16 Macroeconomic equilibrium

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

46 Terms

New classical

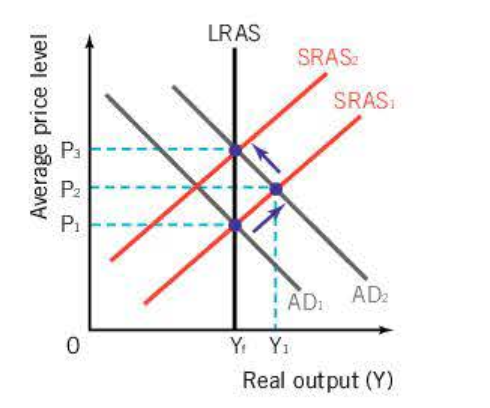

increase in AD

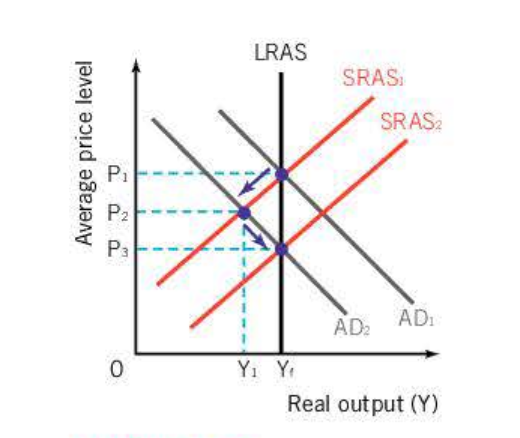

decrease in AD

if increase in AD, with SRAS and and LRAS, inflationary gap

level of output greater than level of output

only possible in short run, SRAS shifts back, above previous

If decrease in AD, deflationary gap

price of FOP’s fell, firms COP fall, sras shifts outwards

Keynesian perspective - inflationary/defaltionary

AS can be perfectly elastic - due to spare capacity

Deflationary gap whereby level of AD not sufficient to buy up potential output, that could be produced at full employment

Three categories of public gov spending

capital - spending that adds to capital stock of economy

current - tend to be ongoing, eg wages

transfer - benefits paid to people

How do government get income

tax and indirect taxes

social security payments

corporate taxes

tariffs

gov owned businesses

What is fiscal policy

defined as set of government’s policies relating to its expenditure and taxation rates

expansionary vs deflationary fiscal - AD

expansionary - increase ad

deflationary - decrease AD

Aims of fiscal policy

maintain low and stable rate of inflation

low unemployment rate

stable economic environment for growth

reduce fluctuations is business cycle

promote equitable income distribution

external balance between export revenue and import expenditure

What is expansionary fiscal policy? and effect

if want to encourage increase C, lower income tax

encourage investment, lower corporate taxes, more profit, increase investment

increase g spending

inflationary pressure, APL increase

trade off between lower unemployment and increase prices

How have fiscal policy helped before

in great depression, helped with deep recession

G expenditure can be used to target specific sectors of the economy

Constraints of fiscal policy

Time lags

Changing tax rates takes time

even after implemented, takes time for AD to change - people have to recognise and react

Political pressure

often influenced by political factors, rather than economic

Sustainable debt

may have to run budget deficits

accumulate into unsustainable debt

effect of net exports

expansionary, may lead to increase in IR

lead to increase in exchange rate (exports less attractive, imports more)

fall in (x-m)

Crowding out

if G spending increases, through increased borrowing, monopolise funds

firms don’t have access to funds, and this investment drops

less shift in AD

Increase in D for borrowing, IR increases thus contractionary monetary effects

Inability to achieve specific targets

large changes, effect may areas of economy

difficult to predict outcome

What is gov debt

It is the accumulation of all the budget deficits over the years and represents the total amount of money that the government owes to its creditors, both domestic and foreign.

How is gov debt expressed

normally expressed as a percentage of GDP

shows the percentage of annual national output that the government owes, both domestically and abroad

What does deficit spending by gov drive

Drives economic growth

Debt servicing costs

amount of money needed to make payments on the principal and interest on a loan in a given time period

Relationship between gov debt and servicing costs

As gov debt increases, so do servicing costs

Bad effects of gov debt.

Lead to crowding out of private investments

Interest payments increase as a % of G budget expenditure, damaging effect on other areas of spending, benefits and services from gov must be cut

require higher rates of taxation to fund expenditure

decrease ability of gov to respond to emergencies, gov has to borrow. If debt too big, fewer fiscal options available

What effect does G spending have to fix deflationary gap

Financial increase in AD be greater than amount of spending

What happens to injections in economy

multiplied by economy, people receive a share of the income and spend part of what they receive

What happens to the income

goes back to gov as form of tax

some saved

spent on foreign goods and services

spent on domestic goods/services

goes to income for others, happens in rounds

MPC

Marginal propensity to consume, income spent on domestic goods and services

What happens when all the money has been respent

final addition, gives value of the contribution that the injection had on national income

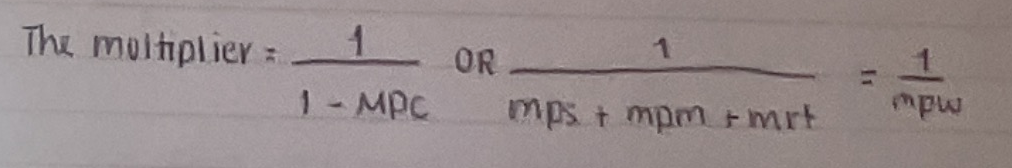

MPW is the value of MPS + MRT (Marginal rate of taxation) + MPI (MP import)

What can be used for value of multiplier

MPC or MPW (Marginal propensity to withdraw)

Formulas

Any change in withdrawls =

change multiplier

What must gov estimate to fill deflationary gap

estimate gap between equilibrium output and full employment

value of multiplier

What is monetary policy

official policies governing supply of money and level of interest rates in an economy

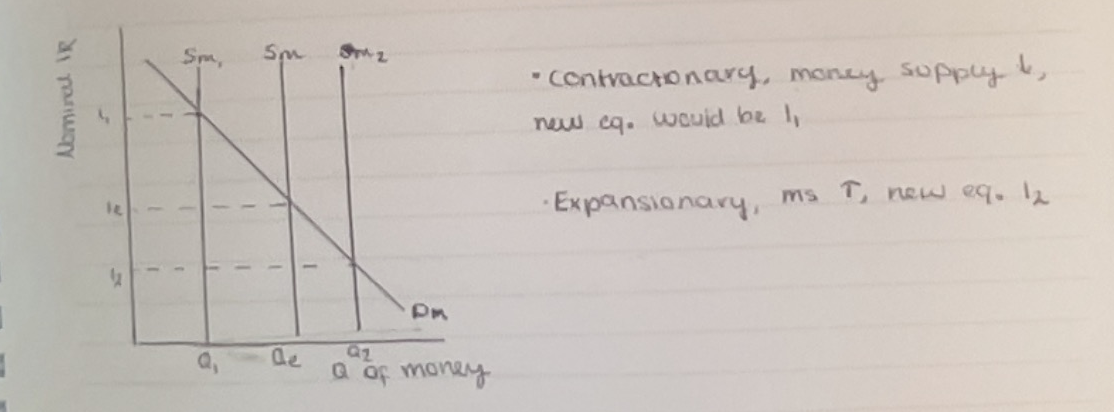

expansionary - increase AD

deflationary - decrease AD

What do commercial banks set

interest rates

What is the central bank

government bank

ultimate control of money supply in an economy

What is the central bank responsible for

mostly responsible for maintaining low and stable rate of inflation in economy

Goals of monetary policy

maintain low and stable rate of inflation

low unemployment rate

stable economic environment for growth

reduce fluctuations is business cycle

promote equitable income distribution

external balance between export revenue and import expenditure

What is expansionary monetary policy

increase AD

banks might lower base rate of interest

reduces cost of borrowing, increase C and I

Increase supply of money

lower its price, lower rate of interest, since IR is the price of money

increase I and C

Effect on economy of expansionary monetary policy

inflationary pressure

increase in real output, increase in national income, economic growth, decrease unemployment

Strength of monetary policy

Relatively quick

No political intervention

generally adjusted by central bank, no political processes to be approved

Absence of “crowding out“

Ability to make small changes

more precise than fiscal

Limitations of monetary

time lags

Can take months, by then economic factors may have changed, no longer applicable

Ineffectiveness when IR are low

cannot continuously lower interest rates. When approach zero no more cuts available

low consumer and business confidence

How do commercial banks create money

credit creation

occurs when lend money to consumers, more than they get, they lend out

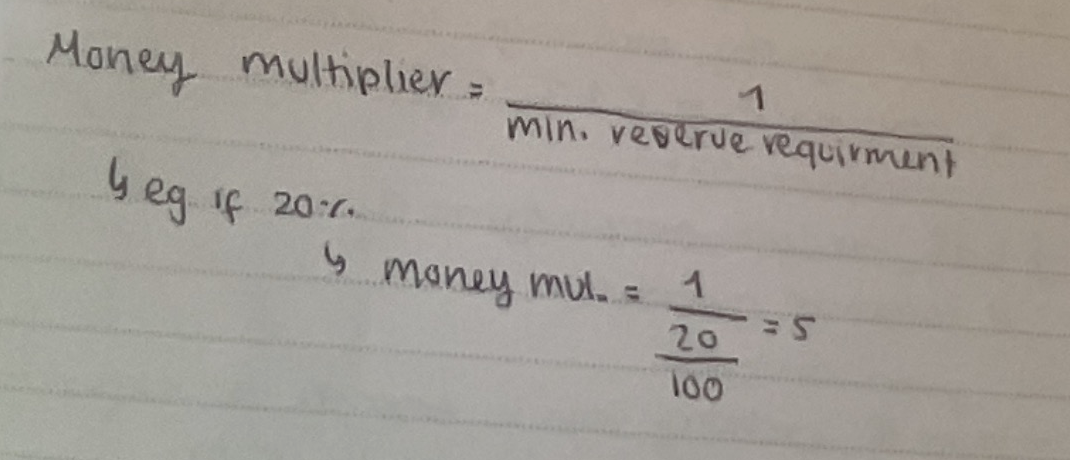

money multiplier

Money multiplier related to min. reserve requirement

& calcularion

percentage of deposits than commercial banks are legally required to hold in reserve, to meet cash requirement of depositor

Tools available for G to control money supply

minimum reserve requirement

larger them MRR, smaller the multiplier

if gov wants to reduce money supply, increase MRR

reduce ability of banks to create credit, reduce money supply

increase IR, thus lower AD

If gov wants to increase MS, reduce MRR

ability of banks to create credit, increase money supply

lower interest rate and increase AD

open market operations

involve buying and selling gov, securities by central bank

gov security is a bond. offers interest on nominal value of bond. very low risk

changes in central bank min, lending rate

when they raise it: increases the cost of borrowing. reducing c and I

lower: encourage investment and C so increase AD

Quantitive easing

CB injects new money into economy by purchasing assets, mostly securities, from commercial banks and other financial institutions with newly created electronic cash

expansionary effects:

increase reserve of commercial banks as they sell securities. Increase liquidity, encourage to lend more to firms and households

IR reduces, reduces debt: increase confidence

Lower IR, exchange rates drop, exports less expensive. imports more expensive. Increase (X-M)

What is gov security

gov security is a bond. offers interest on nominal value of bond. very low risk

Min. lending rate

the rate of interest which the central bank charges on loans and advances to commercial banks.

What is interest rate

Opportunity costs of holsing/spending money

Nominal rate of interest

Rate of interest available in money market not allowing for inflation

real rate of interest

adjusted for inflationI

If nominal IR increase

Give up large return on their savings and investment, so hold/demand less money

If nominal IR decreases

opportunity cost of spending/holding money will be less, hold/demand more money

Graph money supply

Real rate of interest equal to

and example

= nominal rate of interest - inflation rate