lack of investment in capital good

lower productivity

lower growth

83

New cards

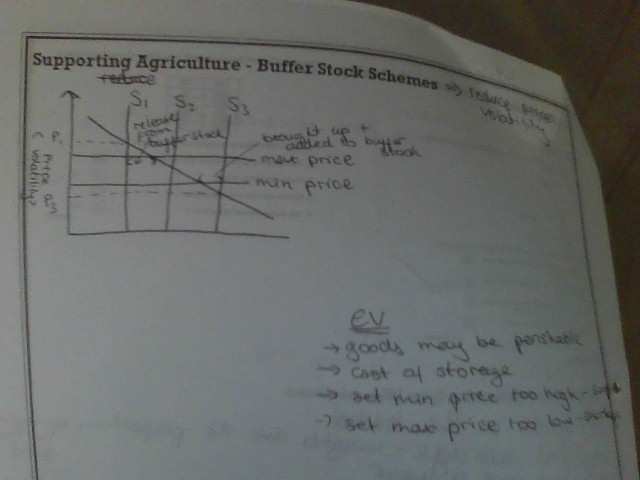

extreme price fluctuations (PPD) EV

buffer stock scheme to reduce price volatility

when there is a good harvest and the supply is high the government buys up the stock to increase the price

when there is a bad harvest and the supply is low the government releases the stock to decrease the price

when there is a good harvest and the supply is high the government buys up the stock to increase the price

when there is a bad harvest and the supply is low the government releases the stock to decrease the price

84

New cards

fluctuations in foreign exchange (PPD) COR

PPD price fluctuations

export revenue fluctuates

fluctuates in foreign exchange

hard to import capital goods

limits growth of secondary sector

lower productivity

lower growth

export revenue fluctuates

fluctuates in foreign exchange

hard to import capital goods

limits growth of secondary sector

lower productivity

lower growth

85

New cards

fluctuations in foreign exchange (PPD) EV

countries like saudi arabia have successfully used export revenue from oil to diversify their economy into sectors such as tourism

86

New cards

natural resource curse (PPD) COR

countries with high reserves of commodities

and have weak legal institutions (due to colonialism)

have a high risk of corruption

can lead to rent seeking govt officials that retain oil revenue for themselves

this increases corruption levels

makes it harder for the govt to enact supply side policies

lower growth and economic development

and have weak legal institutions (due to colonialism)

have a high risk of corruption

can lead to rent seeking govt officials that retain oil revenue for themselves

this increases corruption levels

makes it harder for the govt to enact supply side policies

lower growth and economic development

87

New cards

natural resource curse (PPD) EV

legal institutions can be strengthened through IMF or world bank reforms

88

New cards

prebisch singer hypothesis (PPD) COR

demand and price of primary product rises slower relative to the demand and price of secondary products

this means the terms of trade for PPD countries fall

which makes it challenging for the country to import capital goods

this constraints the growth of the secondary sector

which limits economic growth

this means the terms of trade for PPD countries fall

which makes it challenging for the country to import capital goods

this constraints the growth of the secondary sector

which limits economic growth

89

New cards

prebisch singer hypothesis (PPD) EV

some countries have successfully specialised in cash crops which have seen an increase in demand so TOT would not fall

90

New cards

dutch disease (PPD) COR

discovery of natural resources

more exports of that good

more demand for that currency

appreciation

makes non mining exports more expensive

less competitive so countries stay reliant on primary sector

low growth

more exports of that good

more demand for that currency

appreciation

makes non mining exports more expensive

less competitive so countries stay reliant on primary sector

low growth

91

New cards

dutch disease (PPD) EV

the growth of the primary sector can attract FDI which can provide funds for diversitification

92

New cards

barriers to household form accessing financial services

lack of education

lack of assets

costs

travel distance

lack of assets

costs

travel distance

93

New cards

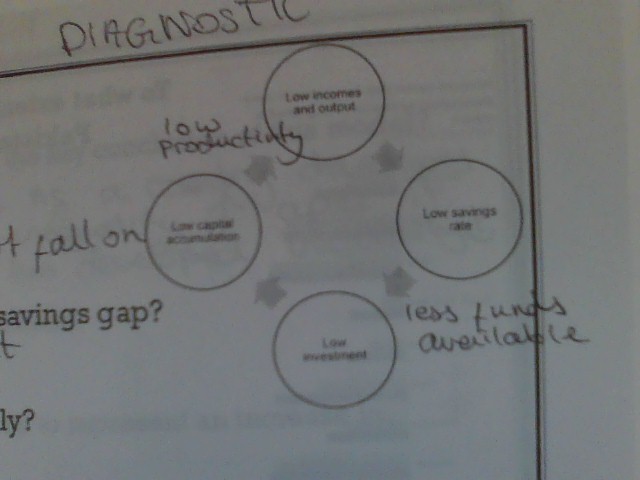

the harrod domar model (savings gap)

low incomes

low savings rate

less funds available

low investment

low capital accumulation

low productivity

low income and output

low savings rate

less funds available

low investment

low capital accumulation

low productivity

low income and output

94

New cards

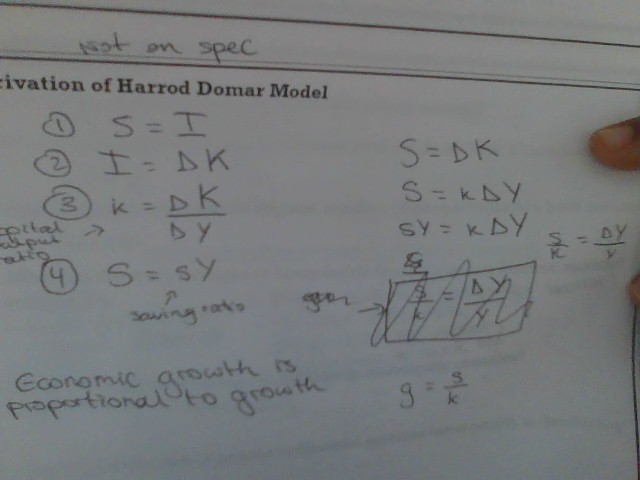

harrod domar model equation

growth rate = savings ratio / capital output ratio

g=s/k

g=s/k

95

New cards

fixing the savings gap

attract FDI to boost investment

use aid to boost income

use aid to boost income

96

New cards

challenges to accessing a good quality education in a developing country

cost of education

infrastructure

lack of teachers

needing children to work or care for siblings

gender inequality

information gap

quality of education

infrastructure

lack of teachers

needing children to work or care for siblings

gender inequality

information gap

quality of education

97

New cards

corruption : lack of legal institutions

government officials may be rent seeking

results in an inefficient allocation of resources

can increase the cost of doing business (bribs)

results in an inefficient allocation of resources

can increase the cost of doing business (bribs)

98

New cards

transfer pricing (tax avoidance) : lack of legal institutions

TNC artificially records profits as being made in a tax haven

subsidiary company trade and sell at a low price to a subsidiary company in a tax haven

then they would sell at a high price to other countries

the resources are never transported to the tax haven

subsidiary company trade and sell at a low price to a subsidiary company in a tax haven

then they would sell at a high price to other countries

the resources are never transported to the tax haven

99

New cards

property rights : lack of legal institutions

intellectual property rights (patents) - lack of enforcement so less innovation

assets (land and housing) - cant use this for collateral so they struggle to access financial services

assets (land and housing) - cant use this for collateral so they struggle to access financial services

100

New cards

informal lender : lack of financial institution

''loan sharks''

IR becomes very high leading to more debt

lack of regulation

IR becomes very high leading to more debt

lack of regulation