3.4 market structures

1/103

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

104 Terms

perfect competition

Perfect competition is a market structure where a large number of small firms sell an homogeneous product, and no single firm has market power.

Firms are price takers, and there is perfect information, no barriers to entry or exit, and perfect resource mobility.

why firms in perfect competition will be price takers

Firms in perfect competition are price takers because:

There are many buyers and sellers, so no single firm can influence the market price.

Products are homogeneous, meaning identical goods — consumers will always buy from the cheapest seller.

Perfect information ensures consumers know all prices, so firms can't charge more than the market price.

Example - 48,000 hair businesses in the UK

list the characteristics of a monopoly and for each give an implication for the industry

Single seller / dominant firm | The firm controls supply → can influence prices (price maker) → less competitive pressure. |

High barriers to entry | New firms can’t enter easily → market remains concentrated → sustained profits in long run. |

Unique product (no close substitutes) | Consumers have limited choice → price inelastic demand → firm can charge higher prices. |

Price maker | Firm sets price rather than taking market price → potential for supernormal profits → may lead to allocative inefficiency. |

evaluation

While monopolies often reduce efficiency and raise prices, in some cases — like natural monopolies — they may be the most cost-effective provider, especially when regulated to protect consumers.

Monopoly and monopoly power

Monopoly refers to the market structure, while monopoly power refers to a firm’s ability to set prices above marginal cost and influence the market.

what is x-inefficiency

X-inefficiency occurs when a firm produces at higher costs than necessary because it lacks competitive pressure.

The firm isn’t forced to minimize costs or operate efficiently.

This often happens in monopolies or firms with little competition.

list the characteristics of a monopolistically competitive market and explain the behaviour of firms in this type of industry

Many Buyers and Sellers | No single firm has significant market power |

2. Low Barriers to Entry and Exit | New firms can easily enter the market, especially in the long run. |

3. Product Differentiation | Each firm offers a slightly different product (e.g. branding, quality, location). |

Monopolistic competition and monopoly

The main difference is that a monopoly has one seller with a unique product and significant barriers to entry, while monopolistic competition features many sellers with differentiated products but no significant barriers to entry or exit. This leads to a monopoly having high price control and no competition, whereas monopolistic competitors have limited price control and face intense non-price competition like advertising

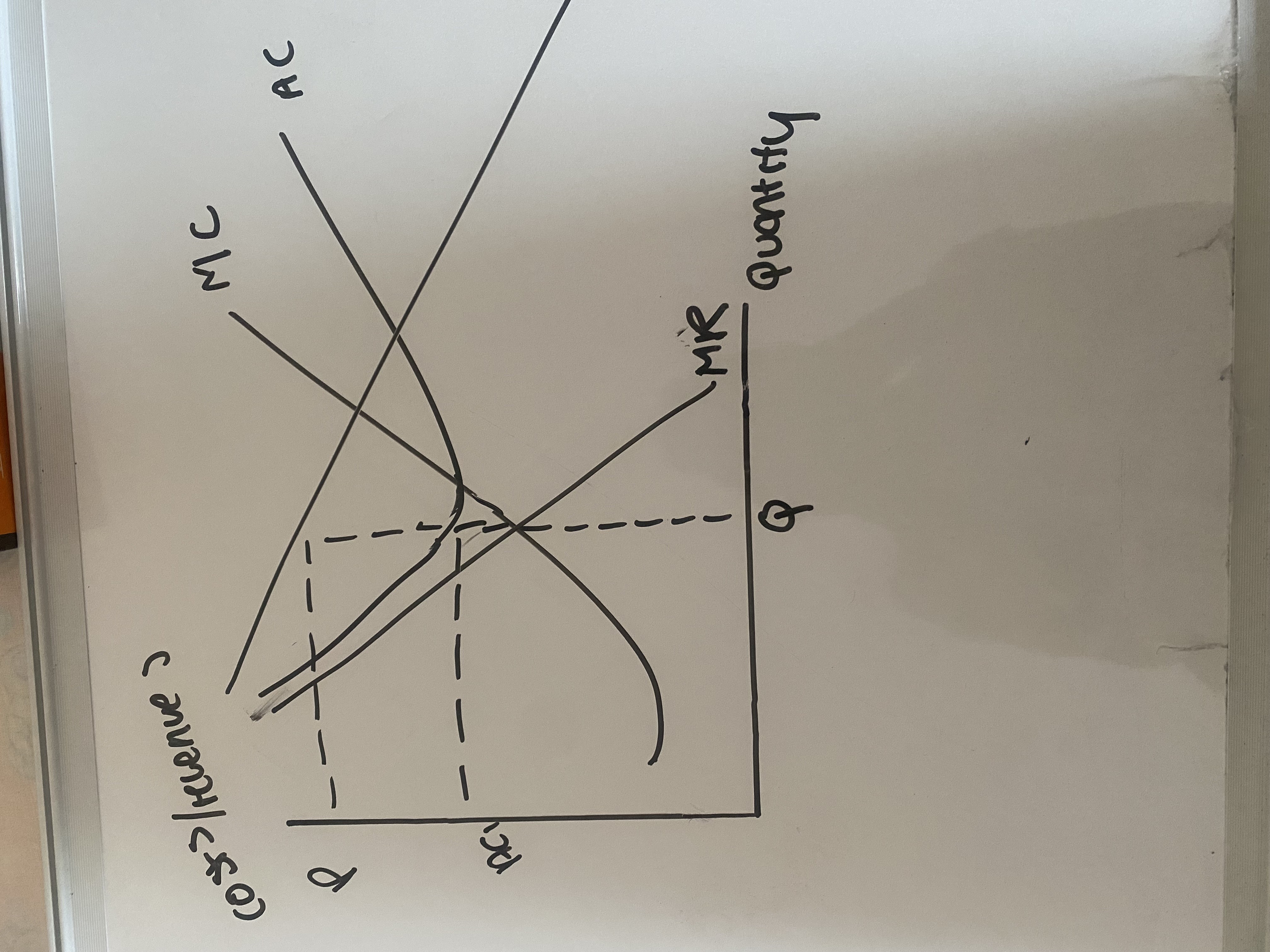

Firm in a monopolistically competitive industry making supernormal profits

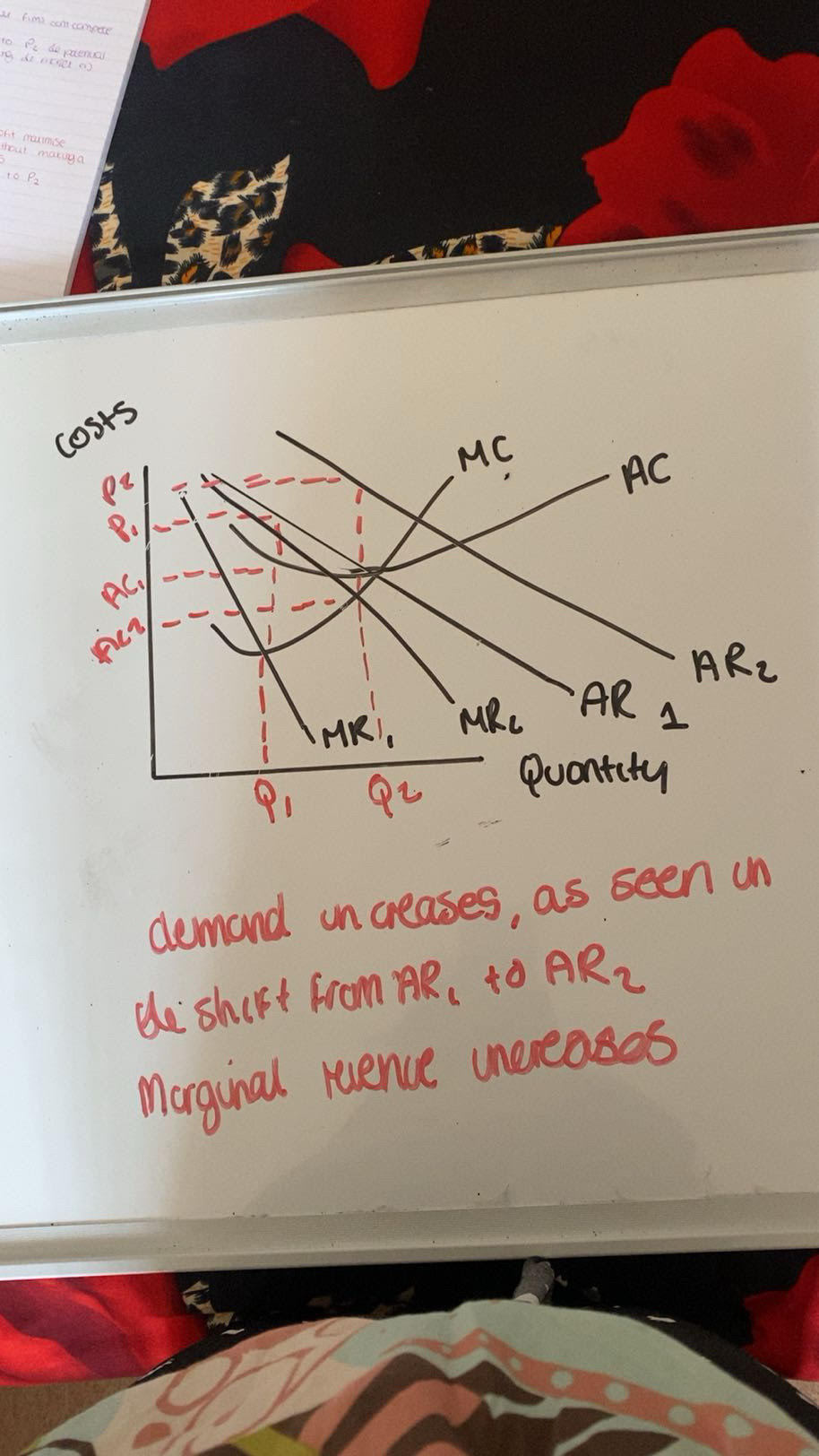

Give a justification for why firms in monopolistic competition will earn normal profit in the long run , even if supernormal profits are being earned in the short run

the supernormal profits will attratc more firms enter increasing competition

more firms enter due to low barriers to entry,increasing competition

The demand curve for each existing firm shifts left (more substitutes) and becomes more price elastic.

consumer has greater choice and demand becomes diluted

Firms are forced to accept normal profits only in the long run — AR = AC at the profit-maximising point.

Explain using an example the meaning of the term "concentration ratio"

The concentration ratio measures the total market share of the top few firms in a market. It shows how dominant those firms are and helps identify if a market is competitive or oligopolistic.

A high concentration ratio (e.g. over 60%) suggests an oligopoly, where a few firms have significant market power.

Supermarkets

Tesco – 27%

Sainsbury’s – 15%

Asda – 14%

Morrisons – 10%

oligopoly

An oligopoly is a market structure dominated by a few large firms, where each firm has a significant share of the market and is interdependent in decision-making.

It is typically characterised by a high concentration ratio, barriers to entry, and non-price competition.

explain the implication and following characteristics of an oligopoly - High barriers to entry and exit

Maintains market power of existing firms

– Prevents new competitors from entering and driving prices down.

– Firms like Tesco or Coca-Cola remain dominant for long periods.Less competitive pressure

– Existing firms face less threat of new entrants, so may collude or engage in non-price competition instead of lowering prices.

explain the implication and following characteristics of an oligopoly - high concentration ratio

A high concentration ratio means that a few large firms dominate the market. For example, a CR4 of 80% means the top 4 firms control 80% of total market share.

Market Power

– Dominant firms can influence price, output, or even market structure.Interdependence

– Firms closely monitor each other's actions, leading to price rigidity (e.g. kinked demand curve).

game theory

Game theory studies how firms make interdependent decisions. In oligopolies, it shows that while collusion maximises joint profits, firms may cheat for short-term gain.

Collusion

Collusion is when firms cooperate (explicitly or tacitly) instead of competing, usually to restrict output, fix prices, or limit competition, to increase joint profits.

Explain the reasons for collusion

Maximise Joint Profits 💰

Firms act like a monopoly when colluding, reducing output and raising prices.The primary objective is for firms to act as a single monopoly and collectively earn higher profits than they would in a competitive market.

→ Higher supernormal profits for all.

2. Reduce Price Wars 🔪

Price competition harms all firms. Collusion stabilises prices and protects profit margins.Collusion allows firms to coordinate prices, either explicitly or through tacit price leadership, so that no firm has an incentive to undercut competitors. By agreeing to maintain prices above marginal cost, firms avoid mutually destructive price competition and instead achieve price stability. As a result, firms are able to earn higher and more predictable profits, reducing uncertainty and restoring long-run profitability across the industry

why collusion may fail

Incentive to cheat (prisoner’s dilemma – short-term gain from undercutting).By cheating while rivals stick to the collusive price, a firm can gain market share and higher individual profits in the short run. Anticipating that rivals may also cheat, firms may choose to undercut pre-emptively, causing the collusive agreement to break down. As a result, prices fall towards marginal cost and profits are reduced, making collusion unstable in the long run.

Regulatory oversight – CMA or EU Commission may fine or break up cartels.Collusion is often illegal and subject to heavy fines and penalties in many jurisdictions. Example: Antitrust laws in the U.S., EU, and other countries aim to detect and penalize collusive behavior.

Consumer backlash – lower demand if prices are too high.

Overt collusion

Overt collusion is when firms openly agree to work together instead of competing — for example, by fixing prices, limiting output, or dividing the market. These agreements are explicit and known, sometimes even formal.

Tacit collusion

Tacit collusion is when firms indirectly coordinate without any formal agreement — they follow each other’s behavior, like keeping prices high, to avoid competition.

Key Features

No explicit agreement → harder to prove and usually legal.

Happens in oligopolies where firms are interdependent.

Cartel

groups of independent producers who collude to set prices, production, or other business practices to achieve higher profits than they would under perfect competition

Key Features

Type of overt collusion.

Members act together like a monopoly to increase profits.

Often illegal (e.g. under UK and EU law).

Price leadership

Price leadership occurs when one dominant firm sets the price, and other firms in the market follow rather than compete on price.

Kinked demand curve

how does the kinked demand curve show interdependence

Above the kink: If a firm raises price, rivals are unlikely to follow — they’ll keep prices the same to gain market share. Demand is elastic here, because consumers will switch.

Below the kink: If a firm cuts price, rivals are likely to match to avoid losing customers. Demand is inelastic, since no firm gains much from the cut.

Uk productivity

33% less than america

government could fund more apprenticeships,training,HS2 was an example of trying to combat this

price war

A price war occurs when rival firms repeatedly undercut each other’s prices to gain or protect market share. It's common in oligopolistic markets, where firms are interdependent and react strategically to competitors' pricing.

how price war effects sales

In the short run, sales volume may increase for some firms.

But because prices are falling, total revenue may not rise — especially if demand is inelastic.

For the market overall, revenues tend to fall as prices are aggressively slashed.

how price war affects profit

Profit margins shrink as firms cut prices while costs remain the same.

Can lead to short-term losses, especially for smaller or less efficient firms.

In the long run, weaker firms may exit, leaving fewer, larger players — possibly allowing remaining firms to raise prices again (post-war).

price wars evaluation

Price wars benefit consumers in the short run through lower prices, but often lead to lower profits and can force smaller firms out, reducing long-term competition.

Firm efficiency: Only low-cost firms can sustain losses.

📌 Overall: Price wars are often unsustainable and may harm long-term market health, despite initial consumer gains.

predatory pricing

Setting prices below average cost to force rivals out of the market.

predatory pricing impact on : sales,revenue and profits

Sales: Likely increase in short term as prices undercut rivals.

Revenue: May rise due to higher sales volume and demand, but not guaranteed if price drop is steep.

Profit: Likely falls or becomes negative short-term as costs are higher than prices

predatory pricing evaluation

Unsustainable: Loss-making prices can't last; if rivals survive, strategy fails.

Illegal: Often breaches competition law (e.g. CMA in UK); risks fines and reputational damage.

Consumer harm: Low prices short-term, but long-term risk of monopoly → higher prices, less choice.

non price strategy advertising and branding

Explanation: Builds awareness, loyalty, and perceived quality.

Sales: Increase (higher demand).

Revenue: Rises as quantity sold increases.

Profit: Can rise long-term, though high upfront costs reduce short-run profit.

predatory pricing diagram

product differentation as a non price strategy

Explanation: Unique features, quality, or design to stand out from rivals.

Sales: More elastic demand → boosts sales if successful.

Revenue: Increases as consumers may pay more or switch from rivals.

Profit: Higher margins possible; depends on R&D and development costs.

non pricing strategy diagram

what would indicate someone is operating in a perfectly competitive market

average revenue equals marginal revenue at every level of output

barrier to entry

an obstacle to prevent new firms from entering the industry

contestable markets

A contestable market is one where the threat of new entrants is enough to discipline incumbent firms, even if there are few actual competitors.

characteristics of contestable markets

The key requirement for a market to be contestable is low barriers to entry and exit

The number of firms is not relevant - a monopoly could, theoretically, be a contestable market if barriers to entry are low

low sunk costs

difference between a contestable market and a competitive market

A competitive market has many firms actively competing, with low barriers to entry, leading to price-taking behaviour.

A contestable market may have few firms (even a monopoly), but low barriers to entry and exit mean the threat of entry forces firms to behave competitively.

explain the impact on profits of an industry having a high degree of contestability

In a highly contestable market, supernormal (abnormal) profits are competed away in the long run, even if there are few firms. This is because:

The threat of new entrants forces existing firms to set prices closer to average costs to avoid attracting competition.

explain the term “sunk costs”

Sunk costs are costs that cannot be recovered once they have been incurred, even if a firm exits the market.

Spending on advertising or specialised equipment with no resale value.

are sunk costs beneficial

To the firm:

❌ No — sunk costs are not beneficial because they cannot be recovered, increasing the risk of entering a market.

To existing firms:

✅ Yes, sometimes — high sunk costs can deter new entrants, protecting profits and reducing competition.

To the market/economy:

❌ No — high sunk costs reduce contestability, which can lead to less competition, higher prices, and inefficiency.

types of barrier to entry

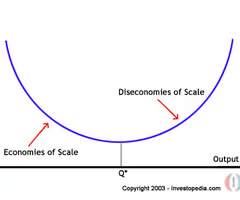

1. Economies of Scale

Large firms have lower average costs due to high output

New entrants can't match their prices without making losses

Example: supermarkets, energy firms

✅ 2. Legal Barriers

Laws or regulations prevent or restrict entry

Includes patents, licenses, and regulatory approval

Example: pharmaceuticals (patents), taxis (licenses)

✅ 3. Sunk Costs

Unrecoverable costs (e.g. advertising, specialist equipment)

Increases the risk of entry, reducing contestability

Example: heavy branding by Coca-Cola

what are barriers to exit?

the costs associated with a decision to leave a market/industry

explain what it means for a market to be conestable or low contestable

What is a Contestable Market?

A market where entry and exit are easy and costless (low barriers).

New firms can enter quickly to compete and leave without heavy losses.

This keeps existing firms behaving competitively, even if there are few competitors.

🟧 Low Contestability

Markets with high entry or exit barriers (e.g. large startup costs, regulations).

New firms find it hard to enter or leave, so incumbents face less competitive pressure.

Sunk cost fallacy

A business might have invested £ millions in being in a market

But still makes a loss (P<AC) and has no realistic prospect of doing so

The investment might be lost if the firm leaves the market

Some firms might be reluctant to realise these losses

This is the called the sunk cost fallacy

It should have no interest on the firm’s decision about whether to leave the market

barriers to exit

Redundancy costs for the workforce

Exit fees from rental agreements e.g. leases on stores or equipment

Reduced value of owned equipment sold at rock-bottom prices in a fire-sale

“monopolies are inefficient”

A monopoly is a single seller in a market, holding at least 25% market share (legal monopoly) -> This means that they have price setting power and are not challenged by any other firms -> Thus, they restrict output and raise prices, operating at profit maximisation point (MC = MR) -> This minimises consumer welfare to benefit the firm itself

BUT…

Dynamic efficiency -> many monopolies are dynamically efficient because of their large supernormal profits. For example, Starbucks spent around $15mn on researching how to improve the taste and design of their drinks in 2024.

Draw a diagram showing a rise in demand for a price taking firm

Draw a diagram showing a rise in fixed costs for a price taking firm

making a loss + cant raise the price

Draw a diagram showing a rise in variable costs for a price taking firm

Can be things such as a rise in minimum wage as MC = supply

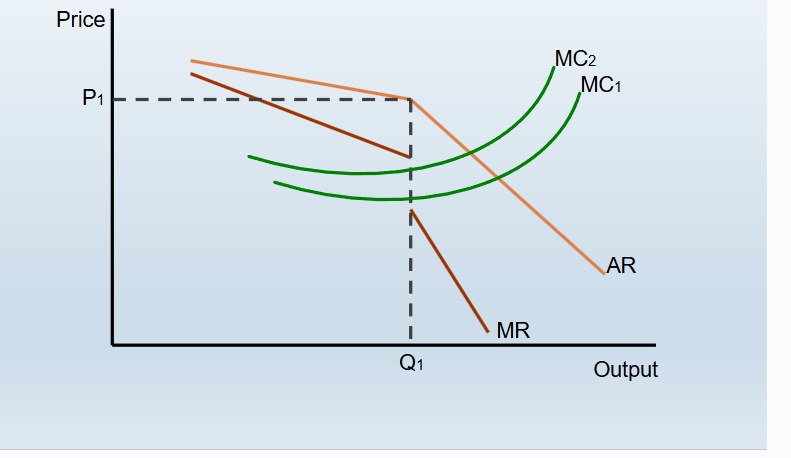

Diagram showing a rise in fixed costs for a price setting firm

average costs rise

they keep their price because they are still profit maximising at MC=MR

Diagram showing a rise in variable costs for a price setting firm

This is then passed onto consumers through higher prices

natural monopoly

a market that runs most efficiently when one large firm supplies all of the output

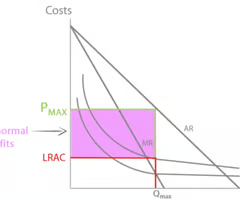

natural monopoly diagram

reasons for the efficiency of natural monopolies

sunk costs (Very high sunk costs mean it would be inefficient if a second firm entered the market and also had to incur those sunk costs - so one firm is most efficient), economies of scale

legal monopoly

Monopoly in which one seller supplies a product or technology to which it holds a patent and it holds over 25% of market share

pure monopoly

a firm with 100% market share (e.g windows in 1985)

advantages of a monopoly

Supernormal profits may be ring-fenced and spent on investment and R&D - which may help the firm achieve dynamic efficiency in the long run and so produce higher quality goods and services at lower prices for consumers.

*Monopoly may be more likely to innovate due to high barriers to entry.

*Monopolies may have large economies of scale, allowing them to produce goods and services at lower prices, they can also produce high quality goods but for cheap prices

High revenue/profit may be a source of government tax revenue.

disadvantages of a monopoly

Monopoly may exploit consumers by charging high prices - this may result in a loss of allocative efficiency -> deadweight losss diagram - lower consumer surplus -> monopolies restrict output and choice

Monopolies have no incentive to become more efficient, because they have few or no competitors, so are not productive efficient.

There is a loss of consumer surplus and a gain of producer surplus. If a monopolist raises the market price above the competitive equilibrium level.

Consumers do not get as much choice in a monopoly as they do in a competitive market.

advantages of monopolies for consumers

Monopolies achieve large supernormal profits. They can use this to invest in their capital and achieve dynamic efficiency, lowering their costs. In addition, monopolies are large enough to access economies of scale. This process will also lower average costs in the long run. Therefore, firms may be able to reduce their prices and provide consumers with lower cost, higher quality products than firms would be able to provide in a competitive market.

Brand profileration

the process of creating multiple brands under one parent company

e.g. coca cola owns sprite, fanta etc.

diseconomies of scale

the situation in which a firm's long-run average costs rise AT AN INCREASING RATE as the firm increases output

what causes diseconomies of scale

motivation decreases

coordination problems

control decreases

how can firms in monopolistic competition benefit consumers - regarding their price taker nature

They are price takers. These firms do not get to choose what price they set consumers. They match the price set by the

market keeping prices low for consumers, effectively maximising consumer surplus. Because demand is perfectly elastic,

raising prices will result in no demand for the firms so consumers will always benefit from low prices.

Eval However, consumer surplus may not be maximised because the goods produced in perfectly competitive markets are

homogenous, this means that there is a lack of consumer sovereignty and choice. These firms may be productively

efficient but are unlikely to care about their methods of production. As a result they may have negative production

externalities, reducing consumer welfare.

how can R&D in monopolistic competition benefit consumers

Firms know what profits they are going to make in advance. This means that they can plan for investment, encouraging investments into R&D, improving the quality of the goods that they are selling. This differs to monopolies that may fail to innovate because of their dominant market position. For example the US oil industry spends 96% of their additional profit on dividends rather than on innovation. The constant demand for perfectly competitive markets also ensures consistent employment, raising government revenues which could be spent on e.g. welfare benefits, further improving the lives of consumers.

Firms in perfectly competitive markets are rarely productive. Perfect information means that there is no incentive for firms to adopt new production techniques or innovate their products because their competitors will do the exact same. Firms also require supernormal profits to invest in innovation (which is only possible in the short run), but firms in perfect competition make normal profits, breaking even, leaving them no additional profits to invest with.

how could a government subsidy increase contestability of a market

Subsidy. Subsidy -> reduce costs of production for new entrants -> lower prices -> these subsidies could be spent on

sunk costs like rent or smartphone factories -> reducing barriers to entry and increasing contestability. Lower prices will

also lead to an increase in output, triggering economies of scale significantly lowering prices even further and attracting new customers. This has been done in China with Huawei, which now owns 13% market share of the global smartphone industry.

Eval Subsidising new entrants does not address the structural issue - large companies like Apple and Samsung have huge brand loyalty. This acts as a barrier to entry in the market because even if Huawei enters with low prices, consumers

have price inelastic demand for iphones so they won’t demand Huawei phones regardless of the price decreases.

how could a R&D tax break increase the contestability of a market

R&D Tax breaks. R&D tax breaks would allow companies to reinvest more of their profits into research and development

improving the quality of their goods. Increased quality will increase demand for their phones, leading to larger market share and increased competitiveness. These innovations may lead to improvements in efficiency and productivity leading to cost reductions and decreased prices.

Eval Depends on the size of the tax break -> if small → no improvements in quality -> no increased demand -> no increases

in market share

Monopsony power

Monopsony power is the market power a single buyer or a dominant buyer holds over sellers, allowing it to dictate lower prices for goods or services than would exist in a competitive market

example of monopsony power

Supermarket - has monopsony power when buying from farmers

NHS - 90% control over uk healthcare market - monopsony when hiring doctors and nurses

why may wages in a monopsony rise slower than other industries

There is no need to change wages because workers have nowhere else to go. Raising wages would only increase costs.

pure monopsony

a firm which is the sole buyer of resources or supplies

how are monopsonists profit maximisers

they aim to minimise costs by paying suppliers the lowest possible price

examples of monopsony industries

British sugar buys almost all the sugar beet crop produced in the UK in a year

NHS is a dominant buyer of pharmaceuticals

conditions for a monopsony to operate

Single Buyer: A monopsony is characterized by a single dominant buyer in a particular market or industry. This buyer has substantial market power and controls a significant share of the total demand for a specific product or labor.

Limited Substitute Buyers: A key condition for a monopsony to exist is the absence of readily available substitute buyers for the goods or services it purchases. This limits the options for sellers to find alternative customers.

Price Maker: The monopsonist has the ability to set the price it is willing to pay for the goods or services it buys. It can do so because sellers have limited alternatives, and the monopsonist's demand significantly affects market prices

impact of monopsony market on a supplier

Suppliers may benefit from the stability and reliability of a monopsony as a consistent buyer.Supplying to a large, dominant buyer like a monopsony can lead to an increase in sales volume, even if the per-unit price is lower.

However, they may face pressure to accept lower prices, reduced profit margins, and less bargaining power.negatively impacts suppliers by forcing them to accept lower prices, which can lead to squeezed profit margins, reduced investment, and a greater risk of market exit. This can also lower the quality of products and limit consumer choice in the long run

impact of a monopsony market on consumers

Consumers may benefit from lower prices for the final goods or services produced by the monopsony, as lower input costs can translate into lower prices for consumers.

However, if the monopsony drives suppliers out of business or reduces the quality of inputs, it could result in limited product variety and potentially higher prices in the long run.

impact of monopsony market on the monopsony firm

Lower costs: The firm can use its market power to negotiate lower prices from its suppliers or pay lower wages to its workers.

Increased profits: Lower costs can lead to lower average and marginal costs, enabling the firm to increase its profit-maximizing output and potentially leading to higher supernormal profits.

Greater efficiency: By bargaining for lower prices from suppliers, the firm can achieve greater economies of scale and efficiency, which may be passed on to consumers in the form of lower prices.

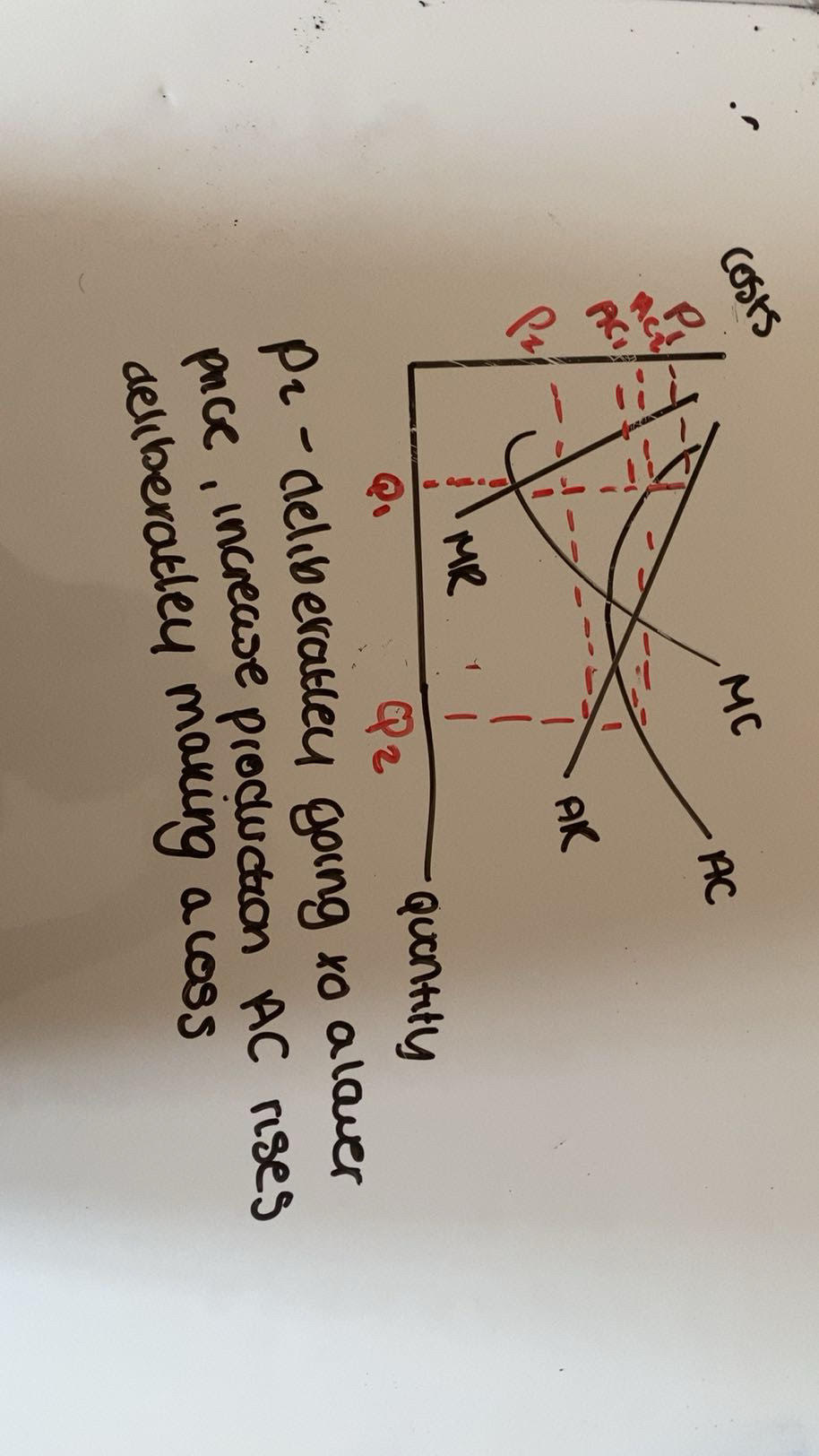

Show the impact of a monopsony market on a supplier on a cost and revenue diagram

they are being “squeezed out” their profits are decresing as they are forced to accept lower prices

how would a monopsony market increase the average costs of a supplier

they may pass these costs onto the consumer

depict on a cost and revenue diagram

Monopsony market on a monopsony firm

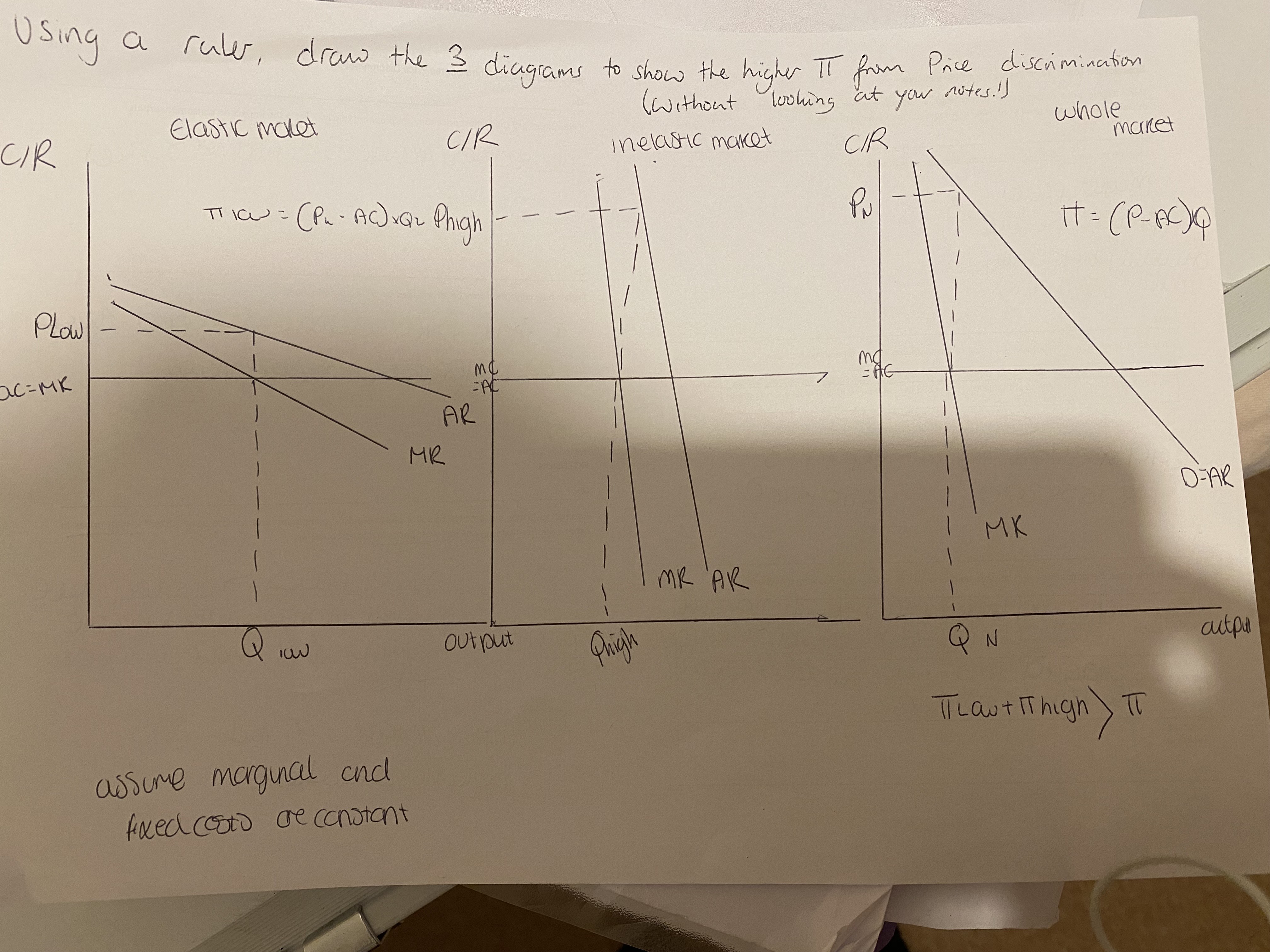

define price discrimination

Charging different prices for the same product in segments of the market. Price charged is linked directly to consumers' willingness and ability to pay for a good or service

conditions required for price discrimination

Market Power:

Explanation: The firm must have some degree of market power, allowing it to influence prices. (monopoly)

Identifiable Market Segments:

Explanation: The firm must be able to identify and separate customers into distinct groups with different elasticities of demand

Prevent Resale:

Explanation: Measures must be in place to prevent customers from reselling the product at a lower price to those who are unwilling to pay more.

Example: Software companies often use licensing agreements to restrict resale and ensure price discrimination.

how does price discrimination benefit producers

Higher revenue and profit

PD allows a firm to charge different prices to different consumer groups based on willingness to pay.

→ This means the firm can capture more consumer surplus, converting it into additional revenue.

→ Total revenue rises, especially if the firm can charge higher prices to inelastic consumers.

→ Higher revenue can lead to higher profits, assuming costs do not increase significantly.

Potential economies of scale

If PD increases output,

→ higher production levels may allow the firm to access economies of scale, such as technical or managerial economies.

→ This reduces long-run average costs.

→ Which increases profit margins and may improve competitiveness.

disadvantages of price discrimination on producers

Risk of consumer backlash

Consumers may view PD as unfair (e.g., different prices for the same flight).

→ This can reduce brand loyalty and make demand more price-elastic.

→ Lower brand loyalty reduces the firm’s ability to set high prices in the future.

→ Potentially reducing long-run revenue and market share.

benefits of price discrimination to consumers

Lower prices for some consumer groups

Firms charge lower prices to elastic-demand groups (e.g., students, off-peak travellers).

→ This makes the product more affordable for groups who otherwise might not purchase.

→ Consumer surplus increases for those who pay the lower price.

Cross-subsidisation of services

High prices paid by inelastic groups can subsidise lower prices for others.

→ This can maintain services that might otherwise shut down (e.g., rural bus routes, postal services).

If the firm recieves increased revenue and higher profits from those paying with inelastic demand it can be reinvested into making the good/service better so all consumers benefit

EV - they may just give their shareholders bonuses

disadvantages of price discrimination for consumers (allocative inefficiency)

Allocative inefficiency - Under price discrimination, a firm charges different prices to different consumer groups not based on cost differences, but based on willingness and ability to pay.

→ This means some consumers pay a price above marginal cost (P > MC).

→ When P > MC, fewer consumers buy the product than would be socially optimal.

→ Output is below the allocatively efficient level, where P = MC.

→ Therefore, total welfare is not maximised, leading to allocative inefficiency.

Explain how PED impacts the profits of the firm when price discriminating

When price discriminating, a firm charges higher prices to groups with inelastic PED.

→ Because their demand is less responsive to price increases, quantity demanded falls only slightly.

→ This means the increase in price outweighs the small fall in quantity, so total revenue rises.

→ With costs largely unchanged, this directly increases profit from inelastic consumers.

Third degree price discrimination diagram

Explain what a natural monopoly is

A natural monopoly occurs when one firm can supply the entire market at a lower cost than multiple firms, due to very high fixed costs and strong economies of scale.

natural monopoly diagram

Private firm - price p1 profit (p1-ac1)xq2

you can see it is not profitable for a small firm to operate due to high fixed costs (AC)

natural monopoly benefits

Gains in productive efficiency due to massive scale

Can be regulated to achieve allocative efficiency

avoids wasteful duplication of resources

dynamic efficiency on a monopoly market position

Dynamic efficiency enables firms to drive down prices and keep new firms from joining the market. As a result, reinvesting large profits can lead to a strengthening of a firm's monopoly position.

monopolies on consumers (benefits)

Lower prices:Monopolies may have large economies of scale, this reduces AC, lower AC means they can charge lower prices and produce goods and services at lower prices, they can also produce high quality goods but for cheap

innovation:Monopolies earn supernormal profits, giving them funds to invest in R&D or infrastructure.This investment can improve product quality or innovate (e.g., new technology, better reliability).Consumers benefit through higher-quality, more advanced products in the long run.

costs of monopolies on consumers

high prices-A monopoly faces no competition, so it can set prices above marginal cost.This leads to higher prices than in competitive markets.Consumers face reduced affordability and lower consumer surplus.

Lower quality:With no rivals, a monopoly has weak incentives to innovate or improve quality.Product quality may stagnate or decline over time.Consumers experience worse service and fewer product improvements.

how can a monopoly benefit from its market power

Monopoly faces no competition, so it can set price above MC.

This generates supernormal profits in the long run.

Firm can reinvest profits into R&D, advertising, or expansion.

Firm growth and market dominance are strengthened.

natural monopoly example

Water supply networks – require huge infrastructure costs (pipes, treatment plants) and have large economies of scale, so one firm can deliver water more cheaply than several competing networks.